By Anora Mahmudova and Mark DeCambre, MarketWatch

S&P 500, Nasdaq Composite on track to mark closing

records

U.S. stocks swung higher Tuesday, with the Dow Jones Industrial

Average making another run at the elusive 20,000, while the S&P

500 and Nasdaq flirt with fresh all-time closing highs.

Firm gains for the stocks come after a solid round of corporate

earnings delivered a boost to investor sentiment after mostly

lackluster trading following President Donald Trump's inauguration.

Upbeat earnings may help investors justify what had been an

otherwise rapid ascent in equity values since the real estate

mogul's November election win, underpinned by the belief that he

would implement a slate of pro-business policies to help rev up

U.S. economic growth.

However, stocks have paused lately, with the Dow declining for

six of the past seven sessions and the broad-market S&P 500

switching equally between modest gains and losses since Jan. 12, as

investors have awaited further confirmation that recent stock

advances are supported by healthy earnings or details on Trump's

legislative agenda.

So far, markets appear to be settling on the former.

"Earnings are coming in generally better than expected while

economic data are also good. We believe the medium-term bias in

equity markets is to the upside," said Karyn Cavanaugh, senior

market strategist at Voya Financial.

The S&P 500 rose 15 points, or 0.7%, to 2,282, with eight of

11 sectors trading higher, edging above its previous closing high

set on Jan. 6. Materials, financials and energy sectors were

leading gains, while telecoms and health-care stocks were the

biggest laggards.

The Dow was up by 132 points, or 0.7%, at 19,931, with more than

two thirds of the components trading higher. The advance put the

blue-chip gauge within 70 points of hitting 20,000, a closely

watched level that may only be important for providing investors

the bullish view that the market is capable of testing new

heights.

The Nasdaq Composite was up 45 points, or 0.8%, at 5,598,

trading above its previous record close. But a drop in

biotechnology stocks was capping gains. The iShares Nasdaq

Biotechnology ETF (IBB) was down 0.5%. The SPDR Health Care Select

Sector ETF

(http://www.marketwatch.com/story/health-care-sector-etf-falls-for-sixth-straight-day-longest-such-streak-in-16-months-2017-01-24)(XLV)

was down 0.5%, putting it on track for a sixth straight loss. But

both ETFs were trading off their worst levels of the session.

Read:Jitters over Trump's presidency may be overdone

(http://www.marketwatch.com/story/this-is-why-jitters-over-a-trump-presidency-are-overblown-2017-01-23)

Cavanaugh cautioned that there is still a lot of uncertainty

about the impact the Trump administration's trade and business

policies will have on the economy and markets. That uncertainty has

led to volatile trade in equities and currencies as Trump forms his

cabinet, meets with titans of industry and lays out his policy

plans.

See:Trump is building a wall of worry, and that might be good

news for stocks

(http://www.marketwatch.com/story/trump-is-building-a-wall-of-worry-and-that-might-be-good-news-for-stocks-2017-01-23)

"At the moment there is a lot of complacency, as [the] VIX is at

very low levels. But with so much uncertainty, it can spike and we

expect a lot of short-term volatility," Cavanaugh said.

The CBOE Volatility index , which measures implied volatility on

the S&P 500 is down 3% to 11.38, well below the historic

average of 20.

Investors have been watching to see what Trump can accomplish in

his first 100 days in office.

And read:"Godfather" of chart analysis says Trump rally has 5%

gain left

(http://www.marketwatch.com/story/godfather-of-chart-analysis-says-trump-stock-market-has-another-5-surge-in-it-2017-01-23)

Trump's policies "feel more isolationist as the days roll by,"

said David Buik, market commentator at Panmure Gordon, in a note

Tuesday.

"Consequently we have seen evidence of a flight to quality--in

other words, investors have been buying bonds, awaiting more

clarity on some more of Trump's plans. We have also seen gold rally

in recent sessions from $1,180 to $1,215 an ounce."

But U.S. stocks have been somewhat "robust," Buik added, noting

the Dow is up 0.2% for the year as of Monday's close, while the

S&P 500 is 1.2% higher and the Nasdaq has gained more than 3%.

All three benchmarks stand less than 1% below their record closes

scored in recent weeks.

Earnings news:Verizon Communications Inc.'s stock (VZ) fell 4.6%

after the telecom's quarterly profit missed forecasts

(http://www.marketwatch.com/story/verizon-shares-drop-more-than-2-after-company-misses-q4-profit-expectations-2017-01-24).

Late on Monday, Yahoo Inc. said its $4.8 billion deal with

Verizon Communications Inc

(http://www.marketwatch.com/story/yahoo-pushes-back-closing-date-for-verizon-deal-2017-01-23).

will close a quarter later than expected, as both sides grapple

with the fallout of two massive data breaches disclosed by the

internet company. Yahoo shares were up 2.9%.

Post-it Notes and Scotch tape maker 3M Co.(MMM) shares fell 0.8%

even after its quarterly profit topped estimates

(http://www.marketwatch.com/story/3m-profit-tops-estimates-reaffirms-2017-guidance-2017-01-24),

while health care giant Johnson & Johnson(JNJ) was 2% lower

after a soft outlook for the year.

Insurer Travelers Cos. Inc.(TRV) rose 0.8% after

better-than-expected results

(http://www.marketwatch.com/story/travelers-companies-beats-on-earnings-and-revenue-2017-01-24),

chemicals conglomerate DuPont(DD) rallied 1.6% after earnings

(http://www.marketwatch.com/story/dupont-sales-fall-ahead-of-merger-with-dow-2017-01-24),

and Chinese e-tailer Alibaba Group Holding Ltd.(BABA) gained 4% as

earnings and revenue both beat

(http://www.marketwatch.com/story/alibaba-revenue-surges-54-buoyed-by-singles-day-2017-01-24).

Chip maker Texas Instruments Inc.(TXN) and aluminum giant Alcoa

Corp.(AA) were due to deliver their quarterly results after the

market's close.

Shares of General Motors Co. (GM) and Ford Co. (F) rose more

than 1%, while Fiat Chrysler Automobiles NV jumped nearly 6% after

President Trump held meetings with U.S. auto-industry executives,

as he looks to persuade them to keep production in the country.

Other markets: The British pound fell against the dollar as

traders reacted to a U.K. court's ruling

(http://www.marketwatch.com/story/uk-supreme-court-rules-theresa-may-must-get-lawmakers-approval-for-brexit-plan-2017-01-24)

that Prime Minister Theresa May can't start the Brexit process

without approval from Parliament. European stocks

(http://www.marketwatch.com/story/european-stocks-hold-modest-gains-as-uk-government-loses-brexit-case-2017-01-24)

traded mostly higher, while Asian markets were mixed

(http://www.marketwatch.com/story/asian-markets-cool-after-trump-pulls-us-out-of-tpp-2017-01-23).

Oil futures

(http://www.marketwatch.com/story/crude-prices-rebound-as-traders-weigh-up-production-outlook-2017-01-24)

advanced, gold futures dipped, and a key dollar index

(http://www.marketwatch.com/story/dollar-directionless-as-investor-concerns-about-trump-protectionism-linger-2017-01-24)

edged up. The 10-year Treasury yield inched higher to 2.43%.

--Victor Reklaitis contributed to this article

(END) Dow Jones Newswires

January 24, 2017 14:53 ET (19:53 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

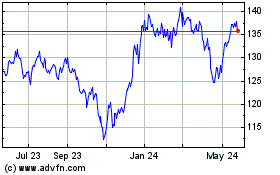

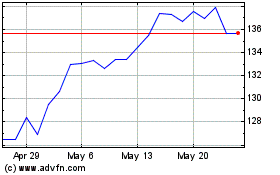

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Feb 2025 to Mar 2025

iShares Biotechnology ETF (NASDAQ:IBB)

Historical Stock Chart

From Mar 2024 to Mar 2025