EUROPE MARKETS: European Markets Rise On China's Economic Pledge

January 15 2019 - 5:01AM

Dow Jones News

By Emily Horton

European markets were mostly in the green on Tuesday, after

Chinese government officials outlined plans to boost the country's

sluggish economy.

In the U.K., politicians are preparing to vote on Prime Minister

Theresa May's contentious agreement for leaving the European Union

in March.

How are the markets trading?

Most of Europe's major indexes were up on Tuesday, with the

Stoxx Europe 600 adding 0.2% to 348.17, after finishing down 0.5%

on Monday.

France's CAC 40 added 0.2% to 4,771.90, the U.K.'s FTSE 100 was

up 0.2% to 6,867.72 and Germany's DAX (DAX) gained 0.1% to

10,869.37.

Italy's FTSE MIB index was the biggest regional loser on Monday,

dropping 0.4% to 19,090.60.

The euro dropped to $1.1436 from $1.147 and the British pound

last bought $1.2874, slightly higher than $1.2866 late Monday.

What is driving the markets?

In China, government officials have stepped up efforts

(http://www.marketwatch.com/story/china-to-ramp-up-efforts-to-support-economy-2019-01-15)

to spur economic growth amid signs the country's economic slowdown

is deepening. Beijing intends to improve credit availability for

smaller companies, accelerate infrastructure investment and cut

taxes

(http://www.marketwatch.com/story/china-to-slash-taxes-keep-currency-stable-to-offset-slowdown-2019-01-14).

In the U.K, a landmark vote over May's divisive agreement for

Brexit is scheduled to take place at 22:30 GMT on Tuesday. Most

expect it to be rejected, with more than 100 Conservative

politicians currently opposed to its terms.

In the event that the deal is voted down, May will have three

days to come up with an alternative for exiting the European Union

on March 29. However, EU leaders have insisted that the deal

already agreed is the only one on offer.

The U.S. and European Union have sharply differing goals for

coming trade negotiations on, raising the prospect for renewed

trans-Atlantic tensions, The Wall Street Journal reports

(https://www.wsj.com/articles/u-s-eu-set-conflicting-goals-for-looming-trade-talks-11547500468).

And Germany's economy slowed sharply last year

(http://www.marketwatch.com/story/germanys-economy-slowed-sharply-in-2018-2019-01-15),

shaken by softening consumer spending at home and weakness in key

export markets.

What stocks are active?

Portuguese food distributor Jeronimo Martins SGPS SA (JMT.LB)

added 5%.

In financial stocks, private-equity firm Partners Group Holding

AG (PGHN.EB) gained 3%.

Italian banks were down on Tuesday, with Unione di Banche

Italiane SpA (UBI.MI) dropping 7% and Banco BPM SpA (BAMI.MI)

losing 6%.

Meanwhile, manufacturer AMS AG (AMS.EB) rose by 3%.

(END) Dow Jones Newswires

January 15, 2019 05:46 ET (10:46 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

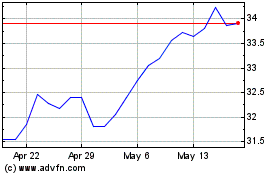

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

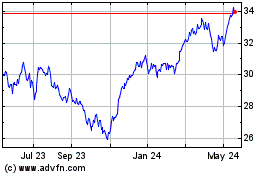

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025