false

0001213809

0001213809

2024-08-13

2024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): August 13, 2024

Dyadic International, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

(State or other jurisdiction of incorporation or organization)

|

000-55264

(Commission File Number)

|

45-0486747

(I.R.S. Employer Identification Number)

|

| |

|

|

|

1044 North U.S. Highway One, Suite 201

Jupiter, FL 33477

|

|

(Address of principal executive offices and zip code)

|

| |

|

(561) 743-8333

|

|

(Registrant’s telephone number, including area code)

|

| |

|

N/A

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

DYAI

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On August 13, 2024, Dyadic International, Inc. (“Dyadic”) issued a press release announcing its results for the quarter ended June 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Current Report on Form 8-K, including the information set forth in Exhibit 99.1, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. Such information shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

Item 9.01. Financial Statements and Exhibits

|

|

|

(d) Exhibits

|

|

|

|

Exhibit

Number

|

Description

|

|

| |

|

|

|

99.1

|

|

|

| 104 |

Cover page Interactive Data File (embedded within the Inline XBRL document) |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 13, 2024

| |

Dyadic International, Inc.

|

| |

|

|

| |

By:

|

/s/ Mark A. Emalfarb

|

| |

Name:

|

Mark A. Emalfarb

|

| |

Title:

|

Chief Executive Officer

|

Exhibit 99.1

Dyadic Announces Second Quarter 2024 Financial Results and Highlights Recent Company Progress

Alternative Proteins

| |

●

|

Entered into a development and commercialization partnership for the sale of animal-free recombinant albumin products with Proliant Health and Biologicals

|

| |

●

|

Entered into a joint development agreement with a Top 10 global dairy company for the development of non-animal alpha-lactalbumin

|

| |

●

|

Ongoing development of a robust pipeline of non-pharmaceutical recombinant product candidates such as alpha-lactalbumin, transferrin, DNASE-1, and several potential biofuels and other enzymes utilizing the DapibusTM platform technology

|

Animal Health

| |

●

|

Provided samples of the C1-produced recombinant ferritin nanoparticle H5 Clade 2.3.3.4.b A/Astrakhan avian influenza ‘Bird Flu’ antigen to multiple parties for evaluation and potential use in poultry and cattle vaccines

|

| |

●

|

Initiated analysis of additional targets for expanded collaboration with Phibro/Abic to develop vaccines and treatments for livestock animal diseases

|

Human Health

| |

●

|

C1- produced adjuvanted H5 Clade 2.3.3.4.b A/Astrakhan recombinant ferritin nanoparticle vaccine candidate demonstrated a strong immune response against the H5 Astrakhan avian influenza ‘Bird Flu’ in animal studies

|

| |

●

|

Successfully expressed H1N1 influenza antigen completing Dyadic’s initial objectives for the collaboration with the Vaccine and Immunotherapy Center at Massachusetts General Hospital

|

| |

●

|

Multiple applications submitted for grant funding from leading Non-Governmental Organization in collaboration with Fondazione Biotecnopolo di Siena and other partners for a variety of vaccine antigens

|

Corporate

| |

●

|

Cash and investment grade securities of $10.1 million as of June 30, 2024

|

| |

●

|

Financial results and business update conference call scheduled for 5:00 p.m. ET today

|

JUPITER, FL / August 13, 2024 (GLOBE NEWSWIRE) Dyadic International, Inc. (“Dyadic”, “we”, “us”, “our”, or the “Company”) (NASDAQ: DYAI), a biotechnology company focused on the efficient large-scale manufacture of proteins for use in human and animal vaccines and therapeutics, as well as non-pharmaceutical applications including food, nutrition, and wellness, today announced its financial results for the second quarter of 2024 and highlighted recent Company progress.

"This quarter, we saw the positive impact of our business strategy, which focuses on near-term non-pharmaceutical applications and mid- to long-term applications in animal and human health for our proprietary and patented C1 and Dapibus™ microbial protein production platforms and pipeline products,” said Mark Emalfarb, President and CEO of Dyadic.

Joe Hazelton, Dyadic’s Chief Operating Officer, commented, "As previously outlined, we have refined our business development strategy to concentrate on areas where we believe our technologies can achieve commercialization more quickly. Our recent development and commercialization agreement with Proliant Health and Biologicals exemplifies how we are monetizing our platform technologies. By focusing on product opportunities like recombinant human albumin and alpha-lactalbumin, both of which have significant global partners, Dyadic has gained multiple avenues for monetization as a licensed product or cell line in pharmaceutical, diagnostic, food, nutrition, health and wellness applications. We are excited about our prospects and remain dedicated to delivering value to our customers and stakeholders.”

Recently, the Company commissioned an independent vaccine expert to assess our adjuvanted avian influenza (“Bird Flu”) ferritin nanoparticle human vaccine candidate, developed in collaboration with ViroVax, LLC. The expert assessment provided a positive outlook on the initial animal studies, reporting that:

“Following a two-dose regimen of ViroVax NP-H5N1 RVPs a significant median neutralizing antibody titer ~11,000 and near identical cross-neutralization titers, ~9,000, of three RVP clades (e.g. A/Vietnam/1203/2004 and A/Astrakhan/3212/2020) were induced in rabbits. These are robust functional antibody responses that are induced following one dose and indicative of a booster immune response.”

This assessment indicates the potential of our adjuvanted avian influenza (“Bird Flu”) ferritin nanoparticle human vaccine candidate to generate high neutralizing antibodies for use in humans, and potentially in poultry, cattle and other animals. As the Bird Flu continues to spread globally among wild birds, poultry, and U.S. dairy cows, and a few recent cases in humans we are experiencing a growing interest in our C1 produced Self-assembling Nanoparticle H5-2.3.4.4b A/Astrakhan antigen.

Mr. Emalfarb continued, “As we move into the third quarter, our company remains focused on enhancing the Dapibus™ platform, which is designed specifically for non-pharmaceutical uses in industries such as food, nutrition, health and wellness, and other bioproducts. Our strategy involves targeting multiple offtakes for a single product in various business segments while seeking new opportunities that align with our goals. Our achievements in the second quarter highlight our ongoing commitment to advancing our microbial platforms for a broad range of protein applications in the alternative proteins sector as well as in animal and human health.”

Recent Company Progress

Alternative Proteins

Non-Food Applications

| |

●

|

On June 28, 2024, the Company announced that it entered into a development and commercialization partnership with Proliant Health and Biologicals (“PHB”), a leading supplier of purified proteins for the diagnostic, nutrition and cell culture markets. According to the terms of the agreement, Dyadic received an initial payment of $500,000 in July 2024. Dyadic will receive a second payment of $500,000 upon the completion of the transfer of a Production Strain (as defined in the agreement), and will receive a final payment of $500,000 upon the meeting of a certain productivity threshold. Dyadic will also receive a share of profits received by PHB from the sale of animal-free recombinant albumin products produced using Dyadic’s filamentous fungal microbial platforms. A portion of the upfront milestone payment will be allocated to the technology transfer and commercialization effort. The initial focus of the partnership will be the commercialization of recombinant human serum albumin products, with the anticipated launch of the first product in the first half of 2025.

|

| |

●

|

The Company has completed its development of the DNASE-1, and a Certificate of Analysis has been issued for the product, which is expected to begin sampling in the third quarter.

|

| |

●

|

The Company’s project to produce recombinant transferrin for use in cell culture media for the alternative protein industry has achieved high titers with additional optimization and analysis ongoing; product samples are expected to be available in the fourth quarter.

|

| |

●

|

The Company’s recombinant bovine albumin was shown in third party application testing to be comparable to animal derived bovine albumin for use as a component of cell culture media to grow animal muscle cells for the cultured meat industry; further development and analyses are ongoing.

|

Food Applications

| |

●

|

As previously announced, in September 2023, the Company entered into a development and exclusive license agreement to commercialize certain non-animal dairy enzymes used in the production of food products using Dapibus™ and received an upfront payment of $0.6 million in October 2023. The Company believes it has achieved the specified target yield level required for achieving a milestone payment and is in the process of delivering the strain for verification by its partner. The development of a second enzyme is progressing.

|

| |

●

|

The Company has developed a highly productive strain and is actively sampling recombinant alpha-lactalbumin, a whey protein, and has entered into a joint development agreement with a Top 10 global dairy company for the development of food grade alpha-lactalbumin. Additionally, the Company has ongoing discussions with plans to provide samples to three additional alternative protein companies.

|

| |

●

|

The Company is sampling recombinant lactoferrin for several interested parties.

|

Bio Industrial Products

| |

●

|

Dyadic has developed three enzymes, with plans for two additional enzymes, that have the potential for use in multiple industries, such as dairy, nutrition, biogas, biofuels and biorefining. Several initial enzymes are under evaluation with interested parties.

|

Animal Health

|

●

|

The Company continued its ongoing development and collaboration with Phibro Animal Health/Abic Biological Laboratories Ltd to develop vaccines and treatments for livestock animal diseases.

|

|

●

|

The Company has provided samples of the C1 produced H5 A/Astrakhan 2.3.4.4b recombinant ferritin nanoparticle antigen to multiple parties for evaluation and potential use in poultry and cattle vaccines.

|

|

●

|

Initial studies indicate that the adjuvanted C1 produced H5 A/2.3.3.4.b A/Astrakhan ferritin nanoparticle antigen has the potential for use as an animal vaccine candidate against the current avian influenza ‘Bird Flu’ viruses in poultry and cattle.

|

|

●

|

Animal studies conducted by ViroVax has demonstrated that the C1 produced H5 A/Astrakhan 2.3.4.4b ferritin nanoparticle vaccine elicits high neutralizing antibodies against the three circulating viruses: (a) H5/Influenza A/Astrakhan/3212/2020, (b) H5/Influenza A /Texas/37/2024, and (c) H5/Influenza A/Dairy Cattle/Texas/24-008749-003/2024.

|

Human Health

|

●

|

In April 2024, Dyadic and its development partner ViroVax reported pre-clinical animal testing on an adjuvanted H5 Clade 2.3.3.4.b A/Astrakhan avian influenza ferritin nanoparticle ‘Bird Flu’ human vaccine candidate that demonstrated a strong immune response in rabbits. The potential vaccine combines Dyadic’s C1 single step ferritin nanoparticle antigen production with a novel antigen and adjuvant from ViroVax. In the second quarter, the Company presented an overview of a H5N1 ‘Bird Flu’ recombinant protein human vaccine candidate to BARDA Tech Watch, NIH, and to the White House Office of Pandemic Preparedness and Response Policy.

|

|

●

|

The Company successfully delivered a C1 produced H1N1 influenza antigen in a fully funded research collaboration with the Vaccine and Immunotherapy Center at Massachusetts General Hospital. The program is focused on expressing vaccine antigens for influenza A and other infectious diseases, as part of a US $5.88 million award granted to Massachusetts General Hospital from the Department of Defense.

|

|

●

|

In third party funded programs, the C1 Platform has:

|

| |

o

|

successfully expressed multiple infectious disease antigens including HPV, HIV, and multiple RSV antigens;

|

| |

o

|

delivered three mAbs for evaluation as neutralizing antibodies for infectious diseases; and

|

| |

o

|

two additional mAbs in development, including a top ten pharmaceutical company.

|

Financial Highlights

Cash Position: As of June 30, 2024, cash, cash equivalents, and the carrying value of investment-grade securities, including accrued interest, were approximately $10.1 million compared to $7.3 million as of December 31, 2023.

Revenue: Revenue for the three months ended June 30, 2024, decreased to approximately $386,000 compared to $837,000 for the same period a year ago. The decrease is due to the winding down of several large research collaborations conducted in 2023. For the three months ended June 30, 2024, the Company’s revenue was generated from ten collaborations compared to eight collaborations for the same period a year ago.

Cost of Revenue: Cost of research and development revenue for the three months ended June 30, 2024, decreased to approximately $302,000 compared to $793,000 for the same period a year ago. The decrease in cost of research and development revenue was due to the same reasons as for revenue described above.

R&D Expenses: Research and development expenses for the three months ended June 30, 2024, decreased to approximately $516,000 compared to $918,000 for the same period a year ago. The decrease reflected the winding down of activities related to the Company’s Phase 1 clinical trial of DYAI-100 vaccine candidate and several other internal research projects.

G&A Expenses: General and administrative expenses for the three months ended June 30, 2024, increased to approximately $1,608,000 compared to $1,403,000 for the same period a year ago. The increase reflected increases in share-based compensation expenses of $84,000, legal expenses of $81,000, business development and investor relations expenses of $60,000, and other increases of $22,000, offset by decreases in management incentives of $36,000 and insurance expenses of $6,000.

Loss from Operations: Loss from operations for the three months ended June 30, 2024, decreased to approximately $2,043,000, compared to $2,290,000 for the same period a year ago. The decrease in loss from operations was due to a decrease in research and development expenses of $402,000, partially offset by an increase in general and administrative expenses of $205,000.

Net Loss: Net loss for the three months ended June 30, 2024, was approximately $2,045,000 or $(0.07) per share compared to $2,153,000 or $(0.07) per share for the same period a year ago. The decrease in net loss was due to a decrease in revenue and research and development expenses of $402,000, partially offset by increases in general and administrative expenses of $205,000 and interest expenses of $141,000 in the second quarter of 2024.

Conference Call Information

Date: Tuesday, August 13, 2024

Time: 5:00 p.m. Eastern Time

Dial-in numbers: Toll Free: 1-877-407-0784 or 1-201-689-8560

Conference ID: 13743569

Webcast Link: https://viavid.webcasts.com/starthere.jsp?ei=1650832&tp_key=276447f116

An archive of the webcast will be available within 24 hours after completion of the live event and will be accessible on the Investor Relations section of the Company’s website at www.dyadic.com. To access the replay of the webcast, please follow the webcast link above.

About Dyadic International, Inc.

Dyadic International, Inc. is a biotechnology company focused on the efficient large-scale manufacture of proteins for use in human and animal vaccines and therapeutics, as well as non-pharmaceutical applications including food, nutrition, and wellness.

Dyadic’s gene expression and protein production platforms are based on the highly productive and scalable fungus Thermothelomyces heterothallica (formerly Myceliophthora thermophila). Our lead technology, C1-cell protein production platform, is based on an industrially proven microorganism (named C1), which is currently used to speed development, lower production costs, and improve performance of biologic vaccines and drugs at flexible commercial scales for the human and animal health markets. Dyadic has also developed the Dapibus™ filamentous fungal based microbial protein production platform to enable the rapid development and large-scale manufacture of low-cost proteins, metabolites, and other biologic products for use in non-pharmaceutical applications, such as food, nutrition, and wellness.

With a passion to enable our partners and collaborators to develop effective preventative and therapeutic treatments in both developed and emerging countries, Dyadic is building an active pipeline by advancing its proprietary microbial platform technologies, including our lead asset DYAI-100 COVID-19 vaccine candidate, as well as other biologic vaccines, antibodies, and other biological products.

To learn more about Dyadic and our commitment to helping bring vaccines and other biologic products to market faster, in greater volumes and at lower cost, please visit http://www.dyadic.com.

Safe Harbor Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act, including those regarding Dyadic International’s expectations, intentions, strategies, and beliefs pertaining to future events or future financial performance, such as the success of our clinical trial and interest in our protein production platforms, our research projects and third-party collaborations, as well as the availability of necessary funding. Forward-looking statements generally can be identified by use of the words “expect,” “should,” “intend,” “anticipate,” “will,” “project,” “may,” “might,” “potential,” or “continue” and other similar terms or variations of them or similar terminology. Forward-looking statements involve many risks, uncertainties or other factors beyond Dyadic’s control. These factors include, but are not limited to, the following: (i) our history of net losses; (ii) market and regulatory acceptance of our microbial protein production platforms and other technologies; (iii) competition, including from alternative technologies; (iv) the results of nonclinical studies and clinical trials; (v) our capital needs; (vi) changes in global economic and financial conditions; (vii) our reliance on information technology; (viii) our dependence on third parties; (ix) government regulations and environmental, social and governance issues; and (x) intellectual property risks. For a more complete description of the risks that could cause our actual results to differ from our current expectations, please see the section entitled “Risk Factors” in Dyadic’s annual reports on Form 10-K and quarterly reports on Form 10-Q filed with the SEC, as such factors may be updated from time to time in Dyadic’s periodic filings with the SEC, which are accessible on the SEC’s website and at www.dyadic.com. All forward-looking statements speak only as of the date made, and except as required by applicable law, Dyadic assumes no obligation to publicly update any such forward-looking statements for any reason after the date of this press release to conform these statements to actual results or to changes in our expectations.

Contact:

Dyadic International, Inc.

Ping W. Rawson

Chief Financial Officer

Phone: (561) 743-8333

Email: ir@dyadic.com

DYADIC INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

| |

|

Three Months Ended June 30,

|

|

|

Six Months Ended June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development revenue

|

|

$ |

385,896 |

|

|

$ |

793,042 |

|

|

$ |

720,513 |

|

|

$ |

1,726,976 |

|

|

License revenue

|

|

|

— |

|

|

|

44,117 |

|

|

|

— |

|

|

|

88,235 |

|

|

Total revenue

|

|

|

385,896 |

|

|

|

837,159 |

|

|

|

720,513 |

|

|

|

1,815,211 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs of research and development revenue

|

|

|

301,956 |

|

|

|

792,944 |

|

|

|

445,911 |

|

|

|

1,519,862 |

|

|

Research and development

|

|

|

515,629 |

|

|

|

917,552 |

|

|

|

1,038,352 |

|

|

|

1,728,118 |

|

|

General and administrative

|

|

|

1,607,756 |

|

|

|

1,402,569 |

|

|

|

3,396,350 |

|

|

|

2,882,609 |

|

|

Foreign currency exchange loss

|

|

|

3,146 |

|

|

|

14,521 |

|

|

|

8,049 |

|

|

|

25,543 |

|

|

Total costs and expenses

|

|

|

2,428,487 |

|

|

|

3,127,586 |

|

|

|

4,888,662 |

|

|

|

6,156,132 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(2,042,591 |

) |

|

|

(2,290,427 |

) |

|

|

(4,168,149 |

) |

|

|

(4,340,921 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income

|

|

|

138,471 |

|

|

|

109,194 |

|

|

|

225,914 |

|

|

|

213,925 |

|

|

Gain on sale of Alphazyme

|

|

|

— |

|

|

|

28,273 |

|

|

|

60,977 |

|

|

|

1,017,592 |

|

|

Interest expense

|

|

|

(88,634 |

) |

|

|

— |

|

|

|

(110,273 |

) |

|

|

— |

|

|

Interest expense - related party

|

|

|

(52,469 |

) |

|

|

— |

|

|

|

(63,288 |

) |

|

|

— |

|

|

Total other income (expense), net

|

|

|

(2,632 |

) |

|

|

137,467 |

|

|

|

113,330 |

|

|

|

1,231,517 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$ |

(2,045,223 |

) |

|

$ |

(2,152,960 |

) |

|

$ |

(4,054,819 |

) |

|

$ |

(3,109,404 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net loss per common share

|

|

$ |

(0.07 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.11 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted weighted-average common shares outstanding

|

|

|

29,291,259 |

|

|

|

28,881,061 |

|

|

|

29,085,696 |

|

|

|

28,786,402 |

|

See Notes to Consolidated Financial Statements in Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 13, 2024.

DYADIC INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

| |

|

June 30, 2024

|

|

|

December 31, 2023

|

|

| |

|

(Unaudited)

|

|

|

(Audited)

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

6,133,398 |

|

|

$ |

6,515,028 |

|

|

Short-term investment securities

|

|

|

3,964,517 |

|

|

|

748,290 |

|

|

Interest receivable

|

|

|

28,160 |

|

|

|

10,083 |

|

|

Accounts receivable

|

|

|

249,806 |

|

|

|

466,159 |

|

|

Prepaid expenses and other current assets

|

|

|

126,720 |

|

|

|

327,775 |

|

|

Total current assets

|

|

|

10,502,601 |

|

|

|

8,067,335 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current assets:

|

|

|

|

|

|

|

|

|

|

Operating lease right-of-use asset, net

|

|

|

117,346 |

|

|

|

141,439 |

|

|

Other assets

|

|

|

10,425 |

|

|

|

10,462 |

|

|

Total assets

|

|

$ |

10,630,372 |

|

|

$ |

8,219,236 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

432,521 |

|

|

$ |

656,445 |

|

|

Accrued expenses

|

|

|

870,597 |

|

|

|

1,057,164 |

|

|

Deferred research and development obligations

|

|

|

482,323 |

|

|

|

490,113 |

|

|

Operating lease liability, current portion

|

|

|

51,075 |

|

|

|

48,059 |

|

|

Accrued interest

|

|

|

80,000 |

|

|

|

— |

|

|

Accrued interest - related party

|

|

|

32,000 |

|

|

|

— |

|

|

Total current liabilities

|

|

|

1,948,516 |

|

|

|

2,251,781 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current liabilities:

|

|

|

|

|

|

|

|

|

|

Convertible notes, net of issuance costs

|

|

|

3,893,602 |

|

|

|

— |

|

|

Convertible notes, net of issuance costs - related party

|

|

|

1,557,441 |

|

|

|

— |

|

|

Operating lease liability, net of current portion

|

|

|

62,631 |

|

|

|

88,870 |

|

|

Total liabilities

|

|

|

7,462,190 |

|

|

|

2,340,651 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies (Note 5)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.0001 par value:

|

|

|

|

|

|

|

|

|

|

Authorized shares - 5,000,000; none issued and outstanding

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.001 par value:

|

|

|

|

|

|

|

|

|

|

Authorized shares - 100,000,000; issued shares - 41,731,141 and 41,064,563, outstanding shares - 29,477,639 and 28,811,061 as of June 30, 2024, and December 31, 2023, respectively

|

|

|

41,732 |

|

|

|

41,065 |

|

|

Additional paid-in capital

|

|

|

106,388,505 |

|

|

|

105,044,756 |

|

|

Treasury stock, shares held at cost - 12,253,502

|

|

|

(18,929,915 |

) |

|

|

(18,929,915 |

) |

|

Accumulated deficit

|

|

|

(84,332,140 |

) |

|

|

(80,277,321 |

) |

|

Total stockholders’ equity

|

|

|

3,168,182 |

|

|

|

5,878,585 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

10,630,372 |

|

|

$ |

8,219,236 |

|

See Notes to Consolidated Financial Statements in Item 1 of Dyadic’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on August 13, 2024.

v3.24.2.u1

Document And Entity Information

|

Aug. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Dyadic International, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

000-55264

|

| Entity, Tax Identification Number |

45-0486747

|

| Entity, Address, Address Line One |

1044 North U.S. Highway One, Suite 201

|

| Entity, Address, City or Town |

Jupiter

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

33477

|

| City Area Code |

561

|

| Local Phone Number |

743-8333

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

DYAI

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001213809

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

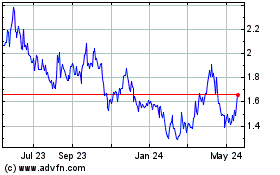

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Oct 2024 to Nov 2024

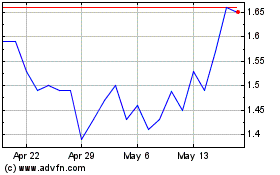

Dyadic (NASDAQ:DYAI)

Historical Stock Chart

From Nov 2023 to Nov 2024