EUROPE MARKETS: European Markets Notch Hard-fought Gains Amid China's Economic Pledge

January 15 2019 - 1:07PM

Dow Jones News

By Emily Horton

Investors were keeping one eye on Brexit vote; Italian equity

market lags behind peers

European markets finished higher Tuesday, in an up-and-down

session, as Chinese government officials outlined plans to boost

the country's sluggish economy.

In the U.K., politicians were preparing to vote on Prime

Minister Theresa May's contentious agreement for leaving the

European Union in March.

How are the markets trading?

The Stoxx Europe 600 gained 0.4% to close at 348.71, after

finishing down 0.5% on Monday.

France's CAC 40 closed 0.5% higher at 4,786.17, the U.K.'s FTSE

100 rose 0.6% to end at 6,895.02 and Germany's DAX (DAX) added 0.3%

to 10,891.79.

Italy's FTSE MIB lagged behind regional peers, finishing little

changed, down less than 0.1% to 19,165.48.

The euro dropped to $1.1388, compared with $1.1472 late Monday,

and the British pound last bought $1.2732, down sharply from

$1.2866, in the previous session.

What is driving the markets?

A landmark vote over May's divisive agreement for Brexit was

scheduled to take place at 10:30 p.m. local time in the U.K. on

Tuesday (around 5:30 p.m. Eastern). Most expect it to be rejected

soundly in the worst defeat for any U.K. prime minister in history

(http://www.marketwatch.com/story/brexit-brief-uk-prime-minister-faces-historic-defeat-in-landmark-vote-2019-01-15),

with more than 100 Conservative politicians currently opposed to

its terms.

In China, government officials have stepped up efforts

(http://www.marketwatch.com/story/china-to-ramp-up-efforts-to-support-economy-2019-01-15)

to spur economic growth amid signs the country's economic slowdown

is deepening. Beijing intends to improve credit availability for

smaller companies, accelerate infrastructure investment and cut

taxes

(http://www.marketwatch.com/story/china-to-slash-taxes-keep-currency-stable-to-offset-slowdown-2019-01-14).

In the event that the deal is voted down, May will have three

days to come up with an alternative for exiting the European Union

on March 29. However, EU leaders have insisted that the deal

already agreed is the only one on offer.

Read:May in last-ditch push for Brexit deal votes -- what the

City of London is saying

(https://www.fnlondon.com/articles/may-in-last-ditch-push-for-brexit-deal-votes-what-the-city-is-saying-20190115)

(https://www.fnlondon.com/articles/may-in-last-ditch-push-for-brexit-deal-votes-what-the-city-is-saying-20190115)Fresh

data showed Germany's economy slowed sharply last year

(http://www.marketwatch.com/story/germanys-economy-slowed-sharply-in-2018-2019-01-15),

shaken by softening consumer spending at home and weakness in key

export markets.

What stocks are active?

Portuguese food distributor Jeronimo Martins SGPS SA (JMT.LB)

was the top gainer, adding 9%.

Italian banks were down on Tuesday, with Unione di Banche

Italiane SpA (UBI.MI) dropping nearly 5% and Banco BPM SpA

(BAMI.MI) losing more than 4% after a report in an Italian

newspaper that the European Central Bank reportedly asked lenders

to set aside more money for by 2016

(https://uk.reuters.com/article/idUKL8N1ZF2B6).

Meanwhile, manufacturer AMS AG (AMS.EB) fell by 0.8%.

(END) Dow Jones Newswires

January 15, 2019 13:52 ET (18:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

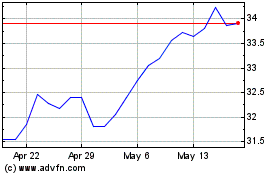

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

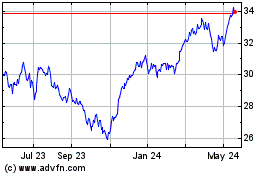

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024