- Amended tender offer statement by Issuer (SC TO-I/A)

February 27 2012 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

(Amendment No. 2)

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF

THE SECURITIES EXCHANGE ACT OF 1934

The Hackett

Group, Inc.

(Name Of Subject Company (Issuer) And Filing Person (Offeror))

Common Shares, par value $0.001 per share

(Title of Class of Securities)

404609109

(CUSIP Number of Common Stock)

Frank A.

Zomerfeld, Esq.

General Counsel

1001 Brickell Bay Drive, Suite 3000

Miami, Florida 33131

(305) 375-8005

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

With a copy to:

John B. Beckman, Esq.

Hogan Lovells US LLP

555 Thirteenth Street, NW

Washington, DC 20004

(202) 637-5600

CALCULATION OF FILING FEE

|

|

|

|

|

|

|

Transaction Valuation*

|

|

Amount Of Filing Fee**

|

|

$55,000,000.00

|

|

$6,303.00

|

|

|

|

|

|

*

|

The transaction value is estimated only for purposes of calculating the filing fee. This amount is based on the offer to purchase for not more than $55 million in

aggregate of up to 12,941,176 shares of common stock, $0.001 par value, at the minimum tender offer price of $4.25 per share.

|

|

**

|

Previously paid. The amount of the filing fee, calculated in accordance with Rule 0-11 under the Securities Exchange Act of 1934, as amended, as modified by Fee Rate

Advisory No. 3 for fiscal year 2012, equals $114.60 per million dollars of the value of the transaction.

|

|

¨

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

|

|

Amount Previously Paid:

|

|

N/A

|

|

Filing Party:

|

|

N/A

|

|

Form or Registration No.:

|

|

N/A

|

|

Date Filed:

|

|

N/A

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer:

¨

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s)

relied upon:

|

|

¨

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

¨

|

Rule 14d-1(d) (Cross-Border Third Party Tender Offer)

|

SCHEDULE TO

This Amendment No. 2 amends and supplements the Tender Offer Statement on Schedule TO originally filed with the United States

Securities and Exchange Commission (the “SEC”) by The Hackett Group, Inc., a Florida corporation (“Hackett” or the “Company”), on February 22, 2012, in connection with the Company’s offer to purchase up to $55

million in value of shares of its common stock, $0.001 par value per share (the “Shares”), at a price not greater than $5.00 nor less than $4.25 per Share, to the seller in cash, less any applicable withholding taxes and without interest.

Only those items amended are reported in this Amendment No. 2. Except as specifically provided herein, the information

contained in the Schedule TO, as amended, remains unchanged and this Amendment No. 2 does not modify any of the information previously reported on the Schedule TO, as amended. You should read this Amendment No. 2 together with

the Schedule TO, the Offer to Purchase dated February 22, 2012 and the Letter of Transmittal.

|

ITEM 3.

|

IDENTITY AND BACKGROUND OF FILING PERSON

|

(a) Section (a) of Item 3 is amended and supplemented as follows:

The

information set forth under the heading “Section 10. Certain Information Concerning Us” is hereby amended and supplemented as follows:

The sub-heading entitled

“Incorporation by Reference”

in Section 10 (“Certain Information Concerning Us”) of the Offer to Purchase is hereby amended and supplemented by deleting

the reference to the Company’s “Annual Report on Form 10-K for the fiscal year ended December 31, 2010” filed on “March 10, 2011” and replacing it with the Company’s “Annual Report on Form 10-K for the fiscal year

ended December 31, 2011” filed on “February 24, 2012”.

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Schedule TO is true, complete and correct.

|

|

|

|

|

|

|

|

|

|

|

|

|

The Hackett Group, Inc.

|

|

|

|

|

|

|

Date: February 27, 2012

|

|

|

|

By:

|

|

/

S

/ T

ED

A. F

ERNANDEZ

|

|

|

|

|

|

|

|

Ted. A. Fernandez

|

|

|

|

|

|

|

|

Chief Executive Officer and Chairman of the Board

|

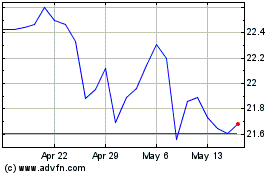

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Oct 2024 to Nov 2024

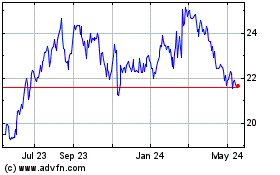

Hackett (NASDAQ:HCKT)

Historical Stock Chart

From Nov 2023 to Nov 2024