Companies adopt modern core systems for

agility, faster product rollouts, better decision-making, ISG

Provider Lens™ report says

Many insurance companies in Asia Pacific are starting to

implement advanced technology platforms to better capture

additional business in a fast-growing region for the industry,

according to a new research report published today by Information

Services Group (ISG) (Nasdaq: III), a leading global technology

research and advisory firm.

The 2024 ISG Provider Lens™ Insurance Platform Solutions report

for Asia Pacific says that insurers need modern core platforms to

remain competitive.

“Companies are eagerly exploring new systems so they can move

away from technology environments they have used for decades,” said

Michael Gale, partner and regional leader, ISG Asia Pacific. “There

has been a massive realization that meeting new customer demands

will require investing in technology.”

While insurance is a younger and faster-growing industry across

Asia Pacific than in North America or Europe, its expansion is

fastest where insurance markets are least mature, such as in India,

Thailand and Malaysia, ISG says. Insurance companies are upgrading

systems most rapidly in these markets, seeking to take advantage of

double-digit growth rates in some product categories.

Many insurers in the region are making new technology

investments despite strong headwinds, including tight budgets and

often weak balance sheets, ISG says. High cost, a wide range of

technology choices and the risks of implementing new systems have

slowed the process at some companies.

However, moving from mainframe-based infrastructure to modern

digital platforms enables faster time to market and many other

benefits, including higher efficiency and scalability, tighter

security, better decision-making and improved customer experience,

the report says. Insurers in Asia Pacific are also using digital

transformation as an opportunity to implement cloud computing and

modern Agile and DevOps methodologies.

To get the most benefit from new technologies, especially AI

platforms that can improve operations and decision-making, many

insurers in Asia Pacific are recognizing the need to modernize

their data systems, ISG says.

“AI cannot produce optimal results from siloed or unreliable

legacy data,” said Jan Erik Aase, partner and global leader, ISG

Provider Lens Research. “Qualified providers are helping insurance

companies clean up their data before implementing the new

generation of tools.”

The report also examines other Asia Pacific insurance industry

trends, including the growing importance of scalable policy

administration systems and the role of low-code/no-code platforms

in modernization projects.

For more insights into the technology challenges facing

insurance companies in Asia Pacific, including undocumented legacy

systems and a low level of trust by insurance customers, plus ISG’s

advice on overcoming these hurdles, see the ISG Provider Lens™

Focal Points briefing here.

The 2024 ISG Provider Lens™ Insurance Platform Solutions report

for Asia Pacific evaluates the capabilities of 28 providers across

two quadrants: Life and Retirement Insurance Platform Solutions and

Property and Casualty Insurance Platform Solutions.

The report names Peak3 (ZA Tech), Sapiens and TCS BaNCS as

Leaders in both quadrants. It names Duck Creek, FINEOS, Guidewire,

Infosys McCamish, IXT, Sinosoft and SSP as Leaders in one quadrant

each.

In addition, KGiSL is named as a Rising Star — a company with a

“promising portfolio” and “high future potential” by ISG’s

definition — in both quadrants, and iNube is named as a Rising Star

in one quadrant.

The 2024 ISG Provider Lens™ Insurance Platform Solutions report

for Asia Pacific is available to subscribers or for one-time

purchase on this webpage.

About ISG Provider Lens™ Research

The ISG Provider Lens™ Quadrant research series is the only

service provider evaluation of its kind to combine empirical,

data-driven research and market analysis with the real-world

experience and observations of ISG's global advisory team.

Enterprises will find a wealth of detailed data and market analysis

to help guide their selection of appropriate sourcing partners,

while ISG advisors use the reports to validate their own market

knowledge and make recommendations to ISG's enterprise clients. The

research currently covers providers offering their services

globally, across Europe, as well as in the U.S., Canada, Mexico,

Brazil, the U.K., France, Benelux, Germany, Switzerland, the

Nordics, Australia and Singapore/Malaysia, with additional markets

to be added in the future. For more information about ISG Provider

Lens research, please visit this webpage.

About ISG

ISG (Information Services Group) (Nasdaq: III) is a leading

global technology research and advisory firm. A trusted business

partner to more than 900 clients, including more than 75 of the

world’s top 100 enterprises, ISG is committed to helping

corporations, public sector organizations, and service and

technology providers achieve operational excellence and faster

growth. The firm specializes in digital transformation services,

including AI and automation, cloud and data analytics; sourcing

advisory; managed governance and risk services; network carrier

services; strategy and operations design; change management; market

intelligence and technology research and analysis. Founded in 2006,

and based in Stamford, Conn., ISG employs more than 1,600

digital-ready professionals operating in more than 20 countries—a

global team known for its innovative thinking, market influence,

deep industry and technology expertise, and world-class research

and analytical capabilities based on the industry’s most

comprehensive marketplace data. For more information, visit

www.isg-one.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240711637493/en/

Press: Will Thoretz, ISG +1 203 517 3119

will.thoretz@isg-one.com Julianna Sheridan, Matter Communications

for ISG +1 978-518-4520 isg@matternow.com

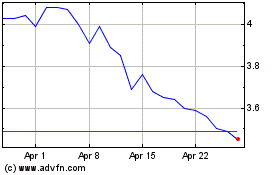

Information Services (NASDAQ:III)

Historical Stock Chart

From Jun 2024 to Jul 2024

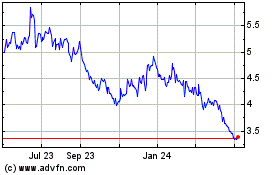

Information Services (NASDAQ:III)

Historical Stock Chart

From Jul 2023 to Jul 2024