Registration of Additional Securities (up to 20%, Foreign Issuer) (f-1mef)

May 27 2021 - 6:55AM

Edgar (US Regulatory)

As

filed with the U.S. Securities and Exchange Commission on May 27, 2021.

Registration

No. 333-

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

F-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

EZGO

Technologies Ltd.

(Exact

name of Registrant as specified in its charter)

Not

Applicable

(Translation

of Registrant’s name into English)

|

British

Virgin Islands

|

|

3751

|

|

Not

Applicable

|

(State

or other jurisdiction of

incorporation or organization)

|

|

(Primary

Standard Industrial

Classification Code Number)

|

|

(I.R.S.

Employer

Identification No.)

|

Building

#A, Floor 2, Changzhou Institute of Dalian University of Technology,

Science

and Education Town,

Wujin

District, Changzhou City

Jiangsu,

China 213164

Tel: + 86 51983683805

(Address,

including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Puglisi&

Associates

850 Library Avenue, Suite 204

Newark, DE 19711

Tel: (302) 738-6680

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

|

Richard

I. Anslow, Esq.

Lijia Sanchez, Esq.

Ellenoff

Grossman & Schole LLP

1345 Avenue of the Americas

New York, NY 10105

Phone: (212) 370-1300

Fax: (212) 370-7889

|

|

Richard

A. Friedman, Esq.

Stephen

A. Cohen, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza, 39th Floor

New

York, NY 10174

Phone:

(212) 653-8600

Fax:

(212) 653-8601

|

Approximate

date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If

any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☐

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☒ 333-256311

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed

Maximum

Aggregate

Offering

Price(1) (2)

|

|

|

Amount of

Registration

Fee

|

|

|

Units (5)

|

|

$

|

1,999,998.00

|

|

|

$

|

218.20

|

|

|

Ordinary shares, par value US$0.001 per share (3)

|

|

|

-

|

|

|

|

-

|

|

|

Warrant to purchase ordinary shares (3)

|

|

|

-

|

|

|

|

-

|

|

|

Ordinary shares issuable upon exercise of the warrants

|

|

$

|

1,399,998.60

|

|

|

$

|

152.74

|

|

|

Placement agent warrants (4)

|

|

|

-

|

|

|

|

-

|

|

|

Ordinary shares issuable upon exercise of the placement agent warrants (4)

|

|

$

|

124,999.88

|

|

|

$

|

13.64

|

|

|

Total

|

|

$

|

3,524,996.48

|

|

|

$

|

384.58

|

(6)

|

|

(1)

|

Estimated

solely for the purpose of calculating the registration fee.

|

|

(2)

|

Represents

only the additional number of securities being registered. Does not include the securities that the Registrant previously registered

on the Registration Statement on Form F-1 (File No. 333-256311).

|

|

(3)

|

Included

in the price of the units. No separate registration fee is required pursuant to Rule 457(i) under the Securities Act.

|

|

(4)

|

Estimated

solely for the purposes of calculating the registration fee pursuant to Rule 457(g) under the Securities Act. We have calculated

the proposed maximum aggregate offering price of the ordinary shares underlying the placement agent warrants by assuming that such

warrants are exercisable at a price per share equal to 125% of the assumed price of $5.18 per share.

|

|

(5)

|

Each

unit includes (i) one ordinary share and (ii) and one warrant to purchase 0.7 ordinary share.

|

|

(6)

|

The

Registrant previously registered securities having a proposed maximum aggregate offering price of $17,625,000.63 on its Registration

Statement on Form F-1, as amended (File No. 333-256311), which was declared effective by the Securities and Exchange Commission on

May 26, 2021. In accordance with Rule 462(b) under the Securities Act, an additional number of securities having a proposed maximum

offering price of $3,524,996.48 is hereby registered.

|

The

Registration Statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b)

under the Securities Act of 1933, as amended.

EXPLANATORY

NOTE

This

Registration Statement on Form F-1 is being filed with respect to the registration of (i) 386,100 additional units of EZGO Technologies

Ltd., a Cayman Islands exempted company (the “Registrant”), each consisting of one ordinary share and one warrant to purchase

0.7 ordinary share, (ii) placement agent warrants to purchase 19,305 ordinary shares of the Registrant and (iii) 19,305 ordinary shares

of the Registrant underlying the placement agent warrants, pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and

General Instruction V to Form S-1. This Registration Statement relates to the Registrant’s Registration Statement on Form F-1,

as amended (File No. 333-256311) (the “Prior Registration Statement”), initially filed by the Registrant on May 20, 2021

and declared effective by the Securities and Exchange Commission (the “Commission”) on May 26, 2021. The required opinions

of counsel and related consents and accountant’s consent are attached hereto and filed herewith. Pursuant to Rule 462(b), the contents

of the Prior Registration Statement, including the exhibits thereto, are incorporated by reference into this Registration Statement.

The

Registrant hereby certifies that its agent (i) has instructed its bank to transmit to the Commission the filing fee set forth on the

cover page of this Registration Statement by a wire transfer of such amount to the Commission’s account at U.S. Bank as soon as

practicable (but no later than the close of business on May 27, 2021), (ii) will not revoke such instructions, (iii) has sufficient funds

in the relevant account to cover the amount of such filing fee and (iv) will confirm receipt of such instructions by its bank during

the bank’s regular business hours no later than May 27, 2021.

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item 16. Exhibits and Financial Statement Schedules.

(a)

Exhibits. All exhibits filed with or incorporated by reference in the Registration Statement on Form F-1 (SEC File No. 333-256311) are

incorporated by reference into, and shall be deemed a part of, this Registration Statement, and the following additional exhibits are

filed herewith, as part of this Registration Statement:

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that

it meets all of the requirements for filing on Form F-1 and has duly caused this registration statement to be signed on its behalf by

the undersigned, thereunto duly authorized, in Changzhou, Jiangsu, China, on May 27, 2021.

|

|

EZGO

Technologies Ltd.

|

|

|

|

|

|

By:

|

/s/

Jianhui Ye

|

|

|

|

Name:

|

Jianhui

Ye

|

|

|

|

Title:

|

Chief

Executive Officer

|

Pursuant

to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in

the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

|

|

|

|

|

|

|

/s/

Jianhui Ye

|

|

Chairman

and Chief Executive Officer

|

|

May

27, 2021

|

|

Jianhui

Ye

|

|

(Principal

Executive Officer)

|

|

|

|

|

|

|

|

|

|

/s/

Jingyan Wu

|

|

Chief

Financial Officer

|

|

May

27, 2021

|

|

Jingyan

Wu

|

|

(Principal

Financial and Accounting Officer)

|

|

|

|

|

|

|

|

|

|

/s/

Di Wu

|

|

Director

|

|

May

27, 2021

|

|

Di

Wu

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Junying Sun

|

|

Director

|

|

May

27, 2021

|

|

Junying

Sun

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Robert Johnson

|

|

Director

|

|

May

27, 2021

|

|

Robert

Johnson

|

|

|

|

|

|

|

|

|

|

|

|

/s/

Guanneng Lai

|

|

Director

|

|

May

27, 2021

|

|

Guanneng

Lai

|

|

|

|

|

SIGNATURE

OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant

to the Securities Act of 1933, as amended, the undersigned, the duly authorized representative in the United States of EZGO Technologies

Ltd. has signed this registration statement or amendment thereto in Newark, Delaware on May 27, 2021.

|

|

Puglisi

& Associates

|

|

|

|

|

|

By:

|

/s/

Donald J. Puglisi

|

|

|

|

Name:

|

Donald

J. Puglisi

|

|

|

|

Title:

|

Managing

Director

|

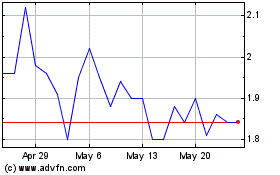

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

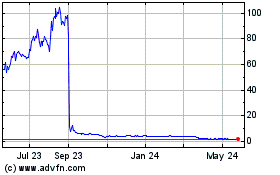

EZGO Technologies (NASDAQ:EZGO)

Historical Stock Chart

From Jul 2023 to Jul 2024