EUROPE MARKETS: European Stocks Inch Higher With Trade Talks, Fed Chair In Focus

November 28 2018 - 8:54AM

Dow Jones News

By Emily Horton

Major oil companies, banks under pressure

European stocks inched into the green on Wednesday, as investors

looked ahead to a trade meeting between the U.S. and China and a

highly anticipated speech by Federal Reserve Chairman Jerome

Powell.

How are the markets performing?

The Stoxx Europe 600 fell 0.2% to 358.10, after closing up 0.2%

on Tuesday.

The German DAX (DAX) was flat at 11,318.69, the French CAC rose

0.2% to 4,993.85 and the FTSE Italy index rose 0.1% to 19,131.72.

The FTSE 100 dipped 0.1% to 7,009.66.

The pound rose to $1.2791 from $1.2745 late in New York on

Tuesday and the euro was mostly unchanged at $1.1294.

What is driving stocks?

European investors were keeping a close eye on geopolitical

events, notably a meeting planned for U.S. President Donald Trump

and President Xi Jinping of China at the G-20 summit in Buenos

Aires this weekend. Trump economic adviser Larry Kudlow said

Tuesday that there was a good possibility for a deal but also that

the White House was disappointed in the Chinese response so

far.

U.K. banks were watching out for the Bank of England's Brexit

stress test results, which will reveal banks resilience to various

Brexit scenarios. Those results are due after the close of U.K.

markets.

What stocks are active?

In the energy sector, BP PLC (BP.LN) (BP.LN) fell 1.3% and Royal

Dutch Shell Group PLC (RDSA.LN) (RDSA.LN) dropped 1.2%.

Among banks, another weak sector, Holdings PLC (HSBA.LN)

(HSBA.LN) fell 1%, while in the consumer goods sector, Reckitt

Benckiser Group PLC (RB.LN) fell nearly 3%, while Unilever PLC

(ULVR.LN)(ULVR.LN) dropped 0.7%.

(END) Dow Jones Newswires

November 28, 2018 09:39 ET (14:39 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

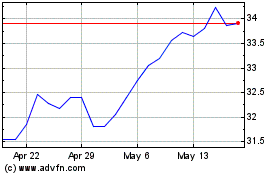

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

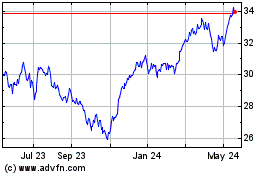

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024