false

0001083743

0001083743

2024-11-15

2024-11-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 15, 2024

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31543 |

|

92-3550089 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 2685

S. Melrose Drive, Vista, California |

|

92081 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

FLUX |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

7.01 Regulation FD Disclosure.

On

November 15, 2024, Flux Power Holdings, Inc. (the “Company”) issued a press release providing an update on inventory restatement

and a timeline with regards to its Annual Report on Form 10-K for the fiscal year ended June 30, 2024 and its Quarterly Report on Form

10-Q for the quarter ended September 30, 2024. A

copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference

The

information in Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Flux

Power Holdings, Inc. |

| |

a

Nevada corporation |

| |

|

|

| |

By:

|

/s/

Ronald F. Dutt |

| |

|

Ronald

F. Dutt, |

| |

|

Chief

Executive Officer |

| |

|

|

| Dated:

November 15, 2024 |

|

|

Exhibit 99.1

Flux

Power Provides Update on Inventory Restatement and Timeline to Report Fiscal FY 2024 and Q1 2025 Financial Results

VISTA,

Calif. – November 15, 2024 – Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of advanced lithium-ion energy

storage solutions for electrification of commercial and industrial equipment, today provided an update regarding its previously discussed

restatement process and subsequent SEC filings for the fiscal fourth quarter and year ended June 30, 2024, and the fiscal first quarter

ended September 30, 2024.

On

September 5, 2024, Flux announced that it had identified approximately $1.7 million of excess and obsolete inventory primarily related

to product innovation and design of its products during a period of rapid growth over the last several years. A further detailed review

of this and related items has resulted in estimated noncash inventory write-downs of approximately$4.4 million and related noncash warranty

related items of approximately $0.5 million, totaling adjustments of approximately $4.9 million. This impact is not a one-time adjustment

but impacting multiple quarters over multiple years. To properly reflect the obsolete inventory, the Company is currently in the process

of restating previously issued financial statements for fiscal year 2023 and the interim periods of fiscal year 2024, which will be reflected

in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024. The Flux team has completed its internal review

of the restatements and 10-K and is working with its auditors to file them as soon as practicable, which reflects a large body of work

over an extended period of time. Upon completion, Flux will work to complete the 10-Q filing for the quarter ending September 30, 2024.

“Flux

continues to execute on our strategy, which includes expanding sales and marketing initiatives to secure new customer relationships,

developing additional technologies and building new partnerships, and we are making good progress as we strive to deliver on our targeted

sales trajectory,” said Ron Dutt, CEO of Flux Power. “Our outlook remains positive as we diligently follow our roadmap to

achieve profitability by focusing on continued innovation, maintaining a disciplined cost structure and driving organic growth. We look

forward to providing our shareholders with financial updates as soon as we finalize our Fiscal Year 2024 10-K and First Quarter 2025

10-Q filings.”

Additional

information is available in the Form 12b-25 filed with the Securities and Exchange Commission today and the Form 8-K filed on September

5, 2024.

About

Flux Power Holdings, Inc.

Flux

Power (NASDAQ: FLUX) designs, manufactures, and sells advanced lithium-ion energy storage solutions for electrification of a range of

industrial and commercial sectors including material handling, airport ground support equipment (GSE), and stationary energy storage.

Flux Power’s lithium-ion battery packs, including the proprietary battery management system (BMS) and telemetry, provide customers

with a better performing, lower cost of ownership, and more environmentally friendly alternative, in many instances, to traditional lead

acid and propane-based solutions. Lithium-ion battery packs reduce CO2 emissions and help improve sustainability and ESG metrics for

fleets. For more information, please visit www.fluxpower.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases

such as “anticipated,” “forward,” “will,” “would,” “could,” “may,”

“intend,” “remain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “estimate,” “and similar expressions are intended to

identify forward-looking statements. These statements include, but are not limited to, statements with respect to: the expected adjustments

to the Company’s financial statements, including the estimated amount and impact of adjustments on the Company’s financial

statements, expectations with respect to the Company’s internal control over financial reporting and disclosure controls and procedures

and related remediation, the potential for additional adjustments to the Company’s financial statements and additional restatements,

the Company’s ability to access its revolving credit facility, expected filing of its Form 10-K, and effect and impact on Company’s

business and credit facility. All of such statements are subject to certain risks and uncertainties, many of which are difficult to predict

and generally beyond the Company’s control, that could cause actual results to differ materially from those expressed in, or implied

or projected by, the forward-looking information and statements. Such risks and uncertainties include, but are not limited to, the completion

of the review and preparation of the Company’s financial statements and internal control over financial reporting and disclosure

controls and procedures and the timing thereof; the discovery of additional information resulting to additional adjustments; delays in

the Company’s financial reporting, including as a result of unanticipated factors; the Company’s ability to obtain necessary

waivers or amendments to its credit facility in the future; the risk that the Company may become subject to stockholder lawsuits or claims;

the Company’s ability to remediate material weaknesses in its internal control over financial reporting; risks inherent in estimates

or judgments relating to the Company’s critical accounting policies, or any of the Company’s estimates or projections, which

may prove to be inaccurate; unanticipated factors in addition to the foregoing that may impact the Company’s financial and business

projections and guidance and may cause the Company’s actual results and outcomes to materially differ from its estimates, projections

and guidance; and those risks and uncertainties identified in the “Risk Factors” sections of the Company’s Annual Report

on Form 10-K for the year ended June 30, 2023, and its other subsequent filings with the SEC. Readers are cautioned not to place undue

reliance on these forward-looking statements. All forward-looking statements contained in this press release speak only as of the date

on which they were made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect

events that occur or circumstances that exist after the date on which they were made.

Flux,

Flux Power, and associated logos are trademarks of Flux Power Holdings, Inc. All other third-party brands, products, trademarks, or registered

marks are the property of and used to identify the products or services of their respective owners.

Follow

us at:

Blog:

Flux Power Blog

News Flux Power News

Twitter: @FLUXpwr

LinkedIn: Flux Power

Contacts

Media

& Investor Relations:

media@fluxpower.com

info@fluxpower.com

External Investor Relations:

Chris Tyson, Executive Vice President

MZ Group - MZ North America

949-491-8235

FLUX@mzgroup.us

www.mzgroup.us

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

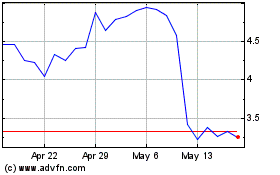

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Oct 2024 to Nov 2024

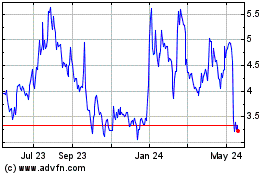

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Nov 2023 to Nov 2024