EUROPE MARKETS: Total, HSBC Help European Stocks Claw Back Lost Ground

November 21 2018 - 2:09PM

Dow Jones News

By Barbara Kollmeyer, MarketWatch , Emily Horton

Italy lags gains as EU set to sanction government over

budget

European stocks finished higher Wednesday, clawing back lost

ground from a global equity rout driven by Wall Street a day

earlier as oil and banking stocks pitched in to boost the Stoxx

Europe 600 index.

How are the markets performing?

The Stoxx Europe 600 rose 0.5% to 352.81, after closing down

1.2% on Tuesday.

The FTSE 100 rose 1.5% to close at 7,050.23, while the German

DAX 30 (DAX) climbed 1.6% to finish at 11,244.71 and the French CAC

40 index (PX.V) rose 1% to 4,975.50.

The British pound was last trading at $1.2800 up from $1.2789

late Tuesday in New York. The euro rose to $1.1410 on Wednesday,

versus $1.1370 late Tuesday.

What drove stocks?

Doubts about holiday sales and the chip sector drove the brutal

U.S. tech stock selloff and it bled into the European markets.

Meanwhile, Italy was in the spotlight after the European Union said

it may sanction the country's government

(https://news.google.com/articles/CBMigQFodHRwczovL3d3dy5ldXJhY3Rpdi5jb20vc2VjdGlvbi9lY29ub21pYy1nb3Zlcm5hbmNlL25ld3MvaXRhbHlzLXJldmlzZWQtYnVkZ2V0LWRpZC1ub3QtZGlzcGVsLWNvbmNlcm5zLWV1cm9ncm91cC1wcmVzaWRlbnQtc2F5cy_SAQA?hl=en-US&gl=US&ceid=US%3Aen)over

a budget that breaches EU rules.

What stocks were active?

As oil prices rebounded along with broader markets, shares of

heavily-weighted Total SA (TOT) (TOT) ended 1.1% higher and Royal

Dutch Shell Group PLC (RDSA.LN) (RDSA.LN)(RDSA.LN) gained 2.3%.

Banking major HSBC Holdings PLC (HSBA.LN) (HSBA.LN) rose 2.7%,

while Banco Santander SA (SAN)(SAN.MC) added 1.8%. Shares of

Deutsche Bank AG (DBK.XE) rose 2%.

(END) Dow Jones Newswires

November 21, 2018 14:54 ET (19:54 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

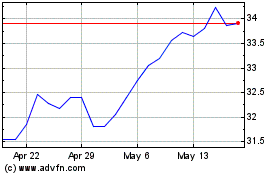

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

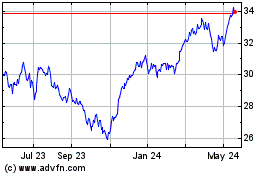

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024