Fidus Investment Corporation Prices Public Offering of $100 Million of 6.750% Notes Due 2030

March 12 2025 - 3:35PM

Fidus Investment Corporation (NASDAQ: FDUS) (“Fidus” or the

“Company”) today announced that it has priced an underwritten

public offering of $100 million aggregate principal amount of

6.750% notes due 2030 (the “Notes”).

The Notes will mature on March 19, 2030, and may

be redeemed in whole or in part at the Company’s option at any time

prior to September 19, 2029 at par plus a “make-whole” premium, and

at par thereafter. The Notes will bear interest at a rate of 6.750%

per year payable semi-annually on March 19 and September 19 of each

year, beginning September 19, 2025.

The offering is expected to close on March 19,

2025, subject to the satisfaction of customary

closing conditions.

Raymond James & Associates, Inc. is acting as book-runner

for this offering. Keefe, Bruyette & Woods, Inc., Oppenheimer

& Co. Inc., and ING Financial Markets LLC are acting as passive

book-runners for this offering. B. Riley Securities, Inc. and

Ladenburg Thalmann & Co. Inc. are acting

as co-managers for this offering. The Company intends to

use the net proceeds from this offering to repay a portion of the

outstanding borrowings under its senior secured revolving credit

facility (the “Credit Facility”). However, the Company

may re-borrow under the Credit Facility and use such

borrowings to invest in lower middle-market companies in accordance

with its investment objective and strategies and for working

capital and general corporate purposes. As of March 11, 2025, the

Company had $125.0 million of outstanding indebtedness under

the Credit Facility.

Investors are advised to consider carefully the

investment objective, risks and charges and expenses of the Company

before investing. The preliminary prospectus supplement

dated March 12, 2025 and the accompanying prospectus dated

May 8, 2024, each of which has been filed with the Securities

and Exchange Commission (the “SEC”), contain a description of these

matters and other important information about the Company and

should be read carefully before investing.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy, nor will there be

any sale of the Notes referred to in this press release, in any

state or jurisdiction in which such offer, solicitation or sale

would be unlawful prior to the registration or qualification under

the securities laws of such state or jurisdiction. A registration

statement (File No. 333-277540) relating to the Notes was filed and

has been declared effective by the SEC.

This offering is being made solely by

means of a written prospectus forming part of the effective

registration statement and a related preliminary prospectus

supplement, which may be obtained for free by visiting the SEC’s

website at www.sec.gov or from Raymond James &

Associates, Inc., 880 Carillon Parkway, St. Petersburg, Florida

33716, email: prospectus@raymondjames.com

or by calling 800-248-8863.

ABOUT FIDUS INVESTMENT

CORPORATION

Fidus Investment Corporation provides customized

debt and equity financing solutions to lower middle-market

companies, which management generally defines as U.S. based

companies with revenues between $10 million and $150 million. The

Company’s investment objective is to provide attractive

risk-adjusted returns by generating both current income from debt

investments and capital appreciation from equity related

investments. Fidus seeks to partner with business owners,

management teams and financial sponsors by providing customized

financing for change of ownership transactions, recapitalizations,

strategic acquisitions, business expansion and other growth

initiatives.

Fidus is an externally managed, closed-end,

non-diversified management investment company that has elected to

be treated as a business development company under the Investment

Company Act of 1940, as amended. In addition, for tax purposes,

Fidus has elected to be treated as a regulated investment company

under Subchapter M of the Internal Revenue Code of 1986, as

amended. Fidus was formed in February 2011 to continue and expand

the business of Fidus Mezzanine Capital, L.P., which commenced

operations in May 2007 and is licensed by the U.S. Small Business

Administration as a Small Business Investment Company (SBIC).

FORWARD-LOOKING STATEMENTS

Statements included herein contain certain

“forward-looking statements” within the meaning of the federal

securities laws, including statements with regard to the offering

of the Notes and the anticipated use of the net proceeds of the

offering. Forward-looking statements can be identified by the use

of forward-looking words such as “outlook,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “should,” “seeks,”

“approximately,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates” or negative versions of those words, other comparable

words or other statements that do not relate to historical or

factual matters. The forward-looking statements are based on our

beliefs, assumptions and expectations of future events and our

future performance, taking into account all information currently

available to us. These statements are not guarantees of future

events, performance, condition or results and involve a number of

risks and uncertainties. Actual results may differ materially from

those in the forward-looking statements as a result of a number of

factors, including, but not limited to, changes in the financial,

capital, and lending markets; general economic, geopolitical, and

industry trends and other factors; dependence of the Company’s

future success on the general economy and its impact on the

industries in which it invests; and those described from time to

time in our filings with the SEC. Any forward-looking statement

speaks only as of the date on which it is made. The Company

undertakes no duty to update any forward-looking statements made

herein, whether as a result of new information, future developments

or otherwise, except as required by law.

| |

|

|

| Company

Contact: |

|

Investor Relations

Contact: |

| Shelby E. Sherard |

|

Jody Burfening |

| Chief Financial Officer |

|

Alliance Advisors IR |

| (847) 859-3938 |

|

(212) 838-3777 |

| ssherard@fidusinv.com |

|

jburfening@allianceadvisors.com |

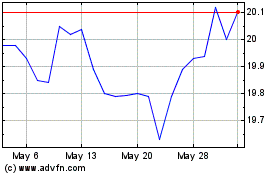

Fidus Investment (NASDAQ:FDUS)

Historical Stock Chart

From Mar 2025 to Apr 2025

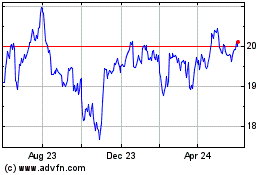

Fidus Investment (NASDAQ:FDUS)

Historical Stock Chart

From Apr 2024 to Apr 2025