During the three months ended December 31, 2023, Daily Journal

Corporation (NASDAQ:DJCO) had consolidated revenues of $15,993,000

as compared to $12,301,000 in the prior year period. This increase

of $3,692,000 was primarily from increases in (i) Journal

Technologies’ license and maintenance fees of $2,162,000,

consulting fees of $980,000, and other public service fees of

$450,000, and (ii) the Traditional Business’ advertising revenues

of $97,000.

The Traditional Business’ pretax income

decreased by $648,000 to $287,000 from $935,000 in the prior fiscal

year, primarily due to increased personnel costs of $331,000 to

$2,549,000 from $2,218,000, and a smaller reduction of $80,000 to

the Company’s long-term supplemental compensation accrual to a

reduction of $420,000 as compared with a reduction of $500,000 in

the prior fiscal year period. Journal Technologies’ business

segment pretax income increased by $1,987,000 to $336,000 from a

pretax loss of $1,651,000 in the prior fiscal year period primarily

resulting from increased revenues of $3,592,000. These revenue

increases were partially offset by increased operating expenses of

$1,605,000 mostly due to (i) increased personnel costs because of

salary adjustments due to recent inflation in the compensation

market for talent, (ii) additional contractor services and the

hiring of additional staff members to strengthen operational

efficiencies, product development, and bolster the teams working on

the Company’s installation projects, and (iii) increased

third-party hosting fees which were billed to clients.

The Company’s non-operating income, net of

expenses, decreased by $9,526,000 to $15,117,000 from $24,643,000

in the prior fiscal year period primarily because of (i) the

recording of net unrealized gains on marketable securities of

$14,690,000 as compared with $24,025,000 in the prior fiscal year

period, (ii) increases in interest expenses of $269,000 to

$1,142,000 from $873,000 primarily due to the federal interest rate

increases, and (iii) the recording of realized net gains on sales

of marketable securities of $422,000 in the prior fiscal year

period. These decreases were partially offset by increases in

dividends and interest income of $500,000 to $1,569,000 from

$1,069,000.

Consolidated pretax income was $15,740,000, as

compared to $23,927,000 in the prior fiscal year period. There was

consolidated net income of $12,615,000 ($9.16 per share) for the

three months ended December 31, 2023, as compared with $17,827,000

($12.95 per share) in the prior fiscal year period.

At December 31, 2023, the Company held

marketable securities valued at $317,818,000, including net pretax

unrealized gains of $152,406,000, and accrued a deferred tax

liability of $39,080,000, for estimated income taxes due only upon

the sales of the net appreciated securities. The balance of the

margin loan secured by the securities portfolio was $70,000,000 at

December 31, 2023.

For the three months ended December 31, 2023,

the Company recorded an income tax provision of $3,125,000 on the

pretax income of $15,740,000. The income tax provision consisted of

tax provisions of $3,765,000 on the unrealized gains on marketable

securities, $30,000 on income from foreign operations, and $270,000

on income from US operations and dividend income, partially offset

by a tax benefit of $120,000 for the dividends received deduction

and other permanent book and tax differences, and a tax benefit of

$820,000 for the effect of a change in state apportionment on the

beginning of the year’s deferred tax liability. Consequently, the

overall effective tax rate for the three months ended December 31,

2023 was 19.9%, after including the taxes on the unrealized gains

on marketable securities.

**********

Daily Journal Corporation publishes newspapers

and web sites covering California and Arizona, and produces several

specialized information services. Journal Technologies, Inc.

supplies case management software systems and related products to

courts and other justice agencies.

This press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Certain statements contained in this press

release are “forward-looking” statements that involve risks and

uncertainties that may cause actual future events or results to

differ materially from those described in the forward-looking

statements. Words such as “expects,” “intends,” “anticipates,”

“should,” “believes,” “will,” “plans,” “estimates,” “may,”

variations of such words and similar expressions are intended to

identify such forward-looking statements. We disclaim any intention

or obligation to revise any forward-looking statements whether as a

result of new information, future developments, or otherwise.

Although we believe that the expectations reflected in such

forward-looking statements are reasonable, we can give no assurance

that such expectations will prove to have been correct. Additional

information concerning factors that could cause actual results to

differ materially from those in the forward-looking statements is

contained from time to time in documents we file with the

Securities and Exchange Commission.

# # #

Contact: Tu To

(213) 229-5436

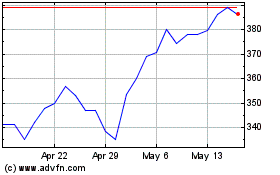

Daily Journal (NASDAQ:DJCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

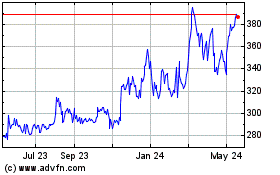

Daily Journal (NASDAQ:DJCO)

Historical Stock Chart

From Dec 2023 to Dec 2024