UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: February 2024

Commission File Number: 005-91913

Fusion Fuel Green PLC

(Translation of registrant’s name into English)

The Victorians

15-18 Earlsfort Terrace

Saint Kevin’s

Dublin 2, D02 YX28, Ireland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Distribution of Proxy Statement

On February 27, 2024, Fusion Fuel Green PLC (the “Company”) distributed a definitive

proxy statement to shareholders for an extraordinary general meeting of shareholders to be held on March 20, 2024. A copy of the proxy

statement is annexed as Exhibit 99.1 hereto.

.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Fusion Fuel Green PLC |

| |

(Registrant) |

| |

|

| Date: February 27, 2024 |

/s/ Frederico Figueira de Chaves |

| |

Frederico Figueira de Chaves |

| |

Chief Executive Officer |

Exhibit 99.1

Notice of Extraordinary General Meeting 2024

TABLE OF CONTENTS

| |

Page

|

|

Letter from Chairperson

|

1 |

|

Notice of Extraordinary General Meeting

|

4 |

|

Questions and Answers about the Extraordinary General Meeting

|

6 |

|

Additional Information

|

9 |

Fusion Fuel Green plc

(the “Company”)

(Registered in Ireland No. 669283)

| Directors |

Registered Office |

| |

|

|

Jeffrey E. Schwarz

Frederico Perez Marques Figueira de Chaves

Rune Magnus Lundetrae

Alla Jezmir

Theresa Jester |

Fusion Fuel Green plc

The Victorians

15-18 Earlsfort Terrace

Saint Kevin’s

Dublin 2

D02 YX28

Ireland |

Dear Shareholder

Introduction

I am writing to you to outline the background to the proposals to be put

forward at the forthcoming Extraordinary General Meeting (“EGM”) of the Company, all of which the board of directors

(the “Board” or the “Directors”) considers to be in the best interests of the Company and the shareholders

as a whole and are recommending for your approval.

Your attention is drawn to the Notice of the EGM of the Company. The EGM

will be held at the offices of Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland on 20 March 2024 at 1pm (Dublin time)

and the Notice is set out at page 4 of this document. The business to be transacted at the EGM is set out below.

Background to EGM

As the Company is registered in Ireland, under Irish law, directors must

have authority from the Company’s shareholders to issue any shares. Additionally, under Irish law, unless otherwise authorised,

when an Irish public limited company issues shares for cash, it is required first to offer those shares on the same or more favorable

terms to existing shareholders of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right).

The Company’s Articles of Association granted the directors the authority

to allot securities and to opt out of the statutory pre-emption rights until 31 December 2023. Those authorisations were successfully

extended at the Company’s AGM on 29 September 2023. The current authorisations allow the directors to issue up to aggregate

nominal amount of $295.30 (2,952,994 ordinary shares, equivalent to approximately 20% of the aggregate nominal value of the issued ordinary

shares of the Company as of 31 August 2023) and to opt out of statutory pre-emption rights when issuing shares for cash, also up to an

aggregate nominal amount of $295.30 (2,952,994 ordinary shares). Both authorities will expire on 31 December 2024.

Earlier this month, the Company received notification from the European

Commission that the Company’s HEVO-Portugal project was among 33 selected for approval under the Important Projects of Common European

Interest Hy2Infra program. This program allows us to commence funding negotiations with the relevant government stakeholders and the European

Investment Bank, which has committed to providing financing and advisory support to those projects selected for public funding. Very positively,

we saw an increase in the Company’s share price following this announcement.

Given recent developments in relation to the Company’s business opportunities

and share price, we consider it to be in the Company’s best interests to now further extend these authorities to ensure that we

can raise sufficient capital to facilitate the Company’s continued growth over the coming years.

You will recall that we launched an at the market (‘ATM’) offering

in June 2022. The ATM program has proven to be an effective instrument, one which we have utilized judiciously and opportunistically to

strengthen our liquidity position. However, the aforementioned limit on the number of securities the Company is authorised to issue this

year, in combination with our market capitalization, represents a fundamental constraint in ensuring that the Company is properly capitalized.

We find ourselves in a position where the Company has a number of exciting business and financial opportunities on the horizon, and we

are keen to ensure that the Company is well-positioned to capitalize on these opportunities and achieve continued growth for the Company

and our shareholders.

If proposals contained in this notice are not approved, we would be required

to obtain shareholder approval prior to issuing any shares in excess of the 20% cap in connection with any new strategic opportunities.

This could put us at a distinct disadvantage vis-à-vis many of our peers and might make it difficult for us to complete projects

and other strategic initiatives in furtherance of our growth strategy, thus potentially limiting our ability to deploy capital to meet

strategic goals that are in the best interests of our shareholders. Likewise, the requirement to first offer shares that we propose to

issue for cash to all of our existing shareholders in time-consuming pro-rata rights offerings would considerably reduce the speed at

which we could complete capital-raising activities, would increase our costs and otherwise might make it difficult for us to achieve our

strategic initiatives.

To be able to participate in various strategic financing arrangements essential

for our continued growth, the Company requires sufficient flexibility to issue new shares. Therefore, we are seeking your approval to

grant the directors authority to issue new shares in excess of the 20% cap (up to the maximum of our authorised but unissued share capital)

and to opt out of the statutory pre-emption right. This measure will empower management to enter into strategic financing discussions

essential for our continued growth.

Proposal 1 – To extend the authorisation of the Directors to allot

securities under Irish law

Under Irish law, directors of an Irish public limited company must have

authority from its shareholders to issue any shares, including shares which are part of the company’s authorised but unissued share

capital. Our current authorisation, which was approved at our annual general meeting last year, grants the Directors the authority to

issue up to aggregate nominal amount of $295.30 (2,952,994 ordinary shares (being equivalent to approximately 20% of the aggregate nominal

value of the issued ordinary shares of the Company as of 31 August 2023 (being the last practicable date before the Notice of 2023 Annual

General Meeting of Shareholders)), with such authority expiring on 31 December 2024.

We are now seeking your approval to grant the Directors the authority to

issue shares up to the maximum of the Company’s authorised but unissued ordinary share capital.

We are not asking you to approve an increase in our authorised share capital

or to approve a specific issuance of shares. Instead, approval of this proposal will only extend the authority of the directors to issue

shares that are already authorised under our Articles of Association, up to an aggregate nominal amount of the authorised but unissued

ordinary share capital.

A majority of the votes cast at the EGM will be required to pass the resolution

in Proposal 1.

Proposal 2 – To extend authorisation

of the Directors to opt out of statutory pre-emption rights under Irish law

Under Irish law, unless otherwise authorised, when an Irish public limited

company issues shares for cash, it is required first to offer those shares on the same or more favorable terms to existing shareholders

of the company on a pro-rata basis (commonly referred to as the statutory pre-emption right). Our current authorisation, which was approved

at our annual general meeting last year, grants the Directors the authority to opt-out of the statutory pre-emption rights when issuing

shares for cash, up to an aggregate nominal amount of $295.30 (2,952,994 ordinary shares (being equivalent to approximately 20% of the

aggregate nominal value of the issued ordinary shares of the Company as of 31 August 2023 (being the last practicable date before the

Notice of 2023 Annual General Meeting of Shareholders)), with such authority expiring on 31 December 2024.

We are now proposing to extend the Directors’ authority to opt-out

of the pre-rights when issuing shares for cash, up to an aggregate nominal amount of the authorised but unissued ordinary share capital

of the Company.

Similar to the authorisation sought for Proposal 1, this authority

is fundamental to our business and will facilitate our ability to fund acquisitions and otherwise raise capital. As with Proposal 1, we

are not asking you to approve an increase in our authorised share capital. Instead, approval of these proposals will only grant the Directors

the authority to issue shares up to the maximum of the Company’s authorised but unissued ordinary share capital.

Without the authorisation provided for in Proposal

2, were we to issue shares for cash in excess of an aggregate nominal amount of $295.30 (2,952,994 ordinary shares-being equivalent to

approximately 20% of the aggregate nominal value of the issued ordinary shares of the Company as of 31 August 2023), we would first have

to offer those shares on the same or more favorable terms to all of our existing shareholders, which could cause delays in the completion

of acquisitions and the raising of capital for our business.

75% of the votes cast at the EGM will be required

to pass the resolution in Proposal 2. In addition, this proposal is conditioned upon the approval of Proposal 1, as required by Irish law.

Further Action

You may submit your proxy over the Internet by logging on to www.cstproxyvote.com.

To log on, you will need your control number which is printed on your proxy card. Online proxy votes must be received no later than 11.59pm

(Eastern Time) on 19 March 2024.

Recommendation

Your Board believes that the proposals to be put forward at the EGM

are in the best interests of the Company and its shareholders. Accordingly, your Directors unanimously recommend that you vote in favor

of the proposals as they intend to do in respect of all the ordinary shares which can be voted by them.

Yours sincerely

/s/ Jeffrey E. Schwarz

Jeffrey E. Schwarz

Chairman

27 February 2024

NOTICE OF EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that the Extraordinary General Meeting (“EGM”)

of Fusion Fuel Green plc (the “Company”) will be held at 1pm (Dublin time) on 20 March 2024 at the offices of the Company’s

counsel, Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland for the following purposes:

| 1. | To extend the authorisation of the Directors to allot securities under Irish, in accordance with the following

resolution: |

TO RESOLVE, as an ordinary resolution, that

the directors be and are hereby generally and unconditionally authorised with effect from passing this resolution to exercise all powers

of the Company to allot and issue relevant securities (within the meaning of Section 1021 of the Companies Act 2014) up to an aggregate

nominal amount of the authorised but unissued ordinary share capital of the Company as of the date of this resolution, and the authority

conferred by this resolution shall expire on 19 March 2029, unless previously renewed, varied or revoked; provided that the Company may

make an offer or agreement before the expiry of this authority, which would or might require any such securities to be allotted after

this authority has expired, and in that case, the directors may allot and issue relevant securities in pursuance of any such offer or

agreement as if the authority conferred hereby had not expired.

| 2. | To extend authorisation of the Directors to opt out of statutory pre-emption rights under Irish law, in

accordance with the following resolution: |

TO RESOLVE, as a special resolution, that, subject to the passing of

the resolution in respect of Proposal 1 as set out above and with effect from this resolution, the directors be and are hereby empowered

pursuant to section 1023(3) of the Irish Companies Act 2014 to allot and issue equity securities (as defined in Section 1023 of that Act)

for cash pursuant to the authority conferred by the directors’ allotment authority proposal (Proposal 1) up to an aggregate nominal

amount equal to the authorised but unissued share capital of the Company as at the date of this resolution as if section 1022 of the Act

did not apply to any such allotment, provided that this authority shall expire on 20 March 2029 and provided that the Company may before

the expiry of such authority make an offer or agreement which would or might require equity securities to be allotted or issued after

such expiry and the Company’s directors may allot or issue equity securities in pursuance of such an offer or agreement as if the

power conferred by this resolution had not expired.

Your Board believes that the proposals to be put forward at the EGM

are in the best interests of the Company and its shareholders. Accordingly, your Directors unanimously recommend you vote in favor of

the proposals. Registered shareholders of the Company at the close of business on the record date (16 February 2024) are eligible to vote

at the meeting.

Your vote is important. To make sure your shares are represented, please

cast your vote as soon as possible in one of the following ways:

| · | Online: At www.cstproxyvote.com; |

| · | Mail: If you received a proxy card in the mail, mark, sign and date your proxy card and return

it in the postage-paid envelope; or |

| · | In person: You may attend the EGM in person at the above address. |

The latest time for receipt of online proxies is 11.59pm (Eastern Time),

19 March 2024. Mail-in proxies must be received by the start of the EGM. The notice is available at www.fusion-fuel.eu. We recommend that

you review the further information on the process for, and deadlines applicable to, voting, attending the meeting and appointing a proxy

under “Questions and Answers about the Extraordinary General Meeting” on page 6.

Yours sincerely

/s/ Gavin Jones

Gavin Jones

Secretary

The Victorians, 15-18 Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28,

Ireland

27 February 2024

QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL

MEETING

Why did I receive this notice?

We are providing this notice in connection with the solicitation by the

Board of proxies to be voted at the Extraordinary General Meeting. You received this notice because you were a shareholder of record as

of the close of business on 16 February 2024.

What is the date, time and location of the Extraordinary General Meeting?

We will hold the Extraordinary General Meeting at 1pm (Dublin time) on

20 March 2024, at the offices of our counsel, Arthur Cox LLP, Ten Earlsfort Terrace, Dublin 2, D02 T380, Ireland, subject to any adjournments

or postponements. For directions to the meeting, you may contact our Company Secretary, c/o Fusion Fuel Green plc, The Victorians, 15-18

Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland.

Who is entitled to vote?

The Board has set 16 February 2024 as the record date for the Extraordinary

General Meeting. All persons who were registered holders of Fusion Fuel Green plc’s Class A ordinary shares at the close of business

on that date are shareholders of record for the purposes of the Extraordinary General Meeting and will be entitled to receive notice of,

and to attend and vote at, the Extraordinary General Meeting. Beneficial owners who, at the close of business on the record date, held

their shares in an account with a broker, bank or other holder of record generally cannot vote their shares directly and instead must

instruct the record holder how to vote their shares.

As of the close of business on the record date, there were 15,084,558 Class

A ordinary shares outstanding. Each shareholder of record is entitled to one vote per Class A ordinary share on each matter submitted

to a vote of shareholders. Your shares will be represented if you attend and vote at the Extraordinary General Meeting or if you submit

a completed proxy by the voting deadlines set forth below.

How do I vote?

Registered shareholders (that is, shareholders who hold their shares directly

with our transfer agent, Continental Stock Transfer & Trust Company) can vote in any of the following ways:

| · | Online: Go to www.cstproxyvote.com to vote your proxy online using the control number that you

were provided with on your proxy card or Notice of Internet Availability. You will need to follow the instructions on the website. |

| · | By Mail: You may mark, sign, date and return your proxy card in the enclosed postage-paid envelope.

Proxies must be received by the deadlines set forth below. |

If you vote online, your electronic vote authorises the named proxies

in the same manner as if you signed, dated and returned a proxy card by mail.

| · | In Person: Attend the Extraordinary General Meeting in Dublin or send a personal representative

with an appropriate proxy to vote at the meeting. Please contact our Company Secretary, Fusion Fuel Green plc, The Victorians, 15-18 Earlsfort

Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland for additional information about sending a personal representative on your behalf.

For information about how to attend the Extraordinary General Meeting, please see “What do I need to be admitted to the Extraordinary

General Meeting?” below. |

If I am a beneficial owner of shares held in street name, how do I vote?

If your shares are held beneficially in the name of a bank, broker or other

holder of record (sometimes referred to as holding shares “in street name”), you will receive instructions from the holder

of record that you must follow in order for your shares to be voted. If you wish to vote in person at the meeting, you must obtain a legal

proxy from the bank, broker or other holder of record that holds your shares, and bring it, or other evidence of stock ownership, with

you to the meeting.

What are the deadlines to submit my vote?

| · | Online: Proxy votes cast online must be received by 11.59pm (Eastern Time) on 19 March 2024. |

| · | Mail: Proxy cards returned by mail must be received by the start of the EGM. |

Can I revoke my proxy or change my vote

after I have voted?

Yes. If you are a registered shareholder and previously

voted online, you may revoke your proxy or change your vote by:

| · | voting online at a later date, as set forth above before the closing of those voting facilities at 11.59pm

(Eastern Time) on 19 March 2024; |

| · | attending the Extraordinary General Meeting in Dublin and submitting a new poll card during the meeting;

or |

| · | sending a written notice of revocation to our Company Secretary, Fusion Fuel Green plc, The Victorians,

15-18 Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland, which must be received before the commencement of the Extraordinary

General Meeting. |

If you are a beneficial owner of shares held in street

name, you must contact the holder of record to revoke a previously authorised proxy.

What do I need to be admitted to the Extraordinary

General Meeting?

For shareholders who plan to attend the Extraordinary General

Meeting in person, at the entrance to the Extraordinary General Meeting in Dublin, we will request to see valid photo identification,

such as a driver’s license or passport. We will also need to determine if you owned ordinary shares on the record date by:

| · | asking to review evidence of your share ownership as of 16 February 2024, such as your brokerage statement.

You must bring such evidence with you in order to be admitted to the meeting; or |

| · | verifying your name and share ownership against our list of registered shareholders. |

If you are acting as a proxy, we will need to review a

valid written legal proxy signed by the registered owner of the ordinary shares granting you the required authority to attend the meeting

and vote such shares.

What constitutes a quorum?

In order to establish a quorum at the Extraordinary General

Meeting there must be at least two shareholders present in person or by proxy who have the right to attend and vote at the meeting and

who together hold shares representing more than 50% of the votes that may be cast by all shareholders of record. For purposes of determining

a quorum, abstentions and broker “non-votes” are counted as present.

How are votes counted?

You may vote “FOR”, “AGAINST” or

“ABSTAIN” with respect to each of the proposals presented. A vote “FOR” will be counted in favor of the proposal

or director nominee and a vote “AGAINST” will be counted against each proposal or nominee. Except as described below, an “ABSTAIN”

vote will not be counted “FOR” or “AGAINST” and will have no effect on the voting results for any of the proposals

in this notice. Continental Stock Transfer & Trust Company will monitor all votes and assist us in tabulating the votes.

What is a “broker non-vote” and how

does it affect voting?

If you are a beneficial owner whose shares are held of

record by a broker, we encourage you to instruct the broker how to vote your shares. If you do not provide voting instructions, your shares

will not be voted on any proposal for which the broker does not have discretionary authority to vote. This is called a “broker non-vote”,

which occurs for proposals considered “non-routine” under NASDAQ rules. Your broker will, however, still be able to register

your shares as being present at the Extraordinary General Meeting for purposes of determining the presence of a quorum and will be able

to vote on “routine” proposals.

There are no “routine” proposals in this notice,

for which your broker has discretionary voting authority under the NASDAQ rules to vote your shares, even if the broker does not receive

voting instructions from you. Proposals 1 and 2 are considered “non-routine” such that, if you are a beneficial owner whose

shares are held of record by a broker and you do not provide voting instructions, a broker non-vote will occur and your shares will not

be voted on these proposals.

What is the vote required to approve each of the

proposals discussed in the notice?

The chart below summarises the voting requirements and

effects of broker non-votes and abstentions on the outcome of the vote for the proposals at the Extraordinary General Meeting.

| Proposals |

Required Approval |

Broker

Discretionary Voting Allowed |

Broker Non-Votes |

Abstentions |

| 1. To extend the authorisation of the Directors to allot securities under Irish law |

Majority of Votes Cast |

No |

No effect |

No effect |

| 2. To extend authorisation of the Directors to opt out of statutory pre-emption rights under Irish law |

75% of Votes Cast |

No |

No effect |

No effect |

Who will pay for the cost of this proxy solicitation?

Fusion Fuel Green plc will bear the costs of soliciting

proxies from the holders of our Class A ordinary shares. Proxies may be solicited on our behalf by our directors, officers and other selected

Fusion Fuel Green plc employees electronically or by other means of communication. Directors, officers and employees who help us in the

solicitation will not be specially compensated for those services, but they may be reimbursed for their out-of-pocket expenses incurred

in connection with the solicitation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward soliciting

materials to beneficial owners and will be reimbursed for their reasonable out-of-pocket expenses incurred in sending the materials to

beneficial owners.

ADDITIONAL INFORMATION

Availability of Materials

Important Notice Regarding the Availability of Materials for the 2024

Extraordinary General Meeting of Shareholders to Be Held on 20 March 2024: The notice is available free of charge at www.fusion-fuel.eu.

Submission of Future Shareholder Proposals

Our annual general meeting of shareholders for 2024 is expected to be held

in September 2024. In accordance with the rules established by the SEC, any shareholder proposal submitted pursuant to Rule 14a-8 to be

included in the notice for that meeting must be received by us by 1 May 2024. If you would like to submit a shareholder proposal to be

included in that notice, you should send your proposal to our Company Secretary, Fusion Fuel Green plc, The Victorians, 15-18 Earlsfort

Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland. In order for your proposal to be included in the notice, the proposal must comply

with the requirements established by the SEC and our Articles of Association.

Pursuant to our Articles of Association, a shareholder must give notice

of any intention to present a proposal at the Annual General Meeting, including a proposal to appoint a director, not less than 60 nor

more than 90 days before the first anniversary of the preceding year’s annual general meeting (“traditional advance notice”).

Subject to our Articles of Association, any notice of an intention to present a proposal pursuant to traditional advance notice must be

received by our Company Secretary on or after 1 July 2024 but no later than 31 July 2024.

Irish law currently provides that shareholders holding 10% or more of the

total voting rights may request that the directors call an extraordinary general meeting at any time. The shareholders who wish to request

an extraordinary general meeting must deliver to The Victorians, 15-18 Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland, a

written notice, signed by the shareholders requesting the meeting and stating the purposes of the meeting. If the directors do not, within

21 days of the date of delivery of the request, proceed to convene a meeting to be held within 2 months of that date, those shareholders

(or any of them representing more than half of the total voting rights of all of them) may themselves convene a meeting, but any meeting

so convened cannot be held after the expiration of 3 months from the date of delivery of the request. These provisions of Irish law are

in addition to, and separate from, the requirements that a shareholder must meet in order to have a proposal included in the notice under

the rules of the SEC.

About Fusion Fuel Green plc

Fusion Fuel Green plc is an emerging leader in the green hydrogen space,

committed to accelerating the energy transition and decarbonising the global energy system by making zero-emissions green hydrogen commercially

viable and accessible. Fusion Fuel has created a revolutionary proprietary electrolyser solution that allows it to produce hydrogen at

highly competitive costs using renewable energy, resulting in zero-carbon emissions. Fusion Fuel’s business lines includes the sale

of electrolyser technology to customers interested in building their own green hydrogen capacity, the development of hydrogen plants to

be owned and operated by Fusion Fuel and active management of the portfolio of such hydrogen plants as assets, and the sale of green hydrogen

as a commodity to end-users through long-term hydrogen purchase agreements.

Fusion Fuel Green plc is organised under the laws of Ireland and maintains

its registered office in Ireland at The Victorians, 15-18 Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland. You may contact

our Investor Relations Group by telephone in Ireland at +353 1 920 1000; by e-mail at IR@fusion-fuel.eu; or by mail at Fusion Fuel Green

plc, Investor Relations, The Victorians, 15-18 Earlsfort Terrace, Saint Kevin's, Dublin 2, D02YX28, Ireland.

Our website address is www.fusion-fuel.eu. We use our website as a channel

of distribution for company information. We make available free of charge on the Investor Relations section of our website (https://ir.fusion-fuel.eu/)

our Annual Report on Form 20-F and our Reports on Form 6-K and all amendments to those reports as soon as reasonably practicable after

such material is electronically filed with or furnished to the SEC pursuant to section 13(a) or 15(d) of the Exchange Act. We also make

available other reports filed with or furnished to the SEC under the Exchange Act through our website, as well as our Code of Ethics and

the charters of each of the Board’s committees. You may request any of these materials and information in print free of charge

by contacting our Investor Relations Group at Fusion Fuel Green plc, Investor Relations, The Victorians, 15-18 Earlsfort Terrace, Saint

Kevin's, Dublin 2, D02YX28, Ireland. We do not intend for information contained on our website to be part of this notice. In addition,

the SEC maintains an Internet site (http://www.sec.gov) that contains reports, proxy and information statements, and other information

regarding issuers, including Fusion Fuel Green plc, that file electronically with the SEC. Copies of materials we file with the SEC may

be reviewed on and printed from the SEC website.

Forward-looking Statements

This notice contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. The words “believe,” “may,” “estimate,” “continue,”

“anticipate,” “intend,” “should,” “plan,” “could,” “target,” “potential,”

“is likely,” “will,” “expect” and similar expressions, as they relate to us, are intended to identify

forward-looking statements. The Company has based these forward-looking statements largely on our current expectations and projections

about future events and financial trends that we believe may affect our financial condition, results of operations, business strategy

and financial needs. Some or all of the results anticipated by these forward-looking statements may not be achieved. Further information

on the Company’s risk factors is contained in our filings with the SEC. Any forward-looking statement made by us herein speaks only

as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and

it is not possible for us to predict all of them. The Company undertakes no obligation to publicly update any forward-looking statement,

whether as a result of new information, future developments or otherwise, except as may be required by law.

10

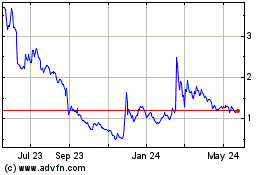

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Oct 2024 to Nov 2024

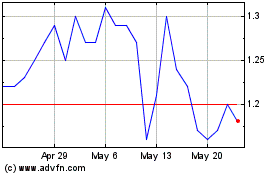

Fusion Fuel Green (NASDAQ:HTOO)

Historical Stock Chart

From Nov 2023 to Nov 2024