0001321741FALSEGLADSTONE INVESTMENT CORPORATIONDE00013217412024-08-052024-08-050001321741us-gaap:CommonStockMember2024-08-052024-08-050001321741gain:A500NotesDue2026Member2024-08-052024-08-050001321741gain:A4875NotesDue2028Member2024-08-052024-08-050001321741gain:A800NotesDue2028Member2024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 5, 2024

Gladstone Investment Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

Delaware | 814-00704 | 83-0423116 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

1521 Westbranch Drive, Suite 100 McLean, Virginia | 22102 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (703) 287-5800

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 par value per share | | GAIN | | The Nasdaq Stock Market LLC |

| 5.00% Notes due 2026 | | GAINN | | The Nasdaq Stock Market LLC |

| 4.875% Notes due 2028 | | GAINZ | | The Nasdaq Stock Market LLC |

| 8.00% Notes due 2028 | | GAINL | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 5, 2024, Gladstone Investment Corporation issued a press release announcing its financial results for its first fiscal quarter ended June 30, 2024. The text of the press release is included as an exhibit to this Current Report on Form 8-K. The information in this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Gladstone Investment Corporation (Registrant) |

| | |

August 5, 2024 | | |

| By: | /s/ Rachael Easton |

| | Rachael Easton |

| | Chief Financial Officer and Treasurer |

Gladstone Investment Corporation Reports Financial Results for its

First Quarter Ended June 30, 2024

MCLEAN, VA, August 5, 2024: Gladstone Investment Corporation (Nasdaq:GAIN) (the "Company") today announced earnings for its first fiscal quarter ended June 30, 2024. Please read the Company's Quarterly Report on Form 10-Q, filed today with the U.S. Securities and Exchange Commission (the "SEC"), which is available on the SEC's website at www.sec.gov or the investors section of the Company's website at www.gladstoneinvestment.com.

Summary Information: (dollars in thousands, except per share data (unaudited)):

| | | | | | | | | | | | | | | | | | | | | | | |

| June 30,

2024 | | March 31,

2024 | | $

Change | | %

Change |

| For the quarter ended: | | | | | | | |

| Total investment income | $ | 22,178 | | | $ | 23,648 | | | $ | (1,470) | | | (6.2) | % |

Total expenses, net(A) | 9,764 | | | 18,325 | | | (8,561) | | | (46.7) | % |

Net investment income(A) | 12,414 | | | 5,323 | | | 7,091 | | | 133.2 | % |

Net realized gain | 2 | | | (14,650) | | | 14,652 | | | NM |

Net unrealized (depreciation) appreciation | (18,942) | | | 31,911 | | | (50,853) | | | NM |

Net (decrease) increase in net assets resulting from operations(A) | $ | (6,526) | | | $ | 22,584 | | | $ | (29,110) | | | NM |

Net investment income per weighted-average common share(A) | $ | 0.34 | | | $ | 0.15 | | | $ | 0.19 | | | 126.7 | % |

Adjusted net investment income per weighted-average common share(B) | $ | 0.24 | | | $ | 0.24 | | | $ | — | | | — | % |

Net (decrease) increase in net assets resulting from operations per weighted-average common share(A) | $ | (0.18) | | | $ | 0.63 | | | $ | (0.81) | | | NM |

| Cash distribution per common share from net investment income | $ | 0.24 | | | $ | 0.24 | | | $ | — | | | — | % |

| | | | | | | |

Weighted-average yield on interest-bearing investments | 14.5 | % | | 14.3 | % | | 0.2 | % | | 1.4 | % |

Total dollars invested | $ | 598 | | | $ | 936 | | | $ | (338) | | | (36.1) | % |

Total dollars repaid and collected from sales and recapitalization of investments | $ | 3,024 | | | $ | 500 | | | $ | 2,524 | | | 504.8 | % |

| Weighted-average shares of common stock outstanding - basic and diluted | 36,688,667 | | | 36,114,984 | | | 573,683 | | | 1.6 | % |

| Total shares of common stock outstanding | 36,688,667 | | | 36,688,667 | | | — | | | — | % |

| | | | | | | |

As of: | | | | | | | |

Total investments, at fair value | $ | 899,138 | | | $ | 920,504 | | | $ | (21,366) | | | (2.3) | % |

Fair value, as a percent of cost | 105.5 | % | | 107.8 | % | | (2.3) | % | | (2.1) | % |

Net assets | $ | 477,380 | | | $ | 492,711 | | | $ | (15,331) | | | (3.1) | % |

Net asset value per common share | $ | 13.01 | | | $ | 13.43 | | | $ | (0.42) | | | (3.1) | % |

Number of portfolio companies | 23 | | | 24 | | | (1) | | | (4.2) | % |

NM = Not Meaningful

(A)Inclusive of $3.8 million, or $0.10 per weighted-average common share, of capital gains-based incentive fees reversed during the three months ended June 30, 2024 and $3.5 million, or $0.09 per weighted-average common share, of capital gains-based incentive fees accrued during the three months ended March 31, 2024, respectively. These fees were (reversed)/accrued in accordance with United States generally accepted accounting principles (“U.S. GAAP”), where such amounts were not contractually due under the terms of the investment advisory agreement for the respective periods. Also see discussion under Non-GAAP Financial Measure – Adjusted Net Investment Income below.

(B)See Non-GAAP Financial Measure - Adjusted Net Investment Income, below, for a description of this non-GAAP measure and a reconciliation from Net investment income to Adjusted net investment income, including on a weighted-average per share basis. The Company uses this non-GAAP financial measure internally in analyzing financial results and believes it is useful to investors as an additional tool to evaluate ongoing results and trends for the Company.

Highlights for the Quarter: During the quarter ended June 30, 2024, the following significant events occurred:

•Portfolio Activity:

◦In May 2024, our remaining shares in Funko Acquisition Holdings, LLC (“Funko”) were sold, representing an exit of our investment in Funko, and resulting in a return of our equity cost basis of $21 thousand and a realized gain of $2 thousand.

•Distributions and Dividends:

◦Paid an $0.08 per common share distribution to common stockholders in each of April, May and June 2024.

First Quarter Results: Net investment income for the quarter ended June 30, 2024 was $12.4 million, or $0.34 per weighted-average common share, compared to net investment income of $5.3 million, or $0.15 per weighted-average common share, for the quarter ended March 31, 2024. This increase was a result of a decrease in total expenses, net of credits, primarily due to a decrease in accruals for capital gains-based incentive fees, partially offset by a decrease in total investment income in the current quarter.

Total investment income for the quarters ended June 30, 2024 and March 31, 2024 was $22.2 million and $23.6 million, respectively. The decrease quarter over quarter was due to a $0.8 million decrease in interest income, primarily due to certain loans to portfolio companies being placed on non-accrual status during the current quarter, as well as a $0.7 million decrease in success fee income, the timing of which can be variable.

Total expenses, net of credits, for the quarters ended June 30, 2024 and March 31, 2024 was $9.8 million and $18.3 million, respectively. The decrease quarter over quarter was primarily due to a $7.2 million decrease in accruals for the capital gains-based incentive fees in the current quarter, as a result of the net impact of realized and unrealized gains and losses, and a $2.2 million decrease in income incentive fees. These decreases were partially offset by a $1.0 million increase in other expenses, primarily due to an increase in bad debt expense.

Net asset value per common share as of June 30, 2024 was $13.01, compared to $13.43 as of March 31, 2024. The decrease quarter over quarter was primarily due to $18.9 million, or $0.52 per common share, of net unrealized depreciation on investments, and $8.8 million, or $0.24 per common share, of distributions paid to common shareholders, partially offset by $12.4 million, or $0.34 per common share, of net investment income.

Subsequent Events: After June 30, 2024, the following significant events occurred:

•Distributions and Dividends: In July 2024, our Board of Directors declared the following monthly and supplemental distributions to common stockholders.

| | | | | | | | | | | | | | | |

Record Date | | Payment Date | | Distribution per Common Share | |

| July 22, 2024 | | July 31, 2024 | | $ | 0.08 | | |

| August 21, 2024 | | August 30, 2024 | | 0.08 | | |

| September 20, 2024 | | September 30, 2024 | | 0.08 | | |

| | Total for the Quarter: | | $ | 0.24 | | |

•Significant Investment Activity:

◦In July 2024, we invested an additional $18.5 million through secured first lien debt in Nocturne Luxury Villas, Inc. to fund an add-on acquisition.

Non-GAAP Financial Measure - Adjusted Net Investment Income: On a supplemental basis, the Company discloses Adjusted net investment income, including on a weighted-average per share basis, which is a financial measure that is calculated and presented on a basis of methodology other than in accordance with GAAP. Adjusted net investment income represents net investment income, excluding capital gains-based incentive fees. The Company uses this non-GAAP financial measure internally in analyzing financial results and believes that this non-GAAP financial measure is useful to investors as an additional tool to evaluate ongoing results and trends for the Company. The Company's investment advisory agreement provides that a capital gains-based incentive fee is determined and paid annually with respect to realized capital gains (but not unrealized appreciation) to the extent such realized capital gains exceed realized capital losses and unrealized depreciation on investments for such year. However, under GAAP, a capital gains-based incentive fee is accrued if realized capital gains and unrealized appreciation of investments exceed realized capital losses and unrealized depreciation of investments. Refer to Note 4 - Related Party Transactions in our Quarterly Report on Form 10-Q for further discussion. The Company believes that Adjusted net investment income is a useful indicator of operations exclusive of any capital gains-based incentive fees, as net investment income does not include realized or unrealized investment activity associated with the capital gains-based incentive fee.

The following table provides a reconciliation of net investment income (the most comparable GAAP measure) to Adjusted net investment income for the periods presented (dollars in thousands, except per share amounts; unaudited):

| | | | | | | | | | | | | | | | | | | | | | | |

| For the quarter ended |

| June 30, 2024 | | March 31, 2024 |

| Amount | | Per Share Amount | | Amount | | Per Share Amount |

Net investment income | $ | 12,414 | | | $ | 0.34 | | | $ | 5,323 | | | $ | 0.15 | |

Capital gains-based incentive fee | (3,788) | | | (0.10) | | | 3,452 | | | 0.09 | |

Adjusted net investment income | $ | 8,626 | | | $ | 0.24 | | | $ | 8,775 | | | $ | 0.24 | |

| Weighted-average shares of common stock outstanding - basic and diluted | | | 36,688,667 | | | | 36,114,984 |

Adjusted net investment income may not be comparable to similar measures presented by other companies, as it is a non-GAAP financial measure that is not based on a comprehensive set of accounting rules or principles and therefore may be defined differently by other companies. In addition, Adjusted net investment income should be considered in addition to, not as a substitute for, or superior to, financial measures determined in accordance with GAAP.

Conference Call: The Company will hold its earnings release conference call on Tuesday, August 6, 2024, at 8:30 a.m. Eastern Time. Please call (866) 424-3437 to enter the conference call. An operator will monitor the call and set a queue for any questions. A replay of the conference call will be available through August 13, 2024. To hear the replay, please dial (877) 660-6853 and use the playback conference number 13746755. The replay will be available beginning approximately one hour after the call concludes. The live audio broadcast of the Company's quarterly conference call will also be available online at www.gladstoneinvestment.com. The event will be archived and available for replay on the Company's website.

About Gladstone Investment Corporation: Gladstone Investment Corporation is a publicly traded business development company that seeks to make secured debt and equity investments in lower middle market businesses in the United States in connection with acquisitions, changes in control and recapitalizations. Information on the business activities of all the Gladstone funds can be found at www.gladstonecompanies.com.

To obtain a paper copy of our Quarterly Report on Form 10-Q, filed today with the SEC, please contact the Company at 1521 Westbranch Drive, Suite 100, McLean, VA 22102, ATTN: Investor Relations. The financial information above is not comprehensive and is without notes, so readers should obtain and carefully review the Company's Form 10-Q for the quarter ended June 30, 2024, including the notes to the consolidated financial statements contained therein.

Investor Relations Inquiries: Please visit ir.gladstoneinvestment.com or call (703) 287-5893.

SOURCE: Gladstone Investment Corporation

Forward-looking Statements:

The statements in this press release regarding potential future distributions, earnings and operations of the Company are “forward-looking statements.” These forward-looking statements inherently involve certain risks and uncertainties in predicting future results and conditions. Although these statements are based on the Company’s current plans that are believed to be reasonable as of the date of this press release, a number of factors could cause actual results and conditions to differ materially from these forward-looking statements, including those factors described from time to time in the Company’s filings with the Securities and Exchange Commission. The Company undertakes no obligation to publicly release the result of any revisions to these forward-looking statements that may be made to reflect any future events or otherwise, except as required by law.

v3.24.2.u1

Cover

|

Aug. 05, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity Registrant Name |

GLADSTONE INVESTMENT CORPORATIONDE

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

814-00704

|

| Entity Tax Identification Number |

83-0423116

|

| Entity Address, Address Line One |

1521 Westbranch Drive

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

McLean

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22102

|

| City Area Code |

703

|

| Local Phone Number |

287-5800

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001321741

|

| Amendment Flag |

false

|

| Common Stock, $0.001 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

GAIN

|

| Security Exchange Name |

NASDAQ

|

| 5.00% Notes due 2026 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.00% Notes due 2026

|

| Trading Symbol |

GAINN

|

| Security Exchange Name |

NASDAQ

|

| 4.875% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2028

|

| Trading Symbol |

GAINZ

|

| Security Exchange Name |

NASDAQ

|

| 8.00% Notes due 2028 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

8.00% Notes due 2028

|

| Trading Symbol |

GAINL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gain_A500NotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gain_A4875NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gain_A800NotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

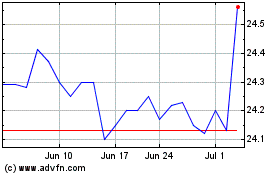

Gladstone Investment (NASDAQ:GAINN)

Historical Stock Chart

From Feb 2025 to Mar 2025

Gladstone Investment (NASDAQ:GAINN)

Historical Stock Chart

From Mar 2024 to Mar 2025