false

0001641398

0001641398

2024-05-31

2024-05-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May

31, 2024

GD Culture Group Limited

(Exact name of Company as specified in charter)

| Nevada |

|

001-37513 |

|

47-3709051 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

22F

- 810 Seventh Avenue,

New

York, NY

10019

(Address of Principal Executive Offices) (Zip

code)

+1-347-

2590292

(Company’s Telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 |

|

GDC |

|

Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive Agreement.

On May 31, 2024, GD Culture Group Limited (the

“Company”) entered into a software purchase agreement (the “Agreement”) with Shanxi Gangdong Cultural Media Co.,

Ltd., a seller unaffiliated with the Company (the “Seller”). Pursuant to the Agreement, the Company agreed to purchase and

the Seller agreed to sell all of Seller’s right, title, and interest in and to the certain software. The purchase price of the software

shall be $1,248,000, payable in the form of issuance of 1,560,000 shares of common stock of the Company (the “Shares”), valued

at $0.80 per share. The Company plans to use the software to develop its AI business.

On June 4, 2024, the Company issued the Shares

to the Seller’s designees and the transaction was completed.

The foregoing description of the Agreement does

not purport to be complete and is qualified in its entirety by reference to the complete text of the Agreement, which is filed as Exhibit

10.1 hereto.

Item 2.01 Completion of Acquisition or Disposition

of Assets.

The information set forth under Item 1.01 above

of this Current Report on Form 8-K is incorporated by reference in this Item 2.01.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth under Item 1.01 above

of this Current Report on Form 8-K is incorporated by reference in this Item 3.02.

This Form 8-K (including

the exhibit) is incorporated by reference into the Company’s Registration Statement on Form S-3 initially filed with the Securities

and Exchange Commission on May 6, 2024 (Registration No. 333-279141), as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

GD CULTURE GROUP LIMITED |

| |

|

| Date: June 6, 2024 |

By: |

/s/ Xiaojian Wang |

| |

Name: |

Xiaojian Wang |

| |

Title: |

Chief Executive Officer, President and

Chairman of the Board |

2

Exhibit 10.1

SOFTWARE PURCHASE AGREEMENT

This

SOFTWARE PURCHASE AGREEMENT (“Agreement”), dated as of May 31, 2024, is made by and between Shanxi Gangdong

Cultural Media Co., Ltd., a company established under the laws of the People’s Republic of China (“Seller”),

and GD Culture Group Limited, a Nevada corporation (“Buyer”).

WHEREAS, Seller

wishes to sell to Buyer, and Buyer wishes to purchase from Seller, all of Seller’s right, title, and interest in and to certain

Software (as defined below), including all copyrights and related rights in the Software, subject to the terms and conditions set forth

herein.

NOW THEREFORE,

in consideration of the mutual covenants and agreements set forth herein and for other good and valuable consideration, the receipt and

sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Purchase and Sale of

Software. Subject to the terms and conditions set forth herein, Seller hereby irrevocably sells, assigns, transfers, and conveys

to Buyer, and Buyer hereby accepts, all of Seller’s right, title, and interest in and to the following (collectively,

“Acquired Rights”):

(a)

The software, including all software copyrights, whether registered or unregistered, arising under any applicable law of any jurisdiction

throughout the world or any treaty or other international convention, listed on Schedule 1 (the “Software”);

(b)

all of Seller’s right, title, and interest in and to all copies and other tangible embodiments of the Software in all languages

and in all forms and media now or hereafter known or developed;

(c)

all royalties, fees, income, payments, and other proceeds now or hereafter due or payable to Seller with respect to any of the

foregoing;

(d)

all claims and causes of action with respect to any of the foregoing, whether accruing before, on, or after the date hereof/accruing

on or after the date hereof, including all rights to and claims for damages, restitution, and injunctive and other legal and equitable

relief for past, present, and future infringement, misappropriation, violation, breach, or default; and

(e)

all other rights, privileges, and protections of any kind whatsoever of Seller accruing under any of the foregoing provided by

any applicable law, treaty, or other international convention throughout the world.

2. No Liabilities. Buyer

neither assumes nor is otherwise liable for any obligations, claims, or liabilities of Seller of any kind, whether known or unknown,

contingent, matured, or otherwise, whether currently existing or hereafter arising (collectively, “Excluded Liabilities”).

3. Purchase Price.

(a)

The aggregate purchase price for the Acquired Rights shall be US$1,248,000, payable in the form of issuance of 1,560,000 shares

of common stock of the Buyer, valued at US$0.8 per share (the “Shares”), to the Seller.

(b)

Buyer shall issue or cause to be issued the Shares within ten (10) business days following the parties’ full execution of

this Agreement. The Shares shall bear the following legend:

THE SECURITIES

HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION OR THE SECURITIES COMMISSION OF ANY STATE IN RELIANCE UPON AN EXEMPTION

FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), AND, ACCORDINGLY, MAY NOT BE OFFERED

OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR

IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE SECURITIES

LAWS.

(c)

If Buyer fails to timely issue the Shares, Seller may terminate this Agreement effective immediately on written notice to Buyer.

4. Deliverables. Upon

execution of this Agreement, Seller shall deliver to Buyer the complete prosecution files for the Software in such form and medium as

reasonably requested by Buyer.

5. Further

Assurances; Recordation.

(a)

From and after the date hereof, each of the parties hereto shall execute and deliver such additional documents, instruments, conveyances,

and assurances, and take such further actions, as may be reasonably required to carry out the provisions hereof and give effect to the

transactions contemplated by this Agreement and the documents to be delivered hereunder.

(b)

Without limiting the foregoing, Seller shall execute and deliver to Buyer such assignments and other documents, certificates, and

instruments of conveyance in a form reasonably satisfactory to Buyer and suitable for filing with the United States Copyright Office and

the registries and other recording governmental authorities in all applicable jurisdictions (including with respect to legalization, notarization,

apostille, certification, and other authentication) as reasonably necessary to enter into, record and perfect any assignment agreements,

and to vest in Buyer all right, title, and interest in and to the Software in accordance with applicable law. As between Seller and Buyer,

Buyer shall be responsible, at Buyer’s expense, for filing any assignment agreements and other documents, certificates, and instruments

of conveyance with the applicable governmental authorities; provided that, upon Buyer’s reasonable request, and Seller shall take

such steps and actions, and provide such cooperation and assistance, to Buyer and its successors, assigns, and legal representatives,

including the execution and delivery of any affidavits, declarations, oaths, exhibits, assignments, powers of attorney, or other documents,

as may be reasonably necessary to effect, evidence, or perfect the assignment of the Acquired Rights to Buyer, or any of Buyer’s

successors or assigns.

(c) The

Seller hereby agrees that, upon the Buyer’s reasonable request and at the Buyer’s expense, the Seller will fully

cooperate with the Buyer in taking all necessary steps to register the copyrights of the Software with the appropriate governmental

authorities. This cooperation shall include, but is not limited to, providing any necessary information, executing all necessary

documents, and performing any other acts reasonably required to facilitate the registration of the copyrights of the Software. The

Seller further agrees to assist the Buyer in protecting and enforcing these copyrights as may be required in the future.

6. Representations and

Warranties of Seller. Seller represents and warrants to Buyer that the statements contained in this Section 6 are true and

correct as of the date hereof.

(a) Authority of

Seller; Enforceability. Seller is duly organized, validly existing, and in good standing as a corporation or other entity as

represented herein under the laws of its jurisdiction of incorporation or organization. Seller has the full right, power, and

authority to enter into this Agreement and perform its obligations hereunder. The execution, delivery, and performance of this

Agreement by Seller’s representative whose signature is set forth herein has been duly authorized by all necessary

organizational action of Seller and, when executed and delivered by both parties, this Agreement will constitute a legal, valid, and

binding obligation of Seller, enforceable against Seller in accordance with its terms and conditions.

(b) No Conflicts;

Consents. The execution, delivery, and performance by Seller of this Agreement, and the consummation of the transactions

contemplated hereby, do not and will not: (i) violate or conflict with the certificate of incorporation, by-laws, or other

organizational documents of Seller; (ii) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule, or

regulation; (iii) conflict with, or result in (with or without notice or lapse of time or both), any violation of or default under,

or give rise to a right of termination, acceleration, or modification of any obligation or loss of any benefit under, any contract

or other instrument to which this Agreement or any of the Acquired Rights are subject; or (iv) result in the creation or imposition

of any encumbrances on the Acquired Rights. No consent, approval, waiver, or authorization is required to be obtained by Seller from

any person or entity (including any governmental authority) in connection with the execution, delivery, and performance by Seller of

this Agreement, or to enable Buyer to register, own, and use the Acquired Rights.

(c) Ownership.

Seller owns all right, title, and interest in and to the Acquired Rights, free and clear of liens, security interests, and other

encumbrances. Seller is in full compliance with all legal requirements applicable to the Acquired Rights and Seller’s

ownership and use thereof.

(d) Validity and

Enforceability. Acquired Rights are valid, subsisting, and enforceable in all applicable jurisdictions.

(e) Non-Infringement.

The registration, ownership, and exercise of the Acquired Rights by Seller did not, do not, and will not infringe, misappropriate, or

otherwise violate the intellectual property or other rights of any third party or violate any applicable regulation or law. No person

has infringed, misappropriated, or otherwise violated, or is currently infringing, misappropriating, or otherwise violating, any of the

Acquired Rights.

(f) Legal

Actions. There are no actions settled, pending, or threatened (including in the form of offers to obtain a license): (i) alleging

any infringement, misappropriation, or other violation of the intellectual property rights of any third party based on the use or exploitation

of any Acquired Rights; (ii) challenging the validity, enforceability, registrability, or ownership of any Acquired Rights or Seller’s

rights with respect thereto; or (iii) by Seller alleging any infringement, misappropriation, or other violation by any third party of

any Acquired Rights.

7. Representations and

Warranties of Buyer. Buyer represents and warrants to Seller that the statements contained in this Section 7 are true and

correct as of the date hereof.

(a) Authority

of Buyer; Enforceability. Buyer is duly organized, validly existing, and in good standing as a corporation or other entity as

represented herein under the laws of its jurisdiction of incorporation or organization. Buyer has the full right, power, and

authority to enter into this Agreement and perform its obligations hereunder. The execution, delivery, and performance of this

Agreement by Buyer’s representative whose signature is set forth herein has been duly authorized by all necessary corporate

action of Buyer and, when executed and delivered by both parties, this Agreement will constitute a legal, valid, and binding

obligation of Buyer enforceable against Buyer in accordance with its terms and conditions.

(b) No

Conflicts; Consents. The execution, delivery, and performance by Buyer of this Agreement, and the consummation of the

transactions contemplated hereby, do not and will not: (i) violate or conflict with the certificate of incorporation, by-laws, or

other organizational documents of Buyer; (ii) violate or conflict with any judgment, order, decree, statute, law, ordinance, rule,

or regulation; or (iii) conflict with, or result in (with or without notice or lapse of time or both), any violation of or default

under, or give rise to a right of termination, acceleration, or modification of any obligation or loss of any benefit under, any

contract or other instrument to which this Agreement is subject. No consent, approval, waiver, or authorization is required to be

obtained by Buyer from any person or entity (including any governmental authority) in connection with the execution, delivery, and

performance by Buyer of this Agreement.

(c)

The Shares have been duly authorized and, when issued pursuant to this Agreement, will be validly issued, fully paid and non-assessable.

8. Indemnification.

(a) Survival.

All representations, warranties, covenants, and agreements contained herein and all related rights to indemnification shall continue

in full force and effect following the date hereof.

(b)

Seller shall defend, indemnify, and hold harmless Buyer, Buyer’s affiliates, and their respective shareholders, directors,

officers, employees, agents, licensees, successors, and assigns (each, a “Buyer Indemnified Party”) from and against

all losses, damages, liabilities, deficiencies, claims, actions, judgments, settlements, interest, awards, penalties, fines, fees, costs,

or expenses of whatever kind, including attorneys’ fees, the cost of enforcing any right to indemnification hereunder, and the

cost of pursuing any insurance providers (collectively, “Losses”) arising out of or in connection with any third-party

claim, suit, action, or proceeding (each, a “Third- Party Claim”) related to any: (i) actual or alleged inaccuracy

in or breach or non-fulfillment of any representation, warranty, covenant, agreement, or obligation of Seller contained in this Agreement

or any document to be delivered hereunder; or (ii) Excluded Liabilities.

(c)

A Buyer Indemnified Party shall promptly notify the Seller upon becoming aware of a Third-Party Claim with respect to which Seller

is obligated to provide indemnification under this Section 8 (“Indemnified Claim”). Seller shall promptly assume control

of the defense and investigation of the Indemnified Claim, with counsel reasonably acceptable to the Buyer, and the Buyer Indemnified

Party shall reasonably cooperate with Seller in connection therewith, in each case at Seller ‘s sole cost and expense. The Buyer

Indemnified Party may participate in the defense of such Indemnified Claim, with counsel of its own choosing and at its own cost and expense.

Seller shall not settle any Indemnified Claim on any terms or in any manner that adversely affects the rights of any Buyer without the

Buyer Indemnified Party’s prior written consent (which consent shall not be unreasonably withheld, conditioned, or delayed). If

Seller fails or refuses to assume control of the defense of such Indemnified Claim, the Buyer Indemnified Party shall have the right,

but no obligation, to defend against such Indemnified Claim, including settling such Indemnified Claim after giving notice to Seller,

in each case in such manner and on such terms as the Buyer Indemnified Party may deem appropriate. Neither the Buyer Indemnified Party’s

failure to perform any obligation under this Section 8(c) nor any act or omission of

the Buyer Indemnified Party in the defense or settlement of any Indemnified Claim shall relieve Seller of its obligations under this Section

8, including with respect to any Losses, except to the extent that Seller can demonstrate that it has been materially prejudiced as a

result thereof.

9. Equitable Remedies.

Seller acknowledges that: (a) a breach or threatened breach by Seller of any of its obligations under this Agreement would give rise

to irreparable harm to Buyer for which monetary damages would not be an adequate remedy; and (b) if a breach or a threatened breach by

Seller of any such obligations occurs, Buyer will, in addition to any and all other rights and remedies that may be available to such

party at law, at equity, or otherwise in respect of such breach, be entitled to equitable relief, including a restraining order, an injunction,

specific performance, and any other relief that may be available from a court of competent jurisdiction, without any requirement to:

(i) post a bond or other security; or (ii) prove actual damages or that monetary damages will not afford an adequate remedy.

10. Miscellaneous.

(a) Interpretation.

For purposes of this Agreement: (i) the words “include,” “includes,” and “including” are deemed

to be followed by the words “without limitation”; (ii) the word “or” is not exclusive; and (iii) the words

“herein,” “hereof,” “hereby,” “hereto,” and “hereunder” refer to this

Agreement as a whole. Unless the context otherwise requires, references herein: (x) to Sections, Schedules, and Exhibits refer to

the Sections of, and Schedules and Exhibits attached to, this Agreement; (y) to an agreement, instrument, or other document means

such agreement, instrument, or other document as amended, supplemented, and modified from time to time to the extent permitted by

the provisions thereof; and (z) to a statute means such statute as amended from time to time and includes any successor legislation

thereto and any regulations promulgated thereunder. This Agreement is intended to be construed without regard to any presumption or

rule requiring construction or interpretation against the party drafting an instrument or causing any instrument to be drafted. The

Schedules and Exhibits referred to herein are intended to be construed with, and as an integral part of, this Agreement to the same

extent as if they were set forth verbatim herein.

(b) Notices.

All notices, requests, consents, claims, demands, waivers, and other communications hereunder shall be in writing and shall be

deemed to have been given: (i) when delivered by hand (with written confirmation of receipt); (ii) when received by the addressee if

sent by a nationally recognized overnight courier (receipt requested); (iii) on the date sent by email of a PDF document (with

confirmation of transmission) if sent during normal business hours of the recipient; and (iv) on the fifth day after the date

mailed, by certified or registered mail (in each case, return receipt requested, postage prepaid). Such communications must be sent

to the respective parties at the addresses on the signature page (or at such other address for a party as shall be specified in a

notice given in accordance with this Section 10(b)):

(c) Entire

Agreement. This Agreement, together with the documents to be delivered hereunder, and all related exhibits and schedules,

constitutes the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein and

therein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect to such

subject matter. In the event of any inconsistency between the statements in the body of this Agreement, the documents to be

delivered hereunder, and the related exhibits and schedules (other than an exception expressly set forth as such in the related

exhibits or schedules), the statements in the body of this Agreement shall control.

(d) Severability.

If any term or provision of this Agreement is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality,

or unenforceability will not affect the enforceability of any other term or provision of this Agreement or invalidate or render

unenforceable such term or provision in any other jurisdiction.

(e) Successors

and Assigns. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective

successors and assigns.

(f) Choice

of Law; Venue. This Agreement and all matters arising out of or relating to this Agreement shall be governed by and construed in

accordance with the internal laws of the State of New York, without giving effect to any conflict of law provisions thereof that

would result in the application of the laws of a different jurisdiction. Either party shall institute any legal suit, action, or

proceeding arising out of or relating to this Agreement or the transactions contemplated hereby in the federal courts of the United

States of America or the courts of the State of New York , in each case located in the City of New York and County of New York , and

each party irrevocably submits to the exclusive jurisdiction of such courts in any such legal suit, action, or proceeding.

(g) Amendment

and Modification. This Agreement may only be amended, modified, or supplemented by an agreement in writing signed by an

authorized representative of each party hereto.

(h) Waiver.

No waiver by any party of any of the provisions hereof will be effective unless explicitly set forth in writing and signed by the party

so waiving. Except as otherwise set forth in this Agreement, no failure to exercise, or delay in exercising, any right, remedy, power,

or privilege arising from this Agreement will operate or be construed as a waiver thereof, nor will any single or partial exercise of

any right, remedy, power, or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy,

power, or privilege.

(i) Counterparts.

This Agreement may be executed in counterparts, each of which will be deemed an original, but all of which together will be deemed

to be one and the same agreement. A signed copy of this Agreement delivered by email or other means of electronic transmission will

be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

[SIGNATURE PAGE

FOLLOWS]

IN WITNESS WHEREOF,

Seller and Buyer have caused this Agreement to be executed as of the date first written above by their respective duly authorized officers.

| |

SELLER |

| |

|

| |

Shanxi Gangdong Cultural Media Co., Ltd. |

| |

|

| |

By: |

/s/ Huiping Li |

| |

Name: |

Huiping Li |

| |

Title: |

President |

| |

Address:

Yangquan Hi-Tech Industrial Development Zone, Shanxi Province, Tianjin Road (China Town East Building, 4th Floor) |

| |

|

| |

BUYER |

| |

|

| |

GD Culture Group Limited |

| |

|

| |

By: |

/s/ Xiao Jian Wang |

| |

Name: |

Xiao Jian Wang |

| |

Title: |

Chief Executive Officer |

| |

Address: 22F - 810 Seventh Avenue, New York, NY 10019 |

| |

Email Address: xiaojian.gdc@gmail.com |

SCHEDULE 1

The Software

| Title |

|

Status |

| Aibox |

|

Not registered |

Overview:

Aibox is a revolutionary

application designed to transform the way small and medium-sized businesses and influencers interact with digital content creation. By

providing a platform accessible through web, mobile, and other applications, Aibox allows users to convert their uploaded videos and audio

into customized AI digital human models. This technology enables the creation of unique digital personas that can be tailored and modified

by the customers themselves.

Target Audience:

Aibox is particularly tailored

towards small and medium enterprises and influencers who are keen to enhance their digital presence through innovative and personalized

content.

Key Features:

Customizable Digital Personas:

Users can create and modify their digital human avatars, making each persona distinctively suited to their brand or personal style.

Advanced Integration:

Building on existing digital personas, Aibox is capable of utilizing its proficiency in mobile live streaming (notably on platforms like

TikTok) to craft even more captivating and engaging custom personas.

Creative Freedom:

Clients can utilize these digital personas to produce videos and live streaming services, meeting a diverse range of content creation

needs.

8

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

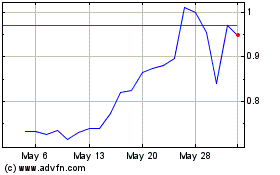

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Jan 2025 to Feb 2025

GD Culture (NASDAQ:GDC)

Historical Stock Chart

From Feb 2024 to Feb 2025