EUROPE MARKETS: Germany's Stock Market Books Best Day In 4 Months As U.S.-China Trade Tensions Ease

December 03 2018 - 1:06PM

Dow Jones News

By Emily Horton

European stocks surge on U. S-China trade detente

European stock markets on Monday finished higher, tracking a

global relief rally, after the U.S. and China over the weekend

agreed to a pause trade-war antagonism at the G-20 summit in a

Argentina.

Resource, oil and auto stocks were among the big gainers.

What are markets doing?

The Stoxx Europe 600 jumped 1% to end at 361.18, after ending

down 1.1% on 357.5 late on Friday.

Germany's DAX (DAX) was the biggest gainer rising 1.9% to

11,465.46, marking its biggest one-day rise since July 26.

Meanwhile, Italy's FTSE MIB rose 2.2% to 19,622.36 and France's CAC

40 added 1% to close at 5,053.98, marking that benchmark's biggest

daily gain since Nov. 21. The U.K.'s FTSE 100 climbed by 1.2% to

7,062.41, having ended down 0.8% on Friday.

The euro rose to $1.1336 from $1.1320 late Friday in New York,

while the British pound grew to $1.2798 from $1.2752 late on

Friday.

What is driving the market?

Stocks around the globe rallied after Donald Trump and Chinese

President Xi Jinping agreed to a cease-fire at the weekend G-20

meeting, with the U.S. promising not to implement planned tariff

increases on a batch of scheduled Chinese exports worth $200

billion to the U.S.

Both leaders agreed to a 90-day truce between U.S. and China to

allow for further time to progress trade talks between the two

countries. Trump also said on Twitter that China will "reduce and

remove" tariffs on U.S. cars.

(http://www.marketwatch.com/story/trump-says-china-will-reduce-and-remove-40-tariffs-on-us-auto-imports-2018-12-02)

Also supporting major indexes, crude prices rallied 4%

(http://www.marketwatch.com/story/crude-prices-rally-4-as-russia-saudis-signal-output-curbs-2018-12-03),

driven by a surprise decision by Canadian producers to cut output,

and comments from Russian President Vladimir Putin at the weekend

G-20. Putin said he and his Saudi Arabia counterpart have agreed to

extend their oil deal to manage supply

(http://www.marketwatch.com/story/putin-says-russia-saudis-agree-to-renew-opec-production-cuts-2018-12-02),

which drove optimism for the end-week OPEC meeting.

Which stocks were active?

German stocks saw the strongest one-day gain since April so far,

with both Daimler AG (DAI.XE) and BMW AG (BMW.XE) jumped by at

least 4.5%, while preferred shares of Volkswagen AG's preferred

shares (VOW.XE) rose 2.9% and German-listed common shares (VOW.XE)

(VOW.XE) climbed by 2.2%.

As China is a big user of natural resources, those stocks also

saw a strong day, with Antofagasta PLC (ANTO.LN) jumped 7.9% and

Rio Tinto PLC (RIO.LN) ended 4% higher.

Major oil companies also helped drive gains for European

indexes, as crude prices rallied. BP PLC (BP.LN) gained 2.3%, Royal

Dutch Shell PLC (RDSA.LN) closed up 1.9% and Total SA (TOT) rose

1.3%.

(END) Dow Jones Newswires

December 03, 2018 13:51 ET (18:51 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

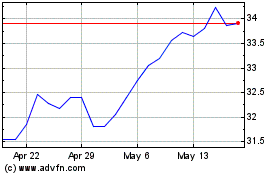

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

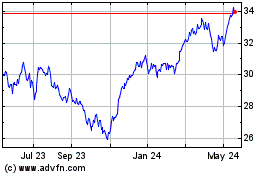

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024