EUROPE MARKETS: European Markets Struggle As Boost Fades From China's Economic Pledge

January 15 2019 - 8:41AM

Dow Jones News

By Emily Horton

Downbeat U.S. earnings help erode earlier gains

European markets gave up gains on Tuesday, after Chinese

government officials outlined plans to boost the country's sluggish

economy.

In the U.K., politicians are preparing to vote on Prime Minister

Theresa May's contentious agreement for leaving the European Union

in March.

How are the markets trading?

Most of Europe's major indexes started the day higher, but were

lower by the afternoon, with the Stoxx Europe 600 moving to flat at

347.34, after finishing down 0.5% on Monday.

France's CAC 40 was flat at 4,764.57, the U.K.'s FTSE 100 was

unchanged at 6,854.71 and Germany's DAX (DAX) slipped 0.2% to

10,828.21.

Italy's FTSE MIB index was the biggest regional loser on Monday,

dropping 0.1% to 19,141.97.

The euro dropped to $1.1442, down 0.3% and the British pound

last bought $1.2874, slightly higher than $1.2866 late Monday.

What is driving the markets?

In China, government officials have stepped up efforts

(http://www.marketwatch.com/story/china-to-ramp-up-efforts-to-support-economy-2019-01-15)

to spur economic growth amid signs the country's economic slowdown

is deepening. Beijing intends to improve credit availability for

smaller companies, accelerate infrastructure investment and cut

taxes

(http://www.marketwatch.com/story/china-to-slash-taxes-keep-currency-stable-to-offset-slowdown-2019-01-14).

The landmark vote over May's divisive agreement for Brexit is

scheduled to take place at 10:30 p.m. local time in the U.K. on

Tuesday (5:30 p.m Eastern). Most expect it to be rejected in the

worst defeat for any U.K. prime minister in history

(http://www.marketwatch.com/story/brexit-brief-uk-prime-minister-faces-historic-defeat-in-landmark-vote-2019-01-15),

with more than 100 Conservative politicians currently opposed to

its terms.

In the event that the deal is voted down, May will have three

days to come up with an alternative for exiting the European Union

on March 29. However, EU leaders have insisted that the deal

already agreed is the only one on offer.

Read:May in last-ditch push for Brexit deal votes -- what the

City of London is saying

(https://www.fnlondon.com/articles/may-in-last-ditch-push-for-brexit-deal-votes-what-the-city-is-saying-20190115)

(https://www.fnlondon.com/articles/may-in-last-ditch-push-for-brexit-deal-votes-what-the-city-is-saying-20190115)Fresh

data showed Germany's economy slowed sharply last year

(http://www.marketwatch.com/story/germanys-economy-slowed-sharply-in-2018-2019-01-15),

shaken by softening consumer spending at home and weakness in key

export markets.

What stocks are active?

Portuguese food distributor Jeronimo Martins SGPS SA (JMT.LB)

was the top gainer, adding over 7%

Italian banks were down on Tuesday, with Unione di Banche

Italiane SpA (UBI.MI) dropping nearly 5% and Banco BPM SpA

(BAMI.MI) losing more than 5% after a report in an Italian

newspaper that the European Central Bank reportedly asked lenders

to set aside more money for by 2016

(https://uk.reuters.com/article/idUKL8N1ZF2B6).

Meanwhile, manufacturer AMS AG (AMS.EB) rose by 3%.

(END) Dow Jones Newswires

January 15, 2019 09:26 ET (14:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

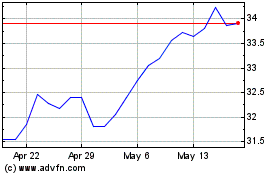

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

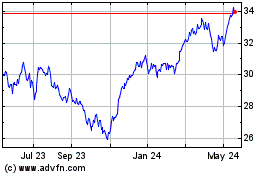

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024