Buiding B15 and 25Coyol Free ZoneAlajuelaCosta RicaNASDAQ5062434 24000001688757false00016887572024-01-312024-01-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | |

| January 31, 2024 |

| Date of Report (date of earliest event reported) |

Establishment Labs Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| British Virgin Islands | 001-38593 | 98-1436377 |

(State or other jurisdiction of

incorporation or organization) | (Commission File No.)

| (I.R.S. Employer

Identification Number) |

Buiding B15 and 25 Coyol Free Zone Alajuela Costa Rica |

| (Address of principal executive offices) (Zip Code) |

| +506 2434 2400 | |

| (Registrant’s telephone number, including area code) | |

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of each exchange on which registered |

| Common Shares, No Par Value | ESTA | The NASDAQ Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2) of this chapter.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On January 31, 2024, Establishment Labs Holdings Inc. (the “Company”) filed with the U.S. Securities and Exchange Commission (the “SEC”) a prospectus supplement (the “Prospectus Supplement”) to its prospectus dated April 24, 2023, which was included in the registration statement on Form S-3 (Registration No. 333-271418) filed with the SEC on April 24, 2023. The Prospectus Supplement relates to the offering and sale from time to time of up to 2,000,000 of the Company’s common shares, no par value per share (the “Common Shares”) by the selling shareholders identified in the Prospectus Supplement consisting of (a) 1,101,565 Common Shares and (b) 898,435 Common Shares issuable upon the exercise of pre-funded warrants held by certain of the selling shareholders in connection with the Company’s previously disclosed securities purchase agreement dated as of January 9, 2024.

An opinion of the Company’s counsel, Conyers Dill & Pearman, regarding the legality of the Common Shares covered by the Prospectus Supplement described above is filed as Exhibit 5.1 hereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 5.1 | |

| 23.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | ESTABLISHMENT LABS HOLDINGS INC. |

| | | | |

Dated: | January 31, 2024 | | By: | /s/ Rajbir S. Denhoy |

| | | Name: | Rajbir S. Denhoy |

| | | Title: | Chief Financial Officer |

| | | | |

January 31, 2024

Matter No.:956078

+1 284-852-1129

nicholas.kuria@conyers.com

Establishment Labs Holdings Inc.

Commerce House

Wickhams Cay 1,

Road Town, Tortola

British Virgin Islands

Ladies and Gentlemen:

We have acted as special counsel in the British Virgin Islands to Establishment Labs Holdings Inc., a company organized under the laws of the British Virgin Islands (the “Company”), in connection with the filing by the Company with the Securities and Exchange Commission (the “Commission”) of a prospectus supplement dated January 30, 2024 (the “Prospectus Supplement”) to the registration statement on Form S-3 (File No. 333-271418) (the “Registration Statement”) and the base prospectus that forms a part thereof (the “Base Prospectus”) filed with the Commission on April 24, 2023, under the Securities Act of 1933, as amended (the “Securities Act. The Prospectus Supplement relates to the offering and sale from time to time of up to 2,000,000 of the Company’s common shares, no par value per share (the “Common Shares”), by the selling shareholders identified in the Prospectus Supplement and consists of (i) 1,101,565 Common Shares (the “Shares”), and (ii) 898,435 Common Shares (the “Warrant Shares”) issuable upon the exercise of pre-funded warrants (the “Pre-Funded Warrants”) held by certain of the selling shareholders.

The Shares and the Pre-Funded Warrants were issued to the selling shareholders pursuant to the Securities Purchase Agreement (the “Purchase Agreement”), dated as of January 9, 2024, by and among the Company and the investors listed on Exhibit A thereto (the “Investors”), and the registration of the offer and sale of the Shares and the Warrant Shares by the selling shareholders identified in the Prospectus Supplement is being made pursuant to the Registration Rights Agreement (the “Registration Rights Agreement”), dated as of January 9, 2024, by and among the Company and the Investors.

We have examined copies of the Purchase Agreement, the Registration Rights Agreement, the Registration Statement, the Base Prospectus and the Prospectus Supplement. We have also examined

instruments, documents and records which we deemed relevant and necessary for the basis of our opinion hereinafter expressed.

In such examination, we have assumed (i) the authenticity of original documents and the genuineness of all signatures, (ii) the conformity to the originals of all documents submitted to us as copies, and (iii) the truth, accuracy, and completeness of the information, representations and warranties contained in the records, documents, instruments and certificates we have reviewed.

We have made no investigation of and express no opinion in relation to the laws of any jurisdiction other than the British Virgin Islands. This opinion is to be governed by and construed in accordance with the laws of the British Virgin Islands and is limited to and is given on the basis of the current law and practice in the British Virgin Islands. This opinion is issued solely for the purposes of filing the Prospectus Supplement and registering the offer and sale of the Shares and the Warrant Shares as described therein and is not to be relied upon in respect of any other matter.

Based on the foregoing, we are of the opinion that (i) the Shares have been duly authorized and are validly issued, fully paid and non-assessable and (ii) that the Warrant Shares, upon issuance and delivery against payment therefor in accordance with the terms of the Pre-Funded Warrants, will be validly issued, fully paid and non-assessable.

We express no opinion as to (i) the effect of any bankruptcy, insolvency, reorganization, arrangement, fraudulent conveyance, moratorium or other similar laws relating to or affecting the rights of creditors generally, (ii) rights to indemnification and contribution which may be limited by applicable law or equitable principles, or (iii) the effect of general principles of equity, including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing, the effect of judicial discretion and the possible unavailability of specific performance, injunctive relief or other equitable relief, and the limitations on rights of acceleration, whether considered in a proceeding in equity or at law.

We hereby consent to the filing of this opinion as an exhibit to the Company’s Current Report on Form 8-K filed on or about January 30, 2024, for incorporation by reference into the Registration Statement, and to the use of our name wherever it appears in the Registration Statement, the Prospectus, Prospectus Supplement, and in any amendment or supplement thereto. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

| | |

| Your faithfully, |

| /s/ Conyers Dill & Pearman |

Conyers Dill & Pearman |

| |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

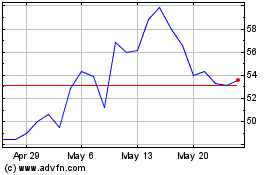

Establishment Labs (NASDAQ:ESTA)

Historical Stock Chart

From Apr 2024 to May 2024

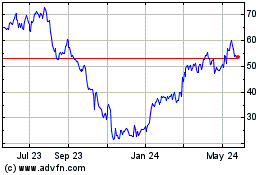

Establishment Labs (NASDAQ:ESTA)

Historical Stock Chart

From May 2023 to May 2024