As filed with the securities and Exchange Commission on October 8, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Immunome, Inc.

(Exact name of Registrant as specified in its charter)

| |

Delaware

(State or other jurisdiction of

incorporation or organization)

|

|

|

77-0694340

(I.R.S. Employer

Identification Number)

|

|

18702 N Creek Parkway, Suite 100

Bothell, WA 98011

(425) 939-7410

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Clay Siegall, Ph.D.

President and Chief Executive Officer

18702 N Creek Parkway, Suite 100

Bothell, WA 98011

(425) 939-7410

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| |

Thomas A. Coll

Carlos Ramirez

Dylan Kornbluth

Cooley LLP

10265 Science Center Drive

San Diego, CA 92121

(858) 550-6000

|

|

|

Sandra G. Stoneman

Chief Legal Officer and General Counsel

Immunome, Inc.

665 Stockton Drive, Suite 300

Exton, PA 19341

(610) 321-3700

|

|

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☐

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☒

|

|

|

Smaller reporting company

☒

|

|

| |

|

|

|

Emerging growth company

☒

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PROSPECTUS

230,415 Shares of Common Stock

This prospectus relates to the proposed resale from time to time by the selling stockholder named herein, together with any of such stockholder’s transferees, pledgees, donees or successors, of 230,415 shares, or the Shares, of our common stock, par value $0.0001 per share issued to the selling stockholder pursuant to a stock issuance agreement entered into on August 7, 2024 between us and such selling stockholder, or the Stock Issuance.

We are registering the offer and sale of the Shares from time to time by the selling stockholder to satisfy registration rights the selling stockholder was granted in connection with the Stock Issuance. We are not selling any of our common stock pursuant to this prospectus, and we will not receive any proceeds from the sale of our common stock offered by this prospectus by the selling stockholder.

The selling stockholder may offer and sell or otherwise dispose of the Shares described in this prospectus from time to time through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The selling stockholder will bear all underwriting fees, commissions and discounts, if any, attributable to the sales of Shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of the Shares. See “Plan of Distribution” for more information about how the selling stockholder may sell or dispose of its Shares.

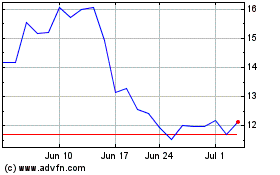

Our common stock is listed on The Nasdaq Capital Market under the trading symbol “IMNM.” On October 7, 2024, the last reported sales price of our common stock on The Nasdaq Capital Market was $12.45 per share.

Investing in our common stock involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” on page 4 of this prospectus, and under similar headings in any amendment or supplement to this prospectus or in the other documents that are incorporated by reference into this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is October 8, 2024.

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

ii |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

12

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of an automatically effective registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act, using a “shelf” registration process. Under this shelf registration process, the selling stockholder may from time to time sell Shares described in this prospectus in one or more offerings or otherwise as described under “Plan of Distribution.”

Neither we nor the selling stockholder have authorized anyone to provide you with any information other than that contained in, or incorporated by reference into, this prospectus. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares of our common stock offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should not assume that the information contained in or incorporated by reference in this prospectus is accurate as of any date other than their respective dates. Our business, financial condition, results of operations and prospects may have changed since those dates.

This prospectus may be supplemented from time to time by one or more prospectus supplements. Such prospectus supplement may add to, update or change the information contained in this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you must rely on the information in the prospectus supplement. You should read both this prospectus and any applicable prospectus supplement together with additional information described below under the heading “Where You Can Find Additional Information.”

Throughout this prospectus, when we refer to the selling stockholder, we are referring to the selling stockholder identified in this prospectus and, as applicable, its permitted transferees or other successors-in-interest that may be identified in a supplement to this prospectus or, if required, a post-effective amendment to the registration statement of which this prospectus is a part.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find Additional Information.”

Unless the context indicates otherwise, as used in this prospectus, the terms “Company,” “we,” “us,” “our,” and “Immunome,” and similar designations, except where context requires otherwise, refer collectively to Immunome, Inc.

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference in this prospectus, and does not contain all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus, including the risks of investing in our securities discussed under the heading “Risk Factors” contained in this prospectus and under similar headings in the other documents that are incorporated by reference into this prospectus. You should also carefully read the information incorporated by reference into this prospectus, including our financial statements, and the exhibits to the registration statement of which this prospectus is a part.

Company Overview

We are a biotechnology company focused on the development of targeted oncology therapies. We believe that the pursuit of novel or underexplored targets will be central to the next generation of transformative therapies and we are dedicated to developing targeted cancer therapies with first-in-class and best-in-class potential. Our goal is to establish a broad pipeline of preclinical and clinical assets and develop these assets into approved products for commercialization. To support that goal, we pair business development activity with significant investment in our internal discovery programs.

We are advancing a pipeline comprising one clinical and two preclinical assets. The clinical asset is AL102, an investigational gamma secretase inhibitor currently under evaluation in a Phase 3 trial for the treatment of desmoid tumors. The preclinical assets are IM-1021, a receptor tyrosine kinase-like orphan receptor 1, or ROR1, antibody-drug conjugate, and IM-3050, a fibroblast activation protein, targeted radioligand therapy.

On October 2, 2023, we completed our merger with Morphimmune Inc., or Morphimmune, a preclinical biotechnology company focused on developing targeted oncology therapies, and Morphimmune became a wholly owned subsidiary of Immunome.

BMS Stock Issuance

On August 7, 2024, in connection with entering into the Amendment No. 2 to License Agreement, or the Amendment, we entered into a stock issuance agreement, or the Stock Issuance Agreement, with Bristol-Myers Squibb Company, or BMS, pursuant to which we issued BMS 230,415 shares of our common stock as partial consideration for entering into the Amendment. The Amendment amends the License Agreement dated November 29, 2017, by and between us, as assignee of Ayala Pharmaceuticals, Inc., and BMS.

Pursuant to the Stock Issuance Agreement, we agreed to prepare and file, on or before the date 7 days following the earlier of (i) October 1, 2024 and (ii) the date we filed our quarterly report on Form 10-Q for the quarter ending September 30, 2024, a registration statement with the SEC to register for resale the Shares.

Subject to complying with applicable securities laws, BMS is not subject to any restrictions with respect to the disposition of the Shares. Additionally, BMS is not subject to any standstill restrictions.

Implications of Being an Emerging Growth Company and Smaller Reporting Company

We are an emerging growth company, as defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. The JOBS Act permits an “emerging growth company” to take advantage of an extended transition period to comply with new or revised accounting standards applicable to public companies. We have elected to use this the extended transition period under the JOBS Act until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, our consolidated financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates. The JOBS Act also allows us to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not emerging growth companies, including relief from the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, less extensive disclosure obligations regarding executive compensation in our registration statements, periodic reports and proxy statements, exemptions from the requirements to hold a nonbinding

advisory vote on executive compensation, and exemptions from stockholder approval of any golden parachute payments not previously approved. We may also elect to take advantage of other reduced reporting requirements in future filings. As a result, our stockholders may not have access to certain information that they may deem important and the information that we provide to our stockholders may be different than, and not comparable to, information presented by other public reporting companies.

We will remain an emerging growth company until the earliest to occur of: (1) the last day of the fiscal year in which we have more than $1.235 billion in annual revenue; (2) the date we qualify as a “large accelerated filer,” with at least $700.0 million of equity securities held by non-affiliates; (3) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period; and (4) December 31, 2025.

We are also a smaller reporting company and may continue to be a smaller reporting company if either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our shares held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Company Information

We were originally incorporated in the Commonwealth of Pennsylvania on March 2, 2006 and converted into a Delaware corporation on December 2, 2015. Our principal executive offices are located at 18702 N Creek Parkway, Suite 100, Bothell, Washington 98011, and our telephone number is (452) 939-7410. Our website is www.immunome.com. The information contained in, or that can be accessed through, our website is not part of, and is not incorporated by reference into, this prospectus and should not be considered part of this prospectus. We have included our website in this prospectus solely as an inactive textual reference.

This prospectus contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

The Offering

Common stock offered by the selling stockholder

230,415 Shares

We will not receive any proceeds from the sale of the Shares covered by this prospectus.

Nasdaq Capital Market

symbol

IMNM

An investment in our common stock involves a high degree of risk. See “Risk Factors” on page 4 of this prospectus, and under similar headings in the other documents that are incorporated by reference into this prospectus for a discussion of the factors you should consider before deciding to invest in shares of our common stock.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described under the heading “Risk Factors” contained in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the SEC on August 12, 2024, as updated by our other filings we make with the SEC, which are incorporated by reference into this prospectus, together with other information in this prospectus and the documents incorporated by reference into this prospectus. The risks described in these documents are not the only ones we face, but those that we consider to be material. There may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that could have material adverse effects on our future results. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occur, our business, financial condition, results of operations or cash flow could be materially and adversely affected. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below titled “Special Note Regarding Forward-Looking Statements.”

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents we have filed with the SEC that are incorporated by reference herein contain “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. These statements relate to future events or to our future operating or financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions (including their use in the negative) intended to identify forward-looking statements. These statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of the document containing the applicable statement, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. Given these uncertainties, you should not place undue reliance on these forward-looking statements. We discuss many of these risks in greater detail under the heading “Risk Factors” in our SEC filings, and may provide additional information in any applicable prospectus supplement. Also, these forward-looking statements represent our estimates and assumptions only as of the date of the document containing the applicable statement.

You should read this prospectus, the registration statement of which this prospectus is a part, the documents incorporated by reference herein, and any applicable prospectus supplement completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of the forward-looking statements in the foregoing documents by these cautionary statements. Unless required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements.

USE OF PROCEEDS

All of the Shares offered to be sold pursuant to this prospectus will be sold by the selling stockholder. We will not receive any of the proceeds from such sale.

The selling stockholder will bear all fees, commissions and discounts, if any, attributable to the sale of the Shares. We will bear all other costs, expenses and fees in connection with the registration of the Shares to be sold by the selling stockholder pursuant to this prospectus.

SELLING STOCKHOLDER

We have prepared this prospectus to allow the selling stockholder to offer and sell from time to time up to 230,415 shares of our common stock for its own account. We are registering the offer and sale of the Shares to satisfy certain registration obligations that we granted the selling stockholder in the Stock Issuance Agreement.

The following table sets forth (i) the name of the selling stockholder; (ii) the number of shares of common stock beneficially owned by the selling stockholder; (iii) the number of Shares that may be offered under this prospectus; and (iv) the number of shares of common stock beneficially owned by the selling stockholder assuming all of the Shares covered hereby are sold. We do not know how long the selling stockholder will hold the Shares before selling them. Except as disclosed below in “— Relationship with Selling Stockholder”, we currently have no agreements, arrangements or understandings with the selling stockholder regarding the sale or other disposition of any Shares.

Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to our common stock. Generally, a person “beneficially owns” shares of common stock if the person has or shares with others the right to vote those shares or to dispose of them, or if the person has the right to acquire voting or disposition rights within 60 days.

The information set forth in the table below is based upon information obtained from the selling stockholder. The percentage of shares beneficially owned prior to, and after, the offering is based on 60,477,606 shares of our common stock outstanding as of October 4, 2024 and assumes the selling stockholder disposes of all of the Shares covered by this prospectus and does not acquire beneficial ownership of any additional shares of common stock. The registration of the Shares does not necessarily mean that the selling stockholder will sell all or any portion of the Shares covered by this prospectus.

As used in this prospectus, the term “selling stockholder” includes the selling stockholder listed in the table below, together with any additional selling stockholder listed in a prospectus supplement, and its donees, pledgees, assignees, transferees, distributees and successors-in-interest that receive Shares in any non-sale transfer after the date of this prospectus.

| |

|

|

Beneficial Ownership

Prior to This Offering

|

|

|

Beneficial Ownership

After This Offering(2)

|

|

|

Name of Selling Stockholder

|

|

|

Number of

Shares

|

|

|

Percentage of

Total Voting

Power

|

|

|

Maximum

Number of

Shares Being

Offered(1)

|

|

|

Number of

Shares

|

|

|

Percentage

of Total

Voting

Power

|

|

|

Bristol-Myers Squibb Company.(3)

|

|

|

|

|

230,415 |

|

|

|

|

|

*% |

|

|

|

|

|

230,415 |

|

|

|

|

|

— |

|

|

|

|

|

— |

|

|

*

Less than one percent

(1)

Represents all of the Shares that the selling stockholder may offer and sell from time to time under this prospectus.

(2)

Assumes the selling stockholder sells the maximum number of Shares possible in this offering.

(3)

Consists of 230,415 Shares held by BMS. BMS is a publicly traded company on the New York Stock Exchange. BMS has sole voting and dispositive power, exercised through its board of directors consisting of more than three people, with respect to all shares of common stock shown as beneficially owned by BMS. The address of BMS is Route 206 and Province Line Road, Princeton, NJ 08543.

Relationship with Selling Stockholder

Except as described below, the selling stockholder does not have, or within the past three years has not had, any position, office or other material relationship with us, any of our predecessors or affiliates.

BMS License

On November 29, 2017, Ayala Pharmaceuticals, Inc., or Ayala, entered into a License Agreement with BMS, as amended by that certain Amendment No. 1 to License Agreement dated as of May 4, 2020, as further

amended by Amendment No. 2 to License Agreement dated August 7, 2024, or, collectively, the License Agreement. We acquired the License Agreement from Ayala pursuant to the Asset Purchase Agreement, dated as of February 5, 2024.

Under the License Agreement, BMS has granted us a worldwide, non-transferable, exclusive, sublicensable license under certain patent rights and know-how controlled by BMS to research, discover, develop, make, have made, use, sell, offer to sell, export, import and commercialize AL101 and AL102, or the BMS Licensed Compounds, and products containing AL101 or AL102, or the BMS Licensed Products, for all uses including the prevention, treatment or control of any human or animal disease, disorder or condition.

Under the License Agreement, we are obligated to use commercially reasonable efforts to develop at least one BMS Licensed Product. We have sole responsibility for, and bear the cost of, conducting research and development and preparing all regulatory filings and related submissions with respect to the BMS Licensed Compounds and/or BMS Licensed Products. Ayala has assigned and transferred all INDs for the BMS Licensed Compounds originally assigned by BMS to Ayala to us. We are also required to use commercially reasonable efforts to obtain regulatory approvals in certain major market countries for at least one BMS Licensed Product, as well as to affect the first commercial sale of and commercialize each BMS Licensed Product after obtaining such regulatory approval. We are sole responsibility for, and bear the cost of, commercializing BMS Licensed Products. For a limited period of time, we may not engage directly or indirectly in the clinical development or commercialization of a Notch inhibitor molecule that is not a BMS Licensed Compound.

We are obligated to pay BMS up to approximately $142 million in the aggregate upon the achievement of certain clinical development or regulatory milestones and up to $50 million in the aggregate upon the achievement of certain commercial milestones by each BMS Licensed Product. In addition, we are obligated to pay BMS tiered royalties ranging from a high single-digit to a low teen percentage on worldwide net sales of all BMS Licensed Products.

BMS has the right to terminate the BMS License in its entirety upon written notice to us (a) for insolvency-related events involving us, (b) for our material breach of the BMS License if such breach remains uncured for a defined period of time, (c) for our failure to fulfil our obligations to develop or commercialize the BMS Licensed Compounds and/or BMS Licensed Products not remedied within a defined period of time following written notice by BMS, or (d) if we or our affiliates commence any action challenging the validity, scope, enforceability or patentability of any of the licensed patent rights. We have the right to terminate the BMS License (a) for convenience upon prior written notice to BMS, the length of notice dependent on whether a BMS Licensed Product has received regulatory approval, (b) upon immediate written notice to BMS for insolvency-related events involving BMS, (c) for BMS’s material breach of the BMS License if such breach remains uncured for a defined period of time, or (d) on a BMS Licensed Compound-by-BMS Licensed Compound and/or BMS Licensed Product-by- BMS Licensed Product basis upon immediate written notice to BMS if we reasonably determine that there are unexpected safety and public health issues relating to the applicable BMS Licensed Compounds and/or BMS Licensed Products. Upon termination of the BMS License in its entirety by us for convenience or by BMS, we grant an exclusive, non-transferable, sublicensable, worldwide license to BMS under certain of our patent rights that are necessary to develop, manufacture or commercialize BMS Licensed Compounds or BMS Licensed Products. In exchange for such license, BMS must pay us a low single-digit percentage royalty on net sales of the BMS Licensed Compounds and/or BMS Licensed Products by it or its affiliates, licensees or sublicensees, provided that the termination occurred after a specified developmental milestone for such BMS Licensed Compounds and/or BMS Licensed Products.

In connection with the Amendment to the License Agreement, we entered into the Stock Issuance Agreement with BMS pursuant to which we issued 230,415 Shares to BMS as partial consideration for the Amendment and agreed to file a registration statement with the SEC to cover the resale of the Shares by BMS. Subject to complying with applicable securities laws, BMS is not subject to any restrictions with respect to the disposition of the Shares. Additionally, BMS is not subject to any standstill restrictions.

PLAN OF DISTRIBUTION

We are registering the resale of the shares of our common stock held by the selling stockholder from time to time after the date of this prospectus. We will not receive any of the proceeds from the sale by the selling stockholder of the shares of our common stock. The selling stockholder will bear all fees, commissions and discounts, if any, attributable to the sales of shares and any transfer taxes. We will bear all other costs, expenses and fees in connection with the registration of shares of our common stock to be sold by the selling stockholder pursuant to this prospectus.

The term “selling stockholder” includes donees, pledgees, transferees or other successors in interest selling securities received after the date of this prospectus from the selling stockholder as a gift, pledge, partnership distribution or other transfer. The selling stockholder will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may be made on the principal trading market for our common stock or any other stock exchange, market or trading facility on which our common stock is traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholder may use any one or more of the following methods when selling securities:

•

ordinary brokerage transactions and transactions in which the broker dealer solicits purchasers;

•

block trades in which the broker dealer will attempt to sell the common stock as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•

purchases by a broker dealer as principal and resale by the broker dealer for its account;

•

an exchange distribution in accordance with the rules of the applicable exchange;

•

directly to one or more purchasers;

•

settlement of short sales;

•

distribution to employees, members, limited partners or stockholders of the selling stockholder;

•

in transactions through broker dealers that agree with the selling stockholder to sell a specified number of such common stock at a stipulated price per security;

•

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

•

by pledge to secured debts and other obligations;

•

delayed delivery arrangements;

•

to or through underwriters, broker-dealers or agents; provided that in no event shall any resales by the selling stockholder take the form of an underwritten offering (as the term “underwritten public offering” is commonly understood, which for clarity does not include a transaction that does not involve the purchase by such broker-dealer of securities with a view to public resale thereby, but which transaction may be treated similarly to an underwritten public offering in terms of the procedures to be followed thereby as a matter of law or customary practice) without our prior consent;

•

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•

in privately negotiated transactions;

•

in options transactions;

•

a combination of any such methods of sale; or

•

any other method permitted pursuant to applicable law.

The selling stockholder may also sell the shares of our common stock under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under this prospectus.

In addition, the selling stockholder that is an entity may elect to make a pro rata in-kind distribution of securities to its members, partners or stockholders pursuant to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. Such members, partners or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration statement. To the extent a distributee is our affiliate (or to the extent otherwise required by law), we may, at our option, file a prospectus supplement in order to permit the distributees to use the prospectus to resell the securities acquired in the distribution.

Broker-dealers engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of our common stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with Financial Industry Regulatory Authority, or FINRA, Rule 5110; and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

To the extent required, this prospectus may be amended or supplemented from time to time to describe a specific plan of distribution. In connection with the sale of our common stock or interests therein, the selling stockholder may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of our common stock in the course of hedging the positions they assume. The selling stockholder may also sell our common stock short and deliver these shares to close out its short positions, or loan or pledge the securities to broker-dealers that in turn may sell these shares. The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction). The selling stockholder may also pledge securities to a broker-dealer or other financial institution, and, upon a default, such broker-dealer or other financial institution, may effect sales of the pledged securities pursuant to this prospectus (as supplemented or amended to reflect such transaction).

In effecting sales, broker-dealers or agents engaged by the selling stockholder may arrange for other broker-dealers to participate. Broker-dealers or agents may receive commissions, discounts or concessions from the selling stockholder in amounts to be negotiated immediately prior to the sale.

The selling stockholder has informed us that it does not have any written or oral agreement or understanding, directly or indirectly, with any person to distribute the shares of our common stock.

We will pay certain fees and expenses incurred by us incident to the registration of the resale of the Shares. We have agreed to indemnify the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act, and the selling stockholder may be entitled to contribution. We may be indemnified by the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act that may arise from any written information furnished to us by the selling stockholder specifically for use in this prospectus, or we may be entitled to contribution.

The resale securities will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale shares of our common stock may not simultaneously engage in market making activities with respect to our common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of our common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

At the time a particular offer of securities is made, if required, a prospectus supplement will be distributed that will set forth the number of securities being offered and the terms of the offering, including the name of any underwriter, dealer or agent, the purchase price paid by any underwriter, any discount, commission and other item constituting compensation, any discount, commission or concession allowed or reallowed or paid to any dealer, and the proposed selling price to the public.

We have agreed with the selling stockholder to keep the registration statement of which this prospectus forms a part effective until the earlier of (i) the third anniversary of the date this registration statement becomes effective, (ii) the date on which the selling stockholder ceases to hold any Shares issued pursuant to Stock Issuance Agreement, and (iii) all the Shares held by the selling stockholder may be sold within 90 days under Rule 144 without being subject to any volume, manner of sale or publicly available information requirements.

LEGAL MATTERS

Cooley LLP, San Diego, California, will pass upon the validity of the shares of our common stock offered by this prospectus.

EXPERTS

The consolidated financial statements of Immunome, Inc. appearing in Immunome, Inc.’s Annual Report (Form 10-K) for the year ended December 31, 2023 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of the registration statement on Form S-3 we filed with the SEC under the Securities Act and does not contain all the information set forth in the registration statement. Whenever a reference is made in this prospectus to any of our contracts, agreements or other documents, the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits to the reports or other documents incorporated by reference into this prospectus for a copy of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act, we file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at http://www.sec.gov. Our website address is www.immunome.com. Information contained on or accessible through our website is not a part of this prospectus and is not incorporated by reference herein, and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part the information or documents listed below that we have filed with the SEC (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary, and other portions of documents that are furnished but not filed or are otherwise not incorporated into registration statements pursuant to the applicable rules promulgated by the SEC) and any future filings made by us with the SEC (other than current reports furnished under Item 2.02 or Item 7.01 of Form 8-K and exhibits filed on such form that are related to such items unless such Form 8-K expressly provides to the contrary, and other portions of documents that are furnished but not filed or are otherwise not incorporated into registration statements pursuant to the applicable rules promulgated by the SEC) that are filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the filing of the registration statement of which this prospectus is a part and prior to the termination of all offerings of securities covered by this prospectus:

•

our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on March 28, 2024;

•

•

our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024 and June 30, 2024, filed with the SEC on May 14, 2024 and August 12, 2024, respectively;

•

our Current Reports on Form 8-K (other than information furnished rather than filed) filed with the SEC on January 2, 2024, January 8, 2024, February 1, 2024, February 6, 2024, February 13, 2024, February 14, 2024, March 26, 2024, April 25, 2024, April 30, 2024, June 13, 2024 and October 7, 2024; and

•

the description of our common stock set forth in the Registration Statement on Form 8-A filed with the SEC on September 30, 2020, including any amendments or reports filed for the purpose of updating such description.

Any statement contained herein or in a document incorporated or deemed to be incorporated by reference into this document will be deemed to be modified or superseded for purposes of the document to the extent that a statement contained in this document or any other subsequently filed document that is deemed to be incorporated by reference into this document modifies or supersedes the statement.

We will provide to each person, including any beneficial owner, to whom a prospectus is delivered, without charge upon written or oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus but not delivered with the prospectus, including exhibits which are specifically incorporated by reference into such documents. You can request a copy of these filings, at no cost, by writing or telephoning us at the following address or telephone number:

Immunome, Inc.

18702 N Creek Parkway, Suite 100

Bothell, WA 98011

Attn: Investor Relations

(452) 939-7410

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth an estimate of the fees and expenses payable by us in connection with the issuance and distribution of the securities being registered (other than the underwriting discounts and commissions and expenses incurred by the selling stockholder in disposing of its Shares). All the amounts shown are estimates, except for the SEC registration fee.

| |

|

|

Amount

|

|

|

SEC registration fee

|

|

|

|

$ |

449 |

|

|

|

Accounting fees and expenses

|

|

|

|

$ |

15,000 |

|

|

|

Legal fees and expenses

|

|

|

|

$ |

40,000 |

|

|

|

Miscellaneous fees and expenses

|

|

|

|

$ |

7,500 |

|

|

|

Total

|

|

|

|

$ |

62,949 |

|

|

Item 15. Indemnification of Directors and Officers

Section 145 of the General Corporation Law of the State of Delaware, or the DGCL, provides that a corporation may indemnify directors and officers as well as other employees and individuals against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement actually and reasonably incurred by such person in connection with any threatened, pending or completed actions, suits or proceedings in which such person is made a party by reason of such person being or having been a director, officer, employee or agent of the corporation. The DGCL provides that Section 145 is not exclusive of other rights to which those seeking indemnification may be entitled under any bylaws, agreement, vote of stockholders or disinterested directors or otherwise. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide for indemnification by us of our directors and officers to the fullest extent permitted by applicable law.

Section 102(b)(7) of the DGCL permits a corporation to provide in its certificate of incorporation that a director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director, except for liability (1) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (2) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (3) for unlawful payments of dividends or unlawful stock purchases or redemptions or other distributions or (4) for any transaction from which the director derived an improper personal benefit. Our Amended and Restated Certificate of Incorporation provides for such limitation of liability to the fullest extent permitted by applicable law.

We have entered into indemnification agreements with each of our directors and executive officers to provide contractual indemnification in addition to the indemnification provided in our Amended and Restated Certificate of Incorporation. Each indemnification agreement provides for indemnification and advancements by us of certain expenses and costs relating to claims, suits or proceedings arising from a director’s or officer’s service to us or, at our request, service to other entities, as officers or directors to the maximum extent permitted by applicable law. We believe that these provisions and agreements are necessary to attract qualified directors.

We also maintain standard policies of insurance under which coverage is provided (1) to our directors and officers against loss arising from claims made by reason of breach of duty or other wrongful act, while acting in their capacity as directors and officers of Immunome and (2) to us with respect to payments which may be made by us to such officers and directors pursuant to any indemnification provision contained in our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws or otherwise as a matter of law.

Item 16. Exhibits

| |

Exhibit

Number

|

|

|

Description

|

|

| |

2.1†

|

|

|

|

|

| |

2.2†

|

|

|

|

|

| |

4.1

|

|

|

Amended and Restated Certificate of Incorporation of the Registrant (incorporated by reference from Exhibit 3.1 to Registrant’s Current Report on Form 8-K filed with the SEC on October 6, 2020).

|

|

| |

4.2

|

|

|

Certificate of Amendment, dated October 2, 2023 to the Amended and Restated Certificate of Incorporation of Immunome, Inc. to implement Officer Exculpation (incorporated by reference from Exhibit 3.3 to the Registrant’s Current Report on Form 8-K filed with the SEC on October 4, 2023).

|

|

| |

4.3

|

|

|

Certificate of Amendment, dated October 2, 2023 to the Amended and Restated Certificate of Incorporation of Immunome, Inc. to implement the Authorized Share Increase (incorporated by reference from Exhibit 3.4 to the Registrant’s Current Report on Form 8-K filed with the SEC on October 4, 2023).

|

|

| |

4.4

|

|

|

|

|

| |

4.5

|

|

|

Form of Common Stock Certificate (incorporated by reference from Exhibit 4.2 to Amendment No. 1 to Registrant’s Registration Statement on Form S-1/A filed with the SEC on September 24, 2020).

|

|

| |

4.6

|

|

|

Stock Issuance Agreement, dated January 5, 2024, by and between the Registrant and Zentalis Pharmaceuticals, Inc (incorporated by reference to Exhibit 4.3 to Registrants Registration Statement on Form S-3 filed with the SEC on February 13, 2024).

|

|

| |

4.7*

|

|

|

|

|

| |

4.8

|

|

|

|

|

| |

5.1*

|

|

|

|

|

| |

23.1*

|

|

|

|

|

| |

23.3*

|

|

|

|

|

| |

24.1*

|

|

|

|

|

| |

107*

|

|

|

|

|

†

Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The registrant undertakes to furnish supplemental copies of any of the omitted schedules upon request by the SEC.

*

Filed herewith.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii)

to reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement.

Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (1)(i), (1)(ii) and (1)(iii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5)

That, for the purpose of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange

Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bothell, State of Washington, on October 8, 2024.

Immunome, Inc.

By:

/s/ Clay Siegall

Clay Siegall, Ph.D.

President and Chief Executive Officer

POWER OF ATTORNEY

Know All Persons By These Presents, that each person whose signature appears below constitutes and appoints Clay Siegall, Ph.D. and Max Rosett, and each of them, as his true and lawful attorneys-in-fact and agents, each with full power of substitution, for him in his name, place and stead, in any and all capacities, to sign any and all amendments to this Registration Statement (including post-effective amendments), and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them, or their or his substitutes or substitute, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the capacities and on the dates indicated.

| |

Signature

|

|

|

Title

|

|

|

Date

|

|

| |

/s/ Clay Siegall

Clay Siegall, Ph.D.

|

|

|

President, Chief Executive Officer and Chairman of the

Board of Directors (Principal Executive Officer)

|

|

|

October 8, 2024

|

|

| |

/s/ Max Rosett

Max Rosett

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting

Officer)

|

|

|

October 8, 2024

|

|

| |

/s/ Isaac Barchas

Isaac Barchas

|

|

|

Director

|

|

|

October 8, 2024

|

|

| |

/s/ Jean-Jacques Bienamié

Jean-Jacques Bienamié

|

|

|

Director

|

|

|

October 8, 2024

|

|

| |

/s/ James Boylan

James Boylan

|

|

|

Director

|

|

|

October 8, 2024

|

|

| |

/s/ Carol Schafer

Carol Schafer

|

|

|

Director

|

|

|

October 8, 2024

|

|

| |

/s/ Sandra Swain

Sandra Swain

|

|

|

Director

|

|

|

October 8, 2024

|

|

| |

/s/ Philip Wagenheim

Philip Wagenheim

|

|

|

Director

|

|

|

October 8, 2024

|

|

Exhibit 4.7

STOCK

ISSUANCE AGREEMENT

This

Stock Issuance Agreement (“Agreement”) is entered into as of August 7, 2024, by and between

Bristol-Myers Squibb Company, a Delaware corporation having offices at Route 206 and Province Line Road, Princeton, New Jersey

08543 (“BMS”), and Immunome, Inc., a Delaware corporation having an office at 18702 N. Creek Parkway,

Suite 100, Bothell, Washington 98011 (“Immunome”). Immunome and BMS are together referred to in this Agreement

as the “Parties” and individually as a “Party.”

Recitals

Subject to and in accordance

with the terms and provisions of this Agreement, Immunome has agreed to issue, and BMS has agreed to acquire, 230,415 shares (the

“Shares”) of Immunome’s common stock, par value $0.0001 per share (the “Common Stock”),

as partial consideration for entering into that certain Amendment No. 2 to License Agreement (the “Amendment”),

dated as of the date hereof, by and between Immunome and BMS, which amends that certain License Agreement dated as of November 29,

2017, by and between BMS and Immunome (as amended, the “License Agreement”), the value of which Immunome has

determined as of the date hereof exceeds the par value of the Shares to be issued hereunder.

Agreement

For good and valuable consideration, the Parties

agree as follows:

Section 1. Stock

Issuance

1.1 Issuance

and Acquisition of Stock. Subject to the terms and conditions of this Agreement, Immunome

will issue to BMS, and BMS will acquire from Immunome, the Shares as partial consideration for entering into the Amendment.

1.2 Closing.

The closing hereunder (the “Closing”) shall occur remotely via the exchange of signatures on the date of this

Agreement at such time as mutually agreed upon, orally or in writing, by Immunome and BMS. At the Closing, Immunome shall instruct

its transfer agent to register the Shares in book entry form in BMS’s name on Immunome’s share register and shall cause its

transfer agent to prepare and deliver to BMS an account statement reflecting the issuance as promptly as possible following the Closing.

Section 2. Representations

and Warranties of Immunome

Except as otherwise specifically

contemplated by this Agreement, Immunome hereby represents and warrants as of the date hereof to BMS that:

2.1 Private

Placement. Neither Immunome nor any person acting on its behalf, has, directly or indirectly,

made any offers or sales of any security or solicited any offers to buy any security, under any circumstances that would require registration

of the Shares under the Securities Act of 1933, as amended (the “Securities Act”). Subject to the accuracy of

the representations and warranties made by BMS in Section 3, the Shares will be issued and sold to BMS in compliance with

applicable exemptions from the registration and prospectus delivery requirements of the Securities Act and the registration and qualification

requirements of all applicable securities laws of the states of the United States. Immunome has not engaged any brokers, finders or agents,

or incurred, or will incur, directly or indirectly, any liability for brokerage or finder’s fees or agents’ commissions or

any similar charges in connection with this Agreement and the transactions contemplated hereby.

2.2 Organization

and Qualification. Immunome is duly incorporated, validly existing and in good standing under

the laws of the State of Delaware, with full corporate power and authority to conduct its business as currently conducted. Immunome is

duly qualified to do business and is in good standing in every jurisdiction in which the nature of the business conducted by it or property

owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, would

not reasonably be expected to have (i) a material adverse effect on the business, assets, liabilities, financial condition, results

of operations, or stockholders’ equity of Immunome and its subsidiaries, taken as a whole, or (ii) materially affect the validity

of the Shares or the legal authority of Immunome to comply in all material respects with this Agreement (clauses (i) and (ii), a

“Material Adverse Effect”).

2.3 Subsidiaries.

Each direct or indirect subsidiary of Immunome that owns any assets material to Immunome has been duly incorporated or organized, as the

case may be, and is validly existing as a corporation, partnership or limited liability company, as applicable, in good standing under

the laws of the jurisdiction of its incorporation or organization and has the power and authority (corporate or other) to own, lease and

operate its properties and to conduct its business as presently conducted. Each subsidiary is duly qualified as a foreign corporation,

partnership or limited liability company, as applicable, to do business and is in good standing in each jurisdiction in which such qualification

is required, whether by reason of the ownership or leasing of property or the conduct of business, except where the failure to so qualify

or be in good standing would not reasonably be expected to have, individually or in the aggregate, a Material Adverse Effect on Immunome.

All of the issued and outstanding capital stock or other equity or ownership interests of each subsidiary have been duly authorized and

validly issued, are fully paid and nonassessable and are owned by Immunome, directly or through subsidiaries, free and clear of any encumbrances

or preemptive and similar rights to subscribe for or purchase securities.

2.4 Authorization;

Enforcement. Immunome has all requisite corporate power and authority to enter into and to perform

its obligations under this Agreement, to consummate the transactions contemplated hereby and to issue the Shares in accordance with the

terms hereof. The execution, delivery and performance of this Agreement by Immunome and the consummation by it of the transactions contemplated

hereby (including the issuance of the Shares in accordance with the terms hereof) have been duly authorized by Immunome’s board

of directors and no further consent or authorization of Immunome, its board of directors, or its stockholders is required. This Agreement

has been duly executed by Immunome and constitutes a legal, valid and binding obligation of Immunome enforceable against Immunome in accordance

with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, or moratorium or similar

laws affecting creditors’ and contracting parties’ rights generally and except as enforceability may be subject to general

principles of equity and except as rights to indemnity and contribution may be limited by state or federal securities laws or public policy

underlying such laws.

2.5 Issuance

of Shares. The Shares are duly authorized and, upon issuance in accordance with the terms of

this Agreement, will be validly issued, fully paid and non-assessable and free and clear of any liens, encumbrances or other restrictions

(other than those imposed by securities laws generally or this Agreement) and will not be subject to preemptive rights or other similar

rights of stockholders of Immunome.

2.6 SEC

Documents, Financial Statements.

(a) All

material statements, reports, schedules, forms and other documents required to have been filed by Immunome or its officers with the SEC

have been so filed on a timely basis. As of the time it was filed with the United States Securities and Exchange Commission’s (“SEC”)

(or, if amended or superseded by a filing prior to the date of this Agreement, then on the date of such filing), each of the statements,

reports, schedules, forms and other documents filed by Immunome with the SEC since January 1, 2022 (the “SEC Documents”)

complied in all material respects with the applicable requirements of the Securities Act or the Exchange Act (as the case may be) and,

as of the time they were filed, none of the SEC Documents contained any untrue statement of a material fact or omitted to state a material

fact required to be stated therein or necessary in order to make the statements therein, in light of the circumstances under which they

were made, not misleading. The certifications and statements required by (i) Rule 13a-14 under the Exchange Act and (ii) 18

U.S.C. §1350 (Section 906 of the Sarbanes-Oxley Act) relating to the SEC Documents are accurate and complete and comply as to

form and content with all applicable Laws. As used in this Section 2.6, the term “file” and variations

thereof shall be broadly construed to include any manner in which a document or information is furnished, supplied or otherwise made available

to the SEC.

(b) The

financial statements (including any related notes) contained or incorporated by reference in the SEC Documents: (i) complied as to

form in all material respects with the published rules and regulations of the SEC applicable thereto; (ii) were prepared in

accordance with GAAP (except as may be indicated in the notes to such financial statements or, in the case of unaudited financial statements,

except as permitted by the SEC on Form 10-Q under the Exchange Act, and except that the unaudited financial statements may not contain

footnotes and are subject to normal and recurring year-end adjustments that are not reasonably expected to be material in amount) applied

on a consistent basis unless otherwise noted therein throughout the periods indicated; and (iii) fairly present, in all material

respects, the financial position of Immunome and its consolidated subsidiaries as of the respective dates thereof and the results of operations

and cash flows of Immunome and its consolidated subsidiaries for the periods covered thereby. Other than as expressly disclosed in the

SEC Documents filed prior to the date of this Agreement, there has been no material change in Immunome’s accounting methods or principles

that would be required to be disclosed in Immunome’s financial statements in accordance with GAAP. The books of account and other

financial records of Immunome and each of its subsidiaries are true and complete in all material respects.

(c) As

of the date of this Agreement, Immunome is in compliance in all material respects with the applicable provisions of the Sarbanes-Oxley

Act and the applicable current listing and governance rules and regulations of Nasdaq.

2.7 Internal

Control; Disclosure Controls and Procedures.

(a) Immunome

maintains a system of internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) of the Exchange

Act) that is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial

statements for external purposes in accordance with GAAP, including policies and procedures that (i) pertain to the maintenance of

records that in reasonable detail accurately and fairly reflect Immunome’s transactions and dispositions of assets, (ii) provide

reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with GAAP,

(iii) that receipts and expenditures are made only in accordance with authorizations of management and Immunome’s board of

directors, and (iv) provide reasonable assurance regarding prevention or timely detection of the unauthorized acquisition, use or

disposition of Immunome’s assets that could have a material effect on Immunome’s financial statements. Immunome has evaluated

the effectiveness of its internal control over financial reporting as of December 31, 2023, and, to the extent required by applicable

Law, presented in any applicable SEC Document that is a report on Form 10-K or Form 10-Q (or any amendment thereto) its conclusions

about the effectiveness of the internal control over financial reporting as of the end of the period covered by such report or amendment

based on such evaluation. Immunome has disclosed, based on its most recent evaluation of internal control over financial reporting, to

Immunome’s auditors and the audit committee of its board of directors: (A) all significant deficiencies and material weaknesses,

if any, in the design or operation of internal control over financial reporting that are reasonably likely to adversely affect Immunome’s

ability to record, process, summarize and report financial information and (B) any known fraud, whether or not material, that involves

management or other employees who have a significant role in Immunome’s or its subsidiaries’ internal control over financial

reporting. Immunome has not identified, based on its most recent evaluation of internal control over financial reporting, any material

weaknesses in the design or operation of Immunome’s internal control over financial reporting.

(b) Immunome

maintains “disclosure controls and procedures” (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange

Act) that are reasonably designed to ensure that information required to be disclosed by Immunome in the periodic reports that it files

or submits under the Exchange Act is recorded, processed, summarized and reported within the required time periods, and that all such

information is accumulated and communicated to Immunome’s management as appropriate to allow timely decisions regarding required

disclosure.

2.8 Capitalization

and Voting Rights.

(a) The

authorized capital of Immunome as of the date hereof consists of: (i) 300,000,000 shares of Common Stock of which, as of June 30,

2024, (w) 60,013,655 shares were issued and outstanding, (x) 14,554,376 shares were reserved for issuance pursuant to Immunome’s

equity incentive plans (including its stock purchase plan), (y) 8,537,999 shares were issuable upon the exercise of stock options

outstanding, and (z) no shares were issuable upon exercise of outstanding warrants, and (ii) 10,000,000 shares of Preferred

Stock, of which no shares are issued and outstanding as of the date of this Agreement. All of the issued and outstanding shares of Common