By Ellie Ismailidou and Victor Reklaitis, MarketWatch

Dow industrials post triple-digit decline; Chipotle falls after

sales drop

U.S. stocks extended losses in late-morning trade Monday,

pushing the Dow industrials into negative territory for the year,

as the market pulled back from Friday's big rally amid a drop in

oil prices that weighed on energy shares.

The S&P 500 fell 21 points or 1% to 2,070. The Dow Jones

Industrial Average slipped more than 200 points at one point during

the session and was about 170 points, or 1%, lower to 17,676 in

recent trade. The Nasdaq Composite fell 42 points or 0.8% to

5,101.

Oil futures fell nearly 5% to below $38 a barrel, approaching

their lowest settlement in nearly seven years and once again

slamming shares of energy companies

(http://www.marketwatch.com/story/energy-shares-tank-dragging-sp-500-lower-amid-crude-oil-tumble-2015-12-07),

after the Organization of the Petroleum Exporting Countries's

decision Friday

(http://www.marketwatch.com/story/oil-prices-stuck-below-40-a-barrel-after-opec-decision-2015-12-07)

to keep crude production running at current levels.

The news weighed on the energy sector across the globe,

resulting in the underperformance of the FTSE relative to Germany's

DAX (DAX) due to the U.K. index's higher weighting in oil and gas

stocks relative to its continental peers, said Colin Cieszynski,

chief market strategist at CMC Markets, in a note.

In the U.S., energy was the worst performer on the S&P

Monday morning, down 4.2%. Shares of energy companies CONSOL Energy

Inc. (CNX), Devon Energy Corporation (DVN) and Chesapeake Energy

Corporation (CHK) were among the biggest decliners in the

index.

Oil has become the main cause for concern for investors,

particularly after several recent high-profile defaults in the

energy sector, said Brian Fenske, head of sales trading at ITG. The

focus on oil comes as a rate hike this month is considered a near

certainty. The market is pricing in a 79% probability that the Fed

will raise interest rates at next week's meeting, in what would be

the first hike in nearly a decade, according to the CME Group's

FedWatch tool

(http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html).

U.S. stocks this week are likely to be governed more by

fundamentals rather than central bank policy

(http://www.marketwatch.com/story/focus-on-stock-fundamentals-grows-as-fed-rate-hike-looks-more-likely-2015-12-06),

some analysts said.

On Friday, the S&P surged about 2%

(http://www.marketwatch.com/story/wall-street-poised-to-battle-back-as-jobs-data-swing-into-focus-2015-12-04),

while the Dow jumped 370 points, marking their biggest one-day

advance in nearly three months, following a strong November U.S.

jobs report. The two indexes scored weekly gains of 0.1% and 0.3%,

respectively. The S&P is up 1.6% for the year, while the Dow is

0.1% higher in 2015.

The S&P is going through a "period of backing-and filling"

as it has had a "loss of short-term momentum since October's

impressive upmove," said Katie Stockton, chief technical strategist

at BTIG, in a note Sunday.

"Resistance remains intact at the all-time high near 2,135,"

Stockton said, but added that "a breakout to new highs is

attainable in the weeks ahead as positive seasonal forces take

hold."

Economic news: At 12:30 p.m. Eastern Time, St. Louis Federal

Reserve President James Bullard is slated to give a speech about

the U.S. economy and monetary policy at Ball State University in

Muncie, Ind.

Bullard's talk is expected to be the last speech by a Fed

official before the central bank goes into a communication blackout

ahead of its Dec. 15-16 meeting.

There are no top-tier U.S. economic reports expected on

Monday.

Individual movers: Keurig Green Mountain Inc. (GMCR) surged 74%

on news of a $13.9 billion buyout by JAB Holding

(http://www.marketwatch.com/story/keurig-green-mountain-to-be-bought-out-by-jab-holding-in-a-139-billion-deal-2015-12-07).

Among energy names, CONSOL Energy Inc. (CNX) shares fell 15.5%,

pulled down by a drop in oil prices. Meanwhile, Southwestern Energy

Company (SWN) shares dropped 6.7% and Chesapeake Energy Corporation

(CHK) shares dropped 7.4%.

Shares in Chipotle Mexican Grill Inc. (CMG) fell 3.2% after the

burrito chain warned late Friday of a fourth-quarter sales drop

(http://www.marketwatch.com/story/chipotle-e-coli-outbreak-causes-sales-slump-stock-tanks-2015-12-04)

in the wake of an E. coli outbreak.

Marvell Technology Group Lt. (MRVL) was down 0.4%, paring

earlier losses after saying it's conducting an internal accounting

probe

(http://www.marketwatch.com/story/marvell-tech-misses-profit-sales-expectations-and-conducts-internal-accounting-probe-2015-12-07).

Pep Boys-Manny Moe & Jack (PBY) was up 0.1%, releasing

earlier gains, after activist investor Carl Icahn late Friday

disclosed a 12% stake

(http://www.marketwatch.com/story/pep-boys-shares-surge-as-carl-icahn-takes-1212-stake-2015-12-04)

in the car parts retailer.

General Electric Co. (GE) shares fell 0.8% after the company

said it has pulled the plug

(http://www.marketwatch.com/story/ge-terminates-deal-with-electrolux-after-antitrust-hurdles-2015-12-07)

on the sale of its appliance business to Sweden's Electrolux AB

(ELUXY). The deal faced antitrust hurdles.

Vail Mountain Resorts Inc. (MTN) rose 3.9% after the operator of

ski resorts before the open posted a smaller-than-expected loss

(http://www.marketwatch.com/story/vail-reports-narrower-than-expected-loss-2015-12-07)

for its most recent quarter. Revenue topped forecasts.

Other markets: Asian stocks closed mostly higher

(http://www.marketwatch.com/story/asian-stocks-end-mixed-after-us-jobs-report-2015-12-07)

on Monday, with Japanese shares up 1%. European equities

(http://www.marketwatch.com/story/european-stocks-rebound-after-worst-week-in-three-months-2015-12-07)

were also advancing. A key dollar index gained about 0.5%, weighing

on dollar-denominated commodities. Gold was moderately lower.

(END) Dow Jones Newswires

December 07, 2015 11:51 ET (16:51 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

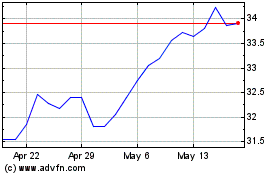

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

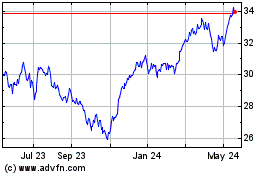

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024