Interparfums, Inc. (NASDAQ GS: IPAR) today reported record results

for the fourth quarter and full year ended December 31, 2024.

|

Fourth Quarter & Full Year Highlights: ($ in

millions, except per share amounts) |

Three Months EndedDecember

31, |

Year EndedDecember 31, |

|

2024 |

2023 |

% Change |

2024 |

2023 |

% Change |

|

Net Sales |

$362 |

$329 |

10% |

$1,452 |

$1,318 |

10% |

|

Gross Margin |

64.5% |

64.7% |

(20 bps) |

63.9% |

63.7% |

+20 bps |

|

Operating Income before impairment loss |

$40 |

$19 |

112% |

$279 |

$251 |

11% |

|

Operating Margin before impairment loss |

11.1% |

5.7% |

+530 bps |

19.2% |

19.1% |

+10 bps |

|

Impairment loss |

$4 |

- |

NA |

$4 |

- |

NA |

|

Operating Income |

$36 |

$19 |

91% |

$275 |

$251 |

9% |

|

Operating Margin |

10.0% |

5.7% |

+420 bps |

18.9% |

19.1% |

(20 bps) |

|

Net Income attributable to Interparfums, Inc |

$24 |

$10 |

133% |

$164 |

$153 |

8% |

|

Diluted EPS |

$0.75 |

$0.32 |

132% |

$5.12 |

$4.75 |

8% |

|

Diluted EPS before impairment loss |

$0.82 |

$0.32 |

156% |

$5.18 |

$4.75 |

9% |

|

The average dollar/euro exchange rate for the 2024 fourth quarter

was 1.07 compared to 1.08 in the 2023 fourth quarter leading to a

negative 0.2% foreign exchange impact. For the full year, the

average dollar/euro exchange rate was 1.08, in line with 2023.NA –

not applicable |

Operational CommentaryJean

Madar, Chairman & Chief Executive Officer of Interparfums

noted, “2024 was our best year ever. Among the highlights were:

record sales and profits, successful product launches and brand

extensions, plus a better-than-expected first year managing Lacoste

and Roberto Cavalli (“Cavalli”) brand fragrances.

“Our sales growth of 10% for both the fourth

quarter and the full year was broad-based across our portfolio,

reflecting strong demand for our key brands worldwide.

“Our current top six brands, representing

approximately 70% of our net sales, increased 5% and 4% during the

fourth quarter and full year, respectively. Notably, all of our key

markets strengthened with our largest markets, North America,

Western Europe and Asia/Pacific, achieving gains of 6%, 21% and 3%,

respectively, compared to 2023 for the full year.

“The Middle East and Africa, Eastern Europe, and

Central and South America also achieved top line growth of 5%, 14%

and 17%, respectively, compared to 2023 for the full year.

Furthermore, travel retail continued to strengthen, driven by the

increase of travel frequency, distribution expansion, and enhanced

consumer experience with our brands.”

Mr. Madar continued, “Jimmy Choo, the largest

brand in our portfolio, increased sales by 7% for the year, largely

driven by the ongoing success of the I Want Choo franchise. GUESS

also had a stellar year, growing 13% as a result of the continued

robust performance of its legacy scents, plus the initial success

of our new pillar, GUESS Iconic (women). The brand entered 2025

with very strong programs and momentum from the fashion house.

“Lacoste and Cavalli performed very well in

their first year under our expertise, and combined, exceeded $115

million in sales behind healthy demand. We expect further growth in

the coming years as these two brands continue to leverage our

knowledge and build their global presence.”

“2025 will be a pivotal year for

Interparfums. We have an aggressive line-up of new pillars and

extensions making their debut for both our European and United

States based operations. In addition, we are putting the finishing

touches on our first proprietary niche brand, Solférino, and plan

to launch the collection this summer through an ultra-selective

distribution, including our own boutique in Paris later in the

year.”

Mr. Madar closed by saying, “Our business is

benefitting from the broad shift into prestige and luxury

fragrances, which resulted in healthy sell-out across our prestige

portfolio at year end, setting the stage for a solid level of

reorders in the first half of 2025.”

Financial CommentaryMichel

Atwood, Chief Financial Officer of Interparfums pointed out, “In

2024, excluding the previously communicated supplemental

non-recurring, non-cash impairment loss of $4 million for Rochas

Fashion, we delivered earnings per diluted share (“EPS”) of $5.18,

beating our guidance of $5.15. Our reported EPS was $5.12, on a

diluted basis, reaching an all-time high in the Company’s

history.

“Consolidated gross margin for the year was

63.9% and expanded 20 basis points from 63.7% driven by favorable

segment mix and the impact of certain one-time expenses related to

inventory in 2023.

“SG&A as a percentage of net sales was 44.7%

in 2024, which is in line with the previous year. The percentage

change was nominal as increased amortization cost from the addition

of the Lacoste license, which represented $6 million for the year,

was partially offset due to advertising and promotional (“A&P”)

activities by our European based operations growing slower than our

consolidated sales in 2024. We invested $281 million on A&P

strategies, a 7% increase compared to 2023, which amounted to 19.3%

of net sales.

“These factors led to $279 million in operating

income before impairment loss, an 11% increase compared to 2023,

and an operating profit margin before impairment loss of 19.2%, up

slightly from 19.1% in 2023.

“We closed the year in a strong financial

position with $235 million in cash, cash equivalents and short-term

investments, and working capital of $582 million. Despite sales

growth, inventory was flat compared to last year as we began to

realize the benefit of our inventory optimization programs. We also

significantly improved our cash conversion cycle, delivering

operating cash flow equivalent to 92% of net income, up from 56% in

2023. Long-term debt approximated $157 million.”

Reaffirms 2025 Guidance

Mr. Atwood concluded, “The fragrance market

remains robust, albeit at a more moderated pace compared to recent

years, influenced in part by retail destocking. Despite the current

economic uncertainty and unfavorable foreign exchange impacts, we

remain confident that our 2025 guidance, which calls for net sales

of $1.51 billion and EPS of $5.35, a 4% increase for both, is

achievable.”

Guidance assumes that the average dollar/euro

exchange rate remains at current levels.

Announcement of Increased Cash

DividendIn February 2025, Interparfums’ Board of Directors

approved an increase in the annual cash dividend rate to $3.20 per

share, up 7% from $3.00 per share. This dividend increase reflects

the Board’s continued confidence in the Company’s financial

strength and ability to achieve long-term, sustainable sales and

earnings growth.

The next quarterly cash dividend of $0.80 per

share is payable on March 28, 2025, to shareholders of record on

March 14, 2025.

Conference CallManagement will

host a conference call to discuss financial results and business

operations beginning at 11:00 am ET on Wednesday, February 26,

2025.

Interested parties may participate in the live

call by dialing:

U.S. / Toll-free: (877)

423-9820International: (201) 493-6749

Participants are asked to dial-in approximately

10 minutes before the conference call is scheduled to begin.

A live audio webcast will also be available in

the “Events” tab within the Investor Relations section of the

Company’s website at www.interparfumsinc.com, or by clicking here.

The conference call will be available for webcast replay for

approximately 90 days following the live event.

About Interparfums,

Inc.Operating in the global fragrance business since 1982,

Interparfums, Inc. produces and distributes a wide array of

prestige fragrance and fragrance related products under license

agreements with brand owners. The Company manages its business in

two operating segments, European based operations, through its 72%

owned subsidiary, Interparfums SA, and United States based

operations, through wholly owned subsidiaries in the United States

and Italy.

The portfolio of prestige brands includes

Abercrombie & Fitch, Anna Sui, Boucheron, Coach, Donna

Karan/DKNY, Emanuel Ungaro, Ferragamo, Graff, GUESS, Hollister,

Jimmy Choo, Karl Lagerfeld, Kate Spade, Lacoste, MCM, Moncler,

Montblanc, Oscar de la Renta, Roberto Cavalli, and Van Cleef &

Arpels, whose products are distributed in over 120 countries around

the world through an extensive and diverse network of distributors.

Interparfums, Inc. is also the registered owner of several

trademarks including Lanvin and Rochas.

Forward-Looking

StatementsStatements in this release which are not

historical in nature are forward-looking statements. Although we

believe that our plans, intentions, and expectations reflected in

such forward-looking statements are reasonable, we can give no

assurance that such plans, intentions, or expectations will be

achieved. In some cases, you can identify forward-looking

statements by forward-looking words such as "anticipate, "believe",

"could", "estimate", "expect", "intend", "may", "should", "will",

and "would" or similar words. You should not rely on

forward-looking statements, because actual events or results may

differ materially from those indicated by these forward-looking

statements as a result of a number of important factors. These

factors include, but are not limited to, the risks and

uncertainties discussed under the headings “Forward Looking

Statements” and "Risk Factors" in Interparfums' most recent annual

report on Form 10-K, and the reports Interparfums files from time

to time with the Securities and Exchange Commission. Interparfums

does not intend to and undertakes no duty to update the information

contained in this press release.

| Contact Information: |

| Interparfums,

Inc. |

|

The Equity

Group Inc. |

| Michel Atwood |

or |

Karin Daly |

| Chief Financial Officer |

|

Investor Relations Counsel |

| (212) 983-2640 |

|

(212) 836-9623 /kdaly@equityny.com |

| www.interparfumsinc.com |

|

www.theequitygroup.com |

| |

|

|

See Accompanying Tables

|

INTERPARFUMS, INC. AND SUBSIDIARIESUnaudited

Consolidated Balance SheetsDecember 31, 2024, and 2023(In thousands

except share and per share data) |

|

|

|

Assets |

2024 |

|

|

2023 |

|

|

Current assets: |

|

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

125,433 |

|

|

$ |

88,462 |

|

| Short-term investments |

|

109,311 |

|

|

|

94,304 |

|

| Accounts receivable, net |

|

274,705 |

|

|

|

247,240 |

|

| Inventories |

|

371,920 |

|

|

|

371,859 |

|

| Receivables, other |

|

6,122 |

|

|

|

7,012 |

|

| Other current assets |

|

27,035 |

|

|

|

29,458 |

|

| Income taxes receivable |

|

306 |

|

|

|

691 |

|

| Total current assets |

|

914,832 |

|

|

|

839,026 |

|

| Property, equipment

and leasehold improvements, net |

|

153,773 |

|

|

|

169,222 |

|

| Right-of-use assets,

net |

|

24,603 |

|

|

|

28,613 |

|

| Trademarks, licenses

and other intangible assets, net |

|

282,484 |

|

|

|

296,356 |

|

| Deferred tax

assets |

|

17,034 |

|

|

|

14,545 |

|

| Other

assets |

|

18,535 |

|

|

|

21,567 |

|

| Total

assets |

$ |

1,411,261 |

|

|

$ |

1,369,329 |

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

|

Loans payable - banks |

$ |

8,311 |

|

|

$ |

4,420 |

|

|

Current portion of long-term debt |

|

41,607 |

|

|

|

29,587 |

|

|

Current portion of lease liabilities |

|

6,087 |

|

|

|

5,951 |

|

|

Accounts payable - trade |

|

91,049 |

|

|

|

97,409 |

|

|

Accrued expenses |

|

172,758 |

|

|

|

178,880 |

|

|

Income taxes payable |

|

12,615 |

|

|

|

8,498 |

|

|

Total current liabilities |

|

332,427 |

|

|

|

324,745 |

|

| Long–term debt, less

current portion |

|

115,734 |

|

|

|

127,897 |

|

| Lease liabilities,

less current portion |

|

20,455 |

|

|

|

24,517 |

|

| Equity: |

|

|

|

|

|

|

|

| Interparfums, Inc.

shareholders’ equity: |

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value. Authorized 1,000,000 shares:

none issued |

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value. Authorized 100,000,000 shares:

outstanding, 32,110,170 and 32,004,660 shares on December 31, 2024,

and 2023, respectively |

|

32 |

|

|

|

32 |

|

|

Additional paid-in capital |

|

106,702 |

|

|

|

98,565 |

|

|

Retained earnings |

|

763,240 |

|

|

|

693,848 |

|

|

Accumulated other comprehensive loss |

|

(72,239 |

) |

|

|

(40,188 |

) |

|

Treasury stock, at cost, 9,981,665 and 9,981,665 common shares on

December 31, 2024, and 2023, respectively |

|

(52,864 |

) |

|

|

(52,864 |

) |

| Total Interparfums, Inc.

shareholders’ equity |

|

744,871 |

|

|

|

699,393 |

|

|

Noncontrolling interest |

|

197,774 |

|

|

|

192,777 |

|

| Total equity |

|

942,645 |

|

|

|

892,170 |

|

| Total liabilities and

equity |

$ |

1,411,261 |

|

|

$ |

1,369,329 |

|

|

INTERPARFUMS, INC. AND SUBSIDIARIESUnaudited

Consolidated Statements of Income(In thousands except per share

data) |

| |

| |

Three Months EndedDecember

31, |

|

Twelve Months EndedDecember

31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

sales |

$ |

361,504 |

|

|

$ |

328,739 |

|

|

$ |

1,452,325 |

|

|

$ |

1,317,675 |

|

| Cost of

sales |

|

128,465 |

|

|

|

116,029 |

|

|

|

524,984 |

|

|

|

478,597 |

|

| Gross

margin |

|

233,039 |

|

|

|

212,710 |

|

|

|

927,341 |

|

|

|

839,078 |

|

| Selling, general and

administrative expenses |

|

193,034 |

|

|

|

193,830 |

|

|

|

648,540 |

|

|

|

587,696 |

|

| Impairment

loss |

|

4,005 |

|

|

|

-- |

|

|

|

4,005 |

|

|

|

-- |

|

| Income from

operations |

|

36,000 |

|

|

|

18,880 |

|

|

|

274,796 |

|

|

|

251,382 |

|

| |

|

|

|

|

|

|

|

| Other expenses

(income): |

|

|

|

|

|

|

|

|

Interest expense |

|

2,099 |

|

|

|

4,223 |

|

|

|

7,825 |

|

|

|

11,253 |

|

|

Loss (gain) on foreign currency |

|

(2,000 |

) |

|

|

2,238 |

|

|

|

1,085 |

|

|

|

1,582 |

|

|

Interest and investment income |

|

(528 |

) |

|

|

(2,308 |

) |

|

|

(2,218 |

) |

|

|

(10,729 |

) |

|

Other income |

|

(252 |

) |

|

|

(192 |

) |

|

|

(287 |

) |

|

|

(317 |

) |

|

|

|

(681 |

) |

|

|

3,961 |

|

|

|

6,405 |

|

|

|

1,789 |

|

| Income before income

taxes |

|

36,681 |

|

|

|

14,919 |

|

|

|

268,391 |

|

|

|

249,593 |

|

| Income taxes |

|

9,984 |

|

|

|

6,689 |

|

|

|

64,958 |

|

|

|

61,817 |

|

|

Net income |

|

26,297 |

|

|

|

8,230 |

|

|

|

203,433 |

|

|

|

187,776 |

|

| Less: Net income attributable

to the noncontrolling interest |

|

2,469 |

|

|

|

(2,190 |

) |

|

|

39,075 |

|

|

|

35,122 |

|

| Net income

attributable to Interparfums, Inc. |

$ |

24,228 |

|

|

$ |

10,420 |

|

|

$ |

164,358 |

|

|

$ |

152,654 |

|

|

|

|

|

|

|

|

|

|

| Net income

attributable to Interparfums, Inc. common

shareholders: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.76 |

|

|

$ |

0.33 |

|

|

$ |

5.13 |

|

|

$ |

4.77 |

|

|

Diluted |

$ |

0.75 |

|

|

$ |

0.32 |

|

|

$ |

5.12 |

|

|

$ |

4.75 |

|

| |

|

|

|

|

|

|

|

| Weighted average

number of shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

32,056 |

|

|

|

31,977 |

|

|

|

32,037 |

|

|

|

31,994 |

|

|

Diluted |

|

32,135 |

|

|

|

32,112 |

|

|

|

32,124 |

|

|

|

32,140 |

|

| Dividends declared per

share |

$ |

0.750 |

|

|

$ |

0.625 |

|

|

$ |

3.00 |

|

|

$ |

2.50 |

|

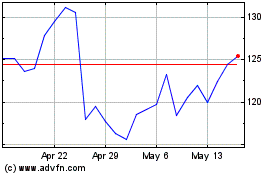

Interparfums (NASDAQ:IPAR)

Historical Stock Chart

From Feb 2025 to Mar 2025

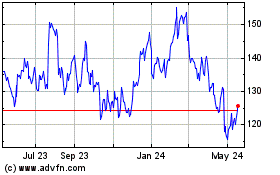

Interparfums (NASDAQ:IPAR)

Historical Stock Chart

From Mar 2024 to Mar 2025