Google May Let Some Air Out of its Cloud

April 16 2020 - 12:48PM

Dow Jones News

By Dan Gallagher

The cloud industry's biggest sugar daddy doesn't look like it

will be sweetening the pot much this year.

Google said Wednesday that it is "reevaluating the pace of our

investment plans" for the year as the internet giant owned by

Alphabet Inc. looks to deal with the fallout of the coronavirus

pandemic. The comments come from an email to employees from Chief

Executive Officer Sundar Pichai. As a part of those plans, Mr.

Pichai said the company will slow its pace of hiring and will also

be "recalibrating the focus and pace of our investments" in areas

like data centers and machines.

The last part could spell bad news for the large ecosystem of

chip companies and other component suppliers that have benefited

from Google's expensive race to catch up in the burgeoning

cloud-computing business. The online advertising giant is well

behind Amazon.com Inc. and Microsoft Corp. in terms of

cloud-related revenues. But it has been the largest spender on the

networks and technology that underpin those services, totaling

$41.4 billion on data center capital expenditures over the last

three years, according to estimates from the Dell'Oro Group. That

compares with a respective $34.5 billion and $32 billion over that

time by Microsoft and Amazon.

That pace of spending looked on track to continue this year.

Recent results from chip makers Nvidia Corp. and Micron Technology

Inc. -- whose fiscal quarters extended into 2020 -- both showed

strong contributions from the data center side. Before the pandemic

hit, Dell'Oro analysts were projecting combined data center

spending from Google, Microsoft and Amazon to top $51 billion this

year -- up 20% from 2019's levels.

But even tech's deepest pockets aren't immune to the effects of

the pandemic and its aftermath. And Google's advertising business,

which still accounts for more than 80% of its revenue, is

particularly vulnerable in a downturn relative to the core

businesses of its two main cloud rivals. Mark Mahaney of RBC

Capital now projects that Alphabet's total revenue will slip 4%

this year, which would be the company's first annual decline on

record.

Not a bad time to trim some bills.

Write to Dan Gallagher at dan.gallagher@wsj.com

(END) Dow Jones Newswires

April 16, 2020 13:33 ET (17:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

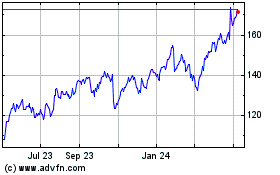

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Jun 2024 to Jul 2024

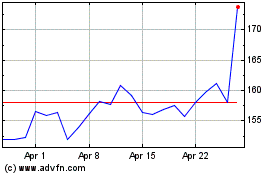

Alphabet (NASDAQ:GOOG)

Historical Stock Chart

From Jul 2023 to Jul 2024