Caesars Entertainment, Inc., (NASDAQ: CZR) (“Caesars,” “CZR,”

“CEI” or “the Company”) today reported operating results for the

third quarter ended September 30, 2024.

Third Quarter 2024 and Recent Highlights:

- GAAP net revenues of $2.9 billion versus $3.0 billion for the

comparable prior-year period.

- GAAP net loss of $9 million compared to net income of $74

million for the comparable prior-year period.

- Same-store Adjusted EBITDA of $1.0 billion versus $1.0 billion

for the comparable prior-year period.

- Caesars Digital Adjusted EBITDA of $52 million versus $2

million for the comparable prior-year period.

Tom Reeg, Chief Executive Officer of Caesars Entertainment,

Inc., commented, “During the third quarter, we delivered another

quarter of $1 billion of same-store consolidated Adjusted EBITDA.

Results in Las Vegas reflect record third quarter hotel, F&B

and banquet revenues driven by strong occupancy and cash ADRs.

Regional segment operating results were negatively impacted by new

competition, construction disruption and difficult comparisons

versus the prior year. Caesars Digital set a new all-time quarterly

record for Adjusted EBITDA driven by over 40% growth in net

revenues.”

Third Quarter 2024 Financial Results Summary and Segment

Information

The following tables present actual 2024 and 2023 results as

well as adjustments to net revenues, net income (loss) and Adjusted

EBITDA for the effects of our completed divestiture in order to

reflect amounts and percentage change on a same-store basis:

Net Revenues

Three Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

1,062

$

1,120

$

(44

)

$

1,076

(1.3

)%

Regional

1,446

1,565

—

1,565

(7.6

)%

Caesars Digital

303

215

—

215

40.9

%

Managed and Branded

68

98

—

98

(30.6

)%

Corporate and Other

(5

)

(4

)

—

(4

)

(25.0

)%

Caesars

$

2,874

$

2,994

$

(44

)

$

2,950

(2.6

)%

Net Revenues

Nine Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

3,191

$

3,379

$

(145

)

$

3,234

(1.3

)%

Regional

4,196

4,415

—

4,415

(5.0

)%

Caesars Digital

861

669

—

669

28.7

%

Managed and Branded

206

239

—

239

(13.8

)%

Corporate and Other

(8

)

1

—

1

*

Caesars

$

8,446

$

8,703

$

(145

)

$

8,558

(1.3

)%

Net Income (Loss)

Three Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

226

$

238

$

—

$

238

(5.0

)%

Regional

125

176

—

176

(29.0

)%

Caesars Digital

11

(29

)

—

(29

)

*

Managed and Branded

19

45

—

45

(57.8

)%

Corporate and Other

(390

)

(356

)

—

(356

)

(9.6

)%

Caesars

$

(9

)

$

74

$

—

$

74

*

Net Income (Loss)

Nine Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

696

$

792

$

(15

)

$

777

(10.4

)%

Regional

115

375

—

375

(69.3

)%

Caesars Digital

(19

)

(83

)

—

(83

)

77.1

%

Managed and Branded

54

83

—

83

(34.9

)%

Corporate and Other

(1,135

)

(309

)

—

(309

)

*

Caesars

$

(289

)

$

858

$

(15

)

$

843

*

Adjusted EBITDA (b)

Three Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

472

$

482

$

—

$

482

(2.1

)%

Regional

498

575

—

575

(13.4

)%

Caesars Digital

52

2

—

2

*

Managed and Branded

19

20

—

20

(5.0

)%

Corporate and Other

(40

)

(36

)

—

(36

)

(11.1

)%

Caesars

$

1,001

$

1,043

$

—

$

1,043

(4.0

)%

Adjusted EBITDA (b)

Nine Months Ended September

30,

(In

millions)

2024

2023

2023 Adj.(a)

Adj. 2023 Total

% Change

Las Vegas

$

1,426

$

1,527

$

(15

)

$

1,512

(5.7

)%

Regional

1,400

1,531

—

1,531

(8.6

)%

Caesars Digital

97

9

—

9

*

Managed and Branded

54

58

—

58

(6.9

)%

Corporate and Other

(123

)

(117

)

—

(117

)

(5.1

)%

Caesars

$

2,854

$

3,008

$

(15

)

$

2,993

(4.6

)%

____________________

*

Not meaningful

(a)

Adjustment for pre-disposition results of

operations reflecting the subtraction of results of operations for

Rio All-Suite & Casino prior to divestiture at the end of the

third quarter of 2023. Such figures are based on unaudited internal

financial statements and have not been reviewed by the Company’s

auditors for the periods presented. The additional financial

information is included to enable the comparison of current results

with results of prior periods.

(b)

Adjusted EBITDA is not a GAAP measurement

and is presented solely as a supplemental disclosure because the

Company believes it is a widely used measure of operating

performance in the gaming industry. See “Reconciliation of GAAP

Measures to Non-GAAP Measures” below for a definition of Adjusted

EBITDA and a quantitative reconciliation of Adjusted EBITDA to net

income (loss), which the Company believes is the most comparable

financial measure calculated in accordance with GAAP.

Balance Sheet and Liquidity

As of September 30, 2024, Caesars had $12.7 billion in aggregate

principal amount of debt outstanding. Total cash and cash

equivalents were $802 million, excluding restricted cash of $124

million.

(In

millions)

September 30, 2024

December 31, 2023

Cash and cash equivalents

$

802

$

1,005

Bank debt and loans

$

6,343

$

3,193

Notes

6,311

9,199

Other long-term debt

44

47

Total outstanding indebtedness

$

12,698

$

12,439

Net debt

$

11,896

$

11,434

As of September 30, 2024, cash on hand and borrowing capacity

was as follows:

(In

millions)

September 30, 2024

Cash and cash equivalents

$

802

Revolver capacity (a)

2,035

Revolver capacity committed to letters of

credit

(84

)

Available revolver capacity committed as

regulatory requirement

(46

)

Total (b)

$

2,707

___________________

(a)

Revolver capacity includes $2.05 billion

of available capacity under the CEI Revolving Credit Facility,

maturing in January 2028 (subject to a springing maturity in the

event certain other long-term debt of Caesars is not extended or

repaid), and $25 million under the Caesars Virginia Revolving

Credit Facility, maturing on April 26, 2029, less $40 million

reserved for specific purposes.

(b)

Excludes approximately $190 million of

additional borrowing available under the Caesars Virginia Delayed

Draw Term Loan.

“On October 17th, we successfully closed on a new $1.1 billion

senior unsecured refinancing which, along with financings earlier

in the year, continue to set the stage for significant interest

expense savings in 2025. As of today, we have received $250 million

in cash proceeds from the World Series of Poker brand sale. We are

excited to be nearing the completion of our multi-year Caesars New

Orleans renovation and permanent Caesars Virginia projects,” said

Bret Yunker, Chief Financial Officer.

Reconciliation of GAAP Measures to Non-GAAP Measures

Adjusted EBITDA (described below), a non-GAAP financial measure,

has been presented as a supplemental disclosure because it is a

widely used measure of performance and basis for valuation of

companies in our industry and we believe that this non-GAAP

supplemental information will be helpful in understanding our

ongoing operating results. Management has historically used

Adjusted EBITDA when evaluating operating performance because we

believe that the inclusion or exclusion of certain recurring and

non-recurring items is necessary to provide a full understanding of

our core operating results and as a means to evaluate

period-to-period results. Adjusted EBITDA represents net income

(loss) before interest income and interest expense, net of interest

capitalized, (benefit) provision for income taxes, depreciation and

amortization, stock-based compensation expense, (gain) loss on

extinguishment of debt, impairment charges, other (income) loss,

net income (loss) attributable to noncontrolling interests,

transaction costs associated with our acquisitions, developments

and divestitures, and non-cash changes in equity method

investments. Adjusted EBITDA also excludes the expense associated

with certain of our leases as these transactions were accounted for

as financing obligations and the associated expense is included in

interest expense. Adjusted EBITDA is not a measure of performance

or liquidity calculated in accordance with accounting principles

generally accepted in the United States (“GAAP”). Adjusted EBITDA

is unaudited and should not be considered an alternative to, or

more meaningful than, net income (loss) as an indicator of our

operating performance. Uses of cash flows that are not reflected in

Adjusted EBITDA include capital expenditures, interest payments,

income taxes, debt principal repayments, and payments under our

leases with affiliates of GLPI and VICI Properties, Inc., which can

be significant. As a result, Adjusted EBITDA should not be

considered as a measure of our liquidity. Other companies that

provide EBITDA information may calculate Adjusted EBITDA

differently than we do. The definition of Adjusted EBITDA may not

be the same as the definitions used in any of our debt

agreements.

Conference Call Information

The Company will host a conference call to discuss its results

on October 29, 2024 at 2:00 p.m. Pacific Time, 5:00 p.m. Eastern

Time. Participants may register for the call approximately 15

minutes before the call start time by visiting the following

website at

https://register.vevent.com/register/BI60631b530d8a4ed9857cb3c83f6bb43f.

Once registered, participants will receive an email with the

dial-in number and unique PIN number to access the live event. The

call will also be accessible on the Investor Relations section of

Caesars’ website at https://investor.caesars.com.

About Caesars Entertainment, Inc.

Caesars Entertainment, Inc. (NASDAQ: CZR) is the largest

casino-entertainment company in the US and one of the world’s most

diversified casino-entertainment providers. Since its beginning in

Reno, NV, in 1937, Caesars Entertainment, Inc. has grown through

development of new resorts, expansions and acquisitions. Caesars

Entertainment, Inc.’s resorts operate primarily under the Caesars®,

Harrah’s®, Horseshoe®, and Eldorado® brand names. Caesars

Entertainment, Inc. offers diversified gaming, entertainment and

hospitality amenities, one-of-a-kind destinations, and a full suite

of mobile and online gaming and sports betting experiences. All

tied to its industry-leading Caesars Rewards loyalty program, the

company focuses on building value with its guests through a unique

combination of impeccable service, operational excellence and

technology leadership. Caesars is committed to its employees,

suppliers, communities and the environment through its PEOPLE

PLANET PLAY framework. To review our latest CSR report, please

visit www.caesars.com/corporate-social-responsibility/csr-reports.

Know When To Stop Before You Start.® Gambling Problem? Call

1-800-522-4700. For more information, please visit

www.caesars.com/corporate.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include statements regarding

our strategies, objectives and plans for future development or

acquisitions of properties or operations, as well as expectations,

future operating results and other information that is not

historical information. When used in this press release, the terms

or phrases such as “anticipates,” “believes,” “projects,” “plans,”

“intends,” “expects,” “might,” “may,” “estimates,” “could,”

“should,” “would,” “will likely continue,” and variations of such

words or similar expressions are intended to identify

forward-looking statements. Although our expectations, beliefs and

projections are expressed in good faith and with what we believe is

a reasonable basis, there can be no assurance that these

expectations, beliefs and projections will be realized. There are a

number of risks and uncertainties that could cause our actual

results to differ materially from those expressed in the

forward-looking statements which are included elsewhere in this

press release. These risks and uncertainties include, but are not

limited to: (a) the impact on our business, financial results and

liquidity of economic trends, inflation, public health emergencies,

terrorist attacks and other acts of war or hostility, work

stoppages and other labor problems, or other economic and market

conditions, including reductions in discretionary consumer spending

as a result of downturns in the economy and other factors outside

our control; (b) the impact of future cybersecurity breaches on our

business, financial conditions and results of operations; (c) our

ability to successfully operate our digital betting and iGaming

platform and expand its user base; (d) risks associated with our

leverage and our ability to reduce our leverage; (e) the effects of

competition, including new competition in certain of our markets,

on our business and results of operations; (f) additional factors

discussed in the sections entitled “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” in the Company’s most recent Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q as filed with the Securities and

Exchange Commission. Other unknown or unpredictable factors may

also cause actual results to differ materially from those projected

by the forward-looking statements.

In light of these and other risks, uncertainties and

assumptions, the forward-looking events discussed in this press

release might not occur. These forward-looking statements speak

only as of the date of this press release, even if subsequently

made available on our website or otherwise, and we do not intend to

update publicly any forward- looking statement to reflect events or

circumstances that occur after the date on which the statement is

made, except as may be required by law.

CAESARS ENTERTAINMENT,

INC.

CONSOLIDATED CONDENSED

STATEMENTS OF OPERATIONS

(UNAUDITED)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In millions, except per share

data)

2024

2023

2024

2023

NET REVENUES:

Casino

$

1,599

$

1,620

$

4,691

$

4,789

Food and beverage

438

443

1,295

1,305

Hotel

515

553

1,522

1,581

Other

322

378

938

1,028

Net revenues

2,874

2,994

8,446

8,703

OPERATING EXPENSES:

Casino

828

831

2,497

2,476

Food and beverage

271

266

800

775

Hotel

152

146

428

426

Other

104

118

298

336

General and administrative

478

528

1,443

1,536

Corporate

76

74

234

239

Impairment charges

—

—

118

—

Depreciation and amortization

326

320

979

943

Transaction and other costs, net

(5

)

(13

)

14

36

Total operating expenses

2,230

2,270

6,811

6,767

Operating income

644

724

1,635

1,936

OTHER EXPENSE:

Interest expense, net

(596

)

(581

)

(1,780

)

(1,761

)

Loss on extinguishment of debt

—

(3

)

(51

)

(200

)

Other income (loss)

4

(1

)

29

5

Total other expense

(592

)

(585

)

(1,802

)

(1,956

)

Income (loss) before income taxes

52

139

(167

)

(20

)

Benefit (provision) for income taxes

(43

)

(47

)

(68

)

904

Net income (loss)

9

92

(235

)

884

Net income attributable to noncontrolling

interests

(18

)

(18

)

(54

)

(26

)

Net income (loss) attributable to

Caesars

$

(9

)

$

74

$

(289

)

$

858

Net income (loss) per share - basic and

diluted:

Basic income (loss) per share

$

(0.04

)

$

0.34

$

(1.34

)

$

3.99

Diluted income (loss) per share

$

(0.04

)

$

0.34

$

(1.34

)

$

3.97

Weighted average basic shares

outstanding

215

215

216

215

Weighted average diluted shares

outstanding

215

216

216

216

CAESARS ENTERTAINMENT,

INC.

RECONCILIATION OF NET INCOME

(LOSS) ATTRIBUTABLE TO CAESARS TO ADJUSTED EBITDA

(UNAUDITED)

Three Months Ended

September 30,

Nine Months Ended

September 30,

(In

millions)

2024

2023

2024

2023

Net income (loss) attributable to

Caesars

$

(9

)

$

74

$

(289

)

$

858

Net income attributable to noncontrolling

interests

18

18

54

26

(Benefit) provision for income taxes

(a)

43

47

68

(904

)

Other (income) loss (b)

(4

)

1

(29

)

(5

)

Loss on extinguishment of debt

—

3

51

200

Interest expense, net

596

581

1,780

1,761

Impairment charges (c)

—

—

118

—

Depreciation and amortization

326

320

979

943

Transaction costs and other, net (d)

7

(27

)

49

47

Stock-based compensation expense

24

26

73

82

Adjusted EBITDA

$

1,001

$

1,043

$

2,854

$

3,008

Pre-disposition Adjusted EBITDA (e)

—

—

—

(15

)

Same-Store Adjusted EBITDA

$

1,001

$

1,043

$

2,854

$

2,993

____________________

(a)

Benefit for income taxes during the nine

months ended September 30, 2023 includes the release of $940

million of valuation allowance against deferred tax assets.

(b)

Other (income) loss for the nine months

ended September 30, 2024 primarily represents a change in estimate

of our disputed claims liability.

(c)

Impairment charges for the nine months

ended September 30, 2024 includes impairments within our Regional

segment, identified in the second quarter of 2024, as a result of a

decrease in projected future cash flows at certain properties

primarily due to localized competition.

(d)

Transaction costs and other, net primarily

includes costs related to non-cash losses on the write down and

disposal of assets, professional services for transaction and

integration costs, various contract exit or termination costs,

pre-opening costs in connection with new property openings and

expansion projects at existing properties, and non-cash changes in

equity method investments. Additionally, transactions costs and

other, net for the three and nine months ended September 30, 2023

includes (i) net proceeds received in exchange for participation

rights in an insurance claim and (ii) proceeds received for the

termination of the Caesars Dubai management agreement.

(e)

Adjustment for pre-disposition results of

operations reflecting the subtraction of results of operations for

Rio All-Suite Hotel & Casino prior to divestiture at the end of

the third quarter of 2023. Such figures are based on unaudited

internal financial statements and have not been reviewed by the

Company’s auditors for the periods presented. The additional

financial information is included to enable the comparison of

current results with results of prior periods.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029891214/en/

Investor Relations: Brian Agnew, bagnew@caesars.com; Charise

Crumbley, ccrumbley@caesars.com, 800-318-0047

Media Relations: Kate Whiteley, kwhiteley@caesars.com

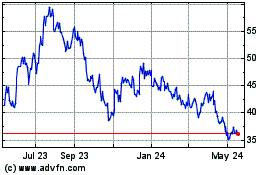

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Oct 2024 to Nov 2024

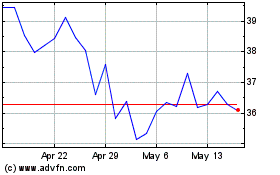

Caesars Entertainment (NASDAQ:CZR)

Historical Stock Chart

From Nov 2023 to Nov 2024