false

0001556727

0001556727

2024-10-21

2024-10-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 21, 2024

FIRST NORTHWEST BANCORP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Washington

|

|

001-36741

|

|

46-1259100

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

105 West 8th Street, Port Angeles, Washington

|

98362

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (360) 457-0461

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class:

|

|

Trading Symbol(s):

|

|

Name of each exchange on which registered:

|

|

Common Stock, par value $0.01 per share

|

|

FNWB

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition

|

On October 25, 2024, First Northwest Bancorp ("the Company") issued a revised earnings release for the quarter ended June 30, 2024., in light of the restatement discussed in Item 4.02 of this Current Report on Form 8-K (the "Current Report"). A copy of the revised earnings release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

This information (including Exhibit 99.1) is being furnished under Item 2.02 hereof and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Item 4.02

|

Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review |

On October 21, 2024, the Audit Committee of the Board of Directors (the "Audit Committee") of the Company, based on the recommendation of, and after consultation with, the Company’s management and independent registered public accounting firm, concluded that the Company’s previously issued unaudited consolidated financial statements as of and for the three and six month periods ended June 30, 2024 (the "Affected Financials") included in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the U.S. Securities and Exchange Commission on August 8, 2024 (the "Affected Quarterly Report"), should no longer be relied upon. Related earnings releases, press releases, shareholder communications, investor presentations or other communications describing relevant portions of the Affected Financials should also no longer be relied upon.

The determination was made following the conclusion that an additional $6.6 million in charge-offs across commercial construction loans, commercial business loans and the Splash unsecured consumer loan program as well as increased provision on Splash consumer loans were required, resulting in a total restated provision for credit losses on loans of $8.7 million. The increases resulted in corrections to loan amortized cost balances, the allowance for credit losses on loans, interest and fees on loans receivable, the provision for credit losses on loans and tax adjustments related to the correction of loan charge-offs and allowance for credit losses on loans. The Company determined the correction of the foregoing is material to the Company’s results of operations included in the Affected Quarterly Report.

The increases in charge-offs and provision for credit losses are the result of management's ongoing credit evaluation in assessing the collectability of the loans discussed above. In consultation with the Company’s prudential regulators, management determined that these amendments were necessary to reflect the credit quality of and underlying collateral values for certain commercial loans. The Audit Committee agreed with management's conclusion.

The Company has restated the Affected Financials and filed them in an amendment to the Affected Quarterly Report (the "Amended Quarterly Report") concurrent with the filing of this Current Report.

As a result of the foregoing, the Company’s management reevaluated the effectiveness of the Company’s internal control over financial reporting ("ICFR") and identified a material weakness in the Company’s ICFR that existed as of June 30, 2024. Additional information regarding the material weakness and the Company’s remediation plan is available in the Amended Quarterly Report.

The Company’s management and the Audit Committee discussed the matters disclosed in this Current Report with Moss Adams LLP, the Company’s independent registered public accounting firm.

|

Item 9.01 Financial Statements and Exhibits

|

|

(d) Exhibit.

|

The following exhibit is furnished with this Current Report.

|

|

|

|

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

FIRST NORTHWEST BANCORP

|

|

|

|

|

|

|

|

|

|

Date:

|

October 25, 2024

|

/s/Matthew P. Deines

|

|

|

|

Matthew P. Deines

|

|

|

|

President and Chief Executive Officer

|

Exhibit 99.1

PORT ANGELES, Wash., Oct. 25, 2024 (GLOBE NEWSWIRE)

CORRECTING and RESTATING

First Northwest Bancorp Reports Second Quarter 2024 Financial Results

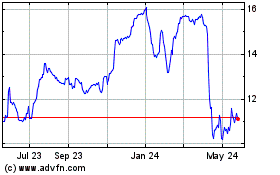

First Northwest Bancorp (Nasdaq: FNWB) ("First Northwest" or the "Company"), the holding company for First Fed Bank (the "Bank"), announced corrections to its press release issued on Thursday, July 25, 2024, as a result of restating its financials for the quarter ended June 30, 2024. The corrected and restated release follows, and should be read together with the Company's concurrently issued Amendment No. 1 to its Quarterly Report on Form 10-Q/A for the quarter ended June 30, 2024, which provides additional information concerning the restatement.

"In spite of challenging times for the entire industry as a result of the rate environment, First Northwest executed on a balance sheet restructure strategy. The restructure included a sale-leaseback transaction for six of our branches, a restructure of our bank-owned life insurance policies, two securities loss sale transactions, two balance sheet hedges against fixed rate loans and municipal bonds and the sale of our Visa B shares," commented Matthew P. Deines, President and CEO. "As a result, we reached an inflection point for the net interest margin in the second quarter after declines for the preceding five quarters. We also reduced wholesale funding reliance in the current quarter, and today are announcing significant expense reduction through a reduction in force which we expect will positively impact earnings in the second half of 2024 and into 2025. We still have substantial work to do in order to produce stronger earnings. However, we believe we have laid the groundwork for improved earnings moving forward as lower yielding assets reprice, payoff and paydown in line with contractual commitments.

"First Northwest continues our efforts to deemphasize real estate lending to focus on generating loans and deposits from small-to-medium sized businesses in our markets. Year-to-date in 2024, real estate loans are essentially flat, while non-real estate loans increased by 11%, or approximately $41 million. We believe that this diversification strategy will decrease interest rate risk and will allow us to build stronger relationships with businesses in our footprint.

"There was a substantial increase to our provision for credit losses this quarter. This was related to two borrowing relationships which we have been managing closely since the beginning of 2023 and losses recorded for three smaller relationships. We have appointed a receiver for both of the larger relationships and we are working to resolve these problem assets as quickly as possible."

The Board of Directors of First Northwest Bancorp declared a quarterly cash dividend of $0.07 per common share. The dividend will be payable on August 23, 2024, to shareholders of record as of the close of business on August 9, 2024.

|

2024 FINANCIAL RESULTS

|

|

2Q 24 (Restated) |

|

|

1Q 24 |

|

|

2Q 23 |

|

|

2024 YTD (Restated) |

|

|

2023 YTD

|

|

|

OPERATING RESULTS (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income

|

|

$ |

(2.2 |

) |

|

$ |

0.4 |

|

|

$ |

1.8 |

|

|

$ |

(1.8 |

) |

|

$ |

5.3 |

|

|

Pre-provision net interest income

|

|

|

14.2 |

|

|

|

13.9 |

|

|

|

16.0 |

|

|

|

28.2 |

|

|

|

32.3 |

|

|

Noninterest expense

|

|

|

15.6 |

|

|

|

14.3 |

|

|

|

15.2 |

|

|

|

29.9 |

|

|

|

30.1 |

|

|

Total revenue, net of interest expense *

|

|

|

21.6 |

|

|

|

16.1 |

|

|

|

17.7 |

|

|

|

37.7 |

|

|

|

36.3 |

|

|

PER SHARE DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted (loss) earnings

|

|

$ |

(0.25 |

) |

|

$ |

0.04 |

|

|

$ |

0.20 |

|

|

$ |

(0.21 |

) |

|

$ |

0.59 |

|

|

Book value

|

|

|

16.81 |

|

|

|

17.00 |

|

|

|

16.56 |

|

|

|

16.81 |

|

|

|

16.56 |

|

|

Tangible book value *

|

|

|

16.64 |

|

|

|

16.83 |

|

|

|

16.39 |

|

|

|

16.64 |

|

|

|

16.39 |

|

|

BALANCE SHEET (in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

$ |

2,216 |

|

|

$ |

2,240 |

|

|

$ |

2,163 |

|

|

$ |

2,216 |

|

|

$ |

2,163 |

|

|

Total loans

|

|

|

1,698 |

|

|

|

1,711 |

|

|

|

1,638 |

|

|

|

1,698 |

|

|

|

1,638 |

|

|

Total deposits

|

|

|

1,708 |

|

|

|

1,667 |

|

|

|

1,653 |

|

|

|

1,708 |

|

|

|

1,653 |

|

|

Total shareholders' equity

|

|

|

159 |

|

|

|

161 |

|

|

|

160 |

|

|

|

159 |

|

|

|

160 |

|

|

ASSET QUALITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-off ratio (1)

|

|

|

1.70 |

% |

|

|

0.19 |

% |

|

|

0.10 |

% |

|

|

0.95 |

% |

|

|

0.05 |

% |

|

Nonperforming assets to total assets

|

|

|

1.07 |

|

|

|

0.87 |

|

|

|

0.12 |

|

|

|

1.07 |

|

|

|

0.12 |

|

|

Allowance for credit losses on loans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

to total loans

|

|

|

1.14 |

|

|

|

1.05 |

|

|

|

1.06 |

|

|

|

1.14 |

|

|

|

1.06 |

|

|

Nonaccrual loan coverage ratio

|

|

|

82 |

|

|

|

92 |

|

|

|

677 |

|

|

|

82 |

|

|

|

677 |

|

|

SELECTED RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average assets (1)

|

|

|

-0.40 |

% |

|

|

0.07 |

% |

|

|

0.34 |

% |

|

|

-0.17 |

% |

|

|

0.51 |

% |

|

Return on average equity (1)

|

|

|

-5.47 |

|

|

|

0.98 |

|

|

|

4.41 |

|

|

|

-2.26 |

|

|

|

6.67 |

|

|

Return on average tangible equity (1) *

|

|

|

-5.53 |

|

|

|

0.99 |

|

|

|

4.47 |

|

|

|

-2.28 |

|

|

|

6.75 |

|

|

Net interest margin

|

|

|

2.76 |

|

|

|

2.76 |

|

|

|

3.25 |

|

|

|

2.76 |

|

|

|

3.35 |

|

|

Efficiency ratio

|

|

|

72.32 |

|

|

|

88.75 |

|

|

|

86.01 |

|

|

|

79.35 |

|

|

|

82.81 |

|

|

Bank common equity tier 1 (CETI) ratio

|

|

|

12.40 |

|

|

|

12.56 |

|

|

|

13.10 |

|

|

|

12.40 |

|

|

|

13.10 |

|

|

Bank total risk-based capital ratio

|

|

|

13.49 |

|

|

|

13.57 |

|

|

|

14.08 |

|

|

|

13.49 |

|

|

|

14.08 |

|

(1) Performance ratios are annualized, where appropriate.

* See reconciliation of Non-GAAP Financial Measures later in this release.

| |

2024 Significant Items |

|

|

Loan charge-offs totaled $7.5 million in the second quarter of 2024 as the collectability of previously identified credits continues to deteriorate. |

| • |

First Fed Bank ("First Fed" or "Bank") made progress on restructuring the balance sheet in the second quarter, resulting in an improved yield on earning assets. |

| |

- Sale-leaseback transaction completed in the second quarter, resulting in a $7.9 million gain on sale of premises and equipment. |

| |

- Sold $23.2 million of lower-yielding security investments which resulted in a $2.1 million loss on sale during the second quarter. |

| |

- Purchased $53.3 million of higher-yielding security investments year-to-date. |

| |

- Continued conversion of lower-yielding bank-owned life insurance ("BOLI") with one conversion completed in the first quarter and two additional policy restructures expected to be completed in the third and fourth quarters. |

| |

- Improved earning assets yield by 13 basis points over the prior quarter to 5.55%. |

| • |

Net interest margin was flat compared to the prior quarter at 2.76% after decreasing for the past five quarters. |

| • |

Loan mix shifted away from construction and commercial real estate in the second quarter. The weighted-average rate on new loans was 8.2% at June 30, 2024. |

| • |

Borrowings decreased $68.9 million, or 18.5%, to $302.6 million at June 30, 2024, compared to $371.5 million at March 31, 2024. |

| • |

Repurchased 214,132 shares of Company stock during the first quarter, which closed out the October 2020 Stock Repurchase Plan. |

| • |

New share repurchase plan approved in April 2024 authorizing the repurchase of 10%, or 944,279, of authorized and outstanding shares. |

| • |

Deposit growth of $41.7 million, or 2.5% during the second quarter to $1.71 billion. |

| • |

Estimated insured deposits totaled $1.3 billion, or 76% of total deposits at June 30, 2024. Available liquidity to uninsured deposit coverage remains strong at 1.4x at June 30, 2024. |

| • |

Classified loans increased to 2.3% of total loans at June 30, 2024, compared to 2.1% at December 31, 2023. |

| • |

Nonperforming assets increased $4.2 million during the second quarter mainly due to credit concerns on one commercial construction project, partially offset by loan charge-offs. |

| • |

Provision for credit losses of $8.7 million was taken in the second quarter related to loan charge-offs of substandard lending relationships and a higher provision on Splash program loans. |

| • |

Completed a reduction-in-force impacting 9% of our workforce on July 24, 2024. This action, along year-to-date headcount management through attrition, is expected to result in a reduction in current levels of compensation expense by approximately $1.0 million a quarter starting in the fourth quarter of 2024. |

First Northwest Bancorp (Nasdaq: FNWB) ("First Northwest" or "Company") today reported a net loss of $2.2 million for the second quarter of 2024, compared to net income of $396,000 for the first quarter of 2024 and $1.8 million for the second quarter of 2023. Basic and diluted loss per share were $0.25 for the second quarter of 2024, compared to basic and diluted earnings per share of $0.04 for the first quarter of 2024 and $0.20 for the second quarter of 2023. In the second quarter of 2024, the Company generated a return on average assets of -0.40%, a return on average equity of -5.47% and a return on average tangible common equity* of -5.53%. Loss before provision for income taxes was $2.8 million for the current quarter, compared to income of $843,000 for the preceding quarter, a decrease of $3.6 million, or 428.1%, and decreased $4.9 million compared to income of $2.2 million for the second quarter of 2023.

The Bank recorded commercial construction loan charge-offs totaling $4.0 million and commercial business loan charge-offs of $2.6 million in the second quarter of 2024 as a result of uncertainty in the collectability of the underlying collateral in specific loan relationships. Charge-offs are based on individual loan evaluations and do not represent a universal decline in the collectability of all loans in these categories. The Company continues to work on resolution plans for these loans. Recording these charge-offs had a significant negative impact on net income and was the primary reason for the net loss recorded for the current quarter.

The Bank continued efforts to restructure the balance sheet to improve earnings, which started in the fourth quarter of 2023. The Bank completed a sale-leaseback transaction involving six branch locations in May 2024. The sale of the branches resulted in a $7.9 million gain on sale of premises and equipment recorded during the second quarter of 2024. Monthly rent expense increased $130,000 as a result of the leaseback for an annual estimated increase of $1.6 million, partially offset by a $204,000 annual reduction to depreciation expense.

Investment security purchases during the second quarter of 2024 totaled $7.8 million, carrying an estimated weighted-average yield of 6.7% with a weighted-average life of 3.6 years. The Bank sold $23.2 million of securities with an average yield of 3.1% during the second quarter of 2024. Proceeds of $21.1 million were used to pay down borrowings carrying an average rate of 5.5%.

The fair value hedge on loans, tied to the compounded overnight index swap using the secured overnight financing rate index, established in the first quarter of 2024 added $551,000 to interest income year-to-date. The fair value hedge on loans reduces interest rate risk by reducing liability sensitivity while increasing interest income. We estimate that if rates remain unchanged, this hedge will add $1.4 million of annualized interest income in 2024. The estimated impact will be reduced if the Federal Reserve implements rate cuts during the year. The Bank should maintain a positive carry on its derivative for up to five rate cuts.

The balance sheet restructure plan also includes the surrender of $22.5 million and exchange of $3.5 million of existing BOLI contracts to reinvest in higher yielding products. The first-year revenue increase will be partially offset by taxes on surrender values and charges on exchanged contracts. The first $6.1 million policy earning 2.58% was surrendered during the first quarter and reinvested into a policy earning 5.18%. The remaining surrender transactions are expected to be completed by the end of the fourth quarter of 2024.

Net Interest Income

Total interest income increased $1.3 million to $28.6 million for the second quarter of 2024, compared to $27.3 million in the previous quarter, and increased $3.1 million compared to $25.5 million in the second quarter of 2023. Interest income increased in the current quarter due to higher yields on loans and investments combined with an increased volume in both categories. Interest and fees on loans increased year-over-year as the loan portfolio grew as a result of draws on new and existing lines of credit, originations of commercial real estate, commercial business and home equity loans, and auto and manufactured home loan purchases. Loan yields increased over the prior year due to higher rates on new originations as well as the repricing of variable and adjustable-rate loans tied to the Prime Rate or other indices.

Total interest expense increased $978,000 to $14.4 million for the second quarter of 2024, compared to $13.4 million in the first quarter of 2024, and increased $4.9 million compared to $9.5 million in the second quarter of 2023. Interest expense for the current quarter was higher due to a 4 basis point increase in the cost of deposits to 2.47% for the quarter ended June 30, 2024, from 2.43% for the prior quarter as a result of customers shifting deposit balances into higher paying products. While the cost of deposits continued to rise during the current quarter, it is significantly lower than the 31 basis point increase reported during the first quarter of 2024. The increase over the second quarter of 2023 was the result of a 93 basis point increase in the cost of deposits from 1.54% in the second quarter one year ago. A shift in the deposit mix from transaction and savings accounts to money market accounts and CDs also added to the higher cost of deposits compared to the second quarter of 2023. Higher costs of brokered CDs also contributed to additional deposit costs with a 150 basis point increase to 4.94% for the current quarter compared to 3.44% for the second quarter one year ago.

Net interest income before provision for credit losses for the second quarter of 2024 increased $307,000, or 2.2%, to $14.2 million, compared to $13.9 million for the preceding quarter, and decreased $1.8 million, or 10.9%, from the second quarter one year ago.

The Company recorded an $8.7 million provision for credit losses in the second quarter of 2024, primarily due to charge-offs of commercial construction loans, commercial business loans and the Splash unsecured consumer loan program with a small increase from the estimated pooled loss rates used in the Current Expected Credit Loss model. Decreases attributable to the loss factors applied to home equity lines of credit, commercial real estate and consumer loans at quarter end were offset by increases to the loss factors applied to one-to-four family, commercial business and multi-family loans. Higher loss factors and a moderate increase in commitment balances also resulted in a provision for credit losses on unfunded commitments at quarter end. The current quarter provision compares to a credit loss provision of $970,000 for the preceding quarter and a provision of $300,000 for the second quarter of 2023.

The net interest margin was 2.76% for both the second quarter of 2024 and the prior quarter, decreasing 49 basis points from 3.25% for the second quarter of 2023. The current quarter reflected higher yields received on increased volumes of loans and investments which were offset by an increased cost on a higher volume of borrowings. The decrease in net interest margin from the same quarter one year ago is due to higher funding costs for deposits and borrowed funds. The weighted-average yield on new loan originations was 8.24%, which partially offset the increase in the cost of funds. Organic loan production comprised 60% of new loan commitments for the second quarter with the remaining 40% added through purchases of higher-yielding loans from established third-party relationships. The Bank's fair value hedging agreements on securities and loans added $174,000 and $378,000, respectively, to interest income for the second quarter of 2024.

The yield on average earning assets for the second quarter of 2024 increased 13 basis points to 5.55% compared to the first quarter of 2024 and increased 38 basis points from 5.17% for the second quarter of 2023. The second quarter increase is attributable to higher loan volume and rates at origination and increased yields on variable-rate loans. The yield on investment securities was positively impacted by higher rates and increased volume as a result of the securities restructuring. The year-over-year increase in interest income was primarily due to higher average loan balances augmented by increases in yields on all earning assets, which were positively impacted by the rising rate environment.

The cost of average interest-bearing liabilities increased 14 basis points to 3.28% for the second quarter of 2024, compared to 3.14% for the first quarter of 2024, and increased 95 basis points from 2.33% for the second quarter of 2023. Total cost of funds increased to 2.87% for the second quarter of 2024 from 2.74% in the prior quarter and increased from 1.98% for the second quarter of 2023.

Current quarter increases were due to higher costs on interest-bearing customer deposits due to competitive pressures related to continued higher market rates and migration from lower costing deposits to higher yield money market accounts. The average brokered CDs balance increased $3.6 million from the linked quarter with no change in the average rate paid.

The increase over the same quarter last year was driven by higher rates paid on deposits and borrowings and higher average CD balances. The Company attracted and retained funding through the use of promotional products and a focus on digital account acquisition during 2023. The mix of retail deposit balances shifted from no or low-cost transaction accounts towards higher cost term certificate and higher yield money market and savings products. Retail CDs represented 26.8%, 28.4% and 25.8% of retail deposits at June 30, 2024, March 31, 2024 and June 30, 2023, respectively. Average interest-bearing deposit balances increased $14.1 million, or 1.0%, to $1.41 billion for the second quarter of 2024 compared to the first quarter of 2024 and increased $74.0 million, or 5.6%, compared to $1.33 billion for the second quarter of 2023.

|

Selected Yields

|

|

2Q 24 (Restated)

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Loan yield

|

|

|

5.62 |

% |

|

|

5.51 |

% |

|

|

5.38 |

% |

|

|

5.31 |

% |

|

|

5.38 |

% |

|

Investment securities yield

|

|

|

5.01 |

|

|

|

4.75 |

|

|

|

4.53 |

|

|

|

4.18 |

|

|

|

4.09 |

|

|

Cost of interest-bearing deposits

|

|

|

2.91 |

|

|

|

2.86 |

|

|

|

2.52 |

|

|

|

2.22 |

|

|

|

1.87 |

|

|

Cost of total deposits

|

|

|

2.47 |

|

|

|

2.43 |

|

|

|

2.12 |

|

|

|

1.85 |

|

|

|

1.54 |

|

|

Cost of borrowed funds

|

|

|

4.76 |

|

|

|

4.52 |

|

|

|

4.50 |

|

|

|

4.45 |

|

|

|

4.36 |

|

|

Net interest spread

|

|

|

2.27 |

|

|

|

2.28 |

|

|

|

2.40 |

|

|

|

2.54 |

|

|

|

2.84 |

|

|

Net interest margin

|

|

|

2.76 |

|

|

|

2.76 |

|

|

|

2.84 |

|

|

|

2.97 |

|

|

|

3.25 |

|

Noninterest Income

Noninterest income increased to $7.4 million for the second quarter of 2024 compared to $2.2 million for the first quarter of 2024. A sale-leaseback transaction involving six branch properties was completed in the second quarter of 2024, resulting in a gain on sale of premises and equipment of $7.9 million. The Bank also sold lower-yielding securities which resulted in a recorded loss of $2.1 million in the current quarter. The proceeds from these activities were used to pay down higher-cost borrowings. Income from the gain on sale of loans in the current quarter includes $116,000 from SBA loans.

Noninterest income increased 329.4% from $1.7 million in the same quarter one year ago, primarily due to the sale-leaseback and security sales transactions described above.

|

Noninterest Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Loan and deposit service fees

|

|

$ |

1,076 |

|

|

$ |

1,102 |

|

|

$ |

1,068 |

|

|

|

1,068 |

|

|

$ |

1,064 |

|

|

Sold loan servicing fees and servicing rights mark-to-market

|

|

|

74 |

|

|

|

219 |

|

|

|

276 |

|

|

|

98 |

|

|

|

(191 |

) |

|

Net gain on sale of loans

|

|

|

150 |

|

|

|

52 |

|

|

|

33 |

|

|

|

171 |

|

|

|

58 |

|

|

Net (loss) gain on sale of investment securities

|

|

|

(2,117 |

) |

|

|

— |

|

|

|

(5,397 |

) |

|

|

— |

|

|

|

— |

|

|

Net gain on sale of premises and equipment

|

|

|

7,919 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Increase in cash surrender value of bank-owned life insurance

|

|

|

293 |

|

|

|

243 |

|

|

|

260 |

|

|

|

252 |

|

|

|

190 |

|

|

Other income

|

|

|

(48 |

) |

|

|

572 |

|

|

|

831 |

|

|

|

1,315 |

|

|

|

590 |

|

|

Total noninterest income

|

|

$ |

7,347 |

|

|

$ |

2,188 |

|

|

$ |

(2,929 |

) |

|

$ |

2,904 |

|

|

$ |

1,711 |

|

Noninterest Expense

Noninterest expense totaled $15.6 million for the second quarter of 2024, compared to $14.3 million for the preceding quarter and $15.2 million for the second quarter a year ago. Increases were primarily due to incentive compensation of $436,000, a one-time tax assessment on the sale-leaseback of $359,000 and additional rent expense of $239,000 for the six properties sold in the sale-leaseback transaction. Other expense increased this quarter due to the one-time entry recorded in the first quarter of 2024 of $218,000 reducing the expense accrued for a civil money penalty. Current quarter decreases included a reduction in legal fees of $116,000, auditing services of $52,000 and consulting fees of $58,000.

The increase in total noninterest expenses compared to the second quarter of 2023 is mainly due to higher incentive compensation of $133,000, payroll taxes of $175,000, tax on the sale-leaseback of $359,000 and additional rent of $239,000, partially offset by lower advertising costs of $552,000, legal fees of $149,000 and consulting fees of $124,000. The Company continues to focus on controlling compensation expense and reducing advertising and other discretionary spending while higher market rates and an inverted yield curve persists, which are outside forces actively compressing the net interest margin.

|

Noninterest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Compensation and benefits

|

|

$ |

8,588 |

|

|

$ |

8,128 |

|

|

$ |

7,397 |

|

|

$ |

7,795 |

|

|

$ |

8,180 |

|

|

Data processing

|

|

|

2,008 |

|

|

|

1,944 |

|

|

|

2,107 |

|

|

|

1,945 |

|

|

|

2,080 |

|

|

Occupancy and equipment

|

|

|

1,799 |

|

|

|

1,240 |

|

|

|

1,262 |

|

|

|

1,173 |

|

|

|

1,214 |

|

|

Supplies, postage, and telephone

|

|

|

317 |

|

|

|

293 |

|

|

|

351 |

|

|

|

292 |

|

|

|

435 |

|

|

Regulatory assessments and state taxes

|

|

|

457 |

|

|

|

513 |

|

|

|

376 |

|

|

|

446 |

|

|

|

424 |

|

|

Advertising

|

|

|

377 |

|

|

|

309 |

|

|

|

235 |

|

|

|

501 |

|

|

|

929 |

|

|

Professional fees

|

|

|

684 |

|

|

|

910 |

|

|

|

1,119 |

|

|

|

929 |

|

|

|

884 |

|

|

FDIC insurance premium

|

|

|

473 |

|

|

|

386 |

|

|

|

418 |

|

|

|

369 |

|

|

|

313 |

|

|

Other expense

|

|

|

906 |

|

|

|

580 |

|

|

|

3,725 |

|

|

|

926 |

|

|

|

758 |

|

|

Total noninterest expense

|

|

$ |

15,609 |

|

|

$ |

14,303 |

|

|

$ |

16,990 |

|

|

$ |

14,376 |

|

|

$ |

15,217 |

|

| |

|

|

(Restated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Efficiency ratio

|

|

|

72.32 |

% |

|

|

88.75 |

% |

|

|

150.81 |

% |

|

|

80.52 |

% |

|

|

86.01 |

% |

Investment Securities

Investment securities decreased $19.2 million, or 5.9%, to $306.7 million at June 30, 2024, compared to $326.0 million three months earlier, and decreased $15.3 million compared to $322.0 million at June 30, 2023. The Bank sold $23.2 million of lower-yielding securities and purchased $7.5 million, at higher rates, during the second quarter of 2024. The market value of the portfolio increased $848,000 during the second quarter of 2024 primarily due to changes in portfolio mix. At June 30, 2024, municipal bonds totaled $78.8 million and comprised the largest portion of the investment portfolio at 25.7%. Agency issued mortgage-backed securities ("MBS agency") were the second largest segment, totaling $77.3 million, or 25.2%, of the portfolio at quarter end. Included in MBS non-agency are $29.8 million of commercial mortgaged-backed securities ("CMBS"), of which 89.8% are in "A" tranches and the remaining 10.2% are in "B" tranches. Our largest exposure in the CMBS portfolio is to long-term care facilities, which comprises 65.2%, or $19.4 million, of our private label CMBS securities. All of the CMBS bonds have credit enhancements ranging from 28.8% to 99.8%, with a weighted-average credit enhancement of 55.2%, that further reduces the risk of loss on these investments.

The estimated average life of the securities portfolio was approximately 7.8 years at the current quarter end, the prior quarter and the second quarter of 2023. The effective duration of the portfolio was approximately 4.3 years at June 30, 2024, compared to 4.4 years in the prior quarter and 5.2 years at the end of the second quarter of 2023. Our recent investments have primarily been floating rate securities to take advantage of higher short-term rates above those offered on cash and to reduce our liability sensitivity.

|

Investment Securities Available for Sale, at Fair Value

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Municipal bonds

|

|

$ |

78,825 |

|

|

$ |

87,004 |

|

|

$ |

87,761 |

|

|

$ |

93,995 |

|

|

$ |

100,503 |

|

|

U.S. Treasury notes

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,377 |

|

|

|

2,364 |

|

|

International agency issued bonds (Agency bonds)

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,703 |

|

|

|

1,717 |

|

|

U.S. government agency issued asset-backed securities (ABS agency)

|

|

|

13,982 |

|

|

|

14,822 |

|

|

|

11,782 |

|

|

|

— |

|

|

|

— |

|

|

Corporate issued asset-backed securities (ABS corporate)

|

|

|

16,483 |

|

|

|

13,929 |

|

|

|

5,286 |

|

|

|

— |

|

|

|

— |

|

|

Corporate issued debt securities (Corporate debt):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior positions

|

|

|

9,066 |

|

|

|

13,617 |

|

|

|

9,270 |

|

|

|

16,975 |

|

|

|

16,934 |

|

|

Subordinated bank notes

|

|

|

43,826 |

|

|

|

39,414 |

|

|

|

42,184 |

|

|

|

37,360 |

|

|

|

36,740 |

|

|

U.S. Small Business Administration securities (SBA)

|

|

|

9,772 |

|

|

|

7,911 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Mortgage-backed securities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. government agency issued mortgage-backed securities (MBS agency)

|

|

|

77,301 |

|

|

|

83,271 |

|

|

|

63,247 |

|

|

|

66,946 |

|

|

|

71,565 |

|

|

Non-agency issued mortgage-backed securities (MBS non-agency)

|

|

|

57,459 |

|

|

|

65,987 |

|

|

|

76,093 |

|

|

|

89,968 |

|

|

|

92,140 |

|

|

Total securities available for sale, at fair value

|

|

$ |

306,714 |

|

|

$ |

325,955 |

|

|

$ |

295,623 |

|

|

$ |

309,324 |

|

|

$ |

321,963 |

|

Loans and Unfunded Loan Commitments

Net loans, excluding loans held for sale, decreased $15.0 million, or 0.9%, to $1.68 billion at June 30, 2024, from $1.69 billion at March 31, 2024, and increased $56.9 million, or 3.5%, from $1.62 billion one year ago.

Auto and other consumer loans increased $16.8 million during the current quarter with $12.7 million of new Woodside auto loan purchases, $9.9 million of First Help auto loan purchases and Triad manufactured home loan purchases totaling $8.1 million, partially offset by payments. Multi-family loans increased $10.5 million during the current quarter. The increase was primarily the result of $12.7 million of construction loans converting into permanent amortizing loans, partially offset by scheduled payments. One-to-four family loans increased $6.0 million during the current quarter as a result of $12.0 million in residential construction loans that converted to permanent amortizing loans, partially offset by payments. Home equity loans increased $222,000 over the previous quarter due to organic home equity loan production of $2.1 million and draws on new and existing commitments offset by payments.

Commercial business loans decreased $19.2 million, primarily attributable to payment activity and a $5.8 million decrease in our Northpointe Bank Mortgage Purchase Program participation and year-to-date charge-offs totaling $2.7 million, which were partially offset by organic originations totaling $6.9 million and draws on existing lines of credit of $3.3 million. Construction loans decreased $18.1 million during the quarter, with $25.4 million converting into fully amortizing loans and year-to-date charge-offs totaling $4.0 million, partially offset by increases from draws on new and existing loans. New single-family residence construction loan commitments totaled $2.7 million in the second quarter, compared to $1.9 million in the preceding quarter. Commercial real estate loans decreased $9.6 million during the current quarter compared to the previous quarter as payoffs and scheduled payments exceeded originations of $4.5 million.

The Company originated $5.0 million in residential mortgages during the second quarter of 2023 and sold $4.9 million, with an average gross margin on sale of mortgage loans of approximately 2.05%. This production compares to residential mortgage originations of $5.0 million in the preceding quarter with sales of $5.2 million, and an average gross margin of 2.16%. Single-family home inventory remains historically low and higher market rates on mortgage loans continue to limit saleable mortgage loan production.

|

Loans by Collateral and Unfunded Commitments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

2Q 24 (Restated)

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

One-to-four family construction

|

|

$ |

49,440 |

|

|

$ |

70,100 |

|

|

$ |

60,211 |

|

|

$ |

72,991 |

|

|

$ |

74,787 |

|

|

All other construction and land

|

|

|

58,346 |

|

|

|

55,286 |

|

|

|

69,484 |

|

|

|

71,092 |

|

|

|

81,968 |

|

|

One-to-four family first mortgage

|

|

|

434,840 |

|

|

|

436,543 |

|

|

|

426,159 |

|

|

|

409,207 |

|

|

|

428,879 |

|

|

One-to-four family junior liens

|

|

|

13,706 |

|

|

|

12,608 |

|

|

|

12,250 |

|

|

|

12,859 |

|

|

|

11,956 |

|

|

One-to-four family revolving open-end

|

|

|

44,803 |

|

|

|

45,536 |

|

|

|

42,479 |

|

|

|

38,413 |

|

|

|

33,658 |

|

|

Commercial real estate, owner occupied:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Health care

|

|

|

29,678 |

|

|

|

29,946 |

|

|

|

22,523 |

|

|

|

22,677 |

|

|

|

23,157 |

|

|

Office

|

|

|

19,215 |

|

|

|

17,951 |

|

|

|

18,468 |

|

|

|

18,599 |

|

|

|

18,797 |

|

|

Warehouse

|

|

|

14,613 |

|

|

|

14,683 |

|

|

|

14,758 |

|

|

|

14,890 |

|

|

|

15,158 |

|

|

Other

|

|

|

56,292 |

|

|

|

55,063 |

|

|

|

61,304 |

|

|

|

57,414 |

|

|

|

60,054 |

|

|

Commercial real estate, non-owner occupied:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Office

|

|

|

50,158 |

|

|

|

53,099 |

|

|

|

53,548 |

|

|

|

53,879 |

|

|

|

54,926 |

|

|

Retail

|

|

|

50,101 |

|

|

|

50,478 |

|

|

|

51,384 |

|

|

|

51,466 |

|

|

|

51,824 |

|

|

Hospitality

|

|

|

62,628 |

|

|

|

66,982 |

|

|

|

67,332 |

|

|

|

61,339 |

|

|

|

53,416 |

|

|

Other

|

|

|

84,428 |

|

|

|

93,040 |

|

|

|

94,822 |

|

|

|

96,083 |

|

|

|

90,870 |

|

|

Multi-family residential

|

|

|

350,382 |

|

|

|

339,907 |

|

|

|

333,428 |

|

|

|

325,338 |

|

|

|

296,398 |

|

|

Commercial business loans

|

|

|

79,055 |

|

|

|

90,781 |

|

|

|

76,920 |

|

|

|

75,068 |

|

|

|

80,079 |

|

|

Commercial agriculture and fishing loans

|

|

|

14,411 |

|

|

|

10,200 |

|

|

|

5,422 |

|

|

|

4,437 |

|

|

|

7,844 |

|

|

State and political subdivision obligations

|

|

|

405 |

|

|

|

405 |

|

|

|

405 |

|

|

|

439 |

|

|

|

439 |

|

|

Consumer automobile loans

|

|

|

151,121 |

|

|

|

139,524 |

|

|

|

132,877 |

|

|

|

134,695 |

|

|

|

137,860 |

|

|

Consumer loans secured by other assets

|

|

|

129,293 |

|

|

|

122,895 |

|

|

|

108,542 |

|

|

|

104,999 |

|

|

|

105,653 |

|

|

Consumer loans unsecured

|

|

|

5,209 |

|

|

|

6,415 |

|

|

|

7,712 |

|

|

|

9,093 |

|

|

|

10,437 |

|

|

Total loans

|

|

$ |

1,698,124 |

|

|

$ |

1,711,442 |

|

|

$ |

1,660,028 |

|

|

$ |

1,634,978 |

|

|

$ |

1,638,160 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unfunded commitments under lines of credit or existing loans

|

|

$ |

155,005 |

|

|

$ |

148,736 |

|

|

$ |

149,631 |

|

|

$ |

154,722 |

|

|

$ |

168,668 |

|

Deposits

Total deposits increased $41.7 million to $1.71 billion at June 30, 2024, compared to $1.67 billion at March 31, 2024, and increased $55.2 million, or 3.3%, compared to $1.65 billion one year ago. During second quarter of 2024, total retail customer deposit balances increased $10.2 million and brokered deposit balances increased $31.5 million. Compared to the preceding quarter, there were balance increases in brokered CDs of $31.5 million, business demand accounts of $20.9 million, business money market accounts of $18.3 million and consumer money market accounts of $9.3 million. These increases were partially offset by decreases in consumer CDs of $18.1 million, consumer savings accounts of $7.8 million, consumer demand accounts of $5.6 million, business savings accounts of $4.2 million, business CDs of $2.0 million, and public fund CDs of $664,000, during the second quarter of 2024. Increases in demand and money market accounts were driven by customer behavior as they sought out higher rates offered as CD specials matured. Overall, the current rate environment continues to contribute to greater competition for deposits with additional deposit rate specials offered to attract new funds.

The Company estimates that $328.4 million, or 24%, of total deposit balances were uninsured at June 30, 2024. Approximately $272.7 million, or 16%, of total deposits were uninsured business and consumer deposits with the remaining $134.1 million, or 8%, consisting of uninsured public funds at June 30, 2024. Uninsured public fund balances were fully collateralized. The Bank holds an FHLB standby letter of credit as part of our participation in the Washington Public Deposit Protection Commission program which covered $116.6 million of related deposit balances while the remaining $17.5 million was fully covered through pledged securities at June 30, 2024.

As of June 30, 2024, consumer deposits made up 57% of total deposits with an average balance of $23,000 per account, business deposits made up 22% of total deposits with an average balance of $53,000 per account, public fund deposits made up 8% of total deposits with an average balance of $1.6 million per account and the remaining 13% of account balances are brokered CDs. We have maintained the majority of our public fund relationships for over 10 years. Approximately 68% of our customer base is located in rural areas, with 19% in urban areas and the remaining 13% are brokered deposits as of June 30, 2024.

|

Deposits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in thousands

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Noninterest-bearing demand deposits

|

|

$ |

276,543 |

|

|

$ |

252,083 |

|

|

$ |

269,800 |

|

|

$ |

280,475 |

|

|

$ |

292,119 |

|

|

Interest-bearing demand deposits

|

|

|

162,201 |

|

|

|

169,418 |

|

|

|

182,361 |

|

|

|

179,029 |

|

|

|

189,187 |

|

|

Money market accounts

|

|

|

423,047 |

|

|

|

362,205 |

|

|

|

372,706 |

|

|

|

374,269 |

|

|

|

402,760 |

|

|

Savings accounts

|

|

|

224,631 |

|

|

|

242,148 |

|

|

|

253,182 |

|

|

|

260,279 |

|

|

|

242,117 |

|

|

Certificates of deposit, retail

|

|

|

398,161 |

|

|

|

443,412 |

|

|

|

410,136 |

|

|

|

379,484 |

|

|

|

333,510 |

|

|

Total retail deposits

|

|

|

1,484,583 |

|

|

|

1,469,266 |

|

|

|

1,488,185 |

|

|

|

1,473,536 |

|

|

|

1,459,693 |

|

|

Certificates of deposit, brokered

|

|

|

223,705 |

|

|

|

207,626 |

|

|

|

169,577 |

|

|

|

179,586 |

|

|

|

134,515 |

|

|

Total deposits

|

|

$ |

1,708,288 |

|

|

$ |

1,676,892 |

|

|

$ |

1,657,762 |

|

|

$ |

1,653,122 |

|

|

$ |

1,594,208 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public fund and tribal deposits included in total deposits

|

|

$ |

138,439 |

|

|

$ |

132,652 |

|

|

$ |

128,627 |

|

|

$ |

130,974 |

|

|

$ |

119,969 |

|

|

Total loans to total deposits

|

|

|

99 |

% |

|

|

102 |

% |

|

|

100 |

% |

|

|

99 |

% |

|

|

103 |

% |

|

Deposit Mix

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Noninterest-bearing demand deposits

|

|

|

16.2 |

% |

|

|

15.0 |

% |

|

|

16.3 |

% |

|

|

17.0 |

% |

|

|

18.3 |

% |

|

Interest-bearing demand deposits

|

|

|

9.5 |

|

|

|

10.1 |

|

|

|

11.0 |

|

|

|

10.8 |

|

|

|

11.9 |

|

|

Money market accounts

|

|

|

24.8 |

|

|

|

21.6 |

|

|

|

22.5 |

|

|

|

22.6 |

|

|

|

25.3 |

|

|

Savings accounts

|

|

|

13.1 |

|

|

|

14.4 |

|

|

|

15.3 |

|

|

|

15.7 |

|

|

|

15.2 |

|

|

Certificates of deposit, retail

|

|

|

23.3 |

|

|

|

26.5 |

|

|

|

24.7 |

|

|

|

23.0 |

|

|

|

20.9 |

|

|

Certificates of deposit, brokered

|

|

|

13.1 |

|

|

|

12.4 |

|

|

|

10.2 |

|

|

|

10.9 |

|

|

|

8.4 |

|

|

Cost of Deposits for the Quarter Ended

|

|

2Q 24

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Interest-bearing demand deposits

|

|

|

0.47 |

% |

|

|

0.45 |

% |

|

|

0.45 |

% |

|

|

0.46 |

% |

|

|

0.45 |

% |

|

Money market accounts

|

|

|

2.40 |

|

|

|

2.08 |

|

|

|

1.48 |

|

|

|

1.22 |

|

|

|

0.99 |

|

|

Savings accounts

|

|

|

1.62 |

|

|

|

1.63 |

|

|

|

1.54 |

|

|

|

1.42 |

|

|

|

1.22 |

|

|

Certificates of deposit, retail

|

|

|

4.10 |

|

|

|

4.13 |

|

|

|

3.92 |

|

|

|

3.52 |

|

|

|

3.25 |

|

|

Certificates of deposit, brokered

|

|

|

4.94 |

|

|

|

4.94 |

|

|

|

4.72 |

|

|

|

4.31 |

|

|

|

3.44 |

|

|

Cost of total deposits

|

|

|

2.47 |

|

|

|

2.43 |

|

|

|

2.12 |

|

|

|

1.85 |

|

|

|

1.54 |

|

Asset Quality

The allowance for credit losses on loans ("ACLL") increased $1.3 million from $18.0 million at March 31, 2024, to $19.3 million at June 30, 2024. The ACLL as a percentage of total loans was 1.14% at June 30, 2024, increasing from 1.05% at March 31, 2024, and from 1.06% one year earlier. The current quarter increase can be attributed to reserves taken on individually evaluated loans and an increase to the loss factors applied as a result of the current economic forecast.

Nonperforming loans totaled $23.6 million at June 30, 2024, an increase of $4.2 million from March 31, 2024, primarily attributable to a $8.1 million commercial construction loan placed on nonaccrual due to credit concerns during the current quarter, a $733,000 increase to a commercial construction relationship previously placed on nonaccrual, a $535,000 delinquent purchased one-to-four family loan and three delinquent auto loans totaling $406,000. Additions were offset by charge-offs totaling $4.9 million on loans previously placed on nonaccrual. The percentage of the allowance for credit losses on loans to nonperforming loans decreased to 82% at June 30, 2024, from 92% at March 31, 2024, and from 677% at June 30, 2023. This ratio continues to decline as higher balances of real estate loans are included in nonperforming assets with no significant corresponding increase to the ACLL as these loans are considered adequately collateralized.

Classified loans increased $3.6 million to $39.8 million at June 30, 2024, due to the downgrade of the loans placed on nonaccrual during the second quarter, partially offset by the same loan charge-offs noted above. An $11.2 million construction loan relationship, which became a classified loan in the fourth quarter of 2022; a $9.1 million commercial loan relationship which became classified in the fourth quarter of 2023; and the $8.1 million commercial construction loan relationship which became classified in the current quarter, account for 71% of the classified loan balance at June 30, 2024. The Bank has exercised legal remedies, including the appointment of a third-party receivership and foreclosure actions, to liquidate the underlying collateral to satisfy the real estate loans in two of the three collateral dependent relationships.

|

$ in thousands

|

|

2Q 24 (Restated)

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Allowance for credit losses on loans to total loans

|

|

|

1.14 |

% |

|

|

1.05 |

% |

|

|

1.05 |

% |

|

|

1.04 |

% |

|

|

1.06 |

% |

|

Allowance for credit losses on loans to nonaccrual loans

|

|

|

82 |

|

|

|

92 |

|

|

|

94 |

|

|

|

714 |

|

|

|

677 |

|

|

Nonaccrual loans to total loans

|

|

|

1.39 |

|

|

|

1.14 |

|

|

|

1.12 |

|

|

|

0.15 |

|

|

|

0.16 |

|

|

Net charge-off ratio (annualized)

|

|

|

1.70 |

|

|

|

0.19 |

|

|

|

0.14 |

|

|

|

0.30 |

|

|

|

0.10 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total nonaccrual loans

|

|

$ |

23,631 |

|

|

$ |

19,481 |

|

|

$ |

18,644 |

|

|

$ |

2,374 |

|

|

$ |

2,554 |

|

|

Reserve for unfunded commitments

|

|

$ |

647 |

|

|

$ |

548 |

|

|

$ |

817 |

|

|

$ |

828 |

|

|

$ |

1,336 |

|

Capital

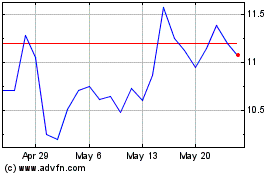

Total shareholders’ equity decreased to $158.9 million at June 30, 2024, compared to $160.5 million three months earlier, due to the $2.2 million net loss and dividends declared of $662,000, partially offset by an increase in the after-tax fair market values of the available-for-sale investment securities portfolio and derivatives of $666,000 and $173,000, respectively.

Book value per common share was $16.81 at June 30, 2024, compared to $17.00 at March 31, 2024, and $16.56 at June 30, 2023. Tangible book value per common share* was $16.64 at June 30, 2024, compared to $16.83 at March 31, 2024, and $16.39 at June 30, 2023.

Capital levels for both the Company and its operating bank, First Fed, remain in excess of applicable regulatory requirements and the Bank was categorized as "well-capitalized" at June 30, 2024. Common Equity Tier 1 and Total Risk-Based Capital Ratios at June 30, 2024, were 12.4% and 13.5%, respectively.

| |

|

2Q 24 (Restated)

|

|

|

1Q 24

|

|

|

4Q 23

|

|

|

3Q 23

|

|

|

2Q 23

|

|

|

Equity to total assets

|

|

|

7.17 |

% |

|

|

7.17 |

% |

|

|

7.42 |

% |

|

|

7.25 |

% |

|

|

7.38 |

% |

|

Tangible common equity to tangible assets *

|

|

|

7.10 |

|

|

|

7.10 |

|

|

|

7.35 |

|

|

|

7.17 |

|

|

|

7.31 |

|

|

Capital ratios (First Fed Bank):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 leverage

|

|

|

9.38 |

|

|

|

9.74 |

|

|

|

9.90 |

|

|

|

10.12 |

|

|

|

10.16 |

|

|

Common equity Tier 1 capital

|

|

|

12.40 |

|

|

|

12.56 |

|

|

|

13.12 |

|

|

|

13.43 |

|

|

|

13.10 |

|

|

Tier 1 risk-based

|

|

|

12.40 |

|

|

|

12.56 |

|

|

|

13.12 |

|

|

|

13.43 |

|

|

|

13.10 |

|

|

Total risk-based

|

|

|

13.49 |

|

|

|

13.57 |

|

|

|

14.11 |

|

|

|

14.38 |

|

|

|

14.08 |

|

Additional Initiatives

First Northwest approved a new share repurchase plan in an ongoing effort return capital to our shareholders in the second quarter of 2024. The Company's Board of Directors authorized the repurchase of 944,279 shares through such new share repurchase plan ("April 2024 Stock Repurchase Plan"). Cash dividends totaling $670,000 were paid in the second quarter of 2024.

* See reconciliation of Non-GAAP Financial Measures later in this release.

Awards/Recognition

The Company received several accolades as a leader in the community in the last year.

|

|

In October 2023, the First Fed team was honored to bring home the Gold for Best Bank in the Best of the Northwest survey hosted by Bellingham Alive for the second year in a row. |

|

|

In September 2023, the First Fed team was recognized in the 2023 Best of Olympic Peninsula surveys, winning Best Bank and Best Financial Advisor in Clallam County. First Fed was also a finalist for Best Bank in Jefferson County, Best Employer in Kitsap County and Best Bank and Best Financial Institution in Bainbridge. |

|

|

In June 2023, First Fed was named on the Puget Sound Business Journal’s Best Workplaces list. First Fed has been recognized as one the top 100 workplaces in Washington, as voted for two years in row by each company’s own employees. |

|

|

In May 2023, First Fed was recognized as a Top Corporate Citizen by the Puget Sound Business Journal. The Corporate Citizenship Awards honors local corporate philanthropists and companies making significant contributions in the region. The top 25 small, medium and large-sized companies were recognized in addition to nine other honorees last year. First Fed was ranked #1 in the medium-sized company category in 2023 and was ranked #3 in the same category in 2022. |

About the Company

First Northwest Bancorp (Nasdaq: FNWB) is a financial holding company engaged in investment activities including the business of its subsidiary, First Fed Bank. First Fed is a Pacific Northwest-based financial institution which has served its customers and communities since 1923. Currently First Fed has 16 locations in Washington state including 12 full-service branches. First Fed’s business and operating strategy is focused on building sustainable earnings by delivering a full array of financial products and services for individuals, small businesses, non-profit organizations and commercial customers. In 2022, First Northwest made an investment in The Meriwether Group, LLC, a boutique investment banking and accelerator firm. Additionally, First Northwest focuses on strategic partnerships to provide modern financial services such as digital payments and marketplace lending. First Northwest Bancorp was incorporated in 2012 and completed its initial public offering in 2015 under the ticker symbol FNWB. The Company is headquartered in Port Angeles, Washington.

Forward-Looking Statements

Certain matters discussed in this press release may contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to, among other things, expectations of the business environment in which we operate, projections of future performance, perceived opportunities in the market, potential future credit experience, and statements regarding our mission and vision, and include, but are not limited to, statements about our plans, objectives, expectations and intentions that are not historical facts, and other statements often identified by words such as "believes," "expects," "anticipates," "estimates," or similar expressions. These forward-looking statements are based upon current management beliefs and expectations and may, therefore, involve risks and uncertainties, many of which are beyond our control. Our actual results, performance, or achievements may differ materially from those suggested, expressed, or implied by forward-looking statements as a result of a wide variety of factors including, but not limited to: increased competitive pressures; changes in the interest rate environment; the credit risks of lending activities; pressures on liquidity, including as a result of withdrawals of deposits or declines in the value of our investment portfolio; changes in general economic conditions and conditions within the securities markets; legislative and regulatory changes; and other factors described in the Company’s latest Annual Report on Form 10-K under the section entitled "Risk Factors," and other filings with the Securities and Exchange Commission ("SEC"),which are available on our website at www.ourfirstfed.com and on the SEC’s website at www.sec.gov.

Any of the forward-looking statements that we make in this press release and in the other public statements we make may turn out to be incorrect because of the inaccurate assumptions we might make, because of the factors illustrated above or because of other factors that we cannot foresee. Because of these and other uncertainties, our actual future results may be materially different from those expressed or implied in any forward-looking statements made by or on our behalf and the Company's operating and stock price performance may be negatively affected. Therefore, these factors should be considered in evaluating the forward-looking statements, and undue reliance should not be placed on such statements. We do not undertake and specifically disclaim any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results for 2024 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us and could negatively affect the Company’s operations and stock price performance.

For More Information Contact:

Matthew P. Deines, President and Chief Executive Officer

Geri Bullard, EVP, Chief Financial Officer and Chief Operating Officer

IRGroup@ourfirstfed.com

360-457-0461

FIRST NORTHWEST BANCORP AND SUBSIDIARY

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands, except share data) (Unaudited)

| |

|

June 30, 2024

|

|

|

March 31, 2024

|

|

|

June 30, 2023

|

|

|