false

0001642453

0001642453

2024-02-05

2024-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 5, 2024

DASEKE, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-37509 |

|

47-3913221 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

15455 Dallas Parkway, Suite 550

Addison, Texas |

|

75001 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s

Telephone Number, Including Area Code: (972) 248-0412

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☒ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each

class |

|

Trading Symbol(s) |

|

Name

of each exchange on which registered |

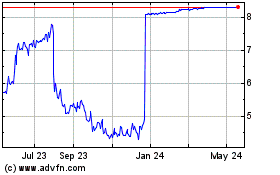

| Common Stock, par value $0.0001 per share |

|

DSKE |

|

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act ☐

Item 5.02. Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On

February 5, 2024, the compensation committee (the “Compensation Committee”) of the board of directors of Daseke, Inc. (the

“Company” or “Daseke”) adopted the Daseke, Inc. Executive Change in Control and Severance Plan (the “Executive

Severance Plan”) as contemplated by that certain Agreement and Plan of Merger, dated as of December 22, 2023 (the “Merger

Agreement”), by and between TFI International Inc., a corporation incorporated pursuant to the Canada Business Corporations Act

(“Parent”), Diocletian MergerCo, Inc., a Delaware corporation and an indirect, wholly owned subsidiary of Parent, and the

Company. The Executive Severance Plan provides severance payments upon a qualifying termination to the Company’s four executive

officers, each of whom the Compensation Committee has designated as an Eligible Executive for purposes of the Executive Severance Plan

as follows: (i) Jonathan Shepko as a Tier 1 Executive and (ii) Aaron Coley, Scott Hoppe, and Soumit Roy as Tier 2 Executives. Capitalized

terms used but not otherwise defined herein have the meanings assigned to them in the Executive Severance Plan.

Upon

the termination of an Eligible Executive’s employment due to an Involuntary Termination (as defined below) that occurs outside of

a Change in Control Protection Period and so long as the Eligible Executive satisfies the Release Requirement (as defined below), the

Eligible Executive will be entitled to receive (i) a cash severance payment equal to the product of (A) 2.0 (for a Tier 1 Executive) or

1.5 (for a Tier 2 Executive) and (B) the Eligible Executive’s Base Salary, payable over the 24 months (for a Tier 1 Executive) or

18 months (for a Tier 2 Executive) following such Involuntary Termination, (ii) a pro-rated portion of the Eligible Executive’s

annual bonus for the calendar year in which such Involuntary Termination occurs, determined based on actual performance and payable at

the same time the Company pays its annual bonuses generally, and (iii) an amount equal to the product of (A) 24 (for a Tier 1 Executive)

or 18 (for a Tier 2 Executive) and (B) the monthly amount of the Company’s contribution to the premiums for the Eligible Executive’s

group health plan coverage (including coverage for the Eligible Executive’s spouse and eligible dependents) under the Company’s

group health plans as in effect immediately prior to the Eligible Executive’s Date of Termination (the “Monthly COBRA Amount”),

payable in a lump sum within 60 days after such Involuntary Termination. For purposes of the Executive Severance Plan, an “Involuntary

Termination” means the termination of an Eligible Executive’s employment by the Company or any of its subsidiaries without

cause. Outstanding equity incentive awards held by the Eligible Executive would be treated in accordance with the terms and conditions

of the applicable award agreement and, as applicable, the Equity Incentive Plan.

Upon

the termination of an Eligible Executive’s employment due to a Qualifying Termination (as defined below) that occurs during a Change

of Control Protection Period and so long as the Eligible Executive satisfies the Release Requirement, the Eligible Executive will be

entitled to receive a cash severance payment equal to the sum of the following amounts, payable in a lump sum no later than 10 days after

the Eligible Executive’s Release becomes effective and irrevocable: (i) an amount equal to the product of (A) 2.5 (for

a Tier 1 Executive) or 1.5 (for a Tier 2 Executive) and (B) the sum of the Eligible Executive’s (1) Base Salary and (2) Target

Annual Bonus, (ii) a pro-rated portion of the Eligible Executive’s Target Annual Bonus, and (iii) an amount equal to the product

of (A) 24 (for a Tier 1 Executive) or 18 (for a Tier 2 Executive) and (B) the Monthly COBRA Amount. For purposes of the Executive

Severance Plan, a “Qualifying Termination” means the termination of an Eligible Executive’s employment (i) due to an

Involuntary Termination or (ii) due to any other separation from the Company Group other than for Cause (which includes any resignation

by the Eligible Executive, whether for Good Reason or without Good Reason). Outstanding equity incentive awards held by the Eligible

Executive would be treated in accordance with the terms and conditions of the applicable award agreement and, as applicable, the Equity

Incentive Plan as though the Eligible Executive experienced an “Involuntary Termination” under, and as defined in, the Equity

Incentive Plan.

Severance

payments under the Executive Severance Plan to an Eligible Executive are conditioned on the Eligible Executive’s execution and non-revocation of

the Release, which includes a general release of claims (the “Release Requirement”). The Executive Severance Plan supersedes

the severance entitlements set forth in the Eligible Executives’ employment agreements. If the payments or benefits payable under

the Executive Severance Plan would be subject to the parachute payment excise tax imposed under Section 4999 of the Internal Revenue

Code of 1986, then those payments or benefits will be reduced (but not below zero) if such reduction would result in a better net after-tax position

for the Eligible Executive.

This summary of the Executive

Severance Plan does not purport to be complete and is subject to and qualified in its entirety by reference to the text of the Executive

Severance Plan and form of Participation Agreement thereunder filed as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K, which

are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Important Additional Information and Where

to Find It

This

Current Report on Form 8-K is being made in connection with the merger contemplated by the Merger Agreement (the “Merger”).

In connection with the Merger, Daseke plans to file a proxy statement and certain other documents regarding the Merger with the Securities

and Exchange Commission (the “SEC”). The definitive proxy statement (if and when available) will be mailed to the common stockholders

of Daseke. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION, STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT REGARDING THE MERGER THAT WILL BE FILED

WITH THE SEC (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE

SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGER. Stockholders

may obtain a free copy of these materials (when they are available) and other documents filed by Daseke with the SEC at the SEC’s

website at www.sec.gov, at Daseke’s website at investor.daseke.com/Home or by sending a written request to Daseke’s Investor

Relations department at investors@daseke.com.

Participants in the Solicitation

Daseke

and certain of its directors, executive officers and other employees may be deemed to be participants in the solicitation of proxies from

Daseke’s common stockholders in connection with the Merger. Information regarding the persons who may, under the rules of the

SEC, be considered to be participants in such solicitation will be set forth in the definitive proxy statement to be filed with the SEC

in connection with the Merger (if and when they become available). Information regarding Daseke’s directors and certain executive

officers, including a description of their direct interests, by security holdings or otherwise, is also contained in Daseke’s proxy

statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 27, 2023. To the extent holdings of

securities by potential participants (or the identity of such participants) have changed since the date on which the 2023 annual meeting

proxy statement was filed, such information has been or will be reflected on Form 3s and 4s filed with the SEC. You may obtain free

copies of these documents using the sources indicated above.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

DASEKE, INC. |

| |

|

|

| Date: February 6, 2024 |

By: |

/s/ Soumit Roy |

| |

Name: |

Soumit Roy |

| |

Title: |

Executive Vice President, Chief Legal Officer, General Counsel and Corporate Secretary |

4

Exhibit 10.1

DASEKE, INC.

EXECUTIVE CHANGE IN CONTROL AND SEVERANCE

PLAN

1. Purpose.

Daseke, Inc. (the “Company”) has adopted the Daseke, Inc. Executive Change in Control and Severance Plan (the

“Plan”) to provide severance pay and benefits to eligible officers and management employees who are Eligible

Executives (as defined below) and whose employment is terminated on or after February 5, 2024 (the “Effective Date”).

The Plan is intended to be maintained primarily for the purpose of providing benefits for a select group of management or highly compensated

employees.

2.

Definitions. For purposes of the Plan, the following terms shall have the respective meanings set forth below:

(a)

“Accrued Amounts” means (i) all accrued and unpaid Base Salary through the Date of Termination, which

shall be paid within ten business days following the Date of Termination (or earlier if required by applicable law); (ii) any earned but

unpaid annual bonus with respect to the calendar year ending on or preceding such Eligible Executive’s Date of Termination, payable

on the otherwise applicable payment date; (iii) reimbursement for all incurred but unreimbursed expenses for which an Eligible Executive

is entitled to reimbursement in accordance with the expense reimbursement policies of the Company in effect as of the Date of Termination;

and (iv) benefits to which an Eligible Executive may be entitled pursuant to the terms of any plan or policy sponsored by the Company

or any of its Affiliates as in effect from time to time.

(b)

“Affiliate” means, with respect to any person, any other person that directly or indirectly through one

or more intermediaries controls, is controlled by or is under common control with, the person in question. As used herein, the term “control”

means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a person, whether

through ownership of voting securities, by contract or otherwise.

(c)

“Applicable CIC COBRA Multiple” means, with respect to each Tier, the applicable multiple set forth on

Exhibit A hereto.

(d)

“Applicable CIC Severance Multiple” means, with respect to each Tier, the applicable multiple set forth

on Exhibit A hereto.

(e)

“Applicable March 15” means March 15 of the calendar year following the calendar year in which the Date

of Termination occurs.

(f)

“Applicable Non-CIC COBRA Multiple” means, with respect to each Tier, the applicable multiple set forth

on Exhibit A hereto.

(g)

“Applicable Non-CIC Severance Multiple” means, with respect to each Tier, the applicable multiple set

forth on Exhibit A hereto.

(h)

“Applicable Non-CIC Severance Period” means, with respect to each Tier, the applicable period set forth

on Exhibit A hereto.

(i)

“Base Salary” means the amount an Eligible Executive is entitled to receive as base salary on an annualized

basis, calculated as of the Date of Termination, including any amounts that an Eligible Executive could have received in cash had such

Eligible Executive not elected to contribute to an employee benefit plan maintained by the Company, but excluding all annual cash incentive

awards, bonuses, equity awards, and incentive compensation payable by the Company as consideration for an Eligible Executive’s services.

Notwithstanding the foregoing, in the event of a reduction in an Eligible Executive’s Base Salary resulting in such Eligible Executive’s

resignation for Good Reason, for purposes of determining such Eligible Executive’s Severance Amount, such Eligible Executive’s

Base Salary shall be deemed to be that in effect immediately prior to such reduction.

(j)

“Board” means the Board of Directors of the Company.

(k)

“Cause” means (i) persistent neglect or negligence in the performance of the Eligible Executive’s

duties; (ii) conviction (including pleas of guilty or no contest) for any act of fraud, misappropriation or embezzlement, or for

any criminal offense related to the Company, any of its subsidiaries or the Eligible Executive’s service; (iii) any deliberate

and material breach of fiduciary duty to the Company or its subsidiaries, or any other conduct that leads to the material damage or prejudice

of the Company or any of its subsidiaries; or (iv) a material breach of a policy of the Company or its subsidiaries, such as the

Company’s code of conduct.

(l)

“Change in Control” has the meaning set forth in the Equity Incentive Plan.

(m)

“Change in Control Protection Period” means the period commencing on the date on which a Change in Control

is consummated and ending on the 24-month anniversary of the date on which such Change in Control is consummated.

(n)

“COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985.

(o)

“Code” means the U.S. Internal Revenue Code of 1986.

(p)

“Committee” means the Compensation Committee of the Board or such other committee designated by the Board

to administer the Plan. If no committee is duly authorized by the Board to administer the Plan, the term “Committee” shall

be deemed to refer to the Board for all purposes under the Plan.

(q)

“Company Group” means the Company and each of its direct and indirect past, present and future subsidiaries.

(r)

“Date of Termination” means the effective date of the termination of an Eligible Executive’s employment

with the Company and its Affiliates, as applicable, such that the Eligible Executive is no longer employed by any member of the Company

Group.

(s)

“Disability” means if such Eligible Executive is entitled to receive long-term disability benefits under

the Company’s disability plan or, if there is no such plan, such Eligible Executive’s inability to perform the essential functions

of such Eligible Executive’s position (after accounting for reasonable accommodation, if applicable), due to an illness or physical

or mental impairment or other incapacity that continues, or can reasonably be expected to continue, for a period in excess of one hundred

twenty (120) days, whether or not consecutive. The determination of whether such Eligible Executive has incurred a Disability shall be

made in good faith by the Board.

(t)

“Eligible Executive” means any employee of any member of the Company Group who (i) is designated by the

Committee as an “Eligible Executive” who is eligible to participate in the Plan; (ii) has executed and returned a Participation

Agreement to the Company; (iii) is not covered under any other severance plan, policy, program or arrangement sponsored or maintained

by any member of the Company Group; and (iv) is not a party to an employment or severance agreement with any member of the Company Group

pursuant to which such employee is eligible for severance payments or benefits or has waived such employee’s rights to severance

payments or benefits thereunder pursuant to such employee’s Participation Agreement. The Committee shall have the sole discretion

to determine whether an employee is an Eligible Executive. Eligible Executives shall be limited to a select group of management or highly

compensated employees within the meaning of Sections 201, 301 and 401 of ERISA.

(u)

“Employment Period” means the period during which an Eligible Executive is employed or engaged by or

affiliated with the Company or any other member of the Company Group.

(v)

“Equity Incentive Plan” means the Daseke, Inc. 2017 Omnibus Incentive Plan, as amended or restated from

time to time, or any successor equity incentive plan established by the Company.

(w)

“ERISA” means the Employee Retirement Income Security Act of 1974.

(x)

“Good Reason” means, with respect to an Eligible Executive, the occurrence of any of the following prior

to the Eligible Executive’s Date of Termination: (i) a material reduction in such Eligible Executive’s Base Salary or Target

Annual Bonus; (ii) a material diminution in such Eligible Executive’s position, reporting relationship, responsibilities or duties

or the assignment of such Eligible Executive to a position, responsibilities or duties of a materially lesser status or degree of responsibility

than such Eligible Executive’s position, responsibilities or duties immediately following the date of such Eligible Executive’s

Participation Agreement; (iii) any material breach by the Company of any provision of the Plan or any other material agreement between

the Company and Employee; or (iv) any requirement of the Company that such Eligible Executive be based anywhere more than 40 miles from

the office where such Eligible Executive is located on the date of such Eligible Executive’s Participation Agreement. Notwithstanding

the foregoing provisions of this definition or any other provision of the Plan to the contrary, any assertion by an Eligible Executive of a termination

for Good Reason shall not be effective unless all of the following conditions are satisfied: (A) the condition giving rise to such Eligible

Executive’s termination of employment must have arisen without such Eligible Executive’s consent; (B) such Eligible Executive

must provide written notice to the Board of the existence of such condition(s) within thirty (30) days of the initial existence of such

condition(s); (C) the condition(s) specified in such notice must remain uncorrected for thirty (30) days following the Board’s

receipt of such written notice; and (D) the date of such Eligible Executive’s termination of employment must occur following

the expiration of the thirty (30) day cure period, but in any event within sixty-five (65) days following the Board’s receipt of

such notice.

(y)

“Participation Agreement” means the participation agreement delivered to each Eligible Executive by the

Committee prior to his or her participation in the Plan evidencing the Eligible Executive’s agreement to participate in the Plan

and to comply with all terms, conditions and restrictions within the Plan.

(z)

“Qualifying Termination” means the termination of an Eligible Executive’s employment (i) by any

member of the Company Group without Cause (which, for the avoidance of doubt, does not include a termination due to death or Disability)

(an “Involuntary Termination”); or (ii) due to any other separation from the Company Group other than for Cause

(which, for clarity, shall include any resignation by the Eligible Executive, whether for Good Reason or without Good Reason), in each

case, such that the Eligible Executive is no longer employed by any member of the Company Group.

(aa)

“Release Requirement” means the requirement that an Eligible Executive execute and deliver to the Company

a separation and release agreement that includes a general release of claims, in the form attached hereto as Exhibit C (the “Release”),

on or prior to the date that is 21 days following the date upon which the Company delivers the Release to an Eligible Executive (which

shall occur no later than seven days following the Date of Termination) or, in the event that such termination of employment is “in

connection with an exit incentive or other employment termination program” (as such phrase is defined in the Age Discrimination

in Employment Act of 1967), the date that is 45 days following such delivery date. Notwithstanding the foregoing or any other provision

in the Plan to the contrary, the Release Requirement shall not be considered satisfied if the Eligible Executive revokes the Release within

any time provided by the Company for such revocation.

(bb) “Section 409A”

means Section 409A of the Code.

(cc)

“Severance Amount” means, collectively, the cash payments set forth in Sections 5(a) or 5(b), as

applicable.

(dd) “Target Annual

Bonus” means an Eligible Executive’s target annual bonus for the calendar year that includes such Eligible Executive’s

Date of Termination.

(ee)

“Tier” means an “Executive Tier” used for purposes of determining the level of severance

benefits an Eligible Executive is eligible to receive. Each Eligible Executive shall be designated by the Committee as a “Tier 1

Executive” or “Tier 2 Executive” pursuant to such Eligible Executive’s Participation Agreement.

3.

Administration of the Plan.

(a)

Administration by the Committee. The Committee shall be responsible for the management and control of the operation and

the administration of the Plan in accordance with its terms and shall exercise such responsibility in good faith.

(b)

Indemnification of the Committee. The Company shall, without limiting any rights that the Committee may have under the Company’s

charter or bylaws, applicable law or otherwise, indemnify and hold harmless the Committee and each member thereof (and any other individual

acting on behalf of the Committee or any member thereof) against any and all expenses and liabilities arising out of such person’s

administrative functions or fiduciary responsibilities, excepting only expenses and liabilities arising out of the person’s own

gross negligence or willful misconduct. Expenses against which such person shall be indemnified hereunder include the amounts of any settlement,

judgment, attorneys’ fees, costs of court, and any other related charges reasonably incurred in connection with a claim, proceeding,

settlement, or other action under the Plan.

(c)

Compensation and Expenses. The Committee shall not receive additional compensation with respect to services for the Plan.

To the extent required by applicable law, but not otherwise, the Committee shall furnish bond or security for the performance of their

duties hereunder. Any expenses properly incurred by the Committee incident to the administration, termination or protection of the Plan,

including the cost of furnishing bond, shall be paid by the Company.

4.

Eligibility. Only individuals who are Eligible Executives may participate in the Plan. The Committee has full and

absolute discretion to determine and select which employees of the Company and its Affiliates are Eligible Executives; provided that only

the individuals listed on Exhibit B may be selected to be Eligible Executives, with the Tier designations set forth on Exhibit B.

Once an employee has been designated as an Eligible Executive, such individual shall automatically continue to be an Eligible Executive

until the Eligible Executive ceases to be an employee or is removed as an Eligible Executive by the Committee. The Plan shall supersede

all prior agreements, practices, policies, procedures and plans solely to the extent relating to severance benefits sponsored, maintained

or entered into by any and all members of the Company Group with respect to the Eligible Executives.

5.

Plan Benefits.

(a)

Involuntary Termination Outside of a Change in Control Protection Period. In the event an Eligible Executive’s employment

with any member of the Company Group ends due to an Involuntary Termination that occurs outside of a Change in Control Protection Period,

such Eligible Executive shall be entitled to receive the Accrued Amounts, and so long as such Eligible Executive satisfies the Release

Requirement, such Eligible Executive shall also be entitled to receive:

(i) A cash severance

payment in an amount equal to (A) the Applicable Non-CIC Severance Multiple, multiplied by (B) such Eligible

Executive’s Base Salary (such amount, the “Base Cash Severance Amount”), to be paid in substantially

equal installments on the Company’s regular payroll schedule for the period commencing on the Eligible Executive’s Date

of Termination and continuing until the expiration of the Eligible Executive’s Applicable Non-CIC Severance Period; provided, however,

that the payment of any Base Cash Severance Amount that is otherwise due and payable to an Eligible Executive prior to the date the

Eligible Executive’s Release becomes final, binding and irrevocable, shall be suspended and shall not be paid to the Eligible

Executive until the Company’s first regularly scheduled pay date on or after the date that is 60 days after such Eligible

Executive’s Date of Termination; provided, further, that to the extent, if any, that the aggregate amount of the

installments of the Base Cash Severance Amount that would otherwise be paid pursuant to this section after the Applicable March 15

exceeds the maximum exemption amount under Treasury Regulation Section 1.409A-1(b)(9)(iii)(A), then such excess shall be paid to

the Eligible Executive in a lump sum on the Applicable March 15 (or the first business day preceding the Applicable March 15 if the

Applicable March 15 is not a business day) and the installments of the Base Cash Severance Amount payable after the Applicable March

15 shall be reduced by such excess (beginning with the installment first payable after the Applicable March 15 and continuing with

the next succeeding installment until the aggregate reduction equals such excess). Notwithstanding the foregoing, the Committee may,

in its sole discretion, elect for the Company to pay an Eligible Executive’s Base Cash Severance Amount under this Section

5(a)(i) in a lump sum cash payment on the Company’s first regularly scheduled pay date that is on or after the date that is 60

days after such Eligible Executive’s Date of Termination (and any election by the Committee for the Company to pay an Eligible

Executive’s Base Cash Severance Amount in a lump sum shall not be binding on the Committee, the Company or any of its

Affiliates with respect to payments to any other Eligible Executive);

(ii) A pro-rated portion of

such Eligible Executive’s annual bonus for the calendar year that includes such Eligible Executive’s Date of Termination,

determined based on actual performance levels when the Company typically makes such determinations under the applicable incentive plan

generally, multiplied by a fraction, (A) the numerator of which equals the number of calendar days that such Eligible Executive

was employed by any member of the Company Group during the calendar year in which the Date of Termination occurs and (B) the denominator

of which equals 365 or 366, as applicable, payable at the same time the Company pays its annual bonuses under the applicable incentive

plan generally (but in no event later the Applicable March 15); and

(iii) An amount equal to (A)

the Applicable Non-CIC COBRA Multiple, multiplied by (B) the monthly amount of the Company’s contribution to the premiums

for such Eligible Executive’s group health plan coverage (including coverage for such Eligible Executive’s spouse and eligible

dependents), determined under the Company’s group health plans as in effect immediately prior to such Eligible Executive’s

Date of Termination (such monthly amount, the “Monthly COBRA Amount”), payable in lump sum within 60 days after

such Eligible Executive’s Date of Termination. For the avoidance of doubt, if, as of an Eligible Executive’s Date of Termination,

such Eligible Executive does not participate in any of the Company’s group health plans, then the Monthly COBRA Amount will equal

zero.

(b) Qualifying

Termination During a Change in Control Protection Period. In the event an Eligible Executive’s employment with any member

of the Company Group ends due to a Qualifying Termination that occurs during a Change in Control Protection Period, such Eligible

Executive shall be entitled to receive the Accrued Amounts, and so long as such Eligible Executive satisfies the Release

Requirement, such Eligible Executive shall also be entitled to receive an amount equal to the sum of the amounts set forth in

clauses (i), (ii) and (iii) (the “Qualifying CIC Termination Severance Payment”), payable in a single lump

sum no later than 10 days after the Release becomes effective and irrevocable:

(i) An amount equal to (A)

the Applicable CIC Severance Multiple, multiplied by (B) the sum of such Eligible Executive’s (1) Base Salary and (2) Target

Annual Bonus;

(ii) A pro-rated portion of

such Eligible Executive’s Target Annual Bonus, multiplied by a fraction, (A) the numerator of which equals the number of

calendar days that such Eligible Executive was employed by any member of the Company Group during the calendar year in which the Date

of Termination occurs and (B) the denominator of which equals 365 or 366, as applicable; and

(iii) An amount equal to (A)

the Applicable CIC COBRA Multiple, multiplied by (B) the Monthly COBRA Amount.

(c)

Equity Incentive Awards. For clarity, in the event that an Eligible Executive’s employment with any member of the

Company Group terminates (pursuant to a Qualifying Termination or otherwise), all outstanding equity incentive awards then held by such

Eligible Executive, and granted pursuant to an award agreement subject to the Equity Incentive Plan or otherwise, will be treated in accordance

with the terms and conditions of such award agreement and, as applicable, the Equity Incentive Plan; provided that, notwithstanding anything

to the contrary, any Qualifying Termination during a Change in Control Protection Period shall be treated as an “Involuntary Termination”

under and as defined in the Equity Incentive Plan.

(d)

Non-Qualifying Terminations of Employment. In the event that an Eligible Executive’s employment with any member of

the Company Group is terminated (i) other than pursuant to an Involuntary Termination outside of a Change in Control Protection Period

or (ii) by the Company for Cause during a Change in Control Protection Period, then all compensation and benefits to such Eligible Executive

shall terminate contemporaneously with such termination of employment, except that such Eligible Executive (or such Eligible Executive’s

estate and/or beneficiaries, as the case may be, if applicable) shall be entitled to the Accrued Amounts.

(e)

No Duplication. Except as otherwise expressly provided pursuant to the Plan, the Plan shall be construed and administered

in a manner which avoids duplication of compensation and benefits which may be provided under any other plan, program, policy or other

arrangement or individual contract or under any statute, rule or regulation. In the event an Eligible Executive is covered by any other

plan, program, policy, individually negotiated agreement or other arrangement, in effect as of the Eligible Executive’s Date of

Termination, that may duplicate the payments and benefits provided for in Sections 5(a) or 5(b), as applicable, the Committee is specifically

empowered to reduce or eliminate the duplicative benefits provided for under the Plan.

6. Certain Excise

Taxes. Notwithstanding anything to the contrary in the Plan, if an Eligible Executive is a “disqualified

individual” (as defined in Section 280G(c) of the Code), and the payments and benefits provided for in the Plan, together with

any other payments and benefits that such Eligible Executive has the right to receive from the Company or any of its Affiliates, and

taking into account reductions in respect of reasonable compensation for personal services to be rendered by the Eligible Executive

on or following the date of the relevant “change in ownership or control” (within the meaning of Section 280G of the

Code), including pursuant to applicable non-competition and other restrictive covenant obligations, would constitute a

“parachute payment” (as defined in Section 280G(b)(2) of the Code), then the payments and benefits shall be either (a)

reduced (but not below zero) so that the present value of such total amounts and benefits received by such Eligible Executive from

the Company and its Affiliates will be one dollar less than three times such Eligible Executive’s “base amount”

(as defined in Section 280G(b)(3) of the Code) and so that no portion of such payments and benefits received by such Eligible

Executive shall be subject to the excise tax imposed by Section 4999 of the Code or (b) paid in full, whichever of clauses (a) or

(b) results in the better net after-tax position to such Eligible Executive (taking into account any applicable excise tax under

Section 4999 of the Code and any other applicable taxes). The reduction of payments and benefits hereunder, if applicable, shall be

made by reducing, first, payments or benefits to be paid in cash in the order in which such payment or benefit would be paid or

provided (beginning with such payment or benefit that would be made last in time and continuing, to the extent necessary, through

such payment or benefit that would be made first in time) and then, reducing any benefit to be provided in-kind hereunder in a

similar order. The determination as to whether any such reduction in the amount of the payments and benefits provided hereunder is

necessary shall be made by the Company in good faith. If a reduced payment or benefit is made or provided and through error or

otherwise that payment or benefit, when aggregated with other payments and benefits from the Company or any of its Affiliates used

in determining if a “parachute payment” exists, exceeds one dollar less than three times such Eligible Executive’s

base amount, then such Eligible Executive shall immediately repay such excess to the Company upon notification that an overpayment

has been made. Nothing in this Section 6 shall require the Company to be responsible for, or have any liability or obligation with

respect to, any Eligible Executives’ excise tax liabilities under Section 4999 of the Code.

7.

Restrictive Covenants. During the period in which an Eligible Executive participates in the Plan, the Eligible Executive

shall be provided with, and will have access to, confidential information. In consideration of such Eligible Executive’s receipt

of confidential information and access to such confidential information and in exchange for other valuable consideration provided hereunder,

each Eligible Executive shall be subject to any restrictive covenants, including covenants related to non-disclosure of information, non-competition,

non-solicitation, non-disparagement and assignment of inventions, contained in any employment agreement between the Eligible Executive

and the applicable member of the Company Group, all of which (including any portion thereof pursuant to which the Company makes any commitment

related to non-disparagement or otherwise) are incorporated herein by reference as fully as though set forth herein and shall apply mutatis

mutandis.

8.

Claims Procedure and Review.

(a) Filing a Claim.

Any Eligible Executive that the Committee determines is entitled to severance payments or benefits under the Plan is not required to

file a claim for such payments or benefits. Any Eligible Executive (i) who is not paid severance payments or benefits hereunder and

who believes that such Eligible Executive is entitled to severance payments or benefits hereunder or (ii) who has been paid

severance payments or benefits hereunder and believes that such Eligible Executive is entitled to greater benefits hereunder may

file a claim for severance payments or benefits under the Plan in writing with the Committee.

(b)

Initial Determination of a Claim. If a claim for severance payments or benefits hereunder is wholly or partially denied,

the Committee shall, within a reasonable period of time but no later than 90 days after receipt of the claim (or 180 days after receipt

of the claim if special circumstances require an extension of time for processing the claim), notify the claimant of the denial. Such

notice shall (i) be in writing, (ii) be written in a manner calculated to be understood by the claimant, (iii) contain the specific reason

or reasons for denial of the claim, (iv) refer specifically to the pertinent Plan provisions upon which the denial is based, (v) describe

any additional material or information necessary for the claimant to perfect the claim (and explain why such material or information is

necessary), and (vi) describe the Plan’s claim review procedures and time limits applicable to such procedures, including a statement

of the claimant’s right to bring a civil action under Section 502(a) of ERISA following an adverse benefit determination on review.

(c)

Appeal of a Denied Claim. Within 60 days of the receipt by the claimant of this notice, the claimant may file a written

appeal with the Committee. In connection with the appeal, the claimant may review Plan documents and may submit written issues and comments.

The Committee shall deliver to the claimant a written decision on the appeal promptly, but not later than 60 days after the receipt of

the claimant’s appeal (or 120 days after receipt of the claimant’s appeal if there are special circumstances which require

an extension of time for processing). Such decision shall (i) be in writing, (ii) be written in a manner calculated to be understood by

the claimant, (iii) include specific reasons for the decision, (iv) refer specifically to the Plan provisions upon which the decision

is based, (v) state that the claimant is entitled to receive, on request and free of charge, reasonable access to and copies of all documents,

records, and other information relevant to the claimant’s claim for benefits, and (vi) a statement of the claimant’s right

to bring an action under Section 502(a) of ERISA. If special circumstances require an extension of up to 180 days for an initial claim

or 120 days for an appeal, whichever applies, the Committee shall send written notice of the extension. This notice shall indicate the

special circumstances requiring the extension and state when the Committee expects to render the decision.

(d)

Compliance with ERISA. The benefits claim procedure provided in this Section 8 is intended to comply with the provisions

of 29 C.F.R. § 2560.503-1. All provisions of this Section 8 shall be interpreted, construed, and limited in accordance with such

intent.

9.

General Provisions.

(a)

Taxes. The Company is authorized to withhold from all payments made hereunder amounts of withholding and other taxes due

or potentially payable in connection therewith, and to take such other action as the Company may deem advisable to enable the Company

and an Eligible Executive to satisfy obligations for the payment of withholding taxes and other tax obligations relating to any payments

made or benefits provided under the Plan.

(b)

No Mitigation. No Eligible Executive shall have any duty to mitigate the amounts payable under the Plan by seeking or accepting

new employment or self-employment following a Qualifying Termination or otherwise.

(c)

Amendment and Termination. Prior to a Change in Control, the Board and the Committee shall have the power to amend or terminate

the Plan (including the Release) from time to time in its discretion and for any reason (or no reason) (including the removal of an individual

as an Eligible Executive); provided that no such amendment or termination shall be effective with respect to an Eligible Executive whose

termination of employment occurred prior to the amendment or termination of the Plan or the Release; and provided, further, that, to the

extent any such amendment has a detrimental impact to any Eligible Executive, such amendment will become effective with respect to such

Eligible Executive six months following approval thereof by the Board or Committee. Notwithstanding the foregoing, during a Change in

Control Protection Period, no amendment or termination of the Plan or the Release shall impair any rights of, or obligations to, any Eligible

Executive under the Plan (including the removal of an individual as an Eligible Executive) or the Release unless such Eligible Executive

expressly consents to such amendment or termination.

(d)

Successors. The Plan will be binding upon any successor to the Company, its assets, its businesses or its interests (whether

as a result of the occurrence of a Change in Control or otherwise), in the same manner and to the same extent that the Company would be

obligated under the Plan if no succession had taken place. All payments and benefits that become due to an Eligible Executive under the

Plan will inure to the benefit of his or her heirs, assigns, designees or legal representatives.

(e)

Transfer and Assignment. Neither an Eligible Executive nor any other person shall have any right to sell, assign, transfer,

pledge, anticipate or otherwise encumber, transfer, hypothecate or convey any amounts payable under the Plan prior to the date that such

amounts are paid.

(f)

Unfunded Obligation. All benefits due to an Eligible Executive under the Plan are unfunded and unsecured and are payable

out of the general assets of the Company. The Company is not required to segregate any monies or other assets from its general funds with

respect to these obligations. Eligible Executives shall not have any preference or security interest in any assets of the Company other

than as a general unsecured creditor.

(g)

Severability. If any provision of the Plan (or portion thereof) is held to be illegal or invalid for any reason, the illegality

or invalidity of such provision (or portion thereof) will not affect the remaining provisions (or portions thereof) of the Plan, but such

provision (or portion thereof) will be fully severable and the

Plan will be construed and enforced as if the illegal or invalid provision (or portion thereof) had never been included herein.

(h)

COBRA. Subject to the rules and regulations of COBRA, in connection with an Eligible Executive’s Date of Termination,

the Company will provide an Eligible Executive the option to elect to continue group health plan coverage through COBRA. The election

of COBRA continuation coverage and the payment of any premiums due with respect to such COBRA continuation coverage will remain such Eligible

Executive’s sole responsibility, and neither the Company nor any of its Affiliates will assume any obligation for payment of any

such premiums relating to such COBRA continuation coverage.

(i)

Section 409A. The Plan is intended to comply with Section 409A or one or more exemptions thereunder and shall be construed

and administered in accordance with such intent. Notwithstanding any other provision of the Plan, payments provided under the Plan may

only be made upon an event and in a manner that complies with Section 409A or an applicable exemption. Any payments under the Plan that

may be exempt from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral shall

be treated as exempt from Section 409A to the maximum extent possible. Any payments to be made under the Plan upon the termination of

an Eligible Executive’s employment shall only be made if such termination of employment constitutes a “separation from service”

under Section 409A. In no event may an Eligible Executive, directly or indirectly, designate the calendar year of any payment under the

Plan. Any installment payment under the Plan is intended to be a separate payment for purposes of Section 409A. Notwithstanding any provision

in the Plan to the contrary, if any payment or benefit provided for herein would be subject to additional taxes and interest under Section

409A if an Eligible Executive’s receipt of such payment or benefit is not delayed until the earlier of (i) the date of such

Eligible Executive’s death or (ii) the date that is six months after such Eligible Executive’s Date of Termination (such date,

the “Section 409A Payment Date”), then such payment or benefit shall not be provided to such Eligible Executive

(or such Eligible Executive’s estate and/or beneficiaries, as the case may be, if applicable) until the Section 409A Payment Date.

Notwithstanding the foregoing, the Company makes no representations that the payments and benefits provided under the Plan are exempt

from, or compliant with, Section 409A and in no event shall the Company or any of its Affiliates be liable for all or any portion of any

taxes, penalties, interest or other expenses that may be incurred by any Eligible Executive on account of non-compliance with Section

409A.

(j)

Governing Law. All questions arising with respect to the provisions of the Plan and payments or benefits due hereunder will

be determined by application of the laws of the State of Texas, without giving effect to any conflict of law provisions thereof, except

to the extent preempted by federal law (including ERISA, which is the federal law that governs the Plan, the administration of the Plan

and any claims made under the Plan).

(k)

Status. The Plan is intended to qualify for the exemptions under Title I of ERISA provided for plans that are unfunded and

maintained primarily for the purpose of providing benefits for a select group of management or highly compensated employees.

(l) No Right to

Continued Employment. The adoption and maintenance of the Plan shall not be deemed to be a contract of employment between the

Company or any of its Affiliates and any person, or to have any impact whatsoever on the at-will employment relationship between the

Company or any of its Affiliates, on the one hand, and any of the Eligible Executives, on the other hand. Nothing in the Plan shall

be deemed to give any person the right to be retained in the employ of the Company or any of its Affiliates for any period of time

or to restrict the right of the Company or any of its Affiliates to terminate the employment of any person at any time.

(m)

Title and Headings; Construction. Titles and headings to Sections hereof are for the purpose of reference only and shall

in no way limit, define or otherwise affect the provisions hereof. Unless the context requires otherwise, all references herein to laws,

regulations, contracts, documents, agreements and instruments refer to such laws, regulations, contracts, documents, agreements and instruments

as they may be amended, restated or otherwise modified from time to time, and references to particular provisions of laws or regulations

include a reference to the corresponding provisions of any succeeding law or regulation. The word “or” as used herein is not

exclusive and is deemed to have the meaning “and/or.” The words “herein”, “hereof”, “hereunder”

and other compounds of the word “here” shall refer to the entire Plan, and not to any particular provision hereof. Wherever

the context so requires, the masculine gender includes the feminine or neuter, and the singular number includes the plural and conversely.

The use herein of the word “including” following any general statement, term or matter shall not be construed to limit such

statement, term or matter to the specific items or matters set forth immediately following such word or to similar items or matters, whether

or not non-limiting language (such as “without limitation”, “but not limited to”, or words of similar import)

is used with reference thereto, but rather shall be deemed to refer to all other items or matters that could reasonably fall within the

broadest possible scope of such general statement, term or matter. Neither the Plan nor any uncertainty or ambiguity herein shall be construed

or resolved against any party hereto, whether under any rule of construction or otherwise. On the contrary, the Plan has been reviewed

by each of the parties hereto and shall be construed and interpreted according to the ordinary meaning of the words used so as to fairly

accomplish the purposes and intentions of the parties hereto.

(n)

Agent for Service of Legal Process. Legal process may be served on the Committee, which is the plan administrator, at the

following address: Compensation Committee of the Board of Directors, c/o Daseke, Inc., 15455 Dallas Parkway, Suite 550, Addison, Texas

75001.

EXHIBIT A

Applicable Severance Multiples,

Severance Period and COBRA Multiples

Involuntary Termination Outside

of a Change in Control Protection Period

| Tier |

Applicable Non-CIC

Severance Multiple |

Applicable Non-CIC

Severance Period |

Applicable Non-CIC

COBRA Multiple |

| Tier 1 |

2.0 |

24 months |

24 months |

| Tier 2 |

1.5 |

18 months |

18 months |

Qualifying Termination During

a Change in Control Protection Period

| Tier |

Applicable CIC

Severance Multiple |

Applicable CIC

COBRA Multiple |

| Tier 1 |

2.5 |

24 months |

| Tier 2 |

1.5 |

18 months |

EXHIBIT B

Eligible Executives

| Tier |

Eligible Executive |

| Tier 1 Executive |

Jonathan Shepko |

| Tier 2 Executives |

Aaron Coley

Scott Hoppe

Soumit Roy |

EXHIBIT C

Form of Release

SEPARATION AND RELEASE AGREEMENT

This Separation and Release

Agreement (this “Agreement”) is entered into, as of [__________], 20[__], between Daseke, Inc., a Delaware corporation

(the “Company”), and [__________] (“Employee” and with the Company, collectively, the “Parties”).

W I T N E S S E T H

WHEREAS, Employee is a participant

in the Company’s Executive Change in Control and Severance Plan (the “Severance Plan”) as a Tier [__] Executive

(as defined in the Severance Plan) pursuant to a Participation Agreement, dated as of [__________], between the Company and Employee (the

“Participation Agreement”);

WHEREAS, Employee was employed

by the Company pursuant to an Employment Agreement, dated as of [__________], between the Company and Employee (the “Employment

Agreement”); and

WHEREAS, the Parties wish

to resolve all matters related to Employee’s employment with the Company and the cessation thereof, on the terms and conditions

expressed in this Agreement.

NOW, THEREFORE, in consideration

of the premises and the releases, representations, covenants and obligations herein contained, the Parties, intending to be legally bound,

hereby agree as follows:

1.

Separation; Accrued Amounts.

(a)

Employee’s employment as [__________] of the Company, as well as from all other officer, director and employment positions

that Employee held at or through the Company, and any of its parents, subsidiaries or affiliates, ceased effective as of [__________]

(the “Separation Date”). Employee agrees to promptly execute such additional documentation as requested by the Company

to effectuate the foregoing; provided that no such documentation shall impair Employee’s entitlement to the Separation Benefits

pursuant to the terms of Severance Plan and this Agreement.

(b)

Regardless of whether Employee executes this Agreement, the Company shall timely pay to Employee, minus applicable withholdings

and authorized or required deductions, all Accrued Amounts (as defined in the Severance Plan).

2.

Separation Benefits.

(a) In accordance with, and

subject to, the terms of the Severance Plan as in effect on the Separation Date and Employee’s Participation Agreement thereunder

(which terms are incorporated herein by reference) and this Agreement, the Company shall pay or cause to be paid to Employee Employee’s

Qualifying CIC Termination Severance Payment (as defined in the Severance Plan) in an amount equal to $[__________]1, less

all applicable withholdings and authorized or required deductions, in a single lump sum no later than 10 days after the Effective Date.

(b)

In accordance with, and subject to, the terms of the Severance Plan, Employee’s Participation Agreement thereunder, the Equity

Incentive Plan (as defined in the Severance Plan) and applicable Award Agreements (as defined in the Equity Incentive Plan), that certain

Agreement and Plan of Merger, dated as of December 22, 2023, by and among TFI International Inc., a corporation incorporated pursuant

to the Canada Business Corporations Act (“Parent”), Diocletian MergerCo, Inc, a Delaware corporation and an indirect,

wholly-owned subsidiary of Parent, and the Company (the “Merger Agreement”), and this Agreement, all Employee’s

outstanding Parent RSUs (as defined in the Merger Agreement) that Employee received in respect of Employee’s outstanding and unvested

Company RSUs and Company PSUs (each as defined in the Merger Agreement) shall become fully vested as of the Separation Date and will be

settled as soon as reasonably practicable following the Effective Date (and in no event later than 60 days following the Separation Date).

The payments and benefits set

forth in this Section 2 are referred to herein collectively as the “Separation Benefits”.

3.

Satisfaction of All Leaves and Payment Amounts; Prior Rights and Obligations; No Other Severance; No Mitigation.

(a)

In entering into this Agreement, Employee expressly acknowledges and agrees that (i) Employee has received all leaves (paid and

unpaid) to which Employee was entitled during Employee’s employment with the Company or any other Released Party (as defined below)

and (ii) Employee has received all wages, bonuses and other compensation, been provided all benefits and been afforded all rights and

been paid all sums that Employee is owed or has been owed by the Company or any other Released Party, including all payments arising out

of all incentive plans and any other bonus arrangements. Notwithstanding the foregoing, Employee remains entitled to receive Employee’s

Accrued Amounts (as defined in the Severance Plan) and eligible to receive the Separation Benefits in accordance with the terms of this

Agreement and the Severance Plan. For the avoidance of doubt, Employee acknowledges and agrees that Employee had no right to the Separation

Benefits but for Employee’s entry into this Agreement.

(b)

Employee acknowledges that Employee is not eligible to receive any other severance payments or benefits other than the Separation

Benefits.

| 1 | Note to Form: This amount should be: |

| ● | For

Tier 1 Executives: (i) 2.5x (Base Salary + Target Annual Bonus) + (ii) pro-rated Target

Annual Bonus + (iii) 24x Monthly COBRA Amount. |

| ● | For

Tier 2 Executives: (i) 1.5x (Base Salary + Target Annual Bonus) + (ii) pro-rated Target

Annual Bonus + (iii) 18x Monthly COBRA Amount. |

(c)

Employee shall not have any duty to mitigate the amount of the Separation Benefits by seeking or accepting new employment or self-employment

following the Separation Date or otherwise.

4.

Continued Effectiveness of Restrictive Covenants. Employee acknowledges

that Employee has made certain commitments with respect to non-disclosure of information, non-competition, non-solicitation, non-disparagement

and assignment of inventions, as set forth in Sections 8, 9 and 10 of the Employment Agreement and incorporated into Section 7 of the

Severance Plan by reference, mutatis mutandis (collectively, the “Restrictive Covenants”). Employee acknowledges

and agrees that in connection with his employment with the Company, he has obtained confidential information.

5.

Release.

(a)

As a material inducement to the Company to enter into this Agreement, and for good and valuable consideration, including the Company’s

agreement to provide the Separation Benefits (or any portion thereof), Employee agrees that, to the maximum extent permitted by law, Employee,

on behalf of Employee, and Employee’s heirs, beneficiaries, administrators, executors, trustees and assigns, shall, and hereby does,

forever and irrevocably release and discharge the Company and each of its past, present and future parents, subsidiaries, affiliates,

portfolio companies and funds, and each of their past, present and future respective owners, officers, directors, employees, independent

contractors, agents, affiliates, parents, subsidiaries, divisions, insurers, attorneys, predecessors, employee benefit plans, purchasers,

assigns, representatives, successors and successors in interest (collectively, the “Released Parties”) from any and

all claims, suits, controversies, actions, causes of action, cross-claims, counter claims, demands, debts, compensatory damages, liquidated

damages, punitive or exemplary damages, other damages, claims for costs and attorneys’ fees, or liabilities of any nature whatsoever

in law and in equity, both past and present and whether known or unknown, suspected, unsuspected or claimed (collectively, “Claims”)

against the Released Parties which Employee or any of Employee’s heirs, executors, administrators or assigns, may have (i) from

the beginning of time through the date upon which Employee executes this Agreement; (ii) arising out of, or relating to, Employee’s

employment with any Released Parties; (iii) arising out of, or relating to, any agreement and/or any awards, policies, plans, programs

or practices of the Released Parties that may apply to Employee or in which Employee may participate, including, but not limited to, any

rights under bonus plans or programs of Released Parties and/or any other short-term or long-term equity-based or cash-based incentive

plans or programs of the Released Parties; (iv) arising out of, or relating to, Employee’s termination of employment from any of

the Released Parties; and/or (v) arising out of, or relating to, Employee’s status as an employee, member, officer or director of

any of the Released Parties, including, but not limited to, any allegation, Claim or violation, arising under any federal, state or local

civil or human rights law, or under any other local, state, or federal law, regulation or ordinance; or under any public policy, contract

(including the Employment Agreement) or tort, or under common law; or arising under any policies, practices or procedures of the Company;

or any Claim for wrongful discharge, breach of contract, infliction of emotional distress, defamation; or any Claim for costs, fees, or

other expenses, including attorneys’ fees incurred in these matters.

(b)

Employee represents and agrees that Employee has not, by himself/herself or on Employee’s behalf, instituted, prosecuted,

filed, or processed any litigation, Claims or proceedings against the Company or any Released Parties, nor has Employee encouraged or

assisted anyone to institute, prosecute, file, or process any litigation, Claims or proceedings against the Company or any Released Parties.

Nothing in this Section 5 shall release or impair (i) any Claim or right that may arise after the date of this Agreement; (ii)

any vested benefits under a 401(k) plan on or prior to the Separation Date; (iii) any Claim or right Employee may have pursuant to indemnification,

advancement, defense, or reimbursement pursuant to any applicable D&O policies, any similar insurance policies, indemnification agreements,

applicable law or otherwise, including pursuant to that certain Indemnification Agreement, dated as of [__________], between the Company

and Employee (the “Indemnification Agreement”), and Section 14 of your Employment Agreement, and any such rights arising

out of Section 6.7 of the Merger Agreement or any documents, policies or arrangements contemplated thereby; and (iv) any Claim which by

law cannot be waived. Nothing in this Agreement is intended to prohibit or restrict Employee’s right to file a charge with or participate

in a charge by the Equal Employment Opportunity Commission, or any other local, state, or federal administrative body or government agency;

provided that Employee hereby waives the right to recover any monetary damages or other relief against any Released Parties; provided,

however, that nothing in this Agreement shall prohibit Employee from receiving any monetary award to which Employee becomes entitled

pursuant to Section 922 of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

(c)

Employee understands that Employee may later discover Claims or facts that may be different than, or in addition to, those which

Employee now knows or believes to exist with regards to the subject matter of this Agreement, and which, if known at the time of executing

this Agreement, may have materially affected this Agreement or Employee’s decision to enter into it. Employee hereby waives any

right or Claim that might arise as a result of such different or additional Claims or facts.

(d)

Employee represents that Employee has made no assignment or transfer of any right or Claim covered by this Section 5 and

that Employee further agrees that Employee is not aware of any such right or Claim covered by this Section 5.

(e)

Through the date upon which it executes this Agreement, the Company agrees that, to the maximum extent permitted by law, it does

not have any known Claims against the Employee.

6.

Indemnification. Without limiting Section 5(b)(iii) of this Agreement or Section 6.7(a) of the Merger Agreement,

the Indemnification Agreement and Section 14 of your Employment Agreement shall survive the termination of Employee’s employment

and remain in force and effect in accordance with their respective terms and the terms of Section 6.7(a) of the Merger Agreement.

7.

No Cooperation with Non-Governmental Third Parties. Employee agrees that, to the maximum extent permitted by law,

Employee will not encourage or voluntarily assist or aid in any way any non-governmental attorneys or their clients or individuals acting

on their own behalf in making or filing any lawsuits, complaints,

or other proceedings against the Company or any other Released Parties, and represents that Employee has not previously engaged in any

such conduct.

8.

No Admission of Liability; No Prevailing Party. The Parties agree that this Agreement is not to be construed as an

admission of any wrongdoing or liability on the part of the Parties under any statute or otherwise, but that on the contrary, any such

wrongdoing or liability is expressly denied by the Parties. The Parties agree that neither this Agreement nor the negotiations in pursuance

thereof shall be construed or interpreted to render the Parties a prevailing party for any reason, including but not limited to an award

of attorney’s fees, expenses or costs under any statute or otherwise.

9.

Voluntary Execution. Employee acknowledges, certifies and agrees that: (a) Employee has carefully read this Agreement

and fully understands all of its terms; (b) Employee had a reasonable amount of time to consider Employee’s decision to execute

this Agreement; (c) in executing this Agreement Employee does not rely and has not relied upon any representation or statement made by

any of the Company’s agents, representatives, or attorneys with regard to the subject matter, basis, or effect of the Agreement;

and (d) that Employee enters into this Agreement voluntarily, of Employee’s own free will, without any duress and with knowledge

of its meaning and effect in exchange for good and valuable consideration to which Employee would not be entitled in the absence of executing

and not revoking this Agreement. Employee acknowledges that the Company has advised Employee to consult with an attorney prior to executing

this Agreement and that Employee has consulted with Employee’s Counsel.

10.

Review Period. Employee has been given [twenty-one (21)] // [forty-five (45)] days from the date of Employee’s

receipt of this Agreement to consider the terms of this Agreement, although Employee may sign it at any time sooner. The Parties agree

that any revisions or modifications to this Agreement, whether material or immaterial, will not and did not restart this time period.

Employee has seven (7) calendar days after the date on which Employee executes this Agreement to revoke this Agreement. Such revocation

must be in writing and must be emailed to [NAME, AT E-MAIL]. Notice of such revocation must be received within the seven (7) calendar

days referenced above. If Employee revokes Employee’s execution of this Agreement, the Agreement shall be null and void and the

“Effective Date” (as defined below) shall not occur. Provided that Employee does not revoke Employee’s execution of

this Agreement within such seven (7) day revocation period, this Agreement will become effective on the eighth (8th) calendar

day after the date on which Employee signs this Agreement (the “Effective Date”).

11.

Permitted Disclosures. Nothing in this Agreement or any other agreement between the Parties or any other policies

of the Company or its affiliates shall prohibit or restrict Employee or Employee’s attorneys from: (a) making any disclosure of

relevant and necessary information or documents in any action, investigation, or proceeding relating to this Agreement, or as required

by law or legal process, including with respect to possible violations of law; (b) participating, cooperating, or testifying in any action,

investigation, or proceeding with, or providing information to, any governmental agency or legislative body, any self-regulatory organization,

and/or pursuant to the Sarbanes-Oxley Act; or (c) accepting any U.S. Securities and Exchange Commission awards. In addition, nothing in

this Agreement or any other agreement between the Parties or any other policies of the Company or its affiliates prohibits or restricts

Employee from initiating communications with, or responding to any inquiry

from, any regulatory or supervisory authority regarding any good faith concerns about possible violations of law or regulation. Pursuant

to 18 U.S.C. § 1833(b), Employee will not be held criminally or civilly liable under any Federal or state trade secret law for the

disclosure of a trade secret of the Company or its affiliates that (i) is made (x) in confidence to a Federal, state, or local government

official, either directly or indirectly, or to Employee’s attorney and (y) solely for the purpose of reporting or investigating

a suspected violation of law; or (ii) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding.

If Employee files a lawsuit for retaliation by the Company for reporting a suspected violation of law, Employee may disclose the trade

secret to Employee’s attorney and use the trade secret information in the court proceeding, if Employee files any document containing

the trade secret under seal, and does not disclose the trade secret, except pursuant to court order. Nothing in this Agreement or any

other agreement between the Parties or any other policies of the Company or its affiliates is intended to conflict with 18 U.S.C. §

1833(b) or create liability for disclosures of trade secrets that are expressly allowed by such section.

12.

Tax Consequences. The Parties agree that the Company shall be entitled to withhold any amounts required to be withheld

in respect of federal, state or local taxes with respect to any amounts payable to Employee hereunder.

13.

Section 409A. It is the intention of the Parties that the payments or benefits payable under this Agreement comply

with or be exempt from Section 409A (as defined in the Severance Plan) and, accordingly, to the maximum extent permitted, this Agreement

shall be interpreted to be exempt from or in compliance therewith. Notwithstanding any other provision of this Agreement, in no event

whatsoever shall the Company or any other Released Party be liable for any additional tax, interest or penalty that may be imposed on

Employee by Section 409A or damages for failing to comply with Section 409A.

14.

Successors and Assigns; Third-Party Beneficiaries. The Parties agree that this Agreement shall inure to the benefit

of the personal representatives, heirs, executors, and administrators of Employee. This Agreement may not be assigned by Employee. The

Company may freely assign all rights and obligations of this Agreement to any affiliate or successor (including to a purchaser of assets).

The Released Parties are expressly intended to be third-party beneficiaries of this Agreement and it may be enforced by each of them.

15.

No Oral Modifications. This Agreement shall not be modified except in writing signed by Employee and an authorized

representative of the Company.

16.

Severability. If any terms of the above provisions of this Agreement (or portions thereof) are found null, void or

inoperative, for any reason, the remaining provisions will remain in full force and effect. The language of all parts of this Agreement

shall in all cases be construed as a whole, according to its fair meaning, and not strictly for or against either of the Parties.

17.

Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original but all of

which together will constitute one and the same instrument. An originally executed version of this Agreement that is scanned as an image

file (e.g., Adobe PDF, TIF, etc.) and then delivered by one party to the other party via electronic mail as evidence of signature, shall,

for all purposes hereof, be deemed an original signature. In addition, an originally executed version of this Agreement that is delivered

via facsimile by one party to the other party as evidence of signature shall, for all purposes hereof, be deemed an original.

18.

Governing Law. Section 9(j) (Governing Law) of the Plan is incorporated herein by reference, mutatis mutandis.

Notwithstanding the foregoing, any claims related to any other document referenced herein shall be governed by the governing law provided

for in such document.

19.

Entire Agreement. This Agreement and the Severance Plan and Employee’s Participation Agreement thereunder (and

the Employment Agreement to the extent referenced in Sections 4, 5(b), and 6 above, the Equity Incentive Plan and

applicable Award Agreements, the Merger Agreement, and the Indemnification Agreement) constitute the complete and entire agreement and

understanding of the Parties, and supersede in their entirety any and all prior understandings, negotiations, commitments, obligations

and/or agreements, whether written or oral, between the Parties. The Parties represent that, in executing this Agreement, each Party has

not relied upon any representation or statement made by the other Party, other than those set forth in this Agreement, with regard to

the subject matter, basis or effect of this Agreement. For the avoidance of doubt, notwithstanding anything to the contrary contained

herein, the Restrictive Covenants shall continue in full force and effect following the Separation Date. Except as expressly set forth

herein, effective as of the Separation Date, the Employment Agreement is hereby terminated, cancelled and of no further force or effect.

* * * *

IN WITNESS WHEREOF, the Parties

have duly executed this Agreement as of the below-indicated date(s).

| DASEKE, INC. |

|

|

| |

|

|

| |

|

|

| (Signature) |

|

Date |

| |

|

|

| Name: |

|

|

| |

|

|

| Title: |

|

|

NOT TO BE EXECUTED

PRIOR TO THE SEPARATION DATE

[Signature Page to Separation and Release Agreement]

Exhibit 10.2

DASEKE, INC.

[Date]

Re: Participation Agreement – Daseke, Inc.

Executive Change in Control and Severance Plan

Dear [__]:

We are pleased to inform you

that you have been designated as eligible to participate in the Daseke, Inc. Executive Change in Control and Severance Plan (as it may

be amended from time to time, the “Plan”), as a Tier [__] Executive. Your participation in the Plan will begin immediately

prior to the closing of the merger contemplated by that certain Agreement and Plan of Merger, dated as of December 22, 2023, by and among

TFI International Inc., a corporation incorporated pursuant to the Canada Business Corporations Act (“Parent”), Diocletian

MergerCo, Inc, a Delaware corporation and an indirect, wholly-owned subsidiary of Parent, and the Company (as defined in the Plan) (the

“Effective Time”). Your participation in the Plan is subject to the terms and conditions of the Plan and your execution

and delivery of this agreement, which constitutes a Participation Agreement (as defined in the Plan). A copy of the Plan is attached hereto

as Annex A and is incorporated herein and deemed to be part of this Participation Agreement for all purposes.

In signing below, you expressly

agree to be bound by, and promise to abide by, the terms of Section 7 of the Plan, which incorporates by reference the non-disclosure

of information, non-competition, non-solicitation, non-disparagement and assignment of inventions covenants as set forth in Sections 8,

9 and 10 of your Employment Agreement, dated as of [__], by and between the Company and you (your “Employment Agreement”),