BOND REPORT: Treasury Prices Surge As Equity Rout Sparks Flight To Quality

January 04 2016 - 9:36AM

Dow Jones News

By Ellie Ismailidou, MarketWatch

Treasury yields fall to lowest level since mid December

Treasury prices surged Monday, pushing yields to their lowest

level since mid December, as a global stock-market rout fueled

demand for assets perceived as safe, including government

bonds.

Worries originated in China, where the Shanghai Composite Index

slid almost 7% on the back of a weak manufacturing reading

(http://www.marketwatch.com/story/chinese-manufacturing-index-slips-as-demand-stalls-2016-01-03).

The slide activated a new circuit-breaker system for Chinese

stocks, halting trading on the mainland for the rest of the day

(http://www.marketwatch.com/story/asian-markets-slide-on-fears-of-stalling-chinese-economy-2016-01-03)

(http://www.marketwatch.com/story/asian-markets-slide-on-fears-of-stalling-chinese-economy-2016-01-03)and

rekindling fears of a repeat of last August's plunge, when another

selloff in China's stock market sparked an unraveling of stocks

around the world.

European stocks and Germany's DAX 30 index (DAX)was on track for

its worst day since August,

(http://www.marketwatch.com/story/european-stocks-slammed-lower-by-chinese-market-rout-2016-01-04)

while the Dow Jones Industrial Average opened with a nearly

400-point fall.

(http://www.marketwatch.com/story/us-stocks-set-for-tumble-at-open-as-china-fears-return-2016-01-04)

(http://www.marketwatch.com/story/us-stocks-set-for-tumble-at-open-as-china-fears-return-2016-01-04)

(http://www.marketwatch.com/story/us-stocks-set-for-tumble-at-open-as-china-fears-return-2016-01-04)"The

Treasury market was the clear beneficiary of the flight-to-quality

flows," said Ian Lyngen, senior rates strategist at CRT Capital

Group, in a note, particularly as traders had "the urgency to

establish positions" before Friday's official U.S. jobs report.

Monday's moves mean that "fundamentals began to matter again,"

said Peter Boockvar, chief market analyst at The Lindsey Group,

adding that this is expected "to intensify in 2016 because the

crutch of central bank policy, particularly from the [Federal

Reserve], is beginning to break."

On balance, the yield on the 10-year Treasury note lost 5.5

basis points to 2.218%, its lowest point since Dec. 18, according

to Tradeweb. Bond yields fall when prices rise and vice versa.

The yield on the two-year Treasury note fell 3.6 basis points to

1.028%, while the yield on the 30-year Treasury bond was down 6

basis points to 2.954%.

The weak economic data weren't limited to Chinese manufacturing.

In the U.S., the Markit PMI manufacturing index fell Monday to its

lowest level since October 2012, while the ISM manufacturing index

also missed expectations.

But the final eurozone manufacturing purchasing managers index

(https://www.markiteconomics.com/Survey/PressRelease.mvc/4fa6a086cb8e4710ba65529c2126f148)

showed factories in the currency bloc ended 2015 with the strongest

growth since April 2014.

Yields also declined in the eurozone, as stocks got crushed,

withe the benchmark 10-year german yield falling 6.4 basis points

to 0.569%, its lowest level since Dec. 21.

(END) Dow Jones Newswires

January 04, 2016 10:21 ET (15:21 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

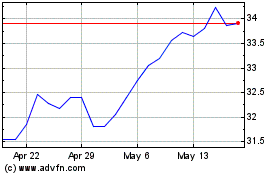

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

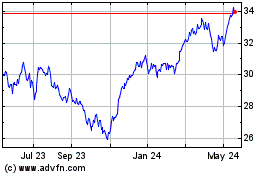

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024