Flux Power Provides Update on Inventory Restatement and Timeline to Report Fiscal FY 2024 and Q1 2025 Financial Results

November 15 2024 - 3:05PM

Business Wire

Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of

advanced lithium-ion energy storage solutions for electrification

of commercial and industrial equipment, today provided an update

regarding its previously discussed restatement process and

subsequent SEC filings for the fiscal fourth quarter and year ended

June 30, 2024, and the fiscal first quarter ended September 30,

2024.

On September 5, 2024, Flux announced that it had identified

approximately $1.7 million of excess and obsolete inventory

primarily related to product innovation and design of its products

during a period of rapid growth over the last several years. A

further detailed review of this and related items has resulted in

estimated noncash inventory write-downs of approximately $4.4

million and related noncash warranty related items of approximately

$0.5 million, totaling adjustments of approximately $4.9 million.

This impact is not a one-time adjustment but impacting multiple

quarters over multiple years. To properly reflect the obsolete

inventory, the Company is currently in the process of restating

previously issued financial statements for fiscal year 2023 and the

interim periods of fiscal year 2024, which will be reflected in the

Company’s Annual Report on Form 10-K for the fiscal year ended June

30, 2024. The Flux team has completed its internal review of the

restatements and 10-K and is working with its auditors to file them

as soon as practicable, which reflects a large body of work over an

extended period of time. Upon completion, Flux will work to

complete the 10-Q filing for the quarter ending September 30,

2024.

“Flux continues to execute on our strategy, which includes

expanding sales and marketing initiatives to secure new customer

relationships, developing additional technologies and building new

partnerships, and we are making good progress as we strive to

deliver on our targeted sales trajectory,” said Ron Dutt, CEO of

Flux Power. “Our outlook remains positive as we diligently follow

our roadmap to achieve profitability by focusing on continued

innovation, maintaining a disciplined cost structure and driving

organic growth. We look forward to providing our shareholders with

financial updates as soon as we finalize our Fiscal Year 2024 10-K

and First Quarter 2025 10-Q filings.”

Additional information is available in the Form 12b-25 filed

with the Securities and Exchange Commission today and the Form 8-K

filed on September 5, 2024.

About Flux Power Holdings, Inc.

Flux Power (NASDAQ: FLUX) designs, manufactures, and sells

advanced lithium-ion energy storage solutions for electrification

of a range of industrial and commercial sectors including material

handling, airport ground support equipment (GSE), and stationary

energy storage. Flux Power’s lithium-ion battery packs, including

the proprietary battery management system (BMS) and telemetry,

provide customers with a better performing, lower cost of

ownership, and more environmentally friendly alternative, in many

instances, to traditional lead acid and propane-based solutions.

Lithium-ion battery packs reduce CO2 emissions and help improve

sustainability and ESG metrics for fleets. For more information,

please visit www.fluxpower.com.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended, and other securities law. Forward-looking

statements are statements that are not historical facts. Words and

phrases such as “anticipated,” “forward,” “will,” “would,” “could,”

“may,” “intend,” “remain,” “potential,” “prepare,” “expected,”

“believe,” “plan,” “seek,” “continue,” “estimate,” “and similar

expressions are intended to identify forward-looking statements.

These statements include, but are not limited to, statements with

respect to: the expected adjustments to the Company’s financial

statements, including the estimated amount and impact of

adjustments on the Company’s financial statements, expectations

with respect to the Company’s internal control over financial

reporting and disclosure controls and procedures and related

remediation, the potential for additional adjustments to the

Company’s financial statements and additional restatements, the

Company’s ability to access its revolving credit facility, expected

filing of its Form 10-K, and effect and impact on Company’s

business and credit facility. All of such statements are subject to

certain risks and uncertainties, many of which are difficult to

predict and generally beyond the Company’s control, that could

cause actual results to differ materially from those expressed in,

or implied or projected by, the forward-looking information and

statements. Such risks and uncertainties include, but are not

limited to, the completion of the review and preparation of the

Company’s financial statements and internal control over financial

reporting and disclosure controls and procedures and the timing

thereof; the discovery of additional information resulting to

additional adjustments; delays in the Company’s financial

reporting, including as a result of unanticipated factors; the

Company’s ability to obtain necessary waivers or amendments to its

credit facility in the future; the risk that the Company may become

subject to stockholder lawsuits or claims; the Company’s ability to

remediate material weaknesses in its internal control over

financial reporting; risks inherent in estimates or judgments

relating to the Company’s critical accounting policies, or any of

the Company’s estimates or projections, which may prove to be

inaccurate; unanticipated factors in addition to the foregoing that

may impact the Company’s financial and business projections and

guidance and may cause the Company’s actual results and outcomes to

materially differ from its estimates, projections and guidance; and

those risks and uncertainties identified in the “Risk Factors”

sections of the Company’s Annual Report on Form 10-K for the year

ended June 30, 2023, and its other subsequent filings with the SEC.

Readers are cautioned not to place undue reliance on these

forward-looking statements. All forward-looking statements

contained in this press release speak only as of the date on which

they were made. Except to the extent required by law, the Company

undertakes no obligation to update such statements to reflect

events that occur or circumstances that exist after the date on

which they were made.

Flux, Flux Power, and associated logos are trademarks of Flux

Power Holdings, Inc. All other third-party brands, products,

trademarks, or registered marks are the property of and used to

identify the products or services of their respective owners.

Follow us at:

Blog: Flux Power Blog News: Flux Power News Twitter: @FLUXpwr

LinkedIn: Flux Power

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241115646468/en/

Media & Investor Relations: media@fluxpower.com

info@fluxpower.com

External Investor Relations: Chris Tyson, Executive Vice

President MZ Group - MZ North America 949-491-8235 FLUX@mzgroup.us

www.mzgroup.us

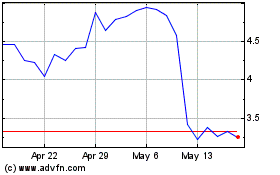

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Dec 2024 to Jan 2025

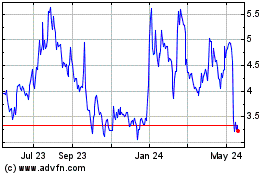

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Jan 2024 to Jan 2025