UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Fluent, Inc.

(Name of Issuer)

Common Stock, par value $0.0005 per share

(Title of Class of Securities)

34380C 201

(CUSIP Number)

Daniel J. Barsky, Esq.

General Counsel and Corporate Secretary

Fluent, Inc.

300 Vesey Street, 9th Floor

New York, NY 10282

Telephone: (646) 669-7272

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 13, 2024

(Date of Event which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 34380C 201 |

Page 2 of 5 |

|

1

|

NAME OF REPORTING PERSONS

Ryan Schulke

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ☐

(b) ☒

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

PF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) or 2(e) ☐

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

| |

1,687,591(1)(2)(3)

|

|

|

8

|

SHARED VOTING POWER

|

|

| |

0

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

| |

1,354,257(1)(2)

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

| |

333,334(3)

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

1,687,591(1)(2)(3)

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.35% based on 13,660,598 shares of the Issuer’s common stock outstanding as of May 13, 2024(2)

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

(1)

|

The Reporting Person’s shares include (i) 1,084,332 shares held directly, (ii) 100,027 shares held by The Schulke Inn Family Foundation Trust, in which the Reporting Person serves as Co-Trustee, (iii) 20,208 shares held by The Ryan Schulke 2020 GRAT, in which the Reporting Person serves as Trustee, and (iv) 149,690 shares held by The Ryan Schulke 2022 GRAT, in which the Reporting Person serves as Trustee. Does not include (a) pre-funded warrants to purchase 1,743,499 shares of the Issuer’s common stock acquired on May 13, 2024, the exercise of which is subject to stockholder approval, (b) 91,667 restricted stock units (“RSUs”) that were fully vested as of January 1, 2019 but are subject to deferred delivery, (c) 8,333 RSUs that were fully vested as of February 1, 2020 but are subject to deferred delivery, and (d) 13,333 RSUs that were fully vested as of March 1, 2021 but are subject to deferred delivery.

|

|

(2)

|

The Reporting Person may be deemed to have shared voting control over the shares owned by Dr. Phillip Frost and Frost Gamma Investments Trust (“Frost Gamma”) by virtue of a Stockholders’ Agreement pursuant to which Dr. Frost and Frost Gamma agreed to vote in favor of the Reporting Person’s nominees for the Issuer’s board of directors. This foregoing does not reflect the Reporting Person’s ownership interest in these shares. If the Reporting Person were deemed to have a beneficial ownership interest in these shares, the Reporting Person would own 4,835,071 shares, or 35.39% of the Issuer’s outstanding common shares, excluding pre-funded warrants to purchase 591.017 shares of the Issuer’s common stock acquired by Frost Gamma on May 13, 2024, the exercise of which is subject to stockholder approval.

|

|

(3)

|

Represents 333,334 shares held by RSMC Partners, LLC, of which the Reporting Person is a member.

|

This Amendment No. 4 further amends the Schedule 13D first filed with the Securities and Exchange Commission on March 1, 2016, as amended (as so amended, the “Schedule 13D”), and is filed by Ryan Schulke with respect to the common stock, par value $0.0005 per share, of Fluent, Inc., a Delaware corporation.

Except as amended herein, the Schedule 13D (as amended to date) is unchanged and remains in effect.

Item 1. Security and Issuer.

Item 1 of the Schedule 13D is amended and restated as follows:

This statement on Schedule 13D relates to the common stock, par value $0.0005 per share, of Fluent, Inc., a Delaware corporation (the “Issuer”). The principal executive offices of the Issuer are located at 300 Vesey Street, 9th Floor, New York, New York 10282.

Item 2. Identity and Background.

Item 2 of the Schedule 13D is amended and restated as follows:

(a) The name of the person filing this statement is Ryan Schulke (the “Reporting Person”).

(b) The address of the principal executive offices and the telephone number of the Reporting Person is 300 Vesey Street, 9th Floor, New York, New York 10282; (646) 669-7272.A

(c) The Reporting Person is the Co-founder, Chief Strategy Officer and Chairman of the Issuer, an industry leader in digital marketing services primarily performing customer acquisition services by operating highly scalable digital marketing campaigns through which the Issuer connects its advertiser clients with consumers they are seeking to reach.

(d) During the last five years the Reporting Person has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) During the last five years, the Reporting Person was not a party to a civil proceeding of a judicial or administrative body of competent jurisdiction as a result of which such person was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) The Reporting Person is a citizen of the United States.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is amended by adding the following paragraphs to the end of such item:

All Pre-Funded Warrants (as defined herein) were purchased with the Reporting Person’s personal funds.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is amended by adding the following paragraphs to the end of such item:

On May 13, 2024, certain accredited investors, including the Reporting Person, entered into Securities Purchase Agreements (the “Purchase Agreements”) with the Issuer. Pursuant to the Purchase Agreement, the Reporting Person received pre-funded warrants (the "Pre-Funded Warrants") to purchase 1,743,499 shares of the Issuer’s common stock at a purchase price of $3.384 per Pre-Funded Warrant for an aggregate consideration of $5,900,000 (the “Private Placement”). The Pre-Funded Warrants have an exercise price of $0.005 per share of common stock, will be immediately exercisable after stockholder approval of the Private Placement and will terminate when exercised in full. The exercise of the Pre-Funded Warrants is subject to stockholder. The Issuer is obligated to use its reasonable best efforts to obtain stockholder approval of the exercise of the Pre-Funded Warrants in accordance with the rules of the Nasdaq Stock Market at a special meeting of the Issuer’s stockholders. In connection with the Private Placement, the Reporting Person entered into a Support Agreement with the Issuer pursuant to which the Reporting Person agreed to vote shares of the Issuer’s common stock beneficially owned by him in favor of certain actions subject to Stockholder Approval (as defined in the Purchase Agreements) at any meeting of stockholders of the Issuer and to vote against or decline to consent to any proposal or any other corporate action or agreement that would result in a breach by the Issuer of the Purchase Agreements or impede, delay or otherwise adversely affect the consummation of the transactions contemplated by the Purchase Agreements or any similar agreements entered into by the Issuer and the stockholders a party thereto in connection with the consummation of the transactions contemplated by the Purchase Agreements.

Other than as described above, the Reporting Person does not have any present plan or proposal which relates to, or would result in any action with respect to, the matters listed in paragraphs (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is amended and restated as follows:

(a) The Reporting Person is the beneficial owner of 1,687,591 shares of common stock of the Issuer, representing 12.35% of the Issuer’s common stock based on 13,660,598 shares of the Issuer’s common stock outstanding as of May 13, 2024. The foregoing excludes (a) Pre-Funded Warrants to purchase 1,743,499 shares of the Issuer’s common stock acquired on May 13, 2024, the exercise of which is subject to stockholder approval, (b) 91,667 RSUs that were fully vested as of January 1, 2019 but are subject to deferred delivery, (c) 8,333 RSUs that were fully vested as of February 1, 2020 but are subject to deferred delivery, and (d) 13,333 RSUs that were fully vested as of March 1, 2021 but are subject to deferred delivery. The Reporting Person may be deemed to have shared voting control over the shares owned by Dr. Phillip Frost and Frost Gamma by virtue of a Stockholders’ Agreement pursuant to which Dr. Frost and Frost Gamma agreed to vote in favor of the Reporting Person’s nominees for the Issuer’s board of directors. This foregoing does not reflect the Reporting Person’s ownership interest in these shares. If the Reporting Person were deemed to have a beneficial ownership interest in these shares, the Reporting Person would own 4,835,071 shares, or 35.39% of the Issuer’s outstanding common shares, excluding Pre-Funded Warrants to purchase 591,017 shares of the Issuer’s common stock acquired by Frost Gamma on May 13, 2024, the exercise of which is subject to stockholder approval.

(b) The Reporting Person is deemed to have sole power to vote or direct the vote of 1,687,591 shares of the Issuer’s common stock, sole power to dispose or to direct the disposition of 1,354,257 shares of the Issuer’s common stock, shared power vote or direct the vote of 0 shares of the Issuer’s common stock and shared power to dispose or to direct the disposition of 333,334 shares of the Issuer’s common stock.

(c) Other than the acquisition by the Reporting Person of the Pre-Funded Warrants to purchase shares of the Issuer’s common stock as set forth in Item 4, the Reporting Person did not effect any transactions in the common stock of the Issuer in the past 60 days.

(d) Not applicable.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is amended by adding the following paragraphs:

The description in Item 4 and the agreement incorporated therein by reference and set forth as an exhibit hereto is incorporated herein by reference in answer to this Item 6.

Item 7. Material to be Filed as Exhibits.

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

Dated: May 15, 2024

|

By:

|

/s/ Ryan Schulke

|

|

|

|

|

Ryan Schulke

|

|

Exhibit 1

SUPPORT AGREEMENT

This Support Agreement (this “Agreement”), dated as of May 13, 2024, by and between Fluent, Inc., a Delaware corporation (the “Company”), and the stockholder listed on the signature page hereto under the heading “Stockholder” (“Stockholder”).

WHEREAS, the Company and certain Buyers (as defined herein) intend to enter into Securities Purchase Agreements (the “Purchase Agreements”), dated as of the date hereof pursuant to which, among other things, the Company will issue and sell to the Buyers, and the Buyers will subscribe for and purchase from the Company, pre-funded warrants to purchase shares of the Company’s common stock, par value $0.0005 per share (the “Common Stock”). “Buyers” means those certain purchasers a party to the Purchase Agreement but shall not include Matthew Conlin, Phillip Frost and each of their respective affiliates; and

WHEREAS, as a condition to the Company’s willingness to enter into the Purchase Agreements and to consummate the transactions contemplated thereby (collectively, the “Transactions”), the Company and the Buyers have required that the Stockholder agree and in order to induce the Buyers to enter into the Purchase Agreements, the Stockholder has agreed, to enter into this Agreement with respect to (i) all the shares of Common Stock now owned and which may hereafter be acquired by the Stockholder or his respective controlled affiliates and (ii) any other securities, if any, which the Stockholder or his controlled affiliates is currently entitled to vote, or after the date hereof, becomes entitled to vote, at any meeting of stockholders of the Company (the securities described in clauses (i) and (ii) above, the “Covered Securities”).

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and agreements contained herein, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

ARTICLE I

VOTING AGREEMENT OF THE STOCKHOLDER

SECTION 1.01. Voting Agreement. The Stockholder hereby agrees that, during the period commencing with the execution and delivery of this Agreement and continuing until the termination of this Agreement in accordance with Section 4.01, at any meeting of the stockholders of the Company, however called, and in any action by written consent of the Company’s stockholders proposed by the Company, with respect to any of the following, the Stockholder shall: (a) vote all of the Covered Securities that the Stockholder or his controlled affiliates are entitled to vote thereon in favor of, or consent on behalf of itself and all of its controlled affiliates to, all of the corporate actions subject to Stockholder Approval (as defined in the Purchase Agreements); and (b) vote all of the Covered Securities that the Stockholder or its controlled affiliates are entitled to vote thereon against, or decline (on behalf of itself and all of its controlled affiliates) to consent to, any proposal or any other corporate action or agreement that would result in a breach by the Company of the Purchase Agreements or impede, delay or otherwise adversely affect the consummation of the transactions contemplated by the Purchase Agreements or any similar agreements entered into by the Company and the Buyers in connection with the consummation of the transactions contemplated by the Purchase Agreements (the “Private Placement Agreements”). The Stockholder acknowledges receipt and review of a copy of the form of Purchase Agreement and the other Transaction Documents (as defined in the Purchase Agreement).

SECTION 1.02. Voting on Other Matters. Notwithstanding anything in Section 1.01 to the contrary, (a) the Stockholder shall not be required to vote or execute written consents with respect to the Covered Securities to approve any amendments or modifications of any of the Private Placement Agreements or other Transaction Documents, or take any other action that could result in the amendment or modification of any of the Private Placement Agreements or other Transaction Documents, or a waiver of a provision thereof, and (b) except as may be set forth in any other agreement concerning the voting of the Covered Securities, the Stockholder shall remain free to vote or execute consents with respect to the Covered Securities with respect to any matter not covered by Section 1.01 in any manner that the Stockholder deems appropriate.

ARTICLE II

REPRESENTATIONS AND WARRANTIES OF STOCKHOLDER

The Stockholder hereby represents and warrants to each of the Buyers as follows:

SECTION 2.01. Authority Relative to This Agreement. The Stockholder has all necessary legal capacity, power and authority to execute and deliver this Agreement, to perform its obligations hereunder and to consummate the transactions contemplated hereby. This Agreement has been duly executed and delivered by the Stockholder and constitutes a legal, valid and binding obligation of the Stockholder, enforceable against the Stockholder in accordance with its terms, except (a) as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, fraudulent conveyance, moratorium or similar laws now or hereafter in effect relating to, or affecting generally the enforcement of creditors’ and other obligees’ rights, (b) where the remedy of specific performance or other forms of equitable relief may be subject to certain equitable defenses and principles and to the discretion of the court before which the proceeding may be brought, and (c) where rights to indemnity and contribution thereunder may be limited by applicable law and public policy.

SECTION 2.02. No Conflict. (a) The execution and delivery of this Agreement by the Stockholder does not, and the performance of this Agreement by the Stockholder shall not, (i) conflict with or violate any foreign, federal, state or local law, statute, ordinance, rule, regulation, order, judgment or decree applicable to the Stockholder or by which the Covered Securities are bound or affected or (ii) result in any breach of or constitute a default (or an event that with notice or lapse of time or both would become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, or result in the creation of a lien, charge, pledge, option, security interest, encumbrance, tax, right of first refusal, preemptive right or other restriction (each, a “Lien”) on any of the Covered Securities pursuant to, any note, bond, mortgage, indenture, contract, agreement, lease, license, permit, franchise or other instrument or obligation to which the Stockholder is a party or by which the Stockholder or the Covered Securities are bound, except, in the case of clauses (i) and (ii) above, any such conflict, breach, default, termination, amendment, acceleration, cancellation or Lien that would not reasonably be expected, individually or in the aggregate, to prevent, materially delay or materially impair the Stockholder’s ability to perform its obligations hereunder.

(b) The execution and delivery of this Agreement by the Stockholder does not, and the performance of this Agreement by the Stockholder shall not, require any consent, approval, authorization or permit of, or filing with or notification to, any governmental entity by the Stockholder.

SECTION 2.03. Title to the Stock. As of the date hereof, the Stockholder is the owner of the number of shares of Common Stock set forth opposite its name on Appendix A attached hereto. Such shares of Common Stock represent all the Common Stock owned, either of record or beneficially, by the Stockholder as of the date hereof, other than any derivative securities to acquire Common Stock that have not been converted or exercised as of the date hereof. Such shares of Common Stock are owned free and clear of all Liens or limitations on the Stockholder’s voting rights of any nature whatsoever, except for (a) the limitations or restrictions under this Agreement, (b) any limitations or restrictions imposed under applicable securities laws, (c) any restrictions on ownership and transfer of securities contained in the Company’s certificate of incorporation or (d) any limitations or restrictions that would not reasonably be expected, individually or in the aggregate, to prevent, materially delay or materially impair the Stockholder’s ability to perform its obligations hereunder. The Stockholder has not appointed or granted any proxy, which appointment or grant is still effective, with respect to any of the Covered Securities.

ARTICLE III

COVENANTS

SECTION 3.01. No Disposition of Stock. The Stockholder hereby covenants and agrees that, until the termination of this Agreement in accordance with Section 4.01, except as contemplated by this Agreement, the Stockholder shall not offer or agree to sell, transfer, tender, assign, hypothecate, pledge or otherwise dispose of, grant a proxy or power of attorney with respect to, or create or permit to exist any Lien or limitation on the Stockholder’s voting rights of any nature whatsoever (other than any limitations or restrictions imposed under applicable securities laws) with respect to the Covered Securities; provided, however, that the Stockholder may assign, sell or transfer any Covered Securities provided that the recipient of such Covered Securities has delivered to the Company a written agreement in a form reasonably satisfactory to the Company that the recipient shall be bound by, and the Covered Securities so transferred, assigned or sold shall remain subject to this Agreement.

SECTION 3.02. Company Cooperation. The Company hereby covenants and agrees that it will not, and the Stockholder irrevocably and unconditionally acknowledges and agrees that the Company will not (and waives any rights against the Company in relation thereto), recognize any Lien on any of the Covered Securities unless the provisions of Section 3.01 have been complied with.

ARTICLE IV

MISCELLANEOUS

SECTION 4.01. Termination. This Agreement shall automatically terminate without further action and shall have no further force and effect upon the earliest to occur of (a) the date that the Company obtains the Stockholder Approval, (b) following the entry into the Purchase Agreements, and (c) the termination of the Purchase Agreements in accordance with their terms.

SECTION 4.02. Further Assurances. The Stockholder will execute and deliver such further documents and instruments and take all further action as may be reasonably necessary in order to consummate the transactions contemplated hereby.

SECTION 4.03. Third Party Beneficiary; Specific Performance. Each Buyer is an express third-party beneficiary of this Agreement and shall have the right to enforce this Agreement against the Company and the Stockholder as if each such Buyer was a party hereto. In addition to being entitled to exercise all rights provided herein or granted by law, including recovery of damages, each of the Buyers (without being joined by any other Buyer) and the Company will be entitled to specific performance under this Agreement. The parties agree that monetary damages may not be adequate compensation for any loss incurred by reason of any breach of obligations contained herein and hereby agree to waive and not to assert in any action for specific performance of any such obligation the defense that a remedy at law would be adequate.

SECTION 4.04. Entire Agreement. This Agreement contains the entire understanding of the parties with respect to the subject matter hereof and supersedes all prior agreements and understandings, oral or written, with respect to such matters, which the parties acknowledge have been merged into this Agreement.

SECTION 4.05. Amendment. The provisions of this Agreement may not be amended or waived, nor may this Agreement be terminated by the Company, without the prior written consent of the Stockholder and all of the Buyers.

SECTION 4.06. Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

SECTION 4.07. Governing Law; Jurisdiction; Waiver of Jury Trial. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretation, enforcement and defense of the transactions contemplated by this Agreement (whether brought against a party hereto or its respective affiliates, directors, officers, stockholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in any action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address set forth on the signature pages to this Agreement (and service so made shall be deemed complete three days after the same has been posted) and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. IN ANY ACTION OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

SECTION 4.08. No Recourse. All actions (whether in contract or in tort, in law or in equity, or granted by statute) that may be based upon, in respect of, arise under, out or by reason of, be connected with, or relate in any manner to this Agreement, or the negotiation, execution or performance of this Agreement may be made only against (and are those solely of) the persons that are expressly identified as parties to this Agreement in the preamble to this Agreement. No other person, including any former, current or future equity holder, controlling person, director, officer, employee, member, partner, manager, agent, attorney, representative or affiliate of any party hereto, or any former, current or future stockholder, controlling person, director, officer, employee, general or limited partner, member, manager, agent, attorney, representative or affiliate of any of the foregoing, shall have any liability (whether in contract or in tort, in law or in equity, or granted by statute) for any claims, causes of action, obligations or liabilities arising under, out of, in connection with or related in any manner to this Agreement or based on, in respect of or by reason of this Agreement or its negotiation, execution, performance or breach.

[Signature page follows]

IN WITNESS WHEREOF, the Stockholder and the Company have duly executed this Agreement as of the date first written above.

|

|

COMPANY:

FLUENT, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Donald Patrick

|

|

|

|

|

Name: Donald Patrick

|

|

|

|

|

Title: CEO

|

|

| |

STOCKHOLDER:

Ryan Schulke

/s/Ryan Schulke

|

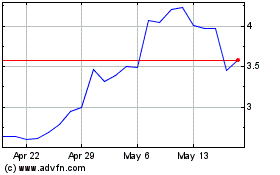

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From May 2024 to Jun 2024

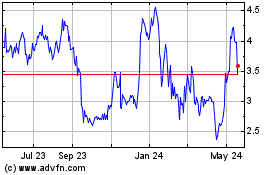

Fluent (NASDAQ:FLNT)

Historical Stock Chart

From Jun 2023 to Jun 2024