UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D/A

UNDER THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 7)

Greenbrook

TMS Inc.

(Name of Issuer)

Common Shares,

no par value

(Title of Class of Securities)

393704309

(CUSIP Number)

Sasha Cucuz

Greybrook Health Inc.

890 Yonge Street, 7th Floor

Toronto, Ontario M4W 3P4

(647) 478-8881

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

April 4, 2024

(Date of Event Which Requires Filing of This

Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ¨

The information required on the remainder of this

cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934

(“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of

the Act.

CUSIP No. 393704309

| 1 |

|

NAMES OF REPORTING PERSONS

GREYBROOK HEALTH INC. |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

– Joint Filing |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(D) OR 2(E)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

ONTARIO

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

SOLE VOTING POWER

0 |

| |

8 |

SHARED VOTING POWER

45,962,922(1) |

| |

9 |

SOLE DISPOSITIVE POWER

0 |

| |

10 |

SHARED DISPOSITIVE POWER

45,962,922(1) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,962,922(1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.4%(2) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

CO |

| |

|

|

|

|

|

|

|

|

|

|

(1) This amount includes (i) 7,000,424

common shares, no par value (the “Common Shares”), of Greenbrook TMS Inc. (the “Issuer”) beneficially

owned by Greybrook Health Inc. (“Greybrook Health”), (ii) 385,870 Common Shares issuable to Greybrook Health upon

the exercise of common share purchase warrants of the Issuer (the “Warrants”) and (iii) an aggregate of 38,576,628

Common Shares estimated to be issuable to Greybrook Health upon conversion of up to US$2,937,603.54 of subordinated convertible promissory

notes (the “Subordinated Convertible Notes”).

(2) This percentage is calculated based upon

45,602,260 outstanding Common Shares of the Issuer as of February 26, 2024 as reported in the Issuer’s prospectus supplement filed

with the Securities and Exchange Commission (“SEC”) on February 26, 2024, plus an additional (i) 385,870 Common

Shares issuable to Greybrook Health upon the exercise of the Warrants and (ii) an aggregate of 38,576,628 Common Shares estimated

to be issuable to Greybrook Health upon conversion of the Subordinated Convertible Notes.

CUSIP No. 393704309

| 1 |

|

NAMES OF REPORTING PERSONS

THE VAMVAKAS FAMILY TRUST (2015) |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

– Joint Filing |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEM 2(D) OR 2(E)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

ONTARIO

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

|

7 |

SOLE VOTING POWER

0 |

| |

8 |

SHARED VOTING POWER

45,962,922(1) |

| |

9 |

SOLE DISPOSITIVE POWER

0 |

| |

10 |

SHARED DISPOSITIVE POWER

45,962,922(1) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

45,962,922(1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

(SEE INSTRUCTIONS)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

54.4%(2) |

| 14 |

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO |

| |

|

|

|

|

|

|

|

|

|

|

(1) Reflects deemed shared beneficial ownership

with Greybrook Health, the indirect subsidiary of The Vamvakas Family Trust (2015), as reported above.

(2) See note 2 for Greybrook Health, as reported

above.

EXPLANATORY NOTE

This seventh amendment (this “Amendment

No. 7”) to the original Schedule 13D previously filed on March 10, 2023 (the “Original Schedule 13D”)

is being filed by and on behalf of Greybrook Health, a corporation formed under the laws of the Province of Ontario, Canada, and The Vamvakas

Family Trust (2015), a trust formed under the laws of the Province of Ontario, Canada (the “Trust,” and together with

Greybrook Health, the “Reporting Persons”), to reflect the increase in the beneficial ownership of Common Shares by

the Reporting Persons resulting from a decrease in the conversion price of the Subordinated Convertible Notes that are held by Greybrook

Health. The Original Schedule 13D, as previously amended, is herein referred to as the “Existing Schedule 13D”. The

Existing Schedule 13D, as amended by this Amendment No. 7, is herein referred to as this “Schedule 13D”.

Information and defined terms reported in the

Existing Schedule 13D remains in effect except to the extent that it is amended or superseded by information or defined terms contained

in this Amendment No. 7.

Item 2. Identity and Background.

Subordinated Convertible Notes

As of the date of this Amendment No. 7, the

Reporting Persons are deemed to beneficially own an aggregate of 38,576,628 Common Shares estimated to be issuable upon conversion of

the US$2,937,603.54 principal amount of Subordinated Convertible Notes held by Greybrook Health. In accordance with the definition of

“Conversion Price” in the Subordinated Note Purchase Agreement, Greybrook Health is entitled to a conversion price equal to

85% of the 30-Day VWAP immediately prior to the date of the applicable exercise of conversion rights; provided, that, in any event, the

conversion price shall not be lower than $0.078 (as adjusted for any subdivision, combination or stock dividend) (the “Floor

Price”). The 30-Day VWAP has been calculated to reflect the trading price of the Common Shares on OTCQB and accordingly, as

of the date hereof, is $0.064, which is lower than Greybrook’s previously reported Reference Conversion Price (as defined in Amendment

No.3 to the Original Schedule 13D) of $0.2157. The updated conversion price available to the Reporting Persons is equal to the Floor Price,

given that the 30-Day VWAP as of the date hereof is lower than the Floor Price. The reduction of the conversion price to the Floor Price

has increased the number of Common Shares into which the Subordinated Convertibles Notes are convertible by 24,627,528, resulting in the

Reporting Persons beneficially owning 54.4% of the Common Shares as of the date hereof.

Item 5. Interest in Securities of the Issuer.

Item 5(a)-(c) of the Existing Schedule 13D

is hereby supplemented as follows:

(a)-(b) The aggregate number and percentage of

Common Shares beneficially owned by the Reporting Persons to which this Schedule 13D relates is 45,962,922 Common Shares, constituting

approximately 54.4% of the Issuer’s outstanding Common Shares, and including (i) 6,800,424 Common Shares that are directly owned

by Greybrook Health and 200,000 Common Shares directly owned by Greybrook Realty, an affiliate of Greybrook Health and an indirect subsidiary

of the Trust, (ii) 385,870 Common Shares issuable to Greybrook Health upon exercise of the Warrants and (iii) an aggregate of 38,576,628

Common Shares estimated to be issuable to Greybrook Health upon conversion of the Subordinated Convertible Notes. The percentage of Common

Shares of the Issuer is calculated based upon 45,602,260 outstanding Common Shares of the Issuer as of February 26, 2024 as reported in

the Issuer’s prospectus supplement filed with the SEC on February 26, 2024, plus an additional (i) 385,870 Common Shares issuable

to Greybrook Health upon the exercise of the Warrants and (ii) an aggregate of 38,576,628 Common Shares estimated to be issuable to Greybrook

Health upon conversion of the Subordinated Convertible Notes.

(c) Other than the transactions described herein,

there have been no other transactions by the Reporting Persons in the Common Shares during the past 60 days.

Item 6. Contracts, Arrangements, Understandings or Relationships

with Respect to Securities of the Issuer.

The information set forth in Item 2 of this Amendment

No. 7 is hereby incorporated by reference into Item 6 of the Existing Schedule 13D.

SIGNATURES

After reasonable inquiry and

to the best of my knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true, complete

and correct.

| April 8, 2024 |

|

| |

GREYBROOK HEALTH INC. |

| |

|

| |

By: |

/s/ Sasha Cucuz |

| |

|

Name: Sasha

Cucuz

Title: Director |

| |

|

|

| |

THE VAMVAKAS FAMILY TRUST (2015) |

| |

|

| |

By: |

/s/ Sasha Cucuz |

| |

|

Name: Sasha

Cucuz

Title: Trustee |

| |

|

|

| |

By: |

/s/ Shawn Walsh |

| |

|

Name: Shawn

Walsh

Title: Trustee |

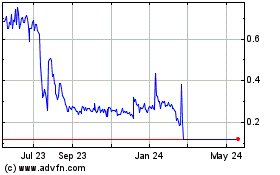

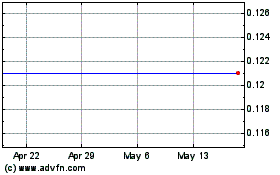

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From Apr 2024 to May 2024

Greenbrook TMS (NASDAQ:GBNH)

Historical Stock Chart

From May 2023 to May 2024