Digihost Announces Restatement of Previously Issued Financial Statements

March 05 2025 - 4:05PM

Digihost Technology Inc. (“

Digihost” or the

“

Company”) (Nasdaq / TSXV: DGHI), an innovative

energy infrastructure company that develops cutting-edge data

centers, today announced that it has filed an amended annual report

on Form 20-F for the fiscal year ended December 31, 2023 (the

“

2023 Annual Report” and, as so amended, the

“

Amended 2023 Annual Report”) with the U.S.

Securities and Exchange Commission (the “

SEC”),

which contains restated financial statements for the fiscal years

ended December 31, 2023 and 2022 (the “

Restatement

Periods”) and related updates to management’s discussion

and analysis for the Restatement Period. In connection with the

SEC’s review of the 2023 Annual Report (the “

SEC

Review”), and in consultation with members of management

and the Audit Committee of the Board of Directors, the Company

determined that its previously issued consolidated financial

statements for the Restatement Periods that were included in the

2023 Annual Report and the related management’s discussion and

analysis for the year ended December 31, 2023 were required to be

restated to correct a material error in the classification of

proceeds derived from the sale of digital assets. Digihost

previously categorized proceeds derived from the sale of digital

assets as a cash flow from operating activities. In conjunction

with the SEC review, it was determined that proceeds from the sale

of digital assets should instead be classified as cash flow from

investing activities.

Shareholders and users of the Company’s

financial statements should note that the restatement is not a

result of any change to the Company’s operations, business or

financial operating performance for the Restatement Periods. For

any and all of the Restatement Periods, there was no impact on the

Company’s overall cash position or net cash flows.

A summary of the restated financial statements

is available in the tables set forth below (expressed in thousands

of U.S. dollars). More details may be found in the revised

financial statements and related revised management’s discussion

and analysis included in the Amended 2023 Annual Report, which are

available on the Company’s profile on SEDAR+ at

www.sedarplus.ca and on EDGAR at www.sec.gov/edgar.

Adjustments to consolidated statements

of cash flows for the year ended December 31, 2022 –

Restatement

|

|

Year ended December 31 |

|

|

2022 (as reported) |

Cash flow reclassification |

2022 (as restated) |

| Cash flows provided by

(used in) in operating activities |

|

|

|

| Net loss |

4,329,342 |

– |

4,329,342 |

| Adjustments for: |

|

|

|

|

Proceeds from sale of digital assets |

15,528,972 |

(12,084,280) |

3,444,692 |

|

Net change in cash related to operating

activities |

(3,410,899) |

(12,084,280) |

(15,495,179) |

| |

|

|

|

| Cash flows provided by

(used in) in investing activities |

|

|

|

| Acquisition of digital

currencies |

– |

(3,932,000) |

(3,932,000) |

|

Proceeds form sale of digital assets |

– |

16,016,280 |

16,016,280 |

|

Net change in cash related to investing

activities |

(14,513,038) |

12,084,280 |

(2,428,758) |

Adjustments to consolidated statements

of cash flows for the year ended December 31, 2023 –

Restatement

|

|

Year ended December 31 |

|

|

2023 (as reported) |

Cash flow reclassification |

2023 (as restated) |

| Cash flows provided by

(used in) in operating activities |

|

|

|

| Net loss |

(21,885,410) |

– |

(21,885,410) |

| Adjustments for: |

|

|

|

|

Proceeds from sale of digital assets |

1,388,123 |

(19,264,980) |

(17,876,857) |

|

Net change in cash related to operating

activities |

5,692,022 |

(19,264,980) |

(13,572,958) |

| |

|

|

|

| Cash flows provided by

(used in) in investing activities |

|

|

|

|

Proceeds from sale of digital assets |

– |

19,264,980 |

19,264,980 |

|

Net change in cash related to investing

activities |

(7,257,482) |

19,264,980 |

12,007,498 |

The Company’s management has previously

concluded that the Company had a material weakness in its internal

control over financial reporting during the Restatement Periods.

Management is in the process of implementing remediation measures

to address the material weakness in respect of the errors described

above.

About

Digihost

Digihost is an innovative energy infrastructure

company that develops cutting-edge data centers to drive the

expansion of sustainable energy assets.

For further information, please contact:

Michel Amar, Chief Executive OfficerDigihost

Technology Inc.www.digihostpower.comDigihost Investor RelationsT:

888-474-9222Email: IR@digihostpower.com

Cautionary

Statement

Trading in the securities of the Company should

be considered highly speculative. No stock exchange, securities

commission or other regulatory authority has approved or

disapproved the information contained herein. Neither the TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this release.

Forward-Looking

Statements

Except for the statements of historical fact,

this news release contains “forward-looking information” and

“forward-looking statements” (collectively, “forward-looking

information”) that are based on expectations, estimates and

projections as at the date of this news release and are covered by

safe harbors under Canadian and United States securities laws.

Forward-looking information in this news release includes

information about potential further improvements to profitability

and efficiency across mining operations, including, as a result of

the Company’s expansion efforts, potential for the Company’s

long-term growth and clean energy strategy, and the business goals

and objectives of the Company. Factors that could cause actual

results to differ materially from those described in such

forward-looking information include, but are not limited to: the

pending SEC Review; the potential that additional restatements of

the Company’s financial statements will be required; the potential

that the Company identifies additional material weaknesses in its

control over financial reporting; the ability of the Company to

remediate known material weaknesses; future capital needs and

uncertainty of additional financing; share dilution resulting from

equity issuances; risks relating to the strategy of maintaining and

increasing Bitcoin holdings and the impact of depreciating Bitcoin

prices on working capital; effects on Bitcoin prices as a result of

the most recent Bitcoin halving; development of additional

facilities and installation of infrastructure to expand operations

may not be completed on the timelines anticipated by the Company,

or at all; ability to access additional power from the local power

grid and realize the potential of the clean energy strategy on

terms which are economic or at all; a decrease in cryptocurrency

pricing, volume of transaction activity or generally, the

profitability of cryptocurrency mining; further improvements to

profitability and efficiency may not be realized; development of

additional facilities to expand operations may not be completed on

the timelines anticipated by the Company; ability to access

additional power from the local power grid; an increase in natural

gas prices may negatively affect the profitability of the Company’s

power plant; the digital currency market; the Company’s ability to

successfully mine digital currency on the cloud; the Company may

not be able to profitably liquidate its current digital currency

inventory, or at all; a decline in digital currency prices may have

a significant negative impact on the Company’s operations; the

volatility of digital currency prices; and other related risks as

more fully set out in the Annual Information Form of the Company

and other documents disclosed under the Company’s filings at

www.sedarplus.ca and www.SEC.gov/EDGAR. The forward-looking

information in this news release reflects the current expectations,

assumptions and/or beliefs of the Company based on information

currently available to the Company. In connection with the

forward-looking information contained in this news release, the

Company has made assumptions about: the current profitability in

mining cryptocurrency (including pricing and volume of current

transaction activity); profitable use of the Company’s assets going

forward; the Company’s ability to profitably liquidate its digital

currency inventory as required; historical prices of digital

currencies and the ability of the Company to mine digital

currencies on the cloud will be consistent with historical prices;

the ability to maintain reliable and economical sources of power to

run its cryptocurrency mining assets; the negative impact of

regulatory changes in the energy regimes in the jurisdictions in

which the Company operates; and there will be no regulation or law

that will prevent the Company from operating its business. The

Company has also assumed that no significant events occur outside

of the Company's normal course of business. Although the Company

believes that the assumptions inherent in the forward-looking

information are reasonable, forward-looking information is not a

guarantee of future performance and accordingly undue reliance

should not be put on such information due to the inherent

uncertainties therein. The Company undertakes no obligation to

revise or update any forward-looking information other than as

required by law.

Digi Power X (NASDAQ:DGHI)

Historical Stock Chart

From Feb 2025 to Mar 2025

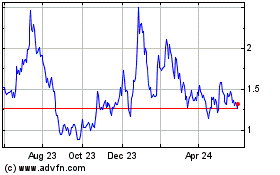

Digi Power X (NASDAQ:DGHI)

Historical Stock Chart

From Mar 2024 to Mar 2025