EVgo Inc. Announces Secondary Offering of Class A Common Stock

December 16 2024 - 3:10PM

Business Wire

EVgo Inc. (NASDAQ: EVGO) (“EVgo” or the “Company”) announced

today that EVgo Holdings, LLC, an affiliate of LS Power Equity

Partners IV, L.P. (“LS Power”), intends to offer for sale in an

underwritten public secondary offering 23,000,000 shares of Class A

common stock, par value $0.0001 per share (the “Class A Shares”) of

the Company. LS Power expects to grant the underwriters a 30-day

option to purchase up to an additional 3,450,000 Class A Shares at

the public offering price, less the underwriting discounts and

commissions. No Class A Shares are being sold by the Company. LS

Power will receive all of the proceeds from the sale of Class A

Shares in the offering, and the Company will not receive any

proceeds from this offering. The offering is subject to market

conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the actual size or terms of the

offering.

J.P. Morgan, Goldman Sachs & Co. LLC, Morgan Stanley and

Evercore ISI are acting as lead book-running managers for the

offering.

The Company has filed a registration statement (including a base

prospectus) and a preliminary prospectus supplement relating to

these securities with the Securities and Exchange Commission (the

“SEC”). The registration statement became effective on August 25,

2022. The offering is being made only by means of a prospectus

supplement (including the accompanying base prospectus), copies of

which may be obtained, when available, from J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, NY 11717, by email at prospectus-eq_fi@jpmchase.com and

postsalemanualrequests@broadridge.com, Goldman Sachs & Co. LLC,

Attention: Prospectus Department, 200 West Street, New York, New

York 10282-2198, or by telephone: (866) 471-2526 or email:

Prospectus-ny@ny.email.gs.com, Morgan Stanley & Co. LLC, Attn:

Prospectus Department, 180 Varick Street, 2nd Floor, New York, NY

10014, and Evercore Group, L.L.C., Attention: Equity Capital

Markets, 55 East 52nd Street, 35th Floor, New York, New York 10055,

or by telephone at (888) 474-0200 or email:

ecm.prospectus@evercore.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful without registration or

qualification under the securities laws of any such state or

jurisdiction.

About EVgo

EVgo (Nasdaq: EVGO) is one of the nation’s leading public fast

charging providers. With more than 1,000 fast charging stations

across 40 states, EVgo strategically deploys localized and

accessible charging infrastructure by partnering with leading

businesses across the U.S., including retailers, grocery stores,

restaurants, shopping centers, gas stations, rideshare operators,

and autonomous vehicle companies. At its dedicated Innovation Lab,

EVgo performs extensive interoperability testing and has ongoing

technical collaborations with leading automakers and industry

partners to advance the EV charging industry and deliver a seamless

charging experience.

Forward-Looking and Cautionary Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act, as amended. In some

cases, you can identify forward-looking statements because they

contain words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “going to,” “could,” “intends,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these words or other

similar terms or expressions that concern the Company’s

expectations, strategy, priorities, plans or intentions.

Forward-looking statements in this press release include, but are

not limited to, statements relating to the completion, timing and

size of the public offering and LS Power’s expectation to grant the

underwriters a 30-day option to purchase additional shares. These

forward-looking statements are based on management’s current

expectations or beliefs and are subject to numerous assumptions,

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements,

including, without limitation, risks and uncertainties related to

the ability of EVgo and LS Power to complete the proposed offering

on the anticipated terms or at all, market conditions and the

satisfaction of closing conditions related to the proposed public

offering. Additional risks and uncertainties that could affect the

Company’s financial results are included under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” in EVgo’s Annual Report on

Form 10-K for the year ended December 31, 2023 and its Quarterly

Reports on Form 10-Q for the quarterly periods ended March 31,

2024, June 30, 2024 and September 30, 2024 as well as its other

filings with the SEC, copies of which are available on EVgo’s

website at investors.evgo.com, and on the SEC’s website at

www.sec.gov. All forward-looking statements in this press release

are based on information available to us as of the date hereof, and

EVgo does not assume any obligation to update the forward-looking

statements provided to reflect events that occur or circumstances

that exist after the date on which they were made, except as

required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241216664249/en/

For Investors: investors@evgo.com

For Media: press@evgo.com

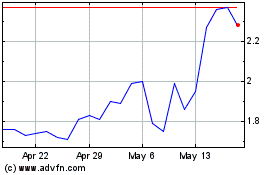

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Jan 2025 to Feb 2025

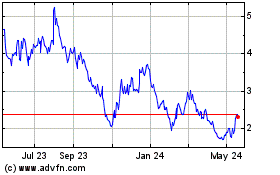

EVgo (NASDAQ:EVGO)

Historical Stock Chart

From Feb 2024 to Feb 2025