0001463101false00014631012024-10-222024-10-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 22, 2024

________________________________________________

ENPHASE ENERGY, INC.

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | |

| Delaware | | 001-35480 | | 20-4645388 |

| (State or other jurisdiction of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

47281 Bayside Parkway

Fremont, CA 94538

(Address of principal executive offices, including zip code)

(707) 774-7000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.00001 par value per share | | ENPH | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 22, 2024, Enphase Energy, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the third quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report. Information on the Company’s website is not, and will not be deemed, a part of this report or incorporated into this or any other filings that the Company makes with the Securities and Exchange Commission.

The information in Item 2.02 of this Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and shall not be incorporated by reference in any registration statement or other document filed under the Securities Act or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filings, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits. | | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | October 22, 2024 | ENPHASE ENERGY, INC. |

| | By: | /s/ Mandy Yang |

| | | Mandy Yang |

| | | Executive Vice President and Chief Financial Officer

(Principal Financial Officer) |

Exhibit 99.1

Enphase Energy Reports Financial Results for the Third Quarter of 2024

FREMONT, Calif., Oct. 22, 2024 - Enphase Energy, Inc. (NASDAQ: ENPH), a global energy technology company and the world’s leading supplier of microinverter-based solar and battery systems, announced today financial results for the third quarter of 2024, which included the summary below from its President and CEO, Badri Kothandaraman.

We reported quarterly revenue of $380.9 million in the third quarter of 2024, along with 48.1% for non-GAAP gross margin. We shipped 1,731,768 microinverters, or approximately 730.0 megawatts DC, and 172.9 megawatt hours of IQ® Batteries.

Financial highlights for the third quarter of 2024 are listed below:

•Quarterly revenue of $380.9 million

•GAAP gross margin of 46.8%; non-GAAP gross margin of 48.1% with net IRA benefit

•Non-GAAP gross margin of 38.9%, excluding net IRA benefit of 9.2%

•GAAP operating income of $49.8 million; non-GAAP operating income of $101.4 million

•GAAP net income of $45.8 million; non-GAAP net income of $88.4 million

•GAAP diluted earnings per share of $0.33; non-GAAP diluted earnings per share of $0.65

•Free cash flow of $161.6 million; ending cash, cash equivalents, and marketable securities of $1.77 billion

Our revenue and earnings for the third quarter of 2024 are provided below, compared with the prior quarter:

(In thousands, except per share and percentage data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | Non-GAAP |

| Q3 2024 | | Q2 2024 | | Q3 2023 | | Q3 2024 | | Q2 2024 | | Q3 2023 |

| Revenue | $ | 380,873 | | | $ | 303,458 | | | $ | 551,082 | | | $ | 380,873 | | | $ | 303,458 | | | $ | 551,082 | |

| | | | | | | | | | | |

| Gross margin | 46.8 | % | | 45.2 | % | | 47.5 | % | | 48.1 | % | | 47.1 | % | | 48.4 | % |

| Operating expenses | $ | 128,383 | | | $ | 135,367 | | | $ | 144,024 | | | $ | 81,612 | | | $ | 81,706 | | | $ | 99,027 | |

| Operating income | $ | 49,788 | | | $ | 1,799 | | | $ | 117,989 | | | $ | 101,411 | | | $ | 61,080 | | | $ | 167,593 | |

| Net income | $ | 45,762 | | | $ | 10,833 | | | $ | 113,953 | | | $ | 88,402 | | | $ | 58,824 | | | $ | 141,849 | |

| Basic EPS | $ | 0.34 | | | $ | 0.08 | | | $ | 0.84 | | | $ | 0.65 | | | $ | 0.43 | | | $ | 1.04 | |

| Diluted EPS | $ | 0.33 | | | $ | 0.08 | | | $ | 0.80 | | | $ | 0.65 | | | $ | 0.43 | | | $ | 1.02 | |

Total revenue for the third quarter of 2024 was $380.9 million, compared to $303.5 million in the second quarter of 2024. Our revenue in the United States for the third quarter of 2024 increased approximately 43%, compared to the second quarter of 2024. The increase was due to higher shipments to distributors as inventory returned to normal levels. Our revenue in Europe decreased approximately 15% for the third quarter of 2024, compared to the second quarter of 2024. The decline in revenue was the result of a further softening in European demand.

Our non-GAAP gross margin was 48.1% in the third quarter of 2024, compared to 47.1% in the second quarter of 2024. Our non-GAAP gross margin, excluding net IRA benefit, was 38.9% in the third quarter of 2024, compared to 41.0% in the second quarter of 2024.

Our non-GAAP operating expenses were $81.6 million in the third quarter of 2024, compared to $81.7 million in the second quarter of 2024. Our non-GAAP operating income was $101.4 million in the third quarter of 2024, compared to $61.1 million in the second quarter of 2024.

We exited the third quarter of 2024 with $1.77 billion in cash, cash equivalents, and marketable securities and generated $170.1 million in cash flow from operations in the third quarter of 2024. Our capital expenditures were $8.5 million in the third quarter of 2024, compared to $9.6 million in the second quarter of 2024.

In the third quarter of 2024, we repurchased 434,947 shares of our common stock at an average price of $114.48 per share for a total of approximately $49.8 million. We also spent approximately $6.3 million dollars by withholding shares to cover taxes for employee stock vesting that reduced the diluted shares by 59,607 shares.

We shipped 172.9 megawatt hours of IQ Batteries in the third quarter of 2024, compared to 120.2 megawatt hours in the second quarter of 2024. We are now shipping our third generation of IQ Batteries, the IQ® Battery 5P™, to the United States, Puerto Rico, Mexico, Canada, Australia, the United Kingdom, Italy, France, the Netherlands, Luxembourg, and Belgium. More than 9,000 installers worldwide are certified to install our IQ Batteries, compared to more than 7,400 installers worldwide in the second quarter of 2024.

During the third quarter of 2024, we shipped approximately 1,176,000 microinverters from our contract manufacturing facilities in the United States that we booked for 45X production tax credits. We began shipping IQ8HC™ Microinverters with higher domestic content, produced at our contract manufacturing facilities in the United States. We expect to begin shipping our commercial microinverters, and batteries with higher domestic content, produced at our United States contract manufacturing facilities in the fourth quarter of 2024.

During the third quarter of 2024, we launched AI-based software that is designed to optimize energy use by integrating solar and consumption forecasting with electricity tariff. This is intended to help consumers maximize savings as energy markets become increasingly complex, such as with dynamic electricity rates in parts of Europe and NEM 3.0 in California. We are gearing up to launch our second-generation IQ® EV charger, the 3-Phase IQ Battery with backup, and the IQ® Balcony Solar Kit all for the European market – pushing the boundaries of innovation. Finally, our fourth-generation energy system, featuring the IQ® Meter Collar, 10 kWh IQ Battery, and enhanced IQ® Combiner, is expected to debut in the United States in early 2025, targeting a substantial reduction in installation costs.

BUSINESS HIGHLIGHTS

On Oct. 16, 2024, Enphase Energy announced that it started shipping IQ8™ Microinverters to support newer, high-powered solar panels in select countries and territories, including the Netherlands, Austria, New Caledonia, and Malta.

On Oct. 9, 2024, Enphase Energy announced that it is expanding its support for grid services programs – or virtual power plants (VPPs) – in New Hampshire, North Carolina, and California, powered by the new IQ Battery 5P.

On Oct. 3, 2024, Enphase Energy announced the launch of its IQ8X™ Microinverters in Australia, and that all IQ8 Microinverters activated starting Oct. 1, 2024 in Australia come with an industry-leading 25-year limited warranty, currently the longest standard residential warranty in the Australian market.

On Sept. 24, 2024, Enphase Energy announced the launch of its most powerful Enphase® Energy System™ to-date, featuring the new IQ Battery 5P and IQ8 Microinverters, for customers in India.

On Sept. 16, 2024, Enphase Energy announced that it started shipping the IQ Battery 5P in Belgium. Enphase also introduced IQ® Energy Management, its new AI-based energy management software to enable support for dynamic electricity rates and the integration of third-party EV chargers and heat pumps in Belgium.

On Sept. 10, 2024, Enphase Energy announced initial shipments of IQ8HC Microinverters supplied from contract manufacturing facilities in the United States with higher domestic content than previous models. The microinverters have SKUs with a “DOM” suffix, indicating the increased amount of domestic content.

On Sept. 4, 2024, Enphase Energy announced a solution for expanding legacy net energy metering (NEM) solar energy systems in California without penalty using new Enphase Energy Systems configurations with IQ® Microinverters, IQ Batteries, and Enphase Power Control.

On Aug. 27, 2024, Enphase Energy announced the availability of pre-orders for IQ Battery 5Ps produced in the United States. Pre-orders are also available for IQ8HC Microinverters, IQ8P-3P™ Microinverters, and IQ8X Microinverters produced in the United States with higher domestic content.

On Aug. 19, 2024, Enphase Energy announced that it started shipping the IQ Battery 5P in the Netherlands. Enphase also introduced IQ Energy Management, its new energy management software to enable support for dynamic electricity rates and the integration of third-party EV chargers and heat pumps in the Netherlands.

On Aug. 8, 2024, Enphase Energy announced the launch of its new North American Charging Standard (NACS) connectors for its entire line of IQ EV Chargers. NACS connectors and charger ports have recently become the industry standard embraced by several major automakers for electric vehicles (EVs).

On Aug. 5, 2024, Enphase Energy announced that it started shipping IQ8P™ and IQ8HC Microinverters to support newer, high-powered solar panels in select countries throughout the Caribbean.

On Aug. 1, 2024, Enphase Energy announced that it started shipping IQ8 Microinverters to support newer, high-powered solar modules in select countries throughout Europe, including France, Germany, Spain, Bulgaria, Estonia, Slovakia, and Croatia.

FOURTH QUARTER 2024 FINANCIAL OUTLOOK

For the fourth quarter of 2024, Enphase Energy estimates both GAAP and non-GAAP financial results as follows:

•Revenue to be within a range of $360.0 million to $400.0 million, which includes shipments of 140 to 160 megawatt hours of IQ Batteries

•GAAP gross margin to be within a range of 47.0% to 50.0% with net IRA benefit

•Non-GAAP gross margin to be within a range of 49.0% to 52.0% with net IRA benefit and 39.0% to 42.0% excluding net IRA benefit. Non-GAAP gross margin excludes stock-based compensation expense and acquisition related amortization

•Net IRA benefit to be within a range of $38.0 million to $41.0 million based on estimated shipments of 1,300,000 units of U.S. manufactured microinverters

•GAAP operating expenses to be within a range of $135.0 million to $139.0 million

•Non-GAAP operating expenses to be within a range of $81.0 million to $85.0 million, excluding $54.0 million estimated for stock-based compensation expense, acquisition related expenses and amortization

For 2024, GAAP and non-GAAP annualized effective tax rate with IRA benefit, excluding discrete items, is expected to be within a range of 17.0% to 19.0%.

Follow Enphase Online

•Read the Enphase blog.

•Follow @Enphase on X (formerly Twitter).

•Visit us on Facebook and LinkedIn.

•Watch Enphase videos on YouTube.

Use of non-GAAP Financial Measures

Enphase Energy has presented certain non-GAAP financial measures in this press release. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either exclude or include amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles in the United States (GAAP). Reconciliation of each non-GAAP financial measure to the most directly comparable GAAP financial measure can be found in the accompanying tables to this press release. Non-GAAP financial measures presented by Enphase Energy include non-GAAP gross profit, gross margin, operating expenses, income from operations, net income, net income per share (basic and diluted), net IRA benefit, and free cash flow.

These non-GAAP financial measures do not reflect a comprehensive system of accounting, differ from GAAP measures with the same captions and may differ from non-GAAP financial measures with the same or similar captions that are used by other companies. In addition, these non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Enphase Energy’s results of operations as determined in accordance

with GAAP. As such, these non-GAAP measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Enphase Energy uses these non-GAAP financial measures to analyze its operating performance and future prospects, develop internal budgets and financial goals, and to facilitate period-to-period comparisons. Enphase Energy believes that these non-GAAP financial measures reflect an additional way of viewing aspects of its operations that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

As presented in the “Reconciliation of Non-GAAP Financial Measures” tables below, each of the non-GAAP financial measures excludes one or more of the following items for purposes of calculating non-GAAP financial measures to facilitate an evaluation of Enphase Energy’s current operating performance and a comparison to its past operating performance:

Stock-based compensation expense. Enphase Energy excludes stock-based compensation expense from its non-GAAP measures primarily because they are non-cash in nature. Moreover, the impact of this expense is significantly affected by Enphase Energy’s stock price at the time of an award over which management has limited to no control.

Acquisition related expenses and amortization. This item represents expenses incurred related to Enphase Energy’s business acquisitions, which are non-recurring in nature, and amortization of acquired intangible assets, which is a non-cash expense. Acquisition related expenses and amortization of acquired intangible assets are not reflective of Enphase Energy’s ongoing financial performance.

Restructuring and asset impairment charges. Enphase Energy excludes restructuring and asset impairment charges due to the nature of the expenses being unusual and arising outside the ordinary course of continuing operations. These costs primarily consist of fees paid for cash-based severance costs and asset write-downs of property and equipment and acquired intangible assets, and other contract termination costs resulting from restructuring initiatives.

Non-cash interest expense. This item consists primarily of amortization of debt issuance costs and accretion of debt discount because these expenses do not represent a cash outflow for Enphase Energy except in the period the financing was secured and such amortization expense is not reflective of Enphase Energy’s ongoing financial performance.

Non-GAAP income tax adjustment. This item represents the amount adjusted to Enphase Energy’s GAAP tax provision or benefit to exclude the income tax effects of GAAP adjustments such as stock-based compensation, amortization of purchased intangibles, and other non-recurring items that are not reflective of Enphase Energy ongoing financial performance.

Non-GAAP net income per share, diluted. Enphase Energy excludes the dilutive effect of in-the-money portion of convertible senior notes as they are covered by convertible note hedge transactions that reduce potential dilution to our common stock upon conversion of the Notes due 2025, Notes due 2026, and Notes due 2028, and includes the dilutive effect of employee’s stock-based awards and the dilutive effect of warrants. Enphase Energy believes these adjustments provide useful supplemental information to the ongoing financial performance.

Net IRA benefit. This item represents the advanced manufacturing production tax credit (AMPTC) from the IRA for manufacturing microinverters in the United States, partially offset by the incremental manufacturing cost incurred in the United States relative to manufacturing in Mexico, India, and China. The AMPTC is accounted for by Enphase Energy as an income-based government grants that reduces cost of revenues in the condensed consolidated statements of operations.

Free cash flow. This item represents net cash flows from operating activities less purchases of property and equipment.

Conference Call Information

Enphase Energy will host a conference call for analysts and investors to discuss its third quarter 2024 results and fourth quarter 2024 business outlook today at 4:30 p.m. Eastern Time (1:30 p.m. Pacific Time). The call is open to the public by dialing (833) 634-5018. A live webcast of the conference call will also be accessible from the “Investor Relations” section of Enphase Energy’s website at https://investor.enphase.com. Following the webcast, an archived version will be available on the website for approximately one year. In addition, an audio replay of the conference call will be available by calling (877) 344-7529; replay access code 2677879, beginning approximately one hour after the call.

Forward-Looking Statements

This press release contains forward-looking statements, including statements related to Enphase Energy’s expectations as to its fourth quarter of 2024 financial outlook, including revenue, shipments of IQ Batteries by megawatt hours, gross margin with net IRA benefit and excluding net IRA benefit, estimated shipments of U.S. manufactured microinverters, operating expenses, and annualized effective tax rate with IRA benefit; its expectations regarding the expected net IRA benefit; its expectations on the timing and introduction of new products and updates to existing products; its expectations for global capacity of microinverters; its ability to support grid services in new locations; the ability of its AI-based software to help consumers maximize savings as energy markets become increasingly complex; and the capabilities, advantages, features, and performance of its technology and products. These forward-looking statements are based on Enphase Energy’s current expectations and inherently involve significant risks and uncertainties. Enphase Energy’s actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of certain risks and uncertainties including those risks described in more detail in its most recently filed Annual Report on Form 10-K, Quarterly Report on Form 10-Q, and other documents on file with the SEC from time to time and available on the SEC’s website at www.sec.gov. Enphase Energy undertakes no duty or obligation to update any forward-looking statements contained in this release as a result of new information, future events or changes in its expectations, except as required by law.

A copy of this press release can be found on the investor relations page of Enphase Energy’s website at https://investor.enphase.com.

About Enphase Energy, Inc.

Enphase Energy, a global energy technology company based in Fremont, CA, is the world's leading supplier of microinverter-based solar and battery systems that enable people to harness the sun to make, use, save, and sell their own power—and control it all with a smart mobile app. The company revolutionized the solar industry with its microinverter-based technology and builds all-in-one solar, battery, and software solutions. Enphase has shipped approximately 78.0 million microinverters, and over 4.5 million Enphase-based systems have been deployed in more than 160 countries. For more information, visit https://enphase.com.

© 2024 Enphase Energy, Inc. All rights reserved. Enphase Energy, Enphase, the “e” logo, IQ, IQ8, and certain other marks listed at https://enphase.com/trademark-usage-guidelines are trademarks or service marks of Enphase Energy, Inc. Other names are for informational purposes and may be trademarks of their respective owners.

Contact:

Zach Freedman

Enphase Energy, Inc.

Investor Relations

ir@enphaseenergy.com

ENPHASE ENERGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | Nine Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Net revenues | $ | 380,873 | | | $ | 303,458 | | | $ | 551,082 | | | $ | 947,670 | | | $ | 1,988,216 | |

| Cost of revenues | 202,702 | | | 166,292 | | | 289,069 | | | 516,825 | | | 1,076,490 | |

| Gross profit | 178,171 | | | 137,166 | | | 262,013 | | | 430,845 | | | 911,726 | |

| Operating expenses: | | | | | | | | | |

| Research and development | 47,843 | | | 48,871 | | | 54,873 | | | 150,925 | | | 172,045 | |

| Sales and marketing | 49,671 | | | 51,775 | | | 55,357 | | | 154,753 | | | 178,383 | |

| General and administrative | 30,192 | | | 33,550 | | | 33,794 | | | 98,924 | | | 104,456 | |

| Restructuring and asset impairment charges | 677 | | | 1,171 | | | — | | | 3,755 | | | 870 | |

| Total operating expenses | 128,383 | | | 135,367 | | | 144,024 | | | 408,357 | | | 455,754 | |

| Income from operations | 49,788 | | | 1,799 | | | 117,989 | | | 22,488 | | | 455,972 | |

| Other income, net | | | | | | | | | |

| Interest income | 19,977 | | | 19,203 | | | 19,669 | | | 58,889 | | | 49,235 | |

| Interest expense | (2,237) | | | (2,220) | | | (2,196) | | | (6,653) | | | (6,571) | |

| Other income (expense), net | (16,785) | | | (7,566) | | | 1,883 | | | (24,264) | | | 2,276 | |

| | | | | | | | | |

| | | | | | | | | |

| Total other income, net | 955 | | | 9,417 | | | 19,356 | | | 27,972 | | | 44,940 | |

| Income before income taxes | 50,743 | | | 11,216 | | | 137,345 | | | 50,460 | | | 500,912 | |

| Income tax provision | (4,981) | | | (383) | | | (23,392) | | | (9,962) | | | (82,895) | |

| Net income | $ | 45,762 | | | $ | 10,833 | | | $ | 113,953 | | | $ | 40,498 | | | $ | 418,017 | |

| Net income per share: | | | | | | | | | |

| Basic | $ | 0.34 | | | $ | 0.08 | | | $ | 0.84 | | | $ | 0.30 | | | $ | 3.06 | |

| Diluted | $ | 0.33 | | | $ | 0.08 | | | $ | 0.80 | | | $ | 0.30 | | | $ | 2.92 | |

| Shares used in per share calculation: | | | | | | | | | |

| Basic | 135,329 | | | 135,646 | | | 136,165 | | | 135,621 | | | 136,491 | |

| Diluted | 139,914 | | | 136,123 | | | 143,863 | | | 136,236 | | | 145,081 | |

ENPHASE ENERGY, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands)

(Unaudited) | | | | | | | | | | | |

| |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 256,325 | | | $ | 288,748 | |

| | | |

| Marketable securities | 1,510,299 | | | 1,406,286 | |

| Accounts receivable, net | 232,225 | | | 445,959 | |

| Inventory | 158,837 | | | 213,595 | |

| Prepaid expenses and other assets | 203,195 | | | 88,930 | |

| Total current assets | 2,360,881 | | | 2,443,518 | |

| Property and equipment, net | 148,444 | | | 168,244 | |

| Operating lease, right of use asset, net | 28,120 | | | 19,887 | |

| Intangible assets, net | 51,152 | | | 68,536 | |

| Goodwill | 214,292 | | | 214,562 | |

| Other assets | 185,448 | | | 215,895 | |

| Deferred tax assets, net | 275,854 | | | 252,370 | |

| | | |

| Total assets | $ | 3,264,191 | | | $ | 3,383,012 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 112,417 | | | $ | 116,164 | |

| Accrued liabilities | 189,819 | | | 261,919 | |

| | | |

| Deferred revenues, current | 129,556 | | | 118,300 | |

| Warranty obligations, current | 35,755 | | | 36,066 | |

| | | |

| Debt, current | 99,931 | | | — | |

| Total current liabilities | 567,478 | | | 532,449 | |

| Long-term liabilities: | | | |

| | | |

| Deferred revenues, non-current | 354,210 | | | 369,172 | |

| Warranty obligations, non-current | 148,477 | | | 153,021 | |

| Other liabilities | 62,392 | | | 51,008 | |

| Debt, non-current | 1,200,261 | | | 1,293,738 | |

| | | |

| Total liabilities | 2,332,818 | | | 2,399,388 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Total stockholders’ equity | 931,373 | | | 983,624 | |

| Total liabilities and stockholders’ equity | $ | 3,264,191 | | | $ | 3,383,012 | |

ENPHASE ENERGY, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Cash flows from operating activities: | | | | | | | | | |

| Net income | $ | 45,762 | | | $ | 10,833 | | | $ | 113,953 | | | $ | 40,498 | | | $ | 418,017 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | | |

| Depreciation and amortization | 20,103 | | | 20,484 | | | 19,448 | | | 60,724 | | | 53,867 | |

| Net amortization (accretion) of premium (discount) on marketable securities | (2,904) | | | (1,030) | | | 5,094 | | | (1,109) | | | (12,611) | |

| Provision for doubtful accounts | 2,704 | | | 1,897 | | | 653 | | | 4,471 | | | 1,282 | |

| Asset impairment | 17,568 | | | 6,241 | | | 903 | | | 24,141 | | | 903 | |

| | | | | | | | | |

| | | | | | | | | |

| Non-cash interest expense | 2,173 | | | 2,157 | | | 2,114 | | | 6,462 | | | 6,254 | |

| | | | | | | | | |

| Net loss (gain) from change in fair value of debt securities | 741 | | | 1,931 | | | (1,910) | | | 1,730 | | | (5,408) | |

| | | | | | | | | |

| Stock-based compensation | 45,940 | | | 52,757 | | | 43,814 | | | 159,530 | | | 157,635 | |

| | | | | | | | | |

| Deferred income taxes | (5,276) | | | (14,076) | | | (11,499) | | | (27,644) | | | (38,295) | |

| Changes in operating assets and liabilities: | | | | | | | | | |

| Accounts receivable | 49,414 | | | 82,183 | | | (34,752) | | | 208,956 | | | (118,249) | |

| Inventory | 17,231 | | | 31,825 | | | (8,003) | | | 54,758 | | | (24,406) | |

| Prepaid expenses and other assets | (64,149) | | | (42,810) | | | (15,383) | | | (117,856) | | | (57,376) | |

| | | | | | | | | |

| Accounts payable, accrued and other liabilities | 32,088 | | | (23,944) | | | 9,903 | | | (58,140) | | | 117,128 | |

| Warranty obligations | 7,053 | | | 15 | | | 8,151 | | | (4,855) | | | 57,420 | |

| Deferred revenues | 1,690 | | | (1,401) | | | 13,369 | | | (5,265) | | | 105,169 | |

| Net cash provided by operating activities | 170,138 | | | 127,062 | | | 145,855 | | | 346,401 | | | 661,330 | |

| Cash flows from investing activities: | | | | | | | | | |

| Purchases of property and equipment | (8,533) | | | (9,636) | | | (23,848) | | | (25,540) | | | (90,326) | |

| Purchases of marketable securities | (319,190) | | | (300,053) | | | (470,766) | | | (1,091,511) | | | (1,743,674) | |

| Maturities and sale of marketable securities | 215,241 | | | 282,063 | | | 494,804 | | | 994,677 | | | 1,406,608 | |

| Investments in private companies | — | | | — | | | (15,000) | | | — | | | (15,000) | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net cash used in investing activities | (112,482) | | | (27,626) | | | (14,810) | | | (122,374) | | | (442,392) | |

| Cash flows from financing activities: | | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Partial settlement of convertible notes | (5) | | | — | | | — | | | (7) | | | — | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Repurchase of common stock | (49,794) | | | (99,908) | | | (110,000) | | | (191,698) | | | (310,000) | |

| Proceeds from issuance of common stock under employee equity plans | 14 | | | 6,769 | | | 719 | | | 7,969 | | | 1,315 | |

| Payment of withholding taxes related to net share settlement of equity awards | (6,286) | | | (7,473) | | | (8,465) | | | (73,801) | | | (93,100) | |

| | | | | | | | | |

| Net cash used in financing activities | (56,071) | | | (100,612) | | | (117,746) | | | (257,537) | | | (401,785) | |

| Effect of exchange rate changes on cash and cash equivalents | 2,638 | | | (374) | | | (1,900) | | | 1,087 | | | (322) | |

| Net increase (decrease) in cash and cash equivalents | 4,223 | | | (1,550) | | | 11,399 | | | (32,423) | | | (183,169) | |

| Cash and cash equivalents—Beginning of period | 252,102 | | | 253,652 | | | 278,676 | | | 288,748 | | | 473,244 | |

| Cash and cash equivalents —End of period | $ | 256,325 | | | $ | 252,102 | | | $ | 290,075 | | | $ | 256,325 | | | $ | 290,075 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

ENPHASE ENERGY, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In thousands, except per share data and percentages)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Gross profit (GAAP) | $ | 178,171 | | | $ | 137,166 | | | $ | 262,013 | | | $ | 430,845 | | | $ | 911,726 | |

| Stock-based compensation | 2,948 | | | 3,730 | | | 2,708 | | | 10,860 | | | 9,775 | |

| | | | | | | | | |

| Acquisition related amortization | 1,904 | | | 1,890 | | | 1,899 | | | 5,685 | | | 5,686 | |

| Gross profit (Non-GAAP) | $ | 183,023 | | | $ | 142,786 | | | $ | 266,620 | | | $ | 447,390 | | | $ | 927,187 | |

| | | | | | | | | |

| Gross margin (GAAP) | 46.8 | % | | 45.2 | % | | 47.5 | % | | 45.5 | % | | 45.9 | % |

| Stock-based compensation | 0.8 | | | 1.3 | | | 0.6 | | | 1.1 | | | 0.5 | |

| | | | | | | | | |

| Acquisition related amortization | 0.5 | | | 0.6 | | | 0.3 | | | 0.6 | | | 0.2 | |

| Gross margin (Non-GAAP) | 48.1 | % | | 47.1 | % | | 48.4 | % | | 47.2 | % | | 46.6 | % |

| | | | | | | | | |

| Operating expenses (GAAP) | $ | 128,383 | | | $ | 135,367 | | | $ | 144,024 | | | $ | 408,357 | | | $ | 455,754 | |

Stock-based compensation (1) | (42,992) | | | (49,027) | | | (41,106) | | | (148,670) | | | (147,860) | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition related expenses and amortization | (3,102) | | | (3,463) | | | (3,891) | | | (10,027) | | | (11,429) | |

| Restructuring and asset impairment charges | (677) | | | (1,171) | | | — | | | (3,755) | | | (901) | |

| | | | | | | | | |

| Operating expenses (Non-GAAP) | $ | 81,612 | | | $ | 81,706 | | | $ | 99,027 | | | $ | 245,905 | | | $ | 295,564 | |

| | | | | | | | | |

(1) Includes stock-based compensation as follows: | | | | | | | | | |

Research and development | $ | 19,790 | | | $ | 20,210 | | | $ | 19,285 | | | $ | 64,550 | | | $ | 64,528 | |

Sales and marketing | 14,237 | | | 16,784 | | | 13,297 | | | 49,199 | | | 49,231 | |

General and administrative | 8,965 | | | 12,033 | | | 8,524 | | | 34,921 | | | 34,101 | |

| | | | | | | | | |

Total | $ | 42,992 | | | $ | 49,027 | | | $ | 41,106 | | | $ | 148,670 | | | $ | 147,860 | |

| | | | | | | | | |

| Income from operations (GAAP) | $ | 49,788 | | | $ | 1,799 | | | $ | 117,989 | | | $ | 22,488 | | | $ | 455,972 | |

| Stock-based compensation | 45,940 | | | 52,757 | | | 43,814 | | | 159,530 | | | 157,635 | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition related expenses and amortization | 5,006 | | | 5,353 | | | 5,790 | | | 15,712 | | | 17,115 | |

| Restructuring and asset impairment charges | 677 | | | 1,171 | | | — | | | 3,755 | | | 901 | |

| | | | | | | | | |

| Income from operations (Non-GAAP) | $ | 101,411 | | | $ | 61,080 | | | $ | 167,593 | | | $ | 201,485 | | | $ | 631,623 | |

| | | | | | | | | |

| Net income (GAAP) | $ | 45,762 | | | $ | 10,833 | | | $ | 113,953 | | | $ | 40,498 | | | $ | 418,017 | |

| Stock-based compensation | 45,940 | | | 52,757 | | | 43,814 | | | 159,530 | | | 157,635 | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition related expenses and amortization | 5,006 | | | 5,353 | | | 5,790 | | | 15,712 | | | 17,115 | |

| Restructuring and asset impairment charges | 677 | | | 1,171 | | | — | | | 3,755 | | | 901 | |

| Non-cash interest expense | 2,173 | | | 2,157 | | | 2,114 | | | 6,462 | | | 6,254 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-GAAP income tax adjustment | (11,156) | | | (13,447) | | | (23,822) | | | (30,775) | | | (61,413) | |

| | | | | | | | | |

| Net income (Non-GAAP) | $ | 88,402 | | | $ | 58,824 | | | $ | 141,849 | | | $ | 195,182 | | | $ | 538,509 | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 | | September 30,

2024 | | September 30,

2023 |

| Net income per share, basic (GAAP) | $ | 0.34 | | | $ | 0.08 | | | $ | 0.84 | | | $ | 0.30 | | | $ | 3.06 | |

| Stock-based compensation | 0.34 | | | 0.39 | | | 0.32 | | | 1.17 | | | 1.15 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition related expenses and amortization | 0.04 | | | 0.04 | | | 0.04 | | | 0.12 | | | 0.13 | |

| Restructuring and asset impairment charges | 0.01 | | | 0.01 | | | — | | | 0.03 | | | 0.01 | |

| Non-cash interest expense | 0.02 | | | 0.02 | | | 0.02 | | | 0.05 | | | 0.04 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-GAAP income tax adjustment | (0.10) | | | (0.11) | | | (0.18) | | | (0.23) | | | (0.44) | |

| Net income per share, basic (Non-GAAP) | $ | 0.65 | | | $ | 0.43 | | | $ | 1.04 | | | $ | 1.44 | | | $ | 3.95 | |

| | | | | | | | | |

| | | | | | | | | |

| Shares used in basic per share calculation GAAP and Non-GAAP | 135,329 | | | 135,646 | | | 136,165 | | | 135,621 | | | 136,491 | |

| | | | | | | | | |

| Net income per share, diluted (GAAP) | $ | 0.33 | | | $ | 0.08 | | | $ | 0.80 | | | $ | 0.30 | | | $ | 2.92 | |

| Stock-based compensation | 0.33 | | | 0.38 | | | 0.32 | | | 1.17 | | | 1.17 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Acquisition related expenses and amortization | 0.04 | | | 0.04 | | | 0.04 | | | 0.12 | | | 0.12 | |

| Restructuring and asset impairment charges | 0.01 | | | 0.01 | | | — | | | 0.03 | | | 0.01 | |

| Non-cash interest expense | 0.02 | | | 0.02 | | | 0.02 | | | 0.05 | | | 0.04 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Non-GAAP income tax adjustment | (0.08) | | | (0.10) | | | (0.16) | | | (0.24) | | | (0.40) | |

Net income per share, diluted (Non-GAAP) (2) | $ | 0.65 | | | $ | 0.43 | | | $ | 1.02 | | | $ | 1.43 | | | $ | 3.86 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Shares used in diluted per share calculation GAAP | 139,914 | | | 136,123 | | | 143,863 | | | 136,236 | | | 145,081 | |

Shares used in diluted per share calculation Non-GAAP | 135,839 | | | 136,123 | | | 138,535 | | | 136,236 | | | 139,753 | |

| | | | | | | | | |

| Income-based government grants (GAAP) | $ | 46,552 | | | $ | 24,329 | | | $ | 18,532 | | | $ | 89,498 | | | $ | 20,583 | |

| Incremental cost for manufacturing in U.S. | (11,396) | | | (5,950) | | | (4,085) | | | (22,228) | | | (4,491) | |

| Net IRA benefit (Non-GAAP) | $ | 35,156 | | | $ | 18,379 | | | $ | 14,447 | | | $ | 67,270 | | | $ | 16,092 | |

| | | | | | | | | |

| Net cash provided by operating activities (GAAP) | $ | 170,138 | | | $ | 127,062 | | | $ | 145,855 | | | $ | 346,401 | | | $ | 661,330 | |

| Purchases of property and equipment | (8,533) | | | (9,636) | | | (23,848) | | | (25,540) | | | (90,326) | |

| | | | | | | | | |

| Free cash flow (Non-GAAP) | $ | 161,605 | | | $ | 117,426 | | | $ | 122,007 | | | $ | 320,861 | | | $ | 571,004 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

(2) Calculation of non-GAAP diluted net income per share for the three and nine months ended September 30, 2023 excludes convertible Notes due 2023 interest expense, net of tax of less than $0.1 million from non-GAAP net income.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

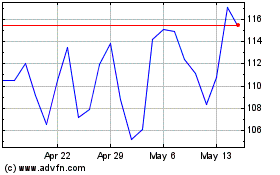

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

Enphase Energy (NASDAQ:ENPH)

Historical Stock Chart

From Nov 2023 to Nov 2024