Achieves 6th Consecutive Quarter of Triple

Digit Year-Over-Year Network Throughput Growth

Raises Midpoint of Total Revenue Guidance by

$10 Million

- Revenue reached a record $66.6 million in the second quarter,

representing an increase of 32% year-over-year.

- Charging network revenue totaled $36.4 million in the second

quarter, an increase of 146% year-over-year, representing the 7th

sequential quarter of double-digit charging revenue growth.

- Network throughput reached a record 66 gigawatt-hours (“GWh”)

in the second quarter, an increase of 164% year-over-year,

representing the 6th consecutive quarter of triple digit

year-over-year growth.

- Added more than 220 new operational stalls during the second

quarter, including EVgo eXtend™ stalls.

- Ended the second quarter with approximately 3,440 stalls in

operation, including EVgo eXtend™ stalls.

- Added over 131,000 new customer accounts in the second quarter,

reaching more than 1 million overall at quarter end.

EVgo Inc. (Nasdaq: EVGO) (“EVgo” or the “Company”) today

announced results for the second quarter ended June 30, 2024.

Management will host a conference call today at 11 am ET / 8 am PT

to discuss EVgo’s results and other business highlights.

Revenue reached $66.6 million in the second quarter of 2024,

compared to $50.6 million in the second quarter of 2023,

representing 32% year-over-year growth. Revenue growth was driven

by year-over-year increases in charging network revenues.

Network throughput increased to 66 GWh in the second quarter of

2024, compared to 25 GWh in the second quarter of 2023,

representing 164% year-over-year growth. The Company added over

131,000 new customer accounts during the second quarter of 2024, a

60% year-over-year increase in new accounts. The overall number of

customer accounts was more than 1 million at quarter end, an

increase of 59% year-over-year.

“EVgo delivered yet another quarter of great financial and

operating results, including the 7th sequential quarter of

double-digit charging revenue growth,” said Badar Khan, EVgo’s CEO.

“We are seeing continual record demand in the industry, which we

are well situated to capture given our position as an owner

operator and as evidenced by the tremendous growth in throughput

and new customer accounts. We look forward to continuing to execute

on our strategic priorities and building the critically important,

fast charging, OEM-agnostic infrastructure necessary to deliver an

excellent customer experience for EV drivers across the nation. We

are confident this momentum will result in strong returns for our

shareholders.”

Business Highlights

- Subaru Charging Credit: Subaru extended their charging

credit program with EVgo, giving new Subaru Solterra drivers a $500

EVgo charging credit.

- Stall Development: The Company ended the quarter with

approximately 3,440 stalls in operation, including EVgo eXtend™

stalls. EVgo added over 220 new DC fast charging stalls during the

quarter, including EVgo eXtend™ stalls.

- EVgo eXtend™: EVgo ended the quarter with 190

operational EVgo eXtend™ stalls.

- Network Utilization: Utilization on the EVgo network in

the second quarter of 2024 was 20%, up from approximately 11% in

the second quarter of 2023.

- Average Daily Network Throughput: Average daily

throughput per stall for the EVgo network was 227 kilowatt hours

per day in the second quarter of 2024, an increase of 103% compared

to 112 kilowatt hours per day in the second quarter of 2023.

- Commercial Charging: EVgo’s commercial charging business

continues to grow driven by rideshare, with throughput increasing

nearly threefold year-over-year.

- EVgo Autocharge+: Autocharge+ was over 18% of total

charging sessions initiated in the second quarter of 2024, and the

number of Autocharge+ charging sessions in the second quarter

increased 202% compared to the second quarter of 2023.

- PlugShare: PlugShare reached 5.3 million registered

users and achieved 8.5 million check-ins since inception.

Financial & Operational Highlights

The below represent summary financial and operational figures

for the second quarter of 2024.

- Revenue of $66.6 million

- Network Throughput1 of 66 gigawatt-hours

- Customer Account Additions of over 131,000 accounts

- Gross Profit of $6.4 million

- Net Loss of $29.6 million

- Adjusted Gross Profit2 of $17.7 million

- Adjusted EBITDA2 of ($8.0) million

- Net Cash Provided By Operating Activities of $7.6

million

- Capital Expenditures of $24.2 million

- Capital Expenditures, Net of Capital Offsets2 of $13.8

million

____________________

1

Network throughput for EVgo

network excludes EVgo eXtend™ sites.

2

Adjusted Gross Profit, Adjusted

EBITDA, and Capital Expenditures, Net of Capital Offsets are

non-GAAP measures and have not been prepared in accordance with

generally accepted accounting principles in the United States of

America (“GAAP”). For a definition of these non-GAAP measures and a

reconciliation to the most directly comparable GAAP measure, please

see “Definitions of Non-GAAP Financial Measures” and

“Reconciliations of Non-GAAP Financial Measures” included elsewhere

in this release.

(unaudited, dollars in thousands)

Q2'24

Q2'23

Better (Worse)

Q2'24 YTD

Q2'23 YTD

Better (Worse)

Network Throughput (GWh)

66

25

164

%

119

43

177

%

Revenue

$

66,619

$

50,552

32

%

$

121,777

$

75,852

61

%

Gross profit

$

6,398

$

5,529

16

%

$

13,239

$

5,570

138

%

Gross margin

9.6

%

10.9

%

(130) bps

10.9

%

7.3

%

360 bps

Net loss

$

(29,610

)

$

(21,539

)

(37

)%

$

(57,803

)

$

(70,620

)

18

%

Adjusted Gross Profit1

$

17,658

$

12,853

37

%

$

34,945

$

19,258

81

%

Adjusted Gross Margin1

26.5

%

25.4

%

110 bps

28.7

%

25.4

%

330 bps

Adjusted EBITDA1

$

(7,982

)

$

(10,553

)

24

%

$

(15,189

)

$

(30,620

)

50

%

____________________

1

Adjusted Gross Profit, Adjusted

Gross Margin, and Adjusted EBITDA are non-GAAP measures and have

not been prepared in accordance with GAAP. For a definition of

these non-GAAP measures and a reconciliation to the most directly

comparable GAAP measures, please see “Definitions of Non-GAAP

Financial Measures” and “Reconciliations of Non-GAAP Financial

Measures” included elsewhere in these materials.

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

Cash flows provided by (used in) operating

activities

$

7,556

$

(3,182

)

337

%

$

(6,526

)

$

(22,525

)

71

%

GAAP capital expenditures

$

24,196

$

34,811

(30

)%

$

45,267

$

100,057

(55

)%

Capital offsets:

OEM infrastructure payments

$

5,956

$

6,022

(1

)%

$

11,782

$

9,917

19

%

Proceeds from capital-build funding

4,459

2,040

119

%

6,139

4,256

44

%

Total capital offsets

10,415

8,062

29

%

17,921

14,173

26

%

Capital Expenditures, Net of Capital

Offsets1

$

13,781

$

26,749

(48

)%

$

27,346

$

85,884

(68

)%

____________________

1

Capital Expenditures, Net of

Capital Offsets are non-GAAP measures and have not been prepared in

accordance with GAAP. For a definition of these non-GAAP measures

and a reconciliation to the most directly comparable GAAP measures,

please see “Definitions of Non-GAAP Financial Measures” and

“Reconciliations of Non-GAAP Financial Measures” included elsewhere

in these materials.

6/30/2024

6/30/2023

Increase

Stalls in operation or under

construction:

EVgo Network

3,690

3,180

16%

EVgo eXtend™

480

—

*

Total stalls in operation or under

construction

4,170

3,180

31%

Stalls in operation:

EVgo Network

3,250

2,520

29%

EVgo eXtend™

190

—

*

Total stalls in operation

3,440

2,520

37%

____________________

*

Percentage not meaningful.

2024 Financial Guidance

EVgo is updating 2024 guidance as follows:

- Raising the midpoint of total revenue guidance by $10 million

with total revenue guidance of $240 - $270 million

- Adjusted EBITDA* of ($44) – ($34) million

____________________

*

A reconciliation of projected

Adjusted EBITDA (non-GAAP) to net income (loss), the most directly

comparable GAAP measure, is not provided because certain measures,

including share-based compensation expense, which is excluded from

Adjusted EBITDA, cannot be reasonably calculated or predicted at

this time without unreasonable efforts. For a definition of

Adjusted EBITDA, please see “Definitions of Non-GAAP Financial

Measures” included elsewhere in this release.

Conference Call Information

A live audio webcast and conference call for EVgo’s second

quarter earnings release will be held today at 11 am ET / 8 am PT.

The webcast will be available at investors.evgo.com, and the

dial-in information for those wishing to access via phone is:

Toll Free: (888) 340-5044 (for U.S. callers)

Toll/International: (646) 960-0363 (for callers outside the

U.S.) Conference ID: 6304708

This press release, along with other investor materials that

will be used or referred to during the webcast and conference call,

including a slide presentation and reconciliations of certain

non-GAAP measures to their nearest GAAP measures, will also be

available on that site.

About EVgo

EVgo (Nasdaq: EVGO) is a leader in electric vehicle charging

solutions, building and operating the infrastructure and tools

needed to expedite the mass adoption of electric vehicles for

individual drivers, rideshare and commercial fleets, and

businesses. EVgo is one of the nation’s largest public fast

charging networks, featuring over 1,000 fast charging locations

across more than 35 states, including stations built through EVgo

eXtend™, its white label service offering. EVgo is accelerating

transportation electrification through partnerships with

automakers, fleet and rideshare operators, retail hosts such as

grocery stores, shopping centers, and gas stations, policy leaders,

and other organizations. With a rapidly growing network and unique

service offerings for drivers and partners including EVgo Optima™,

EVgo Inside™, EVgo Rewards™, and Autocharge+, EVgo enables a

world-class charging experience where drivers live, work, travel

and play.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target,” “assume” or

other similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements are based on management’s current

expectations or beliefs and are subject to numerous assumptions,

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

You are cautioned, therefore, against relying on any of these

forward-looking statements. These forward-looking statements

include, but are not limited to, express or implied statements

regarding EVgo’s future financial and operating performance,

revenues, market size and opportunity, capital expenditures and

offsets; EVgo’s confidence that “this momentum will result in

strong returns for our shareholders”; EVgo’s progress on its

network buildout, customer experience, technological capabilities

and cost efficiencies; growth in the Company’s throughput; growth

in the Company’s commercial charging business; and the Company’s

collaboration with partners. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of EVgo’s management and are not

predictions of actual performance. There are a significant number

of factors that could cause actual results to differ materially

from the statements made in this press release, including changes

or developments in the broader general market; EVgo’s dependence on

the widespread adoption of EVs and growth of the EV and EV charging

markets; competition from existing and new competitors; EVgo’s

ability to expand into new service markets, grow its customer base

and manage its operations; the risks associated with cyclical

demand for EVgo’s services and vulnerability to industry downturns

and regional or national downturns; fluctuations in EVgo’s revenue

and operating results; unfavorable conditions or disruptions in the

capital and credit markets and EVgo’s ability to obtain additional

financing on commercially reasonable terms; EVgo’s ability to

generate cash, service indebtedness and incur additional

indebtedness; any current, pending or future legislation,

regulations or policies that could impact EVgo’s business, results

of operations and financial condition, including regulations

impacting the EV charging market and government programs designed

to drive broader adoption of EVs and any reduction, modification or

elimination of such programs; EVgo’s ability to adapt its assets

and infrastructure to changes in industry and regulatory standards

and market demands related to EV charging; impediments to EVgo’s

expansion plans, including permitting and utility-related delays;

EVgo’s ability to integrate any businesses it acquires; EVgo’s

ability to recruit and retain experienced personnel; risks related

to legal proceedings or claims, including liability claims; EVgo’s

dependence on third parties, including hardware and software

vendors and service providers, utilities and permit-granting

entities; supply chain disruptions, inflation and other increases

in expenses; safety and environmental requirements or regulations

that may subject EVgo to unanticipated liabilities or costs; EVgo’s

ability to enter into and maintain valuable partnerships with

commercial or public-entity property owners, landlords and/or

tenants (collectively “Site Hosts”), original equipment

manufacturers (“OEMs”), fleet operators and suppliers; EVgo’s

ability to maintain, protect and enhance EVgo’s intellectual

property; and general economic or political conditions, including

the conflicts in Ukraine, Israel and the broader Middle East

region, and elevated rates of inflation and associated changes in

monetary policy. Additional risks and uncertainties that could

affect the Company’s financial results are included under the

captions “Risk Factors” and “Management’s Discussion and Analysis

of Financial Condition and Results of Operations of EVgo” in EVgo’s

most recent Annual Report on Form 10-K, filed with the Securities

and Exchange Commission (the “SEC”), as well as its other SEC

filings, copies of which are available on EVgo’s website at

investors.evgo.com, and on the SEC’s website at www.sec.gov. All

forward-looking statements in this press release are based on

information available to EVgo as of the date hereof, and EVgo does

not assume any obligation to update the forward-looking statements

provided to reflect events that occur or circumstances that exist

after the date on which they were made, except as required by

applicable law.

Financial Statements

EVgo

Inc. and Subsidiaries

Condensed Consolidated Balance

Sheets

June 30,

December 31,

2024

2023

(in thousands)

(unaudited)

Assets

Current assets

Cash, cash equivalents and restricted

cash

$

162,736

$

209,146

Accounts receivable, net of allowance of

$553 and $1,116 as of June 30, 2024 and December 31, 2023,

respectively

34,771

34,882

Accounts receivable, capital-build

13,217

9,297

Prepaid expenses and other current

assets

14,747

14,081

Total current assets

225,471

267,406

Property, equipment and software, net

403,418

389,227

Operating lease right-of-use assets

79,444

67,724

Other assets

2,098

2,208

Intangible assets, net

43,845

48,997

Goodwill

31,052

31,052

Total assets

$

785,328

$

806,614

Liabilities, redeemable noncontrolling

interest and stockholders’ equity (deficit)

Current liabilities

Accounts payable

$

16,165

$

10,133

Accrued liabilities

38,742

40,549

Operating lease liabilities, current

6,484

6,018

Deferred revenue, current1

28,610

32,349

Other current liabilities

94

298

Total current liabilities

90,095

89,347

Operating lease liabilities,

noncurrent

73,239

61,987

Earnout liability, at fair value

345

654

Asset retirement obligations

19,829

18,232

Capital-build liability

41,479

35,787

Deferred revenue, noncurrent

64,290

55,091

Warrant liabilities, at fair value

2,746

5,141

Total liabilities

292,023

266,239

Commitments and contingencies

Redeemable noncontrolling interest

479,710

700,964

Stockholders' equity (deficit)

13,595

(160,589

)

Total liabilities, redeemable

noncontrolling interest and stockholders' equity (deficit)

$

785,328

$

806,614

____________________

1

In 2024, deferred revenue,

current, and customer deposits were combined into a single line

item. Previously reported amounts have been updated to conform to

the current period presentation.

EVgo

Inc. and Subsidiaries

Condensed Consolidated

Statements of Operations

(unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

(in thousands, except per share data)

2024

2023

Change %

2024

2023

Change %

Revenue

Charging, retail

$

22,336

$

9,085

146

%

$

40,662

$

15,700

159

%

Charging, commercial

7,094

2,418

193

%

12,933

4,133

213

%

Charging, OEM

3,638

986

269

%

6,370

1,538

314

%

Regulatory credit sales

1,749

1,613

8

%

3,783

2,828

34

%

Network, OEM

1,627

742

119

%

5,050

3,441

47

%

Total charging network

36,444

14,844

146

%

68,798

27,640

149

%

eXtend

27,667

33,281

(17

)%

46,818

43,573

7

%

Ancillary

2,508

2,427

3

%

6,161

4,639

33

%

Total revenue

66,619

50,552

32

%

121,777

75,852

61

%

Cost of sales

Charging network1

23,979

12,009

100

%

43,489

21,988

98

%

Other1

25,093

25,731

(2

)%

43,541

34,669

26

%

Depreciation, net of capital-build

amortization

11,149

7,283

53

%

21,508

13,625

58

%

Total cost of sales

60,221

45,023

34

%

108,538

70,282

54

%

Gross profit

6,398

5,529

16

%

13,239

5,570

138

%

Operating expenses

General and administrative

33,827

34,333

(1

)%

68,053

72,222

(6

)%

Depreciation, amortization and

accretion

4,958

4,783

4

%

9,943

9,567

4

%

Total operating expenses

38,785

39,116

(1

)%

77,996

81,789

(5

)%

Operating loss

(32,387

)

(33,587

)

4

%

(64,757

)

(76,219

)

15

%

Interest income

2,064

2,199

(6

)%

4,337

4,197

3

%

Other expense, net

(8

)

(1

)

(700

)%

(17

)

—

*

Change in fair value of earnout

liability

101

2,496

(96

)%

309

433

(29

)%

Change in fair value of warrant

liabilities

677

7,391

(91

)%

2,395

1,011

137

%

Total other income, net

2,834

12,085

(77

)%

7,024

5,641

25

%

Loss before income tax expense

(29,553

)

(21,502

)

(37

)%

(57,733

)

(70,578

)

18

%

Income tax expense

(57

)

(37

)

(54

)%

(70

)

(42

)

(67

)%

Net loss

(29,610

)

(21,539

)

(37

)%

(57,803

)

(70,620

)

18

%

Less: net loss attributable to redeemable

noncontrolling interest

(19,233

)

(14,513

)

(33

)%

(37,593

)

(50,518

)

26

%

Net loss attributable to Class A common

stockholders

$

(10,377

)

$

(7,026

)

(48

)%

$

(20,210

)

$

(20,102

)

(1

)%

Net loss per share to Class A common

stockholders, basic and diluted

$

(0.10

)

$

(0.08

)

$

(0.19

)

$

(0.25

)

Weighted average common stock outstanding,

basic and diluted

105,584

85,320

105,130

78,196

____________________

*

Not meaningful

1

In the fourth quarter of 2023,

the Company changed the presentation of cost of sales to

disaggregate such costs between “charging network” and “other.”

Previously reported amounts have been updated to conform to the

current presentation.

EVgo

Inc. and Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(unaudited)

Six Months Ended

June 30,

(in thousands)

2024

2023

Cash flows from operating

activities

Net loss

$

(57,803

)

$

(70,620

)

Adjustments to reconcile net loss to net

cash used in operating activities

Depreciation, amortization and

accretion

31,451

23,192

Net loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense

5,497

6,008

Share-based compensation

10,103

14,922

Change in fair value of earnout

liability

(309

)

(433

)

Change in fair value of warrant

liabilities

(2,395

)

(1,011

)

Other

5

(155

)

Changes in operating assets and

liabilities

Accounts receivable, net

112

(11,422

)

Prepaid expenses, other current assets and

other assets

1,324

3,779

Operating lease assets and liabilities,

net

(3

)

642

Accounts payable

6,130

(2,872

)

Accrued liabilities

(5,764

)

2,925

Deferred revenue1

5,461

12,458

Other current and noncurrent

liabilities

(335

)

62

Net cash used in operating activities

(6,526

)

(22,525

)

Cash flows from investing

activities

Capital expenditures

(45,267

)

(100,057

)

Proceeds from insurance for property

losses

152

159

Net cash used in investing activities

(45,115

)

(99,898

)

Cash flows from financing

activities

Proceeds from issuance of Class A common

stock under the ATM

—

5,828

Proceeds from issuance of Class A common

stock under the equity offering

—

128,023

Proceeds from capital-build funding

6,139

4,256

Payments of deferred debt issuance

costs

(908

)

—

Payments of deferred equity issuance

costs

—

(4,751

)

Net cash provided by financing

activities

5,231

133,356

Net (decrease) increase in cash, cash

equivalents and restricted cash

(46,410

)

10,933

Cash, cash equivalents and restricted

cash, beginning of period

209,146

246,493

Cash, cash equivalents and restricted

cash, end of period

$

162,736

$

257,426

____________________

1

In 2024, deferred revenue,

current, and customer deposits were combined into a single line

item. Previously reported amounts have been updated to conform to

the current period presentation.

Use of Non-GAAP Financial Measures

To supplement EVgo’s financial information, which is prepared

and presented in accordance with GAAP, EVgo uses certain non-GAAP

financial measures. The presentation of non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for, or superior to, the financial information prepared and

presented in accordance with GAAP. EVgo uses these non-GAAP

financial measures for financial and operational decision-making

and as a means to evaluate period-to-period comparisons. EVgo

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding the Company’s performance by

excluding certain items that may not be indicative of EVgo’s

recurring core business operating results.

EVgo believes that both management and investors benefit from

referring to these non-GAAP financial measures in assessing EVgo’s

performance. These non-GAAP financial measures also facilitate

management’s internal comparisons to the Company’s historical

performance. EVgo believes these non-GAAP financial measures are

useful to investors both because (1) they allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision-making and (2) they are used by

EVgo’s institutional investors and the analyst community to help

them analyze the health of EVgo’s business.

For more information on these non-GAAP financial measures,

including reconciliations to the most comparable GAAP measures,

please see the sections titled “Definitions of Non-GAAP Financial

Measures” and “Reconciliations of Non-GAAP Financial Measures.”

Definitions of Non-GAAP Financial Measures

This release includes some, but not all of the following

non-GAAP financial measures, in each case as defined below:

“Charging Network Margin,” “Adjusted Cost of Sales,” “Adjusted Cost

of Sales as a Percentage of Revenue,” “Adjusted Gross Profit

(Loss),” “Adjusted Gross Margin,” “Adjusted General and

Administrative Expenses,” “Adjusted General and Administrative

Expenses as a Percentage of Revenue,” “EBITDA,” “EBITDA Margin,”

“Adjusted EBITDA,” “Adjusted EBITDA Margin,” and “Capital

Expenditures, Net of Capital Offsets.” With respect to Capital

Expenditures, Net of Capital Offsets, pursuant to the terms of

certain OEM contracts, EVgo is paid well in advance of when revenue

can be recognized, and usually, the payment is tied to the number

of stalls that commence operations under the applicable contractual

arrangement while the related revenue is deferred at the time of

payment and is recognized as revenue over time as EVgo provides

charging and other services to the OEM and the OEM’s customers.

EVgo management therefore uses these measures internally to

establish forecasts, budgets, and operational goals to manage and

monitor its business, including the cash used for, and the return

on, its investment in its charging infrastructure. EVgo believes

that these measures are useful to investors in evaluating EVgo’s

performance and help to depict a meaningful representation of the

performance of the underlying business, enabling EVgo to evaluate

and plan more effectively for the future.

Charging Network Margin, Adjusted Cost of Sales, Adjusted Cost

of Sales as a Percentage of Revenue, Adjusted Gross Profit (Loss),

Adjusted Gross Margin, Adjusted General and Administrative

Expenses, Adjusted General and Administrative Expenses as a

Percentage of Revenue, EBITDA, EBITDA Margin, Adjusted EBITDA,

Adjusted EBITDA Margin and Capital Expenditures, Net of Capital

Offsets are not prepared in accordance with GAAP and may be

different from non-GAAP financial measures used by other companies.

These measures should not be considered as measures of financial

performance under GAAP and the items excluded from or included in

these metrics are significant components in understanding and

assessing EVgo’s financial performance. These metrics should not be

considered as alternatives to net income (loss) or any other

performance measures derived in accordance with GAAP.

EVgo defines Charging Network Margin as total charging network

revenue less charging network cost of sales divided by total

charging network revenue. EVgo defines Adjusted Cost of Sales as

cost of sales before (i) depreciation, net of capital-build

amortization, and (ii) share-based compensation. EVgo defines

Adjusted Cost of Sales as a Percentage of Revenue as Adjusted Cost

of Sales as a percentage of revenue. EVgo defines Adjusted Gross

Profit (Loss) as revenue less Adjusted Cost of Sales. EVgo defines

Adjusted Gross Margin as Adjusted Gross Profit (Loss) as a

percentage of revenue. EVgo defines Adjusted General and

Administrative Expenses as general and administrative expenses

before (i) share-based compensation, (ii) loss on disposal of

property and equipment, net of insurance recoveries, and impairment

expense, (iii) bad debt expense (recoveries), and (iv) certain

other items that management believes are not indicative of EVgo’s

ongoing performance. EVgo defines Adjusted General and

Administrative Expenses as a Percentage of Revenue as Adjusted

General and Administrative Expenses as a percentage of revenue.

EVgo defines EBITDA as net income (loss) before (i) depreciation,

net of capital-build amortization, (ii) amortization, (iii)

accretion, (iv) interest income, (v) interest expense, and (vi)

income tax expense (benefit). EVgo defines EBITDA Margin as EBITDA

as a percentage of revenue. EVgo defines Adjusted EBITDA as EBITDA

plus (i) share-based compensation, (ii) loss on disposal of

property and equipment, net of insurance recoveries, and impairment

expense, (iii) loss (gain) on investments, (iv) bad debt expense

(recoveries), (v) change in fair value of earnout liability, (vi)

change in fair value of warrant liabilities, and (vii) certain

other items that management believes are not indicative of EVgo’s

ongoing performance. EVgo defines Adjusted EBITDA Margin as

Adjusted EBITDA as a percentage of revenue. EVgo defines Capital

Expenditures, Net of Capital Offsets as capital expenditures

adjusted for the following capital offsets: (i) all payments under

OEM infrastructure agreements excluding any amounts directly

attributable to OEM customer charging credit programs and

pass-through of non-capital expense reimbursements, and (ii)

proceeds from capital-build funding. The tables below present

quantitative reconciliations of these measures to their most

directly comparable GAAP measures as described in this

paragraph.

Reconciliations of Non-GAAP Financial Measures

The following unaudited table presents a reconciliation of

EBITDA, EBITDA Margin, Adjusted EBITDA, and Adjusted EBITDA Margin

to the most directly comparable GAAP measure:

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

GAAP revenue

$

66,619

$

50,552

32

%

$

121,777

$

75,852

61

%

GAAP net loss

$

(29,610

)

$

(21,539

)

(37

)%

$

(57,803

)

$

(70,620

)

18

%

GAAP net loss margin

(44.4

%)

(42.6

%)

(180) bps

(47.5

)%

(93.1

)%

4,560 bps

Adjustments:

Depreciation, net of capital-build

amortization

11,288

7,407

52

%

21,764

13,875

57

%

Amortization

4,342

4,117

5

%

8,805

8,236

7

%

Accretion

477

542

(12

)%

882

1,081

(18

)%

Interest income

(2,064

)

(2,199

)

6

%

(4,337

)

(4,197

)

(3

)%

Interest expense

—

—

* %

—

—

* %

Income tax expense

57

37

54

%

70

42

67

%

EBITDA

$

(15,510

)

$

(11,635

)

(33

)%

$

(30,619

)

$

(51,583

)

41

%

EBITDA margin

(23.3

%)

(23.0

%)

(30) bps

(25.1

)%

(68.0

)%

4,290 bps

Adjustments:

Share-based compensation

$

5,402

$

8,495

(36

)%

10,103

14,922

(32

)%

Loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense

2,757

2,389

15

%

5,497

5,849

(6

)%

Loss on investments

—

5

(100

)%

5

4

25

%

Bad debt expense

81

56

45

%

311

153

103

%

Change in fair value of earnout

liability

(101

)

(2,496

)

96

%

(309

)

(433

)

29

%

Change in fair value of warrant

liabilities

(677

)

(7,391

)

91

%

(2,395

)

(1,011

)

(137

)%

Other1

66

24

175

%

2,218

1,479

50

%

Total adjustments

7,528

1,082

596

%

15,430

20,963

(26

)%

Adjusted EBITDA

$

(7,982

)

$

(10,553

)

24

%

$

(15,189

)

$

(30,620

)

50

%

Adjusted EBITDA Margin

(12.0

%)

(20.9

%)

890 bps

(12.5

%)

(40.4

)%

2,790 bps

____________________

*

Percentage greater than 999%, bps

greater than 9,999 or not meaningful.

1

For the six months ended June 30,

2024, comprised primarily of costs related to the organizational

realignment announced by the Company on January 17, 2024. For the

six months ended June 30, 2023, comprised primarily of costs

related to the previous reorganization of Company resources

announced by the Company on February 23, 2023 and the petition

filed by EVgo in the Delaware Court of Chancery in February 2023

seeking validation of EVgo's charter and share structure (the "205

Petition").

The following unaudited table presents a reconciliation of

Charging Network Margin to the most directly comparable GAAP

measures:

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

GAAP total charging network revenue

$

36,444

$

14,844

146

%

$

68,798

$

27,640

149

%

GAAP charging network cost of sales

23,979

12,009

100

%

43,489

21,988

98

%

Charging Network Margin

34.2

%

19.1

%

1,510 bps

36.8

%

20.4

%

1,640 bps

The following unaudited table presents a reconciliation of

Adjusted Cost of Sales, Adjusted Cost of Sales as a Percentage of

Revenue, Adjusted Gross Profit and Adjusted Gross Margin to the

most directly comparable GAAP measures:

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

GAAP revenue

$

66,619

$

50,552

32

%

$

121,777

$

75,852

61

%

GAAP cost of sales

60,221

45,023

34

%

108,538

70,282

54

%

GAAP gross profit

$

6,398

$

5,529

16

%

$

13,239

$

5,570

138

%

GAAP cost of sales as a percentage of

revenue

90.4

%

89.1

%

130 bps

89.1

%

92.7

%

(360) bps

GAAP gross margin

9.6

%

10.9

%

(130) bps

10.9

%

7.3

%

360 bps

Adjustments:

Depreciation, net of capital-build

amortization

$

11,149

$

7,283

53

%

$

21,508

$

13,625

58

%

Share-based compensation

111

41

171

%

198

63

214

%

Total adjustments

11,260

7,324

54

%

21,706

13,688

59

%

Adjusted Cost of Sales

$

48,961

$

37,699

30

%

$

86,832

$

56,594

53

%

Adjusted Cost of Sales as a Percentage of

Revenue

73.5

%

74.6

%

(110) bps

71.3

%

74.6

%

(330) bps

Adjusted Gross Profit

$

17,658

$

12,853

37

%

$

34,945

$

19,258

81

%

Adjusted Gross Margin

26.5

%

25.4

%

110 bps

28.7

%

25.4

%

330 bps

The following unaudited table presents a reconciliation of

Adjusted General and Administrative Expenses and Adjusted General

and Administrative Expenses as a Percentage of Revenue to the most

directly comparable GAAP measures:

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

GAAP revenue

$

66,619

$

50,552

32

%

$

121,777

$

75,852

61

%

GAAP general and administrative

expenses

$

33,827

$

34,333

(1

)%

$

68,053

$

72,222

(6

)%

GAAP general and administrative expenses

as a percentage of revenue

50.8

%

67.9

%

(1,710) bps

55.9

%

95.2

%

(3,930) bps

Adjustments:

Share-based compensation

$

5,291

$

8,454

(37

)%

$

9,905

$

14,859

(33

)%

Loss on disposal of property and

equipment, net of insurance recoveries, and impairment expense

2,757

2,389

15

%

5,497

5,849

(6

)%

Bad debt expense

81

56

45

%

311

153

103

%

Other1

66

24

175

%

2,218

1,479

50

%

Total adjustments

8,195

10,923

(25

)%

17,931

22,340

(20

)%

Adjusted General and Administrative

Expenses

$

25,632

$

23,410

9

%

$

50,122

$

49,882

0

%

Adjusted General and Administrative

Expenses as a Percentage of Revenue

38.5

%

46.3

%

(780) bps

41.2

%

65.8

%

(2,460) bps

____________________

1

For the six months ended June 30,

2024, comprised primarily of costs related to the organizational

realignment announced by the Company on January 17, 2024. For the

six months ended June 30, 2023, comprised primarily of costs

related to the previous reorganization of Company resources

announced by the Company on February 23, 2023 and the 205

Petition.

The following unaudited table presents a reconciliation of

Capital Expenditures, Net of Capital Offsets, to the most directly

comparable GAAP measure:

(unaudited, dollars in thousands)

Q2'24

Q2'23

Change

Q2'24 YTD

Q2'23 YTD

Change

GAAP capital expenditures

$

24,196

$

34,811

(30

)%

$

45,267

$

100,057

(55

)%

Capital offsets:

OEM infrastructure payments

$

5,956

$

6,022

(1

)%

$

11,782

$

9,917

19

%

Proceeds from capital-build funding

4,459

2,040

119

%

6,139

4,256

44

%

Total capital offsets

10,415

8,062

29

%

17,921

14,173

26

%

Capital Expenditures, Net of Capital

Offsets

$

13,781

$

26,749

(48

)%

$

27,346

$

85,884

(68

)%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801376933/en/

For investors:

investors@evgo.com For Media:

press@evgo.com

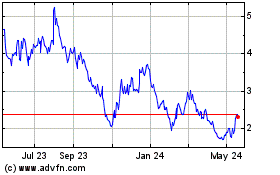

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Nov 2024 to Dec 2024

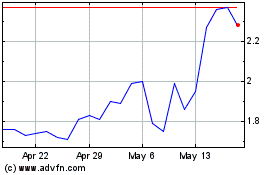

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Dec 2023 to Dec 2024