UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of January 2025

Commission

File Number: 001-33768

AIX

INC.

60/F,

Pearl River Tower

No.15 West Zhujiang Road

Tianhe District, Guangzhou 510623

People’s Republic of China

(Address of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Completion

of Issuance of Class B Ordinary Shares

On

December 30, 2024, AIX Inc. (“AIX” or the “Company”) entered into share subscription agreements (the “Agreements”)

separately with each of Highest Performances Holdings Inc. (“HPH”) and Infinew Limited (“Infinew”). Pursuant

to the Agreements, the Company agreed to issue to HPH and Infinew 510,000,000 class B ordinary shares and 490,000,000 class B ordinary

shares (the “Subscription Shares”, each “a Subscription Share”), respectively, at a price of US$0.001 per Subscription

Share, for a total consideration of US$510,000 and US$490,000, respectively. The gross proceeds to the Company from such transaction

were US$1,000,000, which will be used for general working capital purposes.

With

approval from the board of directors of the Company, the issuance of the Subscription Shares (“Issuance”) have been completed

on January 2, 2025. Following the Issuance, HPH beneficially owns 591,600,788 Class A ordinary shares and 510,000,000 Class B ordinary

shares of the Company, representing 51.67% of the total issued and outstanding ordinary shares of the Company, and 51.01% of the aggregate

voting power of the Company while Infinew beneficially owns 100,000 Class A ordinary shares and 490,000,000 Class B ordinary shares of

the Company, representing 22.99% of the total issued and outstanding ordinary shares of the Company and 48.45% of the aggregate voting

power of the Company.

The

Class B Ordinary Shares are distinguished by the following rights and restrictions:

Voting

Right: Each holder of Class A Ordinary Shares is entitled to one vote for each Class A Ordinary Share he or she holds, while each

holder of Class B Ordinary Shares is entitled to one hundred (100) votes for each Class B Ordinary Share he or she holds on any and all

matters submitted for a vote.

Conversion:

Each Class B Ordinary Share is convertible into one Class A ordinary share, at the option of the holder, subject to approval by two-thirds

of the Board of Directors. In no event shall Class A Ordinary Shares be convertible into Class B Ordinary Shares under any circumstances.

Class

B Ordinary Shares shall be automatically and immediately converted into an equal number of Class A Ordinary Shares under the following

circumstances: (i) if the holder is an employee, upon the termination of their employment with the Company; (ii) if the holder is a Director,

upon their resignation or removal from the Board of Directors; and (iii) if the holder is a wholly-owned company (“Owned Company”)

of a Director, Senior Management, or an existing shareholder, upon the individual ceasing to wholly own the Owned Company.

Limitations

on Economic Rights and Transferability: Each Class B Ordinary Share confers upon the holder: (a) no right to any share in any dividend

or distribution paid by the Company and (b) no right to any share in the distribution of the surplus assets of the Company upon liquidation

or otherwise, and no Class B Ordinary Share may be sold, transferred, assigned, pledged, or otherwise disposed of, or used as collateral

for loans or any obligations.

The Share

Subscription Agreements are filed as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 6-K. The foregoing is

only a brief description of the material terms of the Share Subscription Agreements, and does not purport

to be a complete description of the rights and obligations of the parties thereunder and is qualified in

its entirety by reference to such exhibits.

EXHIBIT

INDEX

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

AIX Inc. |

| |

|

| |

By: |

/s/

Yinan Hu |

| |

Name: |

Yinan Hu |

| |

Title: |

Chief Executive Officer |

Date: January

2, 2025

Exhibit 10.1

SHARE SUBSCRIPTION AGREEMENT

THIS AGREEMENT is made on December

30, 2024 between the following parties:

| (1) | Highest Performances Holdings Inc., a company duly incorporated and validly existing under the laws of

the Cayman Islands (the “Subscriber”); and |

| (2) | AIX Inc., an exempt company with limited liability incorporated under the laws of Cayman Islands (Nasdaq:

AIFU) (the “Company”). |

The Subscriber and the Company

are collectively referred to as the “Parties” and each a “Party.”

1.1 Subject to the terms

and conditions of this Agreement, the Company shall issue to the Subscriber and the Subscriber shall subscribe from the Company, all of

the title and interest in and to 510,000,000 class B ordinary shares of par value of US$0.001 each in the share capital of the Company

(the “Subscription Shares”), together with all rights, privilege and restrictions now and hereafter attaching thereto,

with the consideration as set forth in Clause 3.

1.2 At the Closing, (i) the

Subscriber shall deliver the Purchase Price as defined in Section 3.1 to the Company by wire transfer

in immediately available funds, and (ii) the Company shall deliver or cause to be delivered to the Subscriber one or more certificates

in definitive form for the Subscription Shares, in such denomination or denominations and registered in such name or names (each, a “Designated

Party”) as the Subscriber requests upon notice to the Company at least two Business Days prior to the Closing Date.

2.1 Payment of the consideration

for the Subscription Shares by the Subscriber shall be conditional upon the completion of the issuance and allotment of the Subscription

Shares to the Subscriber in accordance with Clause 1 (“Condition Precedent”).

3.1 The Parties agree that

the total consideration of the Subscription Shares shall be US$0.001 per Subscription Share and US$510,000 (“Purchase Price”)

in total payable by the Subscriber to a bank account designated by the Company. Any bank charges and currency conversion charges for transferring

the fund shall be borne and paid by the Subscriber. The consideration for the Subscription Shares shall be paid within five business days

upon the satisfaction of the Condition Precedent.

3.2 Any taxation and governmental

charges in connection with the issuance and allotments of the Subscription Shares and arising from the execution or performance of this

Agreement shall be borne by the Subscriber.

| 4. | THE SUBSCRIBER’S REPRESENTATIONS, WARRANTIES AND COVENANTS |

As of the date of this Agreement,

the Subscriber makes the following representations, warranties and covenants to the Company:

4.1 It is incorporated and

validly existing under the applicable law and has the right to execute this Agreement.

4.2 It warrants that it will

actively work with the Company to complete all necessary formalities in relation to the issuance and allotment of the Subscription Shares

pursuant to the applicable laws and regulations so as to ensure that the Subscriber legally own the Subscription Shares.

4.3 The signatory whose name

appears under its name on the execution page of this Agreement is a duly authorized signatory of itself.

| 5. | THE COMPANY’S REPRESENTATIONS, WARRANTIES AND COVENANTS |

As of the date of this Agreement,

the Company makes the following representations, warranties and covenants to the Subscriber:

5.1 It is incorporated and

validly existing under the applicable law and has the right to own its property, to issue shares and to carry on the business as currently

conducted and to execute this Agreement.

5.2 It has the legal right

and full power and authority to enter into and perform this Agreement or any other documents in connection with this Agreement, which,

when executed, will constitute valid and binding obligations on itself in accordance with their respective terms.

5.3 The signatory whose name

appears under its name on the execution page of this Agreement is a duly authorized signatory of itself.

5.4 The execution of, and

the performance by it of its obligations under, this Agreement and any other documents in connection with this Agreement will not:

5.4.1

result in a breach of any provision of its articles of association or any other constitutional document; and

5.4.2

result in a breach of any agreement, licence or other instrument, or result in a breach of any order, judgment or decree of any

court, governmental agency or regulatory body to which it is a party or by which it or any of its assets is bound.

This Agreement constitutes

the entire understanding and agreement of the Parties relating to the subject matter of this Agreement, and supersedes all previous oral

and written representations, exchanges, understandings and agreements made or reached by and between the Parties up to and including the

date of this Agreement. The Parties acknowledge and agree that, in entering into this Agreement, no Party has relied on any representation,

warranty or undertaking which is not included in this Agreement.

If any provision of this Agreement

shall be illegal, or for any other reason unenforceable, such provision shall be deemed to be independent from the other provisions of

this Agreement and shall not affect the effect or enforceability of such other provisions, which shall continue to be effective and enforceable

in accordance with their terms.

No Party shall be entitled

to assign the benefit of any provision of this Agreement without the prior written approval of the other Party and compliance with the

applicable law.

Unless otherwise provided in

this Agreement or agreed in writing by the Parties to this Agreement, each Party shall bear its own costs incurred by it in relation to

the execution and implementation of this Agreement (including without limitation legal fees).

All notices shall be delivered

either by hand, registered airmail or email to the following addresses (as the case may be):

Subscriber: Highest Performances

Holdings Inc

Address: 61/F, Pearl River

Tower No. 15 West Zhujiang Road

Guangzhou, Guangdong 510623

People’s Republic of China

Email: yangyuanfen@puyiwm.com

Attention:Yuanfeng

Yang

Company: AIX Inc.

Address: 60/F, Pearl River

Tower No. 15 West Zhujiang Road

Guangzhou, Guangdong 510623

People’s Republic of China

Email: gepeng@aifugroup.com

Attention:Peng

Ge

Notices shall be deemed to

have been delivered at the following times:

| i. | if by hand, on reaching the designated address subject to proof of delivery; |

| | | |

| ii. | if by courier, the fifth business day after the date of dispatch; and |

| | | |

| iii. | if by email, based on the date of the email shown in the incoming mailbox. |

| 11. | LIABILITY FOR BREACH OF AGREEMENT |

11.1

If either Party terminates this Agreement without obtaining the consent of the other Party after the execution of this Agreement,

such Party shall compensate the other Party for all direct and/or indirect losses incurred as a result thereof.

11.2

The liability for breach of this Agreement assumed by either Party shall not be discharged as a result of the termination/dissolution

of this Agreement and/or the completion of the equity interest transfer formalities.

| 12. | GOVERNING LAW AND SUBMISSION TO JURISDICTION |

12.1

This Agreement shall be construed in accordance with and be governed by the laws of Hong Kong.

12.2

Any dispute, controversy or claim arising out of or relating to this Agreement, or the breach, termination or invalidity thereof

shall be settled by arbitration in the Hong Kong International Arbitration Centre under the UNCITRAL Arbitration Rules in accordance with

the Hong Kong International Arbitration Centre Procedures for the Administration of International Arbitration in force at the date of

this Agreement. The arbitration shall be conducted in Chinese.

12.3

The award of the arbitral tribunal shall be final and binding upon the parties to the arbitration, and the prevailing party may

apply to a court of competent jurisdiction for enforcement of such award.

This Agreement may be entered

into in any number of counterparts, all of which taken together shall constitute one and the same original instrument. Any Party may enter

into this Agreement by executing any such counterpart.

(The remainder of this page

is intentionally left blank)

IN WITNESS whereof the Parties

have executed this Agreement on the day and year first above written.

| Subscriber: |

Highest Performances Holdings Inc. |

| |

|

|

| |

By: |

/s/ Yinan Hu |

| |

Name: |

Yinan Hu |

| |

Title: |

Director |

IN WITNESS whereof the Parties

have executed this Agreement on the day and year first above written.

| COMPANY: |

AIX Inc. |

| |

|

|

| |

By: |

/s/ Peng Ge |

| |

Name: |

Peng Ge |

| |

Title: |

Director |

Exhibit 10.2

SHARE SUBSCRIPTION AGREEMENT

THIS AGREEMENT is made on December

30, 2024 between the following parties:

| (1) | Infinew Limited, a company duly incorporated and validly existing under

the laws of the British Virigin Islands (the “Subscriber”); and |

| (2) | AIX Inc., an exempt company with limited liability incorporated under the laws of Cayman Islands (Nasdaq:

AIFU) (the “Company”). |

The Subscriber and the Company

are collectively referred to as the “Parties” and each a “Party.”

1.1 Subject to the

terms and conditions of this Agreement, the Company shall issue to the Subscriber and the Subscriber shall subscribe from the

Company, all of the title and interest in and to 490,000,000 class B ordinary shares of par value of US$0.001 each in the share

capital of the Company (the “Subscription Shares”), together with all rights, privilege and restrictions now and

hereafter attaching thereto, with the consideration as set forth in Clause 3.

1.2 At the Closing, (i) the

Subscriber shall deliver the Purchase Price as defined in Section 3.1 to the Company by wire transfer

in immediately available funds, and (ii) the Company shall deliver or cause to be delivered to the Subscriber one or more certificates

in definitive form for the Subscription Shares, in such denomination or denominations and registered in such name or names (each, a “Designated

Party”) as the Subscriber requests upon notice to the Company at least two Business Days prior to the Closing Date.

2.1 Payment of the consideration

for the Subscription Shares by the Subscriber shall be conditional upon the completion of the issuance and allotment of the Subscription

Shares to the Subscriber in accordance with Clause 1 (“Condition Precedent”).

3.1 The Parties agree that the total consideration of the Subscription

Shares shall be US$0.001 per Subscription Share and US$490,000 (“Purchase Price”) in total payable by the Subscriber

to a bank account designated by the Company. Any bank charges and currency conversion charges for transferring the fund shall be borne

and paid by the Subscriber. The consideration for the Subscription Shares shall be paid within fifteen(15) business days upon the satisfaction

of the Condition Precedent.

3.2 Any taxation and governmental

charges in connection with the issuance and allotments of the Subscription Shares and arising from the execution or performance of this

Agreement shall be borne by the Subscriber.

| 4. | THE SUBSCRIBER’S REPRESENTATIONS, WARRANTIES AND COVENANTS |

As of the date of this Agreement,

the Subscriber makes the following representations, warranties and covenants to the Company:

4.1 It is incorporated and

validly existing under the applicable law and has the right to execute this Agreement.

4.2 It warrants that it will

actively work with the Company to complete all necessary formalities in relation to the issuance and allotment of the Subscription Shares

pursuant to the applicable laws and regulations so as to ensure that the Subscriber legally own the Subscription Shares.

4.3 The signatory whose name

appears under its name on the execution page of this Agreement is a duly authorized signatory of itself.

| 5. | THE COMPANY’S REPRESENTATIONS, WARRANTIES AND COVENANTS |

As of the date of this Agreement,

the Company makes the following representations, warranties and covenants to the Subscriber:

5.1 It is incorporated and

validly existing under the applicable law and has the right to own its property, to issue shares and to carry on the business as currently

conducted and to execute this Agreement.

5.2 It has the legal right

and full power and authority to enter into and perform this Agreement or any other documents in connection with this Agreement, which,

when executed, will constitute valid and binding obligations on itself in accordance with their respective terms.

5.3 The signatory whose name

appears under its name on the execution page of this Agreement is a duly authorized signatory of itself.

5.4 The execution of, and

the performance by it of its obligations under, this Agreement and any other documents in connection with this Agreement will not:

5.4.1

result in a breach of any provision of its articles of association or any other constitutional document; and

5.4.2

result in a breach of any agreement, licence or other instrument, or result in a breach of any order, judgment or decree of any

court, governmental agency or regulatory body to which it is a party or by which it or any of its assets is bound.

This Agreement constitutes

the entire understanding and agreement of the Parties relating to the subject matter of this Agreement, and supersedes all previous oral

and written representations, exchanges, understandings and agreements made or reached by and between the Parties up to and including the

date of this Agreement. The Parties acknowledge and agree that, in entering into this Agreement, no Party has relied on any representation,

warranty or undertaking which is not included in this Agreement.

If any provision of this Agreement

shall be illegal, or for any other reason unenforceable, such provision shall be deemed to be independent from the other provisions of

this Agreement and shall not affect the effect or enforceability of such other provisions, which shall continue to be effective and enforceable

in accordance with their terms.

No Party shall be entitled

to assign the benefit of any provision of this Agreement without the prior written approval of the other Party and compliance with the

applicable law.

Unless otherwise provided in

this Agreement or agreed in writing by the Parties to this Agreement, each Party shall bear its own costs incurred by it in relation to

the execution and implementation of this Agreement (including without limitation legal fees).

All notices shall be delivered

either by hand, registered airmail or email to the following addresses (as the case may be):

Subscriber: Infinew Limited

Address: OMC Chambers, Wickhams Cay 1, Road Town,

Tortola, British Virgin Islands.

Email:Katherinewang6688@gmail.com

Attention:Katherine

Wang

Company: AIX Inc.

Address:

60/F, Pearl River Tower No.

15 West Zhujiang Road

Guangzhou, Guangdong 510623

People’s Republic of China

Email: gepeng@aifugroup.com

Attention:Peng Ge

Notices shall be deemed to

have been delivered at the following times:

| i. | if by hand, on reaching the designated address subject to proof of delivery; |

| | | |

| ii. | if by courier, the fifth business day after the date of dispatch; and |

| | | |

| iii. | if by email, based on the date of the email shown in the incoming mailbox. |

| 11. | LIABILITY FOR BREACH OF AGREEMENT |

11.1

If either Party terminates this Agreement without obtaining the consent of the other Party after the execution of this Agreement,

such Party shall compensate the other Party for all direct and/or indirect losses incurred as a result thereof.

11.2

The liability for breach of this Agreement assumed by either Party shall not be discharged as a result of the termination/dissolution

of this Agreement and/or the completion of the equity interest transfer formalities.

| 12. | GOVERNING LAW AND SUBMISSION TO JURISDICTION |

12.1

This Agreement shall be construed in accordance with and be governed by the laws of Hong Kong.

12.2

Any dispute, controversy or claim arising out of or relating to this Agreement, or the breach, termination or invalidity thereof

shall be settled by arbitration in the Hong Kong International Arbitration Centre under the UNCITRAL Arbitration Rules in accordance with

the Hong Kong International Arbitration Centre Procedures for the Administration of International Arbitration in force at the date of

this Agreement. The arbitration shall be conducted in Chinese.

12.3

The award of the arbitral tribunal shall be final and binding upon the parties to the arbitration, and the prevailing party may

apply to a court of competent jurisdiction for enforcement of such award.

This Agreement may be entered

into in any number of counterparts, all of which taken together shall constitute one and the same original instrument. Any Party may enter

into this Agreement by executing any such counterpart.

(The remainder of this page

is intentionally left blank)

IN WITNESS whereof the Parties

have executed this Agreement on the day and year first above written.

| SUBSCRIBER: |

Infinew Limited |

| |

|

|

| |

By: |

/s/ Katherine Wang |

| |

Name: |

Katherine Wang |

| |

Title: |

Director |

IN WITNESS whereof the Parties

have executed this Agreement on the day and year first above written.

| COMPANY: |

AIX Inc. |

| |

|

|

| |

By: |

/s/ Yinan Hu |

| |

Name: |

Yinan Hu |

| |

Title: |

Director |

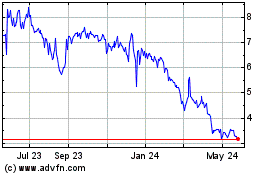

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Dec 2024 to Jan 2025

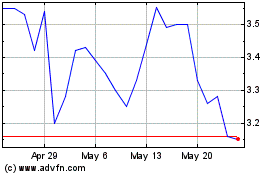

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jan 2024 to Jan 2025