EUROPE MARKETS: Europe Stocks End Lower As Global Economy Clouds Darken

December 14 2018 - 1:24PM

Dow Jones News

By Emily Horton

Mining stocks drop as weak China data rattles investors

European markets fell Friday, as fresh data showed a slowdown in

China and underperforming manufacturing figures for the eurozone,

reigniting investors nerves over slowing global economic

growth.

Banks and mining stocks led the heavyweight decliners.

How are the markets performing?

The Stoxx Europe 600 declined 0.6% to finish at 347.21, but held

on to a 0.5% weekly rise.

The German DAX (DAX) fell 0.5% to 10,865.77, and the French CAC

40 shed 0.9% to 4,853.70 The FTSE 100 dropped 0.5% to 6,845.17.

What is driving markets?

Business activity in China mostly slowed

(http://www.marketwatch.com/story/us-stock-futures-under-pressure-after-weak-china-data-2018-12-14)

in November, official data showed on Friday, as industrial

production and retail sales indicated renewed weakness. Investors

have been driving up stocks this week on optimism over trade

negotiations, but the China data indicated the collateral damage

the data was having.

The euro was hit by underperforming purchasing managers index

composite figures

(http://www.marketwatch.com/story/french-german-pmi-data-underwhelms-2018-12-14),

with data researcher IHS Markit reporting that a provisional

measure of activity for France's private sector basically ground to

a halt. Protests aimed at the government have been widely blamed

for slowing parts of the economy, with more demonstrations expected

this weekend.

The eurozone PMI itself saw the weakest quarter of growth since

early 2013 as Germany and Italy also contracted. Separately,

another set of data showed European car sales falling for a

third-straight month

(http://www.marketwatch.com/story/eu-car-sales-fall-for-a-third-straight-month-2018-12-14).

U.K. Prime Minister Theresa May, having narrowly won a

leadership challenge on Wednesday evening, was under pressure again

in Brussels as she attempted to bid for a new Brexit concession

from her European Union counterparts. May was due to give a speech

later on Friday.

What stocks are active?

As China is a big buyer of natural resources, miners are

vulnerable to signs of weakness in that economy. Glencore PLC

(GLEN.LN) fell by almost 2% and Rio Tinto (RIO.LN) declined

1.6%.

Among auto makers, Renault S.A (RNO.FR) fell 2.5%.

Shares of Scout24 AG (G24.XE) soared 13.6% on a report that the

German online business listings company may go private in a 5

billion euro ($5.6 billion) deal

(http://www.marketwatch.com/story/scout24-weighs-5b-sale-to-take-it-private-ft-2018-12-14),

just three years after it went public.

-- Barbara Kollmeyer contributed to this article

(END) Dow Jones Newswires

December 14, 2018 14:09 ET (19:09 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

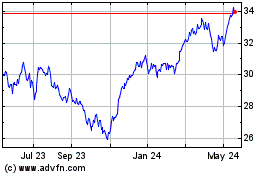

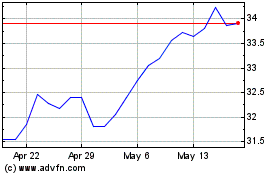

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025