EUROPE MARKETS: Solid Gains For Europe Markets As Oil Climbs, U.S.-China Trade Optimism Grows

December 12 2018 - 1:25PM

Dow Jones News

By Emily Horton

Inditex among big decliners after results disappoint

European markets gained Wednesday, as investors got more

positive on trade talks between the U.S. and China and possible

complications from a jailed Huawei executive, while banks advanced

and gains for oil also helped some heavyweight energy names.

In the U.K., Prime Minister Theresa May faced a vote of

no-confidence in a challenge to her leadership of the Conservative

Party.

How are the markets performing?

The Stoxx Europe 600 surged 1.7%, its biggest rise since Oct.

31, to close at 350, after finishing up 1.5% on Tuesday.

The German DAX (DAX) rose 1.4% to end at 10,929.43, and the

French CAC 40 jumped 2.2% to close at 4,909.45. The FTSE 100

finished 1.1% higher at 6,880.19.

What is driving markets?

May faced a vote of confidence in her leadership Wednesday

evening

(https://www.fnlondon.com/articles/theresa-may-to-face-vote-of-confidence-this-evening-20181212),

after it was confirmed that a group of anti-EU Conservative

politicians had secured enough votes to force a challenge. If

successful, the search for a new leader of the party will begin,

which could take number of months to complete. If May wins the

vote, no challenge can be mounted for another year.

Read:What Theresa May's leadership fight means for Brexit-wary

investors

(http://www.marketwatch.com/story/what-theresa-mays-leadership-fight-means-for-brexit-weary-investors-2018-12-12)

French President Emmanuel Macron's promise to cut taxes and lift

wages for workers, has led investors and politicians to debate if

France's potential breach of the European Union's fiscal rules will

lead Brussels to relent in its budget battle with Rome

(http://www.marketwatch.com/story/will-eu-treat-italy-more-leniently-as-frances-macron-risks-breaching-fiscal-rules-2018-12-11).

The appearance of easing tensions between the U.S. and China

over trade also helped out. U.S. President Donald Trump said he's

on the cusp of intervening in a growing crisis over a Chinese

telecommunications executive if it can help keep a trade deal on

track, according to an interview Reuters

(https://www.reuters.com/article/us-usa-trump/trump-says-would-intervene-in-arrest-of-chinese-executive-idUSKBN1OB01P).

What stocks are active?

Heavyweight oil stocks rose, with Total S.A. (TOT) climbing by

1.5%, Royal Dutch Shell PLC (RDSA.LN) up 0.7%. The stocks pared

earlier gains, however, as crude prices trimmed their advance

(http://www.marketwatch.com/story/oil-prices-gain-on-sign-of-us-inventory-dip-2018-12-12)

in the wake of a smaller-than-expected fall in U.S. crude

inventories.

Banks were big gainers, with BNP Paribas SA (BNP.FR) rising 3%

and Intesa Sanpaolo (ISP.MI) posting a gain of more than 4%.

Shares of Spanish retailing giant Inditex ES (ITX.MC) slumped

nearly 5% as earnings just missed forecasts.

(http://www.marketwatch.com/story/inditex-profit-come-in-slightly-short-of-forecasts-2018-12-12)

John Wood Group PLC (WG.LN) shares dropped more than 10% after

results

(http://www.marketwatch.com/story/wood-group-sees-revenue-up-10-vs-2017-2018-12-12).

Supermarket grup J Sainsbury PLC (SBRY.LN) fell by more than 7%

after saying it and Asda Group Ltd. have asked the Competition

Appeal Tribunal for a review of an investigation

(http://www.marketwatch.com/story/j-sainsbury-asda-ask-for-more-time-on-cma-probe-2018-12-12)

into their merger by the U.K.'s Competition and Markets

Authority.

(END) Dow Jones Newswires

December 12, 2018 14:10 ET (19:10 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

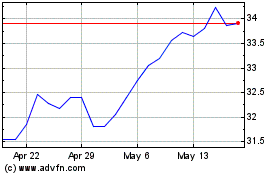

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

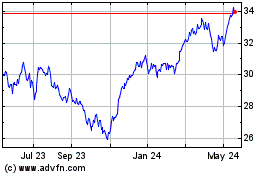

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024