Kanen Wealth Management Calls for the Sale of U.S. Global Investors (GROW) to End its Embarrassing Journey as a Public Company

September 04 2024 - 10:20AM

Dear Mr. Frank Holmes and GROW Directors,

Kanen Wealth Management, LLC (“KWM”) is one of

the largest shareholders of U.S. Global Investors, Inc. (NASDAQ:

GROW), owning over 450K shares, representing 3.3% of the Company’s

stock. At the core of our thesis, we believe that the Company’s

current share price is significantly below its intrinsic value and

that investments, real estate, and cash alone are worth more than

the market cap. Additionally, we believe its asset management

business, with ~$11m in recurring fees, is worth $2.75/share.

We are deeply concerned that the board has shown

little interest in creating value for outside shareholders by

creating policies that funnel an exorbitant amount of money to Mr.

Holmes and insiders. In our opinion, Holmes is incentivized to

gamble shareholder money to earn larger bonuses for himself.

Despite Frank Holmes’ reputation as a sophisticated finance expert,

GROW continues to trade at a significant discount to its

liquidation value. The growing pattern of late filings, accounting

restatements, and stock price underperformance suggests the company

is not fit for public markets. We remind investors that management

rejected a buyout offer two years ago that represents an

approximate 100% premium to today’s stock price.

We question whether such credibility is beyond

repair, as GROW shares are down 90% in the past 18 years. The

market cap is now a mere $36 million. This freefall is a direct

result of poor governance and failed strategies:

- Poor

Corporate Governance: GROW’s Compensation Committee is

dominated by an entrenched board, whose average age is alarmingly

high—Mr. Lydon (64), Mr. Terracina (78), and Mr. Rubinstein (86).

Despite their average tenure of 25 years, the value of their annual

compensation awarded by the company in ‘23 ($300k) exceeds the

value of their ownership in GROW ($215k). We are concerned that the

board is incentivized to act in the best interest of Mr. Holmes and

not outside shareholders.

-

Questionable Incentives: We believe this lack of

independence creates policies funneling an obscene amount of cash

into Mr. Holmes’ pocket. Since 2019, Mr. Holmes has received over

$8 million in cash compensation, which is over 20% of the company’s

market cap. In addition to Mr. Holmes’ base salary and bonus tied

to operating performance, he “receives a bonus when the investment

team meets their performance goals… in recognition of Mr. Holmes’

creation and oversight of the investment processes and strategy.”

We believe this motivates Holmes to pursue a very risky investment

strategy with shareholder money to earn larger bonuses for himself.

If GROW is merely a ‘lifestyle company;’ for Mr. Holmes and his

incompetent board of retirees, it explains their lack of urgency in

creating shareholder value.

- Risky

Investments: Mr. Holmes’ use of GROW capital as “mad

money” to pursue thematic investments is without sufficient

scrutiny. In the event that his risky investments work, we estimate

Mr. Holmes is paid to the tune of 20% of realized gains. If

investments do not pan out, GROW investors lose. Not only does this

create an incentive mismatch between management and investors, it

also distracts Mr. Holmes from turning around the core business.

Why should we trust Mr. Holmes with our capital when his own

company trades below liquidation value?

- In 2023, over

30% of GROW’s portfolio was tied up in HIVE Digital Holdings, a

cryptocurrency mining company where Mr. Holmes is Chairman. After

exiting the equity investment in 2021, GROW reinvested proceeds

into a convertible debenture with warrants. In January ’24, these

warrants expired recording a realized loss of $5.9m, with shares

down ~90% since reinvesting proceeds in the convertible.

- In October 2021,

the company purchased 1 million shares in Network Media Group “to

provide exposure to Network’s emerging non-fungible token (NFT)

business.” Since announcing the private placement, NETWF shares

have traded down ~75%. To our knowledge, Mr. Holmes has not

mentioned this investment publicly since its precipitous

decline.

We believe GROW’s stock trades at a significant

discount to its liquidation value due to questionable corporate

governance and incentives that enrich insiders at the expense of

outside shareholders. Given our understanding of the Company’s

assets and recurring fee income, we believe that a sale of the

Company, if undertaken, could generate meaningful and certain value

creation for equity investors:

- GROW

Assets: When including 1) $28.5m in cash; 2) $5.2m of HIVE

debenture; 3) $11.5m in mutual fund investments; and 4) their

estimated ~$6.0m of real estate value, we believe GROW’s assets are

worth $51.0m, or $3.70/share.

- Asset

Management Business: In addition to our balance sheet, the

investment management business generates ~$11 million in recurring

fee income. Based on our conversations with industry participants,

we believe a strategic would pay 3-4x fee income, which could

equate to $2.75/share.

If the Board pursues a sale, we believe shares

would be worth between $6.0-7.0/share, which represents a 130-175%

upside from the current stock price.

Because the equity trades below the $51m of

tangible assets, the board should immediately authorize a tender up

to $3.60 per share which in effect equals the cash, investments,

and real estate. The fact that the board doesn’t recognize buying

$1.00 of assets for $0.70 demonstrates they lack the skillset to

serve as directors ($36m market cap with $51m of liquid and

tangible assets).

It’s been over two years since Mr. Holmes

dismissed a $5.30 buyout offer as ‘insufficient.’ We believe such

an offer or better is still on the table. If the Board pursues a

sale, we believe GROW’s equity would be worth 2-3x more than its

current stock price implies. Mr. Holmes, it is time to end the

public embarrassment that U.S. Global Investors has become. We urge

you to run a proper sales process and finally create value for

shareholders. What are we waiting for, Director/ Chairman Jerry

Rubinstein’s 90th birthday?

Sincerely,

David Kanen

President/CEO

Kanen Wealth Management

dkanen@kanenadvisory.com

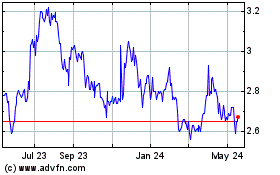

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Oct 2024 to Nov 2024

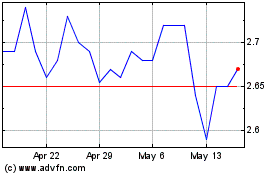

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Nov 2023 to Nov 2024