EUROPE MARKETS: Europe's Markets Struggle Against Downbeat Earnings, Economic News

February 21 2019 - 8:35AM

Dow Jones News

By Emily Horton

Centrica, BAE Systems, AP Moeller Maersk fall on earnings

Europe's markets were mixed on Thursday, struggling against a

myriad of headwinds including weak economic data and earnings.

A batch of earnings data also drove action for a number of

stocks, and leaned on some indexes.(BA.LN)

How are markets performing?

The Stoxx Europe 600 lost 0.2% to 370.75 on Thursday, after

finishing up 0.7% on Wednesday.

The FTSE 100 led the regions top decliners falling 0.9% to

7,180.85, pulled down by poorly received results from U.K.

heavyweights Centrica PLC (CNA.LN) and BAE Systems PLC

(BA.LN)(BA.LN)

Italy's FTSE MIB index was next, dropping by 0.3% to 20,247.76,

while France's CAC 40 remained flat at 5,194.58.

Spain's IBEX 35 gained 0.1% to 9,188.80 and the German DAX (DAX)

rose by 0.3% to 11,431.

The euro remained flat on Thursday, at $1.1334, while the pound

climbed to $1.3066 from $1.3052 late in New York on Wednesday.

What's driving the markets?

Business surveys released Thursday showed the eurozone's

manufacturing sector entered its first downturn since mid-2013, led

by Germany. A batch of U.S. data was also released, which included

weak durable goods orders

(http://www.marketwatch.com/story/autos-planes-boost-durable-goods-orders-in-december-but-everything-else-is-weak-2019-02-21)and

the Philly Fed manufacturing index that slid into negative

territory

(http://www.marketwatch.com/story/philly-fed-manufacturing-index-slumps-into-negative-territory-in-february-2019-02-21).

Investors were reviewing a mixed bag of signals on Thursday,

from fresh optimism over a trade truce between the U.S. and China,

to minutes from the Federal Reserve that indicated a slightly

higher chance of a rate increase this year than investors had

anticipated.

What stocks are active?

Centrica PLC (CNA.LN) slumped by 12%, after the FTSE 100 energy

company warned it will struggle to reach cash flow targets in 2019

owing to exceptional charges

(http://www.marketwatch.com/story/centrica-profit-rises-sells-clockwork-for-300m-2019-02-21).

Although the company met its target for 2018, chief executive Iain

Conn warned 2019 would be a challenge.

A.P. Moeller-Maersk A/S (MAERSK-B.KO) fell by 7%, after its

fourth quarter profit missed expectations

(http://www.marketwatch.com/story/maersk-to-list-drilling-unit-as-profit-disappoints-2019-02-21),

a drop chief executive Soren Skou put down to "a challenging start

to 2018". The world's largest container shipping company acts as a

global gage for trade, at a time when the U.S. and China trade

negotiations are on going.

Shares of U.K. defence company BAE Systems PLC (BA.LN) dropped

by 7%, despite reporting 14% profit increase, after the weapons

maker said that Germany's band on selling arms to Saudi Arabia

could prove "difficult" for the company in the long run, City AM

reported

(http://www.cityam.com/273591/bae-systems-profits-up-despite-mixed-full-year-results).

Barclays PLC (BCS), whose profits rose by a quarter in 2018

(http://www.marketwatch.com/story/barclays-profit-falls-short-but-backs-targets-2019-02-21),

added 0.4%. The U.K. bank booked group pre-tax profits of GBP3.49

billion last year, while revenues were flat. Analysts at Jefferies

described the figures as "a bit dull but possibly good enough."

(END) Dow Jones Newswires

February 21, 2019 09:20 ET (14:20 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

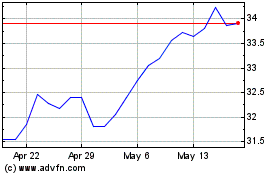

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

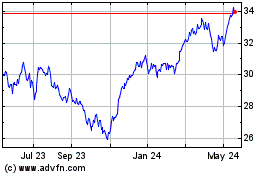

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024