false

0000854560

0000854560

2023-12-20

2023-12-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): December 20, 2023

GREAT

SOUTHERN BANCORP, INC.

(Exact name of registrant as specified in

its charter)

| Maryland |

|

0-18082 |

|

43-1524856 |

| (State

or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS

Employer Identification No.) |

| 1451

East Battlefield, Springfield,

Missouri |

|

65804 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number,

including area code: (417)

887-4400

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common Stock, par value $0.01 per share |

GSBC |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

¨ |

Item 5.02 Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 20, 2023, the

Boards of Directors of Great Southern Bancorp, Inc. (the “Company”) and Great Southern Bank, a wholly owned subsidiary of

the Company (the “Bank”), appointed Amelia “Amy” Counts as a director of the Company and the Bank, with her service

to commence January 1, 2024. Ms. Counts also was named to the Audit, Compensation, and Corporate Governance and Nominating Committees

of the Company’s Board. Ms. Counts will serve in the class of the Company’s directors whose terms will expire at the

Company’s 2025 annual meeting of stockholders.

Ms. Counts

will generally be entitled to the same compensation arrangement as is provided to the other non-employee directors of the Company and

the Bank. Directors of the Company receive a fee of $1,500 for each regular Company Board meeting attended, which is currently the only

compensation paid to directors by the Company, except for stock options granted in the discretion of the Company Board. Directors of the

Bank currently receive a fee of $3,000 for each regular Bank Board meeting attended, which will increase to $3,250 starting in January

2024. Members of the Audit Committee and the Bank’s Compliance Committee currently receive a fee of $300 per committee meeting attended

($350 for the Audit Committee chair), which will increase to $400 ($450 for the Audit Committee chair) starting in January 2024. The directors

of the Company and its subsidiaries are not reimbursed for costs incurred in attending board and committee meetings.

A copy of

a press release issued by the Company on December 21, 2023, announcing the appointment of Ms. Counts is attached as Exhibit 99.1 and is

incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

GREAT SOUTHERN BANCORP, INC. |

| |

|

|

| |

|

|

| Date: December 22, 2023 |

By: |

/s/ Joseph W. Turner |

| |

|

Joseph W. Turner, President and Chief Executive Officer |

Exhibit 99.1

December 21, 2023

Reporters May Contact:

Kelly Polonus, Great Southern Bancorp, 417-895-5242

kpolonus@greatsouthernbank.com

Great Southern Bancorp, Inc. Announces

Appointment of

Amelia “Amy” Counts to Boards of

Directors

Springfield, Mo. – Great Southern Bancorp, Inc., (NASDAQ:GSBC),

the holding company for Great Southern Bank, announced today that Amelia “Amy” Counts has been appointed to the Boards of

Directors of the Bank and the holding company, with her service to commence January 1, 2024.

Great Southern President and CEO Joseph W. Turner said, “We welcome

Amy as a director of our Company and Bank. We value diversity of talent, knowledge and experience in our Board members, and Amy’s

extensive business development and customer relationship expertise will prove to be a tremendous asset to our Board. Amy being a resident

of St. Louis will also bring valuable insight and perspective as we expand customer relationships in this key market for our Company.”

Counts is currently a regional vice president

of sales at St. Louis-based Wise F&I. She has more than 25 years of experience in sales and marketing of information technology and

software solutions, primarily in the automotive industry. Counts earned a bachelor’s degree from Missouri State University. She

has received extensive training from several notable national sales training organizations, including the Northwestern Kellogg Sales Institute.

Counts currently serves on the Board of Trustees

for the Missouri State University Foundation and acts as co-chair of the Foundation’s newly-formed Bears WIN, or Women’s Impact

Network. She was also recently selected to serve as vice-chair of the now-underway Missouri State University Presidential Search Committee.

She previously served on the Missouri State University Board of Governors from 2017 to 2023, acting as chair in 2021. In addition, Counts

is a board member of St. Louis Artworks and an Alumni Advisory Board member for Delta Zeta Sorority – Epsilon Nu Chapter.

Other members of the Great Southern Boards include Chairman William

V. Turner, President and CEO Joseph W. Turner, Kevin R. Ausburn, Julie T. Brown, Thomas J. Carlson, Steven D. Edwards, Debra Mallonee

(Shantz) Hart, Douglas M. Pitt and Earl A. Steinert, Jr.

Headquartered in Springfield, Missouri, with

$5.7 billion in assets, Great Southern offers a broad range of banking services to customers. The Company operates 90 retail banking centers

in Missouri, Iowa, Kansas, Minnesota, Arkansas and Nebraska and commercial lending offices in Atlanta; Charlotte, North Carolina;

Chicago; Dallas; Denver; Omaha, Nebraska; Phoenix and Tulsa, Oklahoma. The common stock of Great Southern Bancorp, Inc. is listed

on the Nasdaq Global Select Market under the symbol "GSBC."

www.GreatSouthernBank.com

Forward-Looking Statements

When used in this press release and in other

documents filed or furnished by Great Southern Bancorp, Inc. (the “Company”) with the Securities and Exchange Commission

(the “SEC”), in the Company’s other press releases or other public or stockholder communications, and in oral statements

made with the approval of an authorized executive officer, the words or phrases “may,” “might,” “could,”

“should,” “will likely result,” “are expected to,” “will continue,” “is anticipated,”

“believe,” “estimate,” “project,” “intends” or similar expressions are intended to identify

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements

also include, but are not limited to, statements regarding plans, objectives, expectations or consequences of announced transactions,

known trends and statements about future performance, operations, products and services of the Company. The Company’s ability to

predict results or the actual effects of future plans or strategies is inherently uncertain, and the Company’s actual results could

differ materially from those contained in the forward-looking statements.

Factors that could cause or contribute to

such differences include, but are not limited to: (i) expected revenues, cost savings, earnings accretion, synergies and other benefits

from the Company’s merger and acquisition activities might not be realized within the anticipated time frames or at all, and costs

or difficulties relating to integration matters, including but not limited to customer and employee retention, might be greater than expected;

(ii) changes in economic conditions, either nationally or in the Company’s market areas; (iii) the remaining effects of

the COVID-19 pandemic on general economic and financial market conditions and on public health; (iv) fluctuations in interest rates,

the effects of inflation or a potential recession, whether caused by Federal Reserve actions or otherwise; (v) the impact of bank

failures or adverse developments at other banks and related negative press about the banking industry in general on investor and depositor

sentiment; (vi) slower economic growth caused by changes in energy prices, supply chain disruptions or other factors; (vii) the

risks of lending and investing activities, including changes in the level and direction of loan delinquencies and write-offs and changes

in estimates of the adequacy of the allowance for credit losses; (viii) the possibility of realized or unrealized losses on securities

held in the Company’s investment portfolio; (ix) the Company’s ability to access cost-effective funding and maintain

sufficient liquidity; (x) fluctuations in real estate values and both residential and commercial real estate market conditions; (xi) the

ability to adapt successfully to technological changes to meet customers’ needs and developments in the marketplace; (xii) the

possibility that security measures implemented might not be sufficient to mitigate the risk of a cyber-attack or cyber theft, and that

such security measures might not protect against systems failures or interruptions; (xiii) legislative or regulatory changes that

adversely affect the Company’s business; (xiv) changes in accounting policies and practices or accounting standards; (xv) results

of examinations of the Company and Great Southern Bank by their regulators, including the possibility that the regulators may, among other

things, require the Company to limit its business activities, change its business mix, increase its allowance for credit losses, write-down

assets or increase its capital levels, or affect its ability to borrow funds or maintain or increase deposits, which could adversely affect

its liquidity and earnings; (xvi) costs and effects of litigation, including settlements and judgments; (xvii) competition;

(xviii) the transition from LIBOR to new interest rate benchmarks; and (xix) natural disasters, war, terrorist activities or

civil unrest and their effects on economic and business environments in which the Company operates. The Company wishes to advise readers

that the factors listed above and other risks described in the Company’s most recent Annual Report on Form 10-K, including,

without limitation, those described under “Item 1A. Risk Factors,” subsequent Quarterly Reports on Form 10-Q and other

documents filed or furnished from time to time by the Company with the SEC (which are available on our website at www.greatsouthernbank.com

and the SEC’s website at www.sec.gov), could affect the Company’s financial performance and cause the Company’s actual

results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current

statements.

The Company does not undertake-and specifically

declines any obligation- to publicly release the result of any revisions which may be made to any forward-looking statements to reflect

events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

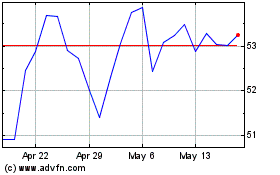

Great Southern Bancorp (NASDAQ:GSBC)

Historical Stock Chart

From Apr 2024 to May 2024

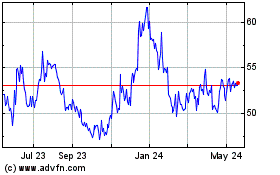

Great Southern Bancorp (NASDAQ:GSBC)

Historical Stock Chart

From May 2023 to May 2024