Edible Garden AG Incorporated (“Edible Garden” or the

“Company”) (Nasdaq: EDBL, EDBLW), a leader in controlled

environment agriculture (CEA), locally grown, organic, and

sustainable produce and products, today announced the signing of a

non-binding letter of intent (LOI) to purchase the outstanding

share capital of Narayan d.o.o. and its subsidiaries (“Narayan

Group”), a prominent producer of organic coconut and superfood

products.

The Narayan Group, headquartered in Slovenia,

brings established products characterized by consistent revenue

growth and EBITDA1 with significant market reach that has achieved

over $22 Million in revenue2 during the first nine months of 2024.

Narayan expects fourth quarter revenue in excess of $9.5 Million,

which would result in expected annual revenue of approximately

$31.5 Million for the year ending December 31, 2024.3

With Narayan’s vertically integrated supply

chain and leadership in the European market combining with Edible

Garden’s innovative CEA technology and product placement within

their North American distribution network on a combined basis, the

Narayan Group and Edible Garden expect to achieve combined revenues

in excess of $60 Million in 2025.4

The Narayan Group has demonstrated consistent

positive EBITDA1, with net sales revenue growing steadily from

$12.1 Million in 2020 to $26.9 Million in 2023. The Narayan Group

generated net income of $0.9 Million and EBITDA1 of $3.0 Million in

2023 and is expected to report increased revenues and EBITDA1 for

fiscal 2024.

Mario Brumat, CEO of Narayan Group, stated, “We

believe this strategic transaction with Edible Garden represents a

transformative opportunity to combine Narayan’s high-growth

business model and strong European market leadership with Edible

Garden’s innovative CEA technology and established distribution

channels in North America. Together, we expect to be able to

accelerate market expansion, particularly in the U.S. and Canada,

by delivering products that meet rising consumer demand for organic

and sustainable food products. We anticipate this collaboration

will drive operational efficiencies, and provide cross selling

opportunities of our combined product lines throughout North

America and Europe which should provide immediate short-term and

sustainable long-term shareholder value through scalable growth and

increased market share in the growing market sector we are

addressing.”

Jim Kras, CEO of Edible Garden, added, “We

believe Narayan Group’s proven success and alignment with our

Zero-Waste Inspired® vision will allow us to build scale, expand

internationally, and enhance our operational efficiency. This value

acquisition should position us to create meaningful value for our

shareholders by meeting the growing demand for sustainable,

plant-based food products. Narayan has a demonstrated strength in

acquiring and developing products under a vertically integrated

supply chain management strategy resulting in strong gross margins

throughout Europe. We believe this transaction will provide us with

immediate value, allow us to introduce Narayan’s products into the

North American market and provide a much stronger base to grow in

the future. Our combined strategy will be to build on Narayan’s

footprint in Europe with their ability to acquire other successful

product offerings and to expand those through our established and

growing North American channels.”

The Proposed Transaction

Under the terms of the LOI, in consideration for

100% of the share capital of Narayan d.o.o. (the parent of the

Narayan Group companies), Edible Garden will issue to the Narayan

shareholders shares of Edible Garden common stock. Subject to

completion of the respective parties’ due diligence investigation

and receipt by Edible Garden of an opinion from an independent

investment banker that the terms of the transaction are fair to the

Edible Garden stockholders from a financial point of view, it is

anticipated that a majority of the fully-diluted outstanding shares

of Edible Garden common stock at closing will be issued to the

Narayan shareholders.

The LOI contemplates that, subject to Nasdaq

requirements, a majority of the members of the Edible Garden board

of directors shall be designated by the Narayan shareholders or

their affiliate. Jim Kras will continue to serve as the Chairman

and Chief Executive Officer of Edible and Mario Brumat, the current

president of Narayan will continue to head European operations and

serve as a member of the Edible Garden board of directors.

Closing of the transaction is expected to be

subject to a number of closing conditions, including a satisfactory

due diligence investigation by both parties, completion of a €6.0

million equity financing for Narayan, consummation of a

contemplated reverse stock split of the current outstanding shares

of common stock of Edible Garden, execution of employment

agreements for Messrs. Kras and Brumat, establishment of a 2025

Equity Incentive Plan for Edible and approval of the transaction by

the Edible Garden stockholders.

About the Narayan Group

The Narayan Group produces over 100 organic food

products that are certified vegan and organic under private label

and proprietary brand offerings. Its products are sold and

distributed by many of the largest food retailers primarily in

Europe and US. The Narayan Group ranks among the top 1000 global

suppliers to the Schwarz Group (Lidl & Kaufland), the #3 ranked

food retailer in the world by international revenues and Aldi, the

#4 ranked food retailer in the world by international revenues,

according to Top 50 Global Retailers 2024 by the National Retail

Federation. Narayan products are available through retail channels

with a combined reach of approximately 75,000 retail stores

globally, located in more than 30 countries, primarily within the

EU.

The Narayan Group business currently operates in

two core food product segments – Organic Coconut and Superfoods

Products.

The organic coconut products segment includes a

range of packaged organic coconut food products. Narayan sources,

produces, mixes, bottles, and packages private label and branded

organic coconut products, including organic and conventional virgin

and refined, bleached, and deodorized coconut oils, coconut flour,

coconut sugar, and coconut syrup. Our coconut products come in

different varieties, packaging, and flavors. Narayan believes our

organic virgin coconut oil is a premier energy source and a

high-quality, sustainable ingredient.

In addition to its organic coconut products, the

Narayan Group also sells assorted spices, grains, seeds and pulses,

nuts, cereals, fruits, syrups, ready-to-cook meals, and toppings,

including quinoa, flax seeds, chia seeds, lentils, psyllium husk,

sesame seeds, bulgur, whole grain couscous, goji berries, which

they market as Superfoods. Its selection of organic superfood

products are produced and sold in a range of sizes and packaging

options and feature different flavors.

The Narayan growth strategy includes entry into the United

States and Canadian markets and strategic acquisition of other

businesses in the food segment. For more information on The Narayan

Group go to https://narayanfood.com/.

About Edible

Garden®

Edible Garden AG Incorporated is a leader in

controlled environment agriculture (CEA), locally grown, organic,

and sustainable produce and products backed by Zero-Waste Inspired®

next generation farming. Offered at over 5,000 stores in the US,

Caribbean and South America, Edible Garden is disrupting the CEA

and sustainability technology movement with its safety-in-farming

protocols, use of sustainable packaging, patented GreenThumb

software and Self-Watering in-store displays. The Company currently

operates its own state-of-the-art vertically integrated greenhouses

and processing facilities in Belvidere, New Jersey and Grand

Rapids, Michigan, and has a network of contract growers, all

strategically located near major markets in the U.S. Its

proprietary GreenThumb 2.0 patented (US Nos.: US 11,158,006 B1, US

11,410,249 B2 and US 11,830, 088 B2) software optimizes growing in

vertical and traditional greenhouses while seeking to reduce

pollution-generating food miles. Its proprietary patented (U.S.

Patent No. D1,010,365) Self-Watering display is designed to

increase plant shelf life and provide an enhanced in-store plant

display experience. The Company has been named a FoodTech 500

company by Forward Fooding, a leading AgriFoodTech

organization. In addition, Edible Garden is also a Giga Guru

member of Walmart's Project Gigaton sustainability initiative.

Edible Garden is also a developer of ingredients and proteins,

providing an accessible line of plant and whey protein powders

under the Vitamin Way® and Vitamin Whey® brands. In addition, the

Company’s Kick. Sports Nutrition line features premium performance

products that cater to today’s health-conscious athletes looking

for cleaner labeled, better for you options. Furthermore, Edible

Garden offers a line of fresh, sustainable and functional

condiments such as Pulp fermented gourmet & chili-based sauces

and Edible Garden's Pickle Party - fresh pickles & krauts.

For more information on Pulp products go

to https://www.pulpflavors.com. For more information on

Vitamin Whey® products go to https://vitaminwhey.com. For more

information on Edible Garden go to https://ediblegardenag.com. A

copy of the Company’s latest corporate video is also available

here.

Presentation of Financial Information

All dollar amounts set forth in this press

release are in United States dollars.

The Narayan Group’s financial statements are

prepared in accordance with IFRS, and any financial information of

The Narayan Group included in this press release has been derived

from The Narayan Group’s annual or interim financial statements

prepared in accordance with IFRS and has been prepared using

accounting policies that are consistent with IFRS. Edible Garden’s

financial statements are prepared in accordance with accounting

principles generally accepted in the United States (“GAAP”), and

any financial information of Edible Garden included in this press

release has been derived from Edible Garden’s annual or interim

financial statements prepared in accordance with GAAP and has been

prepared using accounting policies that are consistent with

GAAP.

IFRS differs in certain material respects from

GAAP. The financial information of the Narayan Group presented in

this press release has not been adjusted to give effect to the

differences between GAAP and IFRS or to accounting policies that

comply with GAAP, and thus may not be directly comparable to Edible

Garden’s financial information prepared in accordance with

GAAP.

Use of Non-IFRS Financial Measures

The Narayan Group utilizes non-IFRS financial

measures, including EBITDA, to complement its IFRS reporting and

provide stakeholders with a deeper understanding of its operational

performance and financial health. These measures offer insights

into trends and factors that IFRS metrics may not fully capture.

Non-IFRS financial measures should not be considered in isolation

from, or as a substitute for, financial information presented in

compliance with IFRS, and non-IFRS financial measures as used by

The Narayan Group may not be comparable to similarly titled amounts

used by other companies. The Narayan Group defines EBITDA as

earnings before interest, taxes, depreciation, and amortization.

The table below presents The Narayan Group’s EBITDA for the year

ended December 31, 2023 reconciled to The Narayan Group’s Net

Profit for the year ended December 31, 2023 which is the most

comparable IFRS measure (in millions):

Net

Profit

$0.942

Interest

Expense

1.014

Taxes

.088

Depreciation/

.965

Amortization

EBITDA

$3.00

Cautionary Statement Concerning

Forward-Looking Statements:

This press release contains forward-looking

statements, including with respect to the proposed transaction with

Narayan Group and its expected timing, the results of the proposed

transaction, if completed, the Company’s growth strategies, the

Company’s ability to improve its financial results, and performance

as a public company. The words “anticipate,” “believe,” “design,”

“expect,” “opportunities,” “seek,” “should” “strategy,” “will,” and

similar expressions are intended to identify forward-looking

statements. These forward-looking statements are subject to a

number of risks, uncertainties, and assumptions, including the

uncertainty of whether a definitive agreement can be reached, the

Company’s ability to obtain the requisite vote of its stockholders

to approve the proposed transaction, the parties’ ability to

satisfy the conditions to closing the proposed transaction, the

risk that management’s attention is diverted to transaction-related

matters, market and other conditions, whether the revenue

expectations of the combined companies will be as expected or that

the combined companies will be able to generate a profit, the

Company’s ability to achieve its growth objectives, and other

factors set forth in the Company’s filings with the Securities and

Exchange Act Commission, including the Company’s annual report on

Form 10-K for the year ended December 31, 2023, and subsequent

quarterly reports. Actual results might differ materially from

those explicit or implicit in the forward-looking statements. The

Company undertakes no obligation to update any such forward-looking

statements after the date hereof to conform to actual results or

changes in expectations, except as required by law. References to

information included on, or accessible through, websites and social

media platforms do not constitute incorporation herein by reference

of the information contained at or available through such websites

or social media platforms, and the reader should not consider such

information to be part of this press release.

Investor Contact:Crescendo Communications,

LLC212-671-1020EDBL@crescendo-ir.com

1 EBITDA is a non-GAAP (as defined below) and non-International

Financial Reporting Standards (“IFRS”) measure, which should not be

considered in isolation or as a substitute for IFRS measures.

EBITDA is not a recognized measure under IFRS and does not have a

standardized meaning prescribed by IFRS and therefore may not be

comparable to similar measures presented by other companies. See

“Use of Non-IFRS Financial Measures” below for more

information.

2 The Narayan Group reports its financial results pursuant to

IFRS. See “Presentation of Financial Information” below for more

information about IFRS.

3 This financial information being presented

above is preliminary and unaudited, based upon estimates, and

subject to further internal review by Narayan management and

compilation of actual results. Narayan has not completed its

closing procedures for the fourth quarter and year ended December

31, 2024. While Narayan expects its actual results will be

consistent with these preliminary and unaudited estimates, its

actual results may differ materially from these preliminary

estimates. This preliminary financial information should not be

viewed as a substitute for Narayan’s full interim or annual

financial statements prepared in accordance with U.S. generally

accepted accounting principles. Accordingly, you should not place

undue reliance on this preliminary financial information. The

preliminary financial information has been prepared by, and is the

responsibility of, Narayan’s management. Marcum LLP, Narayan’s

public accounting firm, has not audited, reviewed, compiled or

performed any procedures with respect to the preliminary financial

data. Accordingly, Marcum LLP does not express an opinion or any

other form of assurance with respect thereto.

4 The Company does not provide any representation regarding the

accuracy or reliability of this projection or that this projection

will be achieved. Readers are cautioned not to rely on this

projection in making an investment decision. This projection was

not examined or compiled by the parties’ public accounting firm

Marcum LLP. Accordingly, Marcum LLP does not express an

opinion or any other form of assurance with respect thereto. See

“Cautionary Statement of Forward-Looking Statements” below for

additional information regarding certain risks that could impact

this projection.

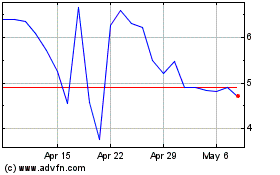

Edible Garden (NASDAQ:EDBL)

Historical Stock Chart

From Jan 2025 to Feb 2025

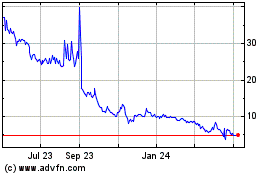

Edible Garden (NASDAQ:EDBL)

Historical Stock Chart

From Feb 2024 to Feb 2025