EUROPE MARKETS: Earnings News Helps Support Gains For European Markets

January 29 2019 - 8:39AM

Dow Jones News

By Emily Horton

London rallies as investors await series of Brexit-related

votes

European markets were mostly in the green on Tuesday, as

investors picked up shares of consumer stocks, and a series of

positive announcements from technology and metal companies helped

hoist the main index up.

How did markets perform?

Nearly all of Europe's major indexes were in the green on

Tuesday, with the Stoxx Europe up 1% to 357.94, all but reversing a

loss of nearly 1% on Monday.

France's CAC 40 surged 1.1% to 4,945.19 and the FTSE 100 rose

1.4% to reach 6,840.84.

Germany's DAX 30 (DAX) and Italy's FTSE MIB Italy index , lagged

behind, with gains of 0.2% and 0.8%, respectively.

The euro slipped Tuesday, fetching $1.1421 from $1.1429 late in

New York on Monday.

The British pound rose to $1.3555 from $1.3157 seen in late

trading in New York on Friday.

What drove the markets?

The trade relationship between the U.S. and China was under

pressure again on Tuesday, after the Trump administration revealed

a series of criminal charges

(http://www.marketwatch.com/story/huawei-denies-us-violations-disappointed-by-criminal-charges-2019-01-28)

against telecom giant Huawei Technologies Co (002502.SZ).

Nervousness over trade issues can draw investors to perceived

safe-haven plays such as consumer stocks, with Unilever PLC

(ULVR.LN) up 1.7% and Reckitt Benckiser Group PLC (RB.LN) adding

1.6%.

In economic news, European Central Bank President Mario Draghi,

told European lawmakers in Brussels on Monday that the central bank

is open to resuming quantitative-easing if needed, The Wall Street

Journal reported

(https://www.wsj.com/articles/ecb-open-to-resuming-quantative-easing-if-needed-says-draghi-11548698353).

In the U.K., the parliamentary debate and vote over the changes

British lawmakers want Prime Minister Theresa May to add to her

Brexit deal will begin on Tuesday

(http://www.marketwatch.com/story/uks-may-plans-to-renegotiate-brexit-deal-2019-01-29).

Read: British pound slightly higher ahead of expected volatile

Brexit trading

(http://www.marketwatch.com/story/british-pound-slightly-higher-ahead-of-expected-volatile-brexit-trading-2019-01-29)

What shares were active?

Koninklijke Philips NV ADR (PHIA.AE) jumped 3.4% after the tech

company announced the start of a new $1.71 billion share-buyback

program

(http://www.marketwatch.com/story/philips-profit-falls-announces-15b-buyback-2019-01-29).

SSAB AB gained 5% after that the Swedish steelmaker said the

near-term outlook was relatively good for business

(http://www.marketwatch.com/story/ssab-profit-shy-of-expectations-amid-outages-2019-01-29).

Within health-care stocks, Siemens Healthineers AG (SHL.XE) fell

2.7% on the news of a profit rise

(http://www.marketwatch.com/story/siemens-healthineers-profit-up-diagnostics-weak-2019-01-29).

Meanwhile, Royal Mail PLC(RMG.LN) slumped 11%, after investors

were unimpressed by the postal service company's lackluster results

(http://www.marketwatch.com/story/royal-mail-underlying-revenue-rises-2019-01-29).

Norwegian Air Shuttle ASA (NAS.OS) lost 12% after the airline

reportedly

(https://www.ft.com/content/9e8cb982-2394-11e9-b329-c7e6ceb5ffdf)

announced a $355 million rights issue and disclosed a deepening

annual loss.

And shares of German business software group SAP AG (SAP.XE)

(SAP.XE) were down 2% after the company reported a drop in

fourth-quarter revenue and said it will restructure for the first

time in four years

(http://www.marketwatch.com/story/germanys-saps-restructuring-to-affect-4400-jobs-2019-01-29),

with 4,400 jobs affected.

he financial services provider Hargreaves Lansdown PLC (HL.LN)

announced its assets had dropped by 6% on Tuesday, Reuters reported

(https://uk.reuters.com/article/uk-hargreaves-results/hargreaves-lansdown-assets-drop-6-percent-in-first-half-as-markets-slide-idUKKCN1PN0KY),

leading to a 6% decline in its share price.

(END) Dow Jones Newswires

January 29, 2019 09:24 ET (14:24 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

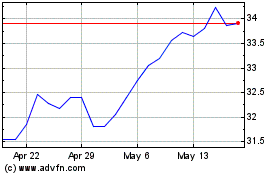

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

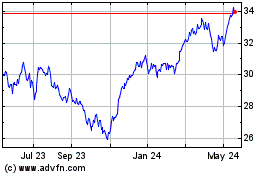

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Mar 2024 to Mar 2025