false

0001487428

0001487428

2024-10-09

2024-10-09

0001487428

hrzn:CommonStockParValue0001PerShareCustomMember

2024-10-09

2024-10-09

0001487428

hrzn:NotesDue20264875CustomMember

2024-10-09

2024-10-09

0001487428

hrzn:NotesDue2027625CustomMember

2024-10-09

2024-10-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 9, 2024

HORIZON TECHNOLOGY FINANCE CORPORATION

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

814-00802

|

|

27-2114934

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

312 Farmington Avenue

Farmington, CT 06032

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (860) 676-8654

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Ticker Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

HRZN

|

|

The Nasdaq Stock Market LLC

|

|

4.875% Notes due 2026

|

|

HTFB

|

|

The New York Stock Exchange

|

|

6.25% Notes due 2027

|

|

HTFC

|

|

The New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Section 2

|

Financial Information

|

|

Item 2.02

|

Results of Operations and Financial Condition

|

On October 9, 2024, Horizon Technology Finance Corporation (the “Company”) issued a press release announcing its investment portfolio update for the three months ended September 30, 2024. A copy of this press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished herewith, is being furnished and shall not be deemed “filed” for any purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of such Section. The information in this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

Section 9

|

Financial Statements and Exhibits

|

|

Item 9.01

|

Financial Statements and Exhibits

|

(d) Exhibits.

| |

|

|

99.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

Date: October 9, 2024

|

HORIZON TECHNOLOGY FINANCE CORPORATION

|

|

| |

|

|

| |

|

|

| |

By:

|

/s/ Robert D. Pomeroy, Jr.

|

|

| |

|

Robert D. Pomeroy, Jr.

|

|

| |

|

Chief Executive Officer

|

|

3

Horizon Technology Finance Provides Third Quarter 2024 Portfolio Update

- HRZN Originates $93.1 Million of New Loans in Q3 -

- HRZN Ends Quarter with Committed Backlog of $189.9 Million -

Farmington, Connecticut – October 9, 2024 – Horizon Technology Finance Corporation (NASDAQ: HRZN) (“HRZN” or “Horizon”), an affiliate of Monroe Capital, and a leading specialty finance company that provides capital in the form of secured loans to venture capital-backed companies in the technology, life science, healthcare information and services, and sustainability industries, today provided its portfolio update for the third quarter ended September 30, 2024 and an update on the lending platform (“Horizon Platform”) of Horizon Technology Finance Management LLC (“HTFM”), its investment adviser.

“We made excellent progress in the third quarter with respect to originating new, high-quality investments, as the venture environment continues to show improvement,” said Gerald A. Michaud, President of Horizon and HTFM. “For the quarter, we originated $93.1 million of loans, as our venture debt portfolio returned to meaningful growth. We also significantly increased our committed backlog to $189.9 million of debt investments, providing Horizon with a solid foundation for future lending opportunities. We continue to believe Horizon remains well positioned to deliver additional value to its shareholders.”

Third Quarter 2024 Portfolio Update

Originations

During the third quarter of 2024, HRZN funded a total of $93.1 million of loans, as follows:

| |

●

|

$25.0 million to a new portfolio company, Hometeam Technologies, Inc. (dba Vesta Healthcare), a tech-enabled clinical services company that integrates caregivers, patients and the healthcare delivery system to monitor chronic conditions of high-risk patients.

|

| |

●

|

$16.0 million to an existing portfolio company, Spineology, Inc., a developer of anatomy-conserving technology solutions for use in lumbar spinal fusion procedures.

|

| |

●

|

$15.0 million to a new portfolio company, GT Medical Technologies, Inc., a developer of a proprietary solution to treat brain tumors.

|

| |

●

|

$15.0 million to a new portfolio company, Infobionic, Inc., a developer of an FDA-cleared SaaS remote monitoring system to help treat cardiac arrythmia.

|

| |

●

|

$10.0 million to a new portfolio company, Pivot Bio, Inc., a developer of natural microbial products that ensure crops receive essential nitrogen needed to grow.

|

| |

●

|

$10.0 million to a new portfolio company, a developer of a connected digital supply chain for custom manufacturing that networks highly-vetted manufacturing partners around the globe.

|

| |

●

|

$1.0 million to an existing portfolio company, Swift Health Systems, Inc. (dba InBrace), a developer of teeth straightening technology that provides an alternative to traditional braces and aligners.

|

| |

●

|

$0.6 million to an existing portfolio company, a developer of a breathalyzer test to detect recent cannabis use.

|

| |

●

|

$0.5 million to an existing affiliated portfolio company, a builder of conservation memorial forests that offer sustainable alternatives to cemeteries.

|

Liquidity Events and Partial Paydowns

HRZN experienced liquidity events from four portfolio companies in the third quarter of 2024, consisting of principal prepayments of $37.5 million, compared to $33.8 million of principal prepayments during the second quarter of 2024:

| |

●

|

In July, MyForest Foods Co. (“MyForest Foods”) prepaid its outstanding principal balance of $3.8 million on its venture loan, plus interest, end-of-term payment and prepayment fee. HRZN continues to hold warrants in MyForest Foods.

|

| |

●

|

In July, Lemongrass Holdings, Inc. (“Lemongrass”) prepaid its outstanding principal balance of $6.2 million on its venture loan, plus interest, end-of-term payment and prepayment fee. HRZN continues to hold warrants in Lemongrass.

|

| |

●

|

In July, Slingshot Aerospace, Inc. (“Slingshot Aerospace”) prepaid its outstanding principal balance of $20.0 million on its venture loan, plus interest, end-of-term payment and prepayment fee. HRZN continues to hold warrants in Slingshot Aerospace.

|

| |

●

|

In July, with the proceeds of a new loan from the Horizon Platform, Spineology paid its outstanding principal balance of $7.5 million on its venture loan, plus interest and end-of-term payment. HRZN continues to hold warrants in Spineology.

|

HRZN also received prepayments of principal from two portfolio companies in the aggregate amount of $1.8 million during the third quarter of 2024, compared to $11.4 million of prepayments of principal during the second quarter of 2024.

Principal Payments Received

During the third quarter of 2024, HRZN received regularly scheduled principal payments on investments totaling $12.4 million, compared to regularly scheduled principal payments totaling $11.8 million during the second quarter of 2024.

Commitments

During the quarter ended September 30, 2024, HRZN closed new loan commitments totaling $172.9 million to eight companies, compared to new loan commitments of $12.5 million to two companies in the second quarter of 2024.

Pipeline and Term Sheets

As of September 30, 2024, HRZN’s unfunded loan approvals and commitments (“Committed Backlog”) were $189.9 million to 16 companies. This compares to a Committed Backlog of $137.5 million to 13 companies at HRZN as of June 30, 2024. HRZN’s portfolio companies have discretion whether to draw down such commitments and the right of a portfolio company to draw down its commitment is often subject to achievement of specific milestones and other conditions to borrowing. Accordingly, there is no assurance that any or all of these transactions will be funded by HRZN.

During the quarter, HTFM received signed term sheets that are in the approval process, which may result in the Horizon Platform providing up to an aggregate of $35.0 million of new debt investments. These opportunities are subject to underwriting conditions including, but not limited to, the completion of due diligence, negotiation of definitive documentation and investment committee approval, as well as compliance with HTFM’s allocation policy. Accordingly, there is no assurance that any or all of these transactions will be completed or funded by HRZN.

Warrant and Equity Portfolio

As of September 30, 2024, HRZN held a portfolio of warrant and equity positions in 103 portfolio companies, including 92 private companies, which provides the potential for future additional returns to HRZN’s shareholders.

About Horizon Technology Finance

Horizon Technology Finance Corporation (NASDAQ: HRZN), externally managed by Horizon Technology Finance Management LLC, an affiliate of Monroe Capital, is a leading specialty finance company that provides capital in the form of secured loans to venture capital backed companies in the technology, life science, healthcare information and services, and sustainability industries. The investment objective of Horizon is to maximize its investment portfolio’s return by generating current income from the debt investments it makes and capital appreciation from the warrants it receives when making such debt investments. Horizon is headquartered in Farmington, Connecticut, with a regional office in Pleasanton, California, and investment professionals located throughout the U.S. Monroe Capital is a $19.5 billion asset management firm specializing in private credit markets across various strategies, including direct lending, technology finance, venture debt, opportunistic, structured credit, real estate and equity. To learn more, please visit horizontechfinance.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical facts included in this press release may constitute forward-looking statements and are not guarantees of future performance, condition or results and involve a number of risks and uncertainties. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in the Company’s filings with the Securities and Exchange Commission. Horizon undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

Contacts:

Investor Relations:

ICR

Garrett Edson

ir@horizontechfinance.com

(646) 200-8885

Media Relations:

ICR

Chris Gillick

HorizonPR@icrinc.com

(646) 677-1819

v3.24.3

Document And Entity Information

|

Oct. 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

HORIZON TECHNOLOGY FINANCE CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 09, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

814-00802

|

| Entity, Tax Identification Number |

27-2114934

|

| Entity, Address, Address Line One |

312 Farmington Avenue

|

| Entity, Address, City or Town |

Farmington

|

| Entity, Address, State or Province |

CT

|

| Entity, Address, Postal Zip Code |

06032

|

| City Area Code |

860

|

| Local Phone Number |

676-8654

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001487428

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

HRZN

|

| Security Exchange Name |

NASDAQ

|

| NotesDue20264875 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2026

|

| Trading Symbol |

HTFB

|

| Security Exchange Name |

NYSE

|

| NotesDue2027625 Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.25% Notes due 2027

|

| Trading Symbol |

HTFC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_NotesDue20264875CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=hrzn_NotesDue2027625CustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

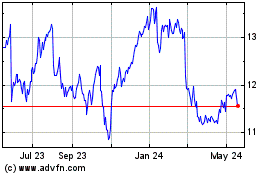

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Mar 2025 to Apr 2025

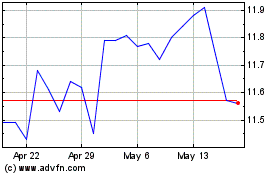

Horizon Technology Finance (NASDAQ:HRZN)

Historical Stock Chart

From Apr 2024 to Apr 2025