Current Report Filing (8-k)

May 08 2023 - 3:06PM

Edgar (US Regulatory)

0001892322

false

0001892322

2023-05-02

2023-05-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 2, 2023

HEARTCORE

ENTERPRISES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41272 |

|

87-0913420 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1-2-33,

Higashigotanda, Shinagawa-ku, Tokyo, Japan

(Address

of principal executive offices)

+81-3-6409-6966

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions.

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HTCR |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

On

May 2, 2023, HeartCore Enterprises, Inc. (the “Company”) entered into that certain Note Purchase Agreement by and between

the Company and ZEROSPO. Pursuant to the terms of the Note Purchase Agreement, ZEROSPO agreed to issue and sell to the Company, and the

Company agreed to purchase, a promissory note in the principal amount of $300,000 (the “Note”).

Pursuant

to the terms of the Note, ZEROSPO agreed to pay to the Company $300,000 and to pay interest on the outstanding principal amount at the

rate of 8% per annum. To the extent not earlier paid, the principal amount and all accrued interest will be due and payable on the Maturity

Date (as hereinafter defined) or earlier in the event of an event of default as provided in the Note. The “Maturity Date”

means the earlier of:

| (i) | The

date of the closing of capital-raising transactions consummated by ZEROSPO via the issuance

of any debt securities or equity securities of ZEROSPO or any of its affiliates which results

in gross proceeds to ZEROSPO or any of its affiliates of $300,000 or more; |

| (ii) | The

date on which ZEROSPO completes a transaction pursuant to which its ordinary shares are listed

for trading on The Nasdaq Capital Market, or any related exchange, including the NASDAQ Global

Market, or on the New York Stock Exchange or any related securities exchange, including the

NYSE American; and |

| (iii) | The

date which is 180 days following May 2, 2023. |

ZEROSPO

may, at its sole option, prepay the Note and any accrued interest thereunder in whole or in part at any time. In the event that any amount

due under the Note is not paid as and when due, such amounts will accrue interest at the rate of 12% per year, simple interest, non-compounding,

until paid.

The

foregoing description of the Note Purchase Agreement and the Note is qualified in its entirety by reference to the Note Purchase Agreement

and the Note, copies of which are filed as Exhibits 10.1 and 10.2 hereto and which are incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HEARTCORE

ENTERPRISES, INC. |

| |

|

|

| Dated:

May 8, 2023 |

By: |

/s/

Sumitaka Yamamoto |

| |

Name: |

Sumitaka

Yamamoto |

| |

Title: |

Chief

Executive Officer |

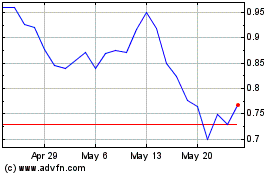

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Jun 2024 to Jul 2024

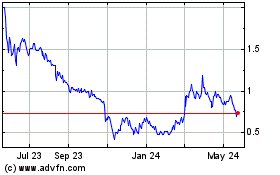

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Jul 2023 to Jul 2024