false 0001833769 0001833769 2025-02-11 2025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

Hyperfine, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-39949 |

|

98-1569027 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 351 New Whitfield Street Guilford, Connecticut |

|

06437 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (866) 796-6767

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions.

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock, $0.0001 par value per share |

|

HYPR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 11, 2025, Hyperfine, Inc. (the “Company”) updated its corporate presentation (the “Investor Presentation”), as described further below, which included information with respect to certain preliminary unaudited financial results of the Company. For the fiscal year ended December 31, 2024, the Company had estimated total revenue of approximately $12.9 million, including estimated device revenue of approximately $10.5 million and estimated service revenue of approximately $2.4 million, and estimated gross margin of approximately 46%, and estimated cash and cash equivalents of approximately $37.6 million as of December 31, 2024.

The estimated total revenue, device revenue, service revenue, and gross margin for the fiscal year ended December 31, 2024 and the estimated cash and cash equivalents as of December 31, 2024 are preliminary and may change, and are based on information available to management as of the date of this Current Report on Form 8-K (the “Report”) and are subject to completion by management of the financial statements as of and for the year ended December 31, 2024. There can be no assurance that the Company’s total revenue, device revenue, service revenue, and gross margin for fiscal year 2024 or the cash and cash equivalents as of December 31, 2024 will not differ from these estimates and any such changes could be material. The preliminary financial data included in this Report has been prepared by and is the responsibility of the Company’s management. The Company’s independent registered public accounting firm has not audited, reviewed, compiled, or applied agreed-upon procedures with respect to the preliminary financial data. Accordingly, the Company’s independent registered public accounting firm does not express an opinion or any other form of assurance with respect thereto. Complete quarterly results will be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024.

The information in this Item 2.02 is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

| Item 7.01 |

Regulation FD Disclosures. |

On February 11, 2025, the Company updated its Investor Presentation, which management intends to use from time to time in general corporate communications, investor communications and conferences. A copy of the Investor Presentation is attached and furnished hereto as Exhibit 99.1 and is also available on the “Investor Relations” portion of the Company’s website. The Investor Presentation is current as of February 11, 2025, and the Company disclaims any obligation to update the Investor Presentation after such date.

The information in this Item 7.01 and Exhibit 99.1 is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

During the fourth quarter of 2024, the Company achieved several milestones in support of growth catalyst for 2025, including:

| |

• |

|

Received accreditation from the Intersocietal Accreditation Commission (IAC) accepting ultra-low-field MRI technology allowing accredited facilities to qualify for reimbursement from the US Centers for Medicare & Medicaid Services (CMS). |

| |

• |

|

Obtained CE approval of 9th generation AI-powered brain imaging software with enhanced speed. The Swoop® system is now available in four European language configurations (German, Spanish, Italian and French). |

| |

• |

|

Expanded global market reach with new distribution partnerships and exited 2024 with 13 distribution partners. |

| |

• |

|

Ten scientific abstracts highlighting ultra-low-field imaging presented at the Radiological Society of North America (RSNA). |

| |

• |

|

CARE PMR data presented at the Clinical Trials on Alzheimer’s Disease conference showcasing the potential value of the Swoop® system in Alzheimer’s patient management. |

| |

• |

|

Appointed two new executive roles (Vice President of Office Strategy and Partnerships and Vice President of Hospital Strategy and Health Economics) to develop strategies to drive the adoption of the Swoop® system in hospital settings and expand into the neurology office setting. |

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

HYPERFINE, INC. |

|

|

|

|

| Date: February 11, 2025 |

|

|

|

|

|

/s/ Brett Hale |

|

|

|

|

|

|

Brett Hale |

|

|

|

|

|

|

Chief Administrative Officer, Chief Financial |

|

|

|

|

|

|

Officer, Treasurer and Corporate Secretary |

Exhibit 99.1 AI-Powered, Portable Brain MRI ® ® The Swoop

Portable MR Imaging system is driving the future of brain health. Corporate Investor Deck Hyperfine, Swoop, and Portable MR Imaging are registered trademarks of Hyperfine, Inc. PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved.

Forward-looking Statements This presentation includes

“forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Actual results of Hyperfine, Inc. (the “Company”) may differ from its

expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,”

“budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,”

“potential,” “continue,” and similar expressions (or the negative versions of such words or expressions) are intended to identify such forward-looking statements. These forward-looking statements include, without limitation,

the Company’s goals and commercial plans, including the Company’s expansion plans; the benefits of the Company’s products and services, including the clinical evidence supporting those benefits; the market demand and acceptance for

the Company’s products and services; the Company’s cash runway; the Company’s future performance, including its financial performance; and the Company’s ability to implement its strategy. These forward-looking statements

involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the Company’s control and are difficult to predict. Factors that may cause

such differences include, but are not limited to: the success, cost and timing of the Company’s product development and commercialization activities, including the degree that the Swoop® system is accepted and used by healthcare

professionals; the Company’s ability to grow and manage growth profitably and retain its key employees; changes in applicable laws or regulations; the ability of the Company to raise financing in the future; the ability of the Company to

obtain and maintain regulatory clearance or approval for its products, and any related restrictions and limitations of any cleared or approved product; the ability of the Company to identify, in-license or acquire additional technology; the ability

of the Company to maintain its existing or future license, manufacturing, supply and distribution agreements and to obtain adequate supply of its products; the ability of the Company to compete with other companies currently marketing or engaged in

the development of products and services that the Company is currently marketing or developing; the size and growth potential of the markets for the Company’s products and services, and its ability to serve those markets, either alone or in

partnership with others; the pricing of the Company’s products and services and reimbursement for medical procedures conducted using the Company’s products and services; the Company’s ability to generate clinical evidence of the

benefits of the Company’s products and services; the Company’s estimates regarding expenses, revenue, capital requirements and needs for additional financing; the Company’s financial performance; and other risks and uncertainties

indicated from time to time in Company’s filings with the Securities and Exchange Commission (the “SEC”), including those under “Risk Factors” therein. The Company cautions readers that the foregoing list of factors is

not exclusive and that readers should not place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or

revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. This presentation includes preliminary financial estimates for the

fiscal year ended December 31, 2024, which reflect management’s current views and may change as a result of management’s final review of results and other factors, including significant business, economic and competitive risks and

uncertainties. Such preliminary financial information is subject to the finalization and closing of the accounting books and records of the Company (which have yet to be performed). In the course of preparing and finalizing these accounting books

and records, and in preparing full financial statements for the year ended December 31, 2024, the preliminary estimates for the year ended December 31, 2024 will be subject to change and the Company may identify items that will require it to make

adjustments to the Company’s preliminary estimates described herein. Any such changes could be material. For these or other reasons, the preliminary financial estimates for the year ended December 31, 2024 may not ultimately be indicative of

the Company’s results for such period and actual results may differ materially from those described above. No independent registered public accounting firm has audited, reviewed or compiled, examined or performed any procedures with respect to

these preliminary results, nor have they expressed any opinion or any other form of assurance on these preliminary results. These unaudited preliminary reserving estimates are presented for informational purposes only and do not purport to represent

the Company’s financial condition or results of operations for any future date or period. As a result, caution should be exercised in relying on these estimates and no inferences should be drawn from these estimates regarding financial or

operating data not provided. 2 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Leadership Team With Proven Track Record of Success Maria Sainz Dave

Castiglioni President and Chief Chief Commercial Officer Executive Officer Brett Hale Chi Nguyen Chief Administrative Vice President of Officer and Chief Office Strategy and Financial Officer Partnerships Tom Teisseyre, PhD Rafael Donnay Chief

Operating Vice President of Officer Hospital Strategy and Health Economics Edmond Knopp, MD Recent Commercial Strategy Additions Chief Medical Officer 3 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

The Portable Swoop System Serves Patients and Clinicians Where and When

They Need Brain Imaging 1 Diagnostic-quality images Broad FDA-clearance for brain with ultra-low-field MRI imaging of patients of all ages First mover with proprietary Commercially available in the technology (150+ patents) US through direct sales

channel and AI-powered software Platform technology Reimbursement in place in the US designed for multiple under existing CPT codes in both brain imaging applications hospital and office settings New ultra-low-field brain imaging Global footprint

through paradigm—disrupts access and international distributors supported economics and expands the MRI by recent CE approval of latest market software 4 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 Broad indication for

imaging of the brain (all ages)

Sizeable and Growing U.S. Total Addressable Market Opportunity 1

Expanding TAM Through New Sites of Care & New Clinical Applications $1.5B $6B+ $16B+ 2026+ 2024+ 2025+ Beachhead Large Neuro Market Brain Health 2 5,600 emergency departments 10,700 urgent care facilities 4,000 critical care units 2,400

neurology practices 15,600 nursing homes 3,600 infusion centers 1 TAM Calculation Based on Number of Sites of Care (Company Estimates on File) Multiplied by US Device ASP 5 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 2 Data as of

2020

Multiple & Diverse Anticipated Growth Catalysts Broad Indication

& Versatile Technology Expected to Drive New Market Entrance and Adoption 2024 2025 Today US Critical Care: Continued Expansion New Outpatient Market Entry Site of Care and Use Case Drivers SITE OF CARE & USE CASE Emergency Department Entry

ACTION PMR Data (Stroke) Stroke Workflow Study EXPANSION Hospital Based Clinic Entry CARE PMR Data (Alzheimer's) Alzheimer’s Workflow Study IAC Accreditation / CMS Office Site Pilot Office Based Entry India Distributor Established India CDSCO

Submission CDSCO Approval India Market Entry GEOGRAPHIC EXPANSION Europe & Asia Pacific Distributors Established 1st Full Year International Expansion 1 th 1 th th 8th Gen AI-Powered Software 9 Gen AI-Powered Software 10 Gen AI-Powered Software

11 Gen AI-Powered Software TECH DEV (AI Denoising) (Faster Image Acquisition) 6 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 FDA & CE Cleared

Growth Catalysts De-Risked by Recent Milestones 2024 2025 Today US

Critical Care: Continued Expansion New Outpatient Market Entry Site of Care and Use Case Drivers SITE OF CARE & USE CASE Emergency Department Entry ACTION PMR Data (Stroke) Stroke Workflow Study EXPANSION Hospital Based Clinic Entry CARE PMR

Data (Alzheimer's) Alzheimer’s Workflow Study IAC Accreditation / CMS Office Site Pilot Office Based Entry India Distributor Established India CDSCO Submission CDSCO Approval India Market Entry GEOGRAPHIC EXPANSION Europe & Asia Pacific

Distributors Established 1st Full Year International Expansion 1 th 1 th th 8th Gen AI-Powered Software 9 Gen AI-Powered Software 10 Gen AI-Powered Software 11 Gen AI-Powered Software TECH DEV (AI Denoising) (Faster Image Acquisition) 7 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved. 1 FDA & CE Cleared

Innovation: Fast Cadence of AI-Powered Software Releases to Drive Image

Quality Performance ... 2024 Software (8.8): Faster imaging Software (8.7): AI denoising in DWI sequence 2023 Software (8.6): DWI improvements, motion correction Software (8.5): Improved DWI image quality, intensity AI-powered Imaging uniformity,

and faster imaging. 2022 Hardware (1.9): Updates to hardware components and minimum patient weight limit Software (8.4): Fast T2: 50% faster option to the existing higher-quality T2 sequence T1 (Standard): better intraparenchymal visibility,

improved noise cancellation 2021 Software (8.3): Advanced diagnostic image reconstruction leveraging deep learning for T1, T2, and FLAIR sequences. Hardware (1.8) and Software (8.2): Automatic alignment and motion correction feature updates 2020

Hardware (1.7) and Software (8.1): Brain imaging for all ages. Hardware (1.6) and Software (8.0): The first bedside MRI system for brain imaging of patients ages 2 and up 8 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Image Quality Approaching High Field Hyperfine has Rapidly Accelerated

the Clinical Utility of Portable Ultra-low field MRI Illustrative Image Quality Improvements with FLAIR Contrast: pULF workhorse th th 1 First FDA Clearance 8 Generation SW Next Gen (10 ) SW Q1 2020 Launched Q1 2024 Expected 1H 2025 Proprietary

Software and AI Deep Learning Innovation 9 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 th 10 Generation Software Not Regulatory Cleared.

Solid Financial Fundamentals 2 Revenue and Gross Margin Cash Burn 2

Year Revenue CAGR +38% $71.0 Service Revenue 46% $20.0M 80% 43% 13% Device Revenue 30% $42.3 $15.0M $12.9M YoY $38.4 (20%) Gross Margin (%) $11.0M Growth -78% YoY $2.4M +17% Growth $10.0M (70%) $2.3M +62% $6.8M -162% (120%) $1.6M $10.5M $5.0M $8.7M

$1.5M (170%) $5.2M $0.3M $0.0M (220%) 1 2020 2021 2022 2023 2024 1 Systems Sold: 4 23 35 37 48 2022 2023 2024 Revenue Fundamentals Gross Margin Fundamentals Cash Burn Fundamentals 1 • Capital placements • Established global contract

manufacturing • $37.6M of Cash and Cash Equivalents as of partner December 31, 2024 • Recurring 3-to-5-year service & software • Current cash runway expected into 2H 2026 revenue • Cost efficiencies: Connected ecosystem;

cloud infrastructure • Operating lean & efficient • International expansion began in 2024 • Scale efficiencies with volume and growing • Transition to Commercial Stage organization installed base accelerated by January

2025 reorganization 1 The unaudited, preliminary 2024 financial results presented above for 2024 Revenue, Gross Margin and Cash are based on current expectations and may be adjusted as a result of, among other things, completion of annual audit

procedures. This financial information does not represent a comprehensive statement of the Company’s financial results for 2024 and remains subject to the completion of financial closing procedures and internal reviews 10 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved. 2 Cash Burn Calculated as Change in Cash and Cash Equivalent Less Net Proceeds of $0.8M From Shares Issued Under ATM Program in 2024

Transformation of Business Poised to Drive Growth Acceleration From

Multiple Catalysts • Transformation Launched in Q4’24 Revenue Transformation From Research to Organic Commercial • 2025+ Expansion Strategy Is Aggressively Pursuing New 15 Markets $12.9 13 • Initial Commercialization Through

2024 driven by Research and US Critical Care Swoop System Placements $11.0 $2.4 • Long Selling Processes 11 • Multiple Stakeholders with Shared Decision Between Clinicians and Radiology 70% $3.4 9 Non-KCL Rev YOY Growth • Growth

from New Markets Derisked by Recent Milestones $6.8 7 Neurology Offices $0.6 $2.3 23% • IAC Accreditation Published Non-KCL Rev $1.6 $10.5 YOY Growth • First Commercial Offices Accredited for ULF 5 • First Time HYPR Presence at ASN

& NeuroNet 3 $5.3 International $4.6 • CE Marked Swoop System with Latest Software • Exited 2024 with 13 Active Distributors 1 • India Submission underway 2 -1 2022 2023 2024 US Emergency Department • Stroke Data

Presentations at RSNA and IAC 1 Device Revenue ex-KCL Service Revenue KCL Device Revenue 1 Kings College of London (KCL) completed a one-time purchase of 20 Swoop Systems with the support from the Bill and Melinda Gates Foundation 2 The unaudited,

preliminary 2024 financial results presented above for 2024 Revenue, Gross Margin and Cash are based on current expectations and may be adjusted as a result of, among other things, completion of annual audit procedures. This 11 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved. financial information does not represent a comprehensive statement of the Company’s financial results for 2024 and remains subject to the completion of financial closing procedures and internal

reviews

Appendix February 2025 Corporate Investor Deck 12 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved.

Who is Hyperfine? First FDA-cleared, portable MR brain imaging system

with proprietary AI technology, a proven track record of innovation, broad labeling, and existing reimbursement Platform technology reshaping the care paradigm and expanding the brain imaging It feels market globally to address large, unmet

healthcare needs at multiple sites of care in hospital and office settings Revenue-generating business with attractive revenue growth and gross margin profile, strong spending discipline, and increased operating leverage 13 PROPERTY OF HYPERFINE,

INC. ©2025. All rights reserved.

A First for Brain Health Hyperfine, Inc. has a unique ultra-low-field

portable MR brain imaging system that aims to improve brain health globally. • Designed to improve access, equity, and affordability for clinicians and patients • Expands brain MR imaging to multiple professional healthcare settings

(critical care, emergency departments, clinics, and offices) • Enables clinicians to make timely and early diagnosis of critical brain conditions • Potential to reduce the burden to healthcare systems of widespread and devastating global

neurological conditions, such as stroke and Alzheimer’s disease PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

MRI is the Clinical Gold Standard Capacity and Availability of

Conventional MRI Compromise Access and Equity Globally High-cost and complex site requirements limit access Need for highly trained personnel constrains capacity Limited availability leads to delayed diagnosis and care Inpatient transport increases

risk of adverse events PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

The Portable Swoop System Serves Patients and Clinicians Where and When

They Need Brain Imaging 1 Diagnostic-quality images Broad FDA-clearance for brain with ultra-low-field MRI imaging of patients of all ages First mover with proprietary Commercially available in the technology (150+ patents) US through direct sales

channel and AI-powered software Platform technology Reimbursement in place in the US designed for multiple under existing CPT codes in both brain imaging applications hospital and office settings New ultra-low-field brain imaging Global footprint

through paradigm—disrupts access and international distributors supported economics and expands the MRI by recent CE approval of latest market software 16 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 Broad indication for

imaging of the brain (all ages)

A New Paradigm in the Economics, Value, and Safety of Brain Imaging

Conventional MRI Swoop System CT Scanner Low Up-front Capital No Construction or Installation Required Minimal Recurring Costs No Need for Certified Operators Limited Staff Disruption Portable Soft Tissue Characterization Patient Safety: Ionizing

Radiation, Heating, Transport Risk 17 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

The Swoop System is Transforming Brain Imaging Safe for clinicians,

patients, and Portable through standard doors Intuitive iPad-based interface caregivers across multiple sites of care and elevators 18 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Blueprint for Anticipated Growth The Swoop System Designed to Expand

the Global Imaging Market to Increase Access and Equity 2026+ Brain Health 2025+ Large Neuro Market 2024+ Primary Care / Community Beachhead ED / Clinics / Offices Hospital Remote Care Critical Care Alzheimer's Pediatrics Stroke Well Brain

Monitoring, Screening, and Early Detection Office Expansion With Accreditation & CMS Global Expansion 19 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Sizeable and Growing U.S. Total Addressable Market Opportunity 1

Expanding TAM Through New Sites of Care & New Clinical Applications $1.5B $6B+ $16B+ 2026+ 2024+ 2025+ Beachhead Large Neuro Market Brain Health 2 5,600 emergency departments 10,700 urgent care facilities 4,000 critical care units 2,400

neurology practices 15,600 nursing homes 3,600 infusion centers 1 TAM Calculation Based on Number of Sites of Care (Company Estimates on File) Multiplied by US Device ASP 20 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 2 Data as of

2020

Multiple & Diverse Anticipated Growth Catalysts Broad Indication

& Versatile Technology Expected to Drive New Market Entrance and Adoption 2024 2025 Today US Critical Care: Continued Expansion New Outpatient Market Entry Site of Care and Use Case Drivers SITE OF CARE & USE CASE Emergency Department Entry

ACTION PMR Data (Stroke) Stroke Workflow Study EXPANSION Hospital Based Clinic Entry CARE PMR Data (Alzheimer's) Alzheimer’s Workflow Study IAC Accreditation / CMS Office Site Pilot Office Based Entry India Distributor Established India CDSCO

Submission CDSCO Approval India Market Entry GEOGRAPHIC EXPANSION Europe & Asia Pacific Distributors Established 1st Full Year International Expansion 1 th 1 th th 8th Gen AI-Powered Software 9 Gen AI-Powered Software 10 Gen AI-Powered Software

11 Gen AI-Powered Software TECH DEV (AI Denoising) (Faster Image Acquisition) 21 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 FDA & CE Cleared

Drive Adoption In Emergency Departments - Acute Ischemic Stroke Triage

Use Case Stroke Detection Sequence Optimization & AI Market Adoption • ACTION-PMR, is a multi-center • Software & sequence optimizations • Begin placement of Swoop units in evaluation to assess the use of / updates

emergency departments and hub- Swoop system in detecting acute and-spoke stroke networks • Enhance speed and accuracy for ischemic stroke as compared to stroke detection to optimize for • Internal stroke advisory committee, conventional

MRI and CT time sensitive diagnosis helping adoption • 100 patients enrolled in detection environments phase • Data included in study published in Annals of Neurology (Aug 2024) and presented at ESNR (Sept 2024), RSNA (Dec 2024) and ISC

(Feb 2025) 22 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Drive Adoption In Neurology Office Right to Play & Office Business

Model Market Adoption Clinical Evidence • IAC Accreditation standards • Refine & optimize sales and • Begin placement of Swoop units published November 2024 now support business model in neurology clinics include

ultra-low-field MRI, • Facilitate ancillary services • Drive awareness and relevance of enabling accredited medical offices (Telerad, PACS, etc.) to drive a Swoop in the Neurology to qualify for CMS reimbursement scalable office-based

solution ecosystem effective immediately • Collaboration and partnerships • CARE PMR clinical utility study, (e.g. Lilly, NeuroNet) presentations at AAIC, AAIC-Tokyo and CTAD Conferences. • White paper on Office Use case to

demonstrate clinical and economic benefit 23 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

IAC Standards Published in Nov 2024 Opens Office Market Opportunity

Intersocietal Accreditation Commission (IAC) • 1 of 4 CMS-approved accreditation bodies • Offices that get IAC accreditation are immediately eligible for CMS reimbursement New standards Incorporating Portable MRI • Standards

include portable MRI technology • Includes safety, training, & quality guidelines specific to POC MRI • Does not require MR tech to operate POC MRI Commercially Activated • Commercial pilot sites will initiate accreditation

process • IAC partnering on education handouts for Hyperfine office customers PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 24

Execution: Three Focus Areas & Spending Discipline Innovation

Commercialization Clinical Evidence 25 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Innovation: Fast Cadence of AI-Powered Software Releases to Drive Image

Quality Performance ... 2024 Software (8.8): Faster imaging Software (8.7): AI denoising in DWI sequence 2023 Software (8.6): DWI improvements, motion correction AI-powered Imaging Software (8.5): Improved DWI image quality, intensity uniformity,

and faster imaging. 2022 Hardware (1.9): Updates to hardware components and minimum patient weight limit Software (8.4): Fast T2: 50% faster option to the existing higher-quality T2 sequence T1 (Standard): better intraparenchymal visibility,

improved noise cancellation 2021 Software (8.3): Advanced diagnostic image reconstruction leveraging deep learning for T1, T2, and FLAIR sequences. Hardware (1.8) and Software (8.2): Automatic alignment and motion correction feature updates 2020

Hardware (1.7) and Software (8.1): Brain imaging for all ages. • Broad indication for imaging of the brain (all ages). Hardware (1.6) and Software (8.0): The first bedside MRI system for brain imaging of patients • CE certification

achieved under latest MDR regulations. ages 2 and up 26 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Image Quality Approaching High Field Hyperfine has Rapidly Accelerated

the Clinical Utility of Portable Ultra-low field MRI Illustrative Image Quality Improvements with FLAIR Contrast: pULF workhorse th th 1 First FDA Clearance 8 Generation SW Next Gen (10 ) SW Q1 2020 Launched Q1 2024 Expected 1H 2025 Proprietary

Software and AI Deep Learning Innovation 27 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 th 10 Generation Software Not Regulatory Cleared.

Clinical Evidence: Large & Growing Body of Published Data to

Support Adoption Studies to Drive Evidence in New Use Cases Current Commercial Clinical Research Future and Clinical Applications for Future Applications Opportunities Advisory Groups Pilot Programs User Groups Critical Care Pediatrics Stroke

Alzheimer’s Remote Care New Use Cases 50+ 175+ Peer Reviewed Peer Reviewed Publications Conference Presentations Prospective Studies HOPE PMR (Hydrocephalus) ACTION PMR (Stroke) SAFE MRI (ECMO) CARE PMR (Alzheimer’s) 28 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved.

Commercialization: Scalable US Direct Sales & Global Distribution

Network Commercial Profile • Upfront and Recurring Revenue Model • Multiple Placement Potential per Customer • Flagship Reference Institutions in Adult and Pediatric Care Installed Base Health Economics Over 175 Swoop 1 •

Existing Reimbursement in Systems Globally place in the US • Reduce Cost of Care Through Faster Clinical Decision Making • Address Healthcare Staffing Shortages Direct Distributors • Free-up Conventional MRI for Elective Scans

• Improve Efficiency, Reduced Patient Transport, and etc. Superior Care 29 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 Installed Base Includes Commercial and Research Units as of December 2024

System Economics Provide Attractive Margin Expansion Opportunity Strong

Margin Foundation with Healthy U.S. Pricing and Recurring Revenue Recurring Revenue Expected to Increase with Growth in Placements & Installed Base---------------à Year 1 Years 2 – 5 INITIAL Annual Recurring Revenue (Software &

Technical Service): MSRP $47.5K / Year SYSTEM SALES $475K U.S. MSRP ADDITIONAL Additional Recurring Revenue SYSTEM SALES ADDITIONAL Additional Recurring Revenue SYSTEM SALES ADDITIONAL Additional Recurring PROPERTY OF HYPERFINE, INC. ©2025. All

rights reserved. SYSTEM SALES Revenue

Solid Financial Fundamentals 2 Revenue and Gross Margin Cash Burn 2

Year Revenue CAGR +38% $71.0 Service Revenue 46% $20.0M 80% 43% 13% Device Revenue 30% $42.3 $15.0M $12.9M YoY $38.4 (20%) Gross Margin (%) $11.0M Growth -78% YoY $2.4M +17% Growth $10.0M (70%) $2.3M +62% $6.8M -162% (120%) $1.6M $10.5M $5.0M $8.7M

$1.5M (170%) $5.2M $0.3M $0.0M (220%) 1 2020 2021 2022 2023 2024 1 Systems Sold: 4 23 35 37 48 2022 2023 2024 Revenue Fundamentals Gross Margin Fundamentals Cash Burn Fundamentals 1 • Capital placements • Established global contract

manufacturing • $37.6M of Cash and Cash Equivalents as of partner December 31, 2024 • Recurring 3-to-5-year service & software • Current cash runway expected into 2H 2026 revenue • Cost efficiencies: Connected ecosystem;

cloud infrastructure • Operating lean & efficient • International expansion began in 2024 • Scale efficiencies with volume and growing • Transition to Commercial Stage organization installed base accelerated by January

2025 reorganization 1 The unaudited, preliminary 2024 financial results presented above for 2024 Revenue, Gross Margin and Cash are based on current expectations and may be adjusted as a result of, among other things, completion of annual audit

procedures. This financial information does not represent a comprehensive statement of the Company’s financial results for 2024 and remains subject to the completion of financial closing procedures and internal reviews 31 PROPERTY OF

HYPERFINE, INC. ©2025. All rights reserved. 2 Cash Burn Calculated as Change in Cash and Cash Equivalent Less Net Proceeds of $0.8M From Shares Issued Under ATM Program in 2024

Illustration of Potential Revenue Opportunity Based on TAM $100M US

Swoop Device Revenue For Every 1.5% Market Penetration (1) Illustration of Potential US Device Revenue With Site Penetration Growth (Beachhead and Neuro Market Only) Market Entry Hurdles Cleared Potential $400M Reimbursement Selling Sites of Care

FDA Cleared? Available? Leverage (#) $300M+ Critical Care 4,000 Yes Yes Hospital $300M Hospital Clinic & Infusion Centers Emergency Dept 5,600 Yes Yes Hospital $200M+ Neurology Practices $200M Hospital Clinic & 3,600 Yes Yes Hospital

Infusion Centers Emergency Departments $100M+ Concentrated Yes Neurology Practices 2,400 Yes Accreditation in Nov ‘24 $100M Decision Maker Total 15,600** Critical Care **26,400 Additional Brain Health Market Opportunities $- 1.5% 3.0% 4.5%

Annual Penetration Rate of Market WW Service Revenue and International Device Sales Incremental To US Device Revenue 32 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. 1 Based on Sites of Care Market Size, Penetration Rate and US Device

MSRP ($475K) Annual Device Revenue

Leadership Team With Proven Track Record of Success Maria Sainz Dave

Castiglioni President and Chief Chief Commercial Officer Executive Officer Brett Hale Chi Nguyen Chief Administrative Vice President of Officer and Chief Office Strategy and Financial Officer Partnerships Tom Teisseyre, PhD Rafael Donnay Chief

Operating Vice President of Officer Hospital Strategy and Health Economics Edmond Knopp, MD Chief Medical Officer 33 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

The Hyperfine, Inc. Opportunity First FDA-cleared portable Growth

blueprint driven by expanding ultra-low-field AI-powered MR brain to new sites of care; emergency imaging system with strong departments, clinics and offices, new proprietary technology geography and sustained innovation Commercial stage company

Solid financial profile with rapid poised to solve large unmet It feels we topline growth and attractive gross clinical/provider needs such as margins Alzheimer’s and Stroke globally Prolific engine of fast innovation Highly experienced

executive team and clinical evidence with deep industry expertise 34 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

Hyperfine, Swoop, and Portable MR Imaging are registered trademarks of

Hyperfine, Inc. 35 PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved. PROPERTY OF HYPERFINE, INC. ©2025. All rights reserved.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

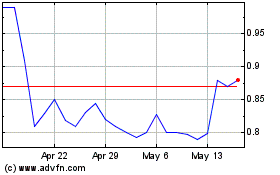

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hyperfine (NASDAQ:HYPR)

Historical Stock Chart

From Feb 2024 to Feb 2025