As filed with the Securities and Exchange Commission on May 28, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

iRobot Corporation

(Exact Name of Registrant as Specified in its Charter)

| | | | | |

Delaware (State or Other Jurisdiction of Incorporation or Organization) | 77-0259335 (I.R.S. Employer Identification No.) |

iRobot Corporation

8 Crosby Drive

Bedford, Massachusetts 01730

(Address of Principal Executive Offices, including zip code)

2018 Stock Option and Incentive Plan

Non-Plan Restricted Stock Unit Awards

Non-Plan Performance-Based Restricted Stock Unit Awards

(Full Title of the Plan)

______________________________________________________________

Gary S. Cohen

Chief Executive Officer

iRobot Corporation

8 Crosby Drive

Bedford, Massachusetts 01730

(Name and Address of Agent For Service)

(781) 430-3000

(Telephone Number, including Area Code, of Agent For Service)

Copy to:

Mark T. Bettencourt, Esq.

Gregg Katz, Esq.

Goodwin Procter LLP

100 Northern Ave.

Boston, Massachusetts 02210

(617) 570-1000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

| Large accelerated filer | ý | Accelerated filer | ¨ |

| | | |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| | | |

| | Emerging growth company | ¨ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

EXPLANATORY NOTE

This Registration Statement on Form S-8 (“Registration Statement”) is filed for the purposes of registering 900,000 additional shares of common stock, par value $0.01 per share (“Common Stock”), of iRobot Corporation (the “Registrant”) that may be issued pursuant to equity awards granted pursuant to the iRobot Corporation 2018 Stock Option and Incentive Plan, as amended (the “2018 Plan”). On May 23, 2024, pursuant to an amendment to the 2018 Plan, the number of shares of Common Stock reserved and available for issuance under the 2018 Plan increased by 900,000. This Registration Statement registers these additional 900,000 shares of Common Stock. The additional shares are of the same class as other securities for which registration statements of the Registrant filed on Form S-8 (SEC File No. 333-225482), Form S-8 (SEC File No. 333-239573) and Form S-8 (SEC File No. 333-265677) are effective. The information contained in each of the Registrant’s registration statements on Form S-8 (SEC File No. 333-225482), Form S-8 (SEC File No. 333-239573) and Form S-8 (SEC File No. 333-265677) is hereby incorporated by reference pursuant to General Instruction E, except to the extent supplemented, amended or superseded by the information set forth herein. Only those items of Form S-8 containing new information not contained in the earlier registration statements are presented herein.

This Registration Statement is also filed for the purpose of registering an aggregate of 725,000 shares of Common Stock (collectively, the “Inducement Awards”) comprised of:

•435,000 shares of Common Stock that may be issued upon the vesting of performance-based restricted stock units that will vest in accordance with the terms of a Performance-Based Restricted Stock Unit Award Agreement by and between the Registrant and Gary S. Cohen, as an inducement for his accepting employment with the Registrant; and

•290,000 shares of Common Stock that may be issued upon the vesting of time-based restricted stock units that will vest in accordance with the terms of a Restricted Stock Unit Award Agreement by and between the Registrant and Gary S. Cohen, as an inducement for his accepting employment with the Registrant.

The Inducement Awards will be issued outside of the 2018 Plan, approved by the Registrant’s board of directors and issued pursuant to the “inducement” grant exception under 5635(c)(4) of the Marketplace Rules of the NASDAQ Stock Market LLC, as inducements that are material to employees’ entering into employment with the Registrant.

Part I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

Item 1. Plan Information.

The documents containing the information specified in this Item 1 will be sent or given to (i) participants in the equity benefit plans covered by this Registration Statement and (ii) the employee issued the Inducement Awards as specified by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). In accordance with the rules and regulations of the Securities and Exchange Commission (the “Commission”) and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

Item 2. Registrant Information and Employee Plan Annual Information.

The documents containing the information specified in this Item 2 will be sent or given to (i) participants in the equity benefit plans covered by this Registration Statement and (ii) the employee issued the Inducement Awards as specified by Rule 428(b)(1) under the Securities Act. In accordance with the rules and regulations of the Commission and the instructions to Form S-8, such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 under the Securities Act.

Part II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Registrant hereby incorporates by reference into this Registration Statement the following documents filed with the Commission:

(a) The Registrant’s Annual Report on Form 10-K for the year ended December 30, 2023, filed with the Commission on February 27, 2024.

(b) All other documents filed by the Registrant pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), since the end of the fiscal year covered by the document referred to in (a) above; and

(c) The description of the Common Stock contained in Exhibit 4.2 to the Registrant’s Form 10-K for the fiscal year ended December 28, 2019, filed with the Commission on February 13, 2020, including any amendments or reports filed for the purpose of updating this description.

All documents that the Registrant subsequently files pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act prior to the filing of a post-effective amendment to this Registration Statement which indicates that all of the shares of Common Stock offered have been sold or which deregisters all of such shares then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of the filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained herein or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Under no circumstances will any information furnished under current items 2.02 or 7.01 of Form 8-K be deemed incorporated herein by reference unless such Form 8-K expressly provides to the contrary.

Item 4. Description of Services.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 145 of the General Corporation Law of the State of Delaware permits a corporation to include in its charter documents, and in agreements between the corporation and its directors and officers, provisions expanding the scope of indemnification beyond that specifically provided by the current law.

The Registrant’s second amended and restated certificate of incorporation provides for the indemnification of directors to the fullest extent permissible under Delaware law.

The Registrant’s amended and restated by-laws, as amended, provide for the indemnification of officers, directors and other employees if such persons act in good faith and in a manner reasonably believed to be in, or not opposed to, the Registrant’s best interests, and, with respect to any criminal action or proceeding, such indemnified party had no reasonable cause to believe his or her conduct was unlawful.

The Registrant has entered into agreements with certain of its officers and directors that also provide for indemnification and expenses and liability reimbursement in addition to the indemnification provisions provided for in its charter documents, and the Registrant intends to enter into indemnification agreements with any new directors and executive officers in the future. These agreements require the Registrant to indemnify such persons against liabilities that may arise by reason of their status or service as officers and directors and to advance their expenses incurred as a result of any proceeding against them as to which they could be indemnified. In addition, the Registrant has purchased and maintains insurance on behalf of any person who is or was a director or officer against any loss arising from any claim asserted against him or her and incurred by him or her in that capacity, subject to certain exclusions and limits of the amount of coverage.

These indemnification provisions and the indemnification agreements entered into between the Registrant and its officers and directors may be sufficiently broad to permit indemnification of the Registrant’s officers and directors for liabilities (including reimbursement of expenses incurred) arising under the Securities Act.

Item 7. Exhibits Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

The exhibits to this Registration Statement are listed in the Exhibit Index attached hereto and incorporated by reference herein.

| | | | | |

| Exhibit No. | Description of Exhibit |

| Opinion of Goodwin Procter LLP |

| Consent of Goodwin Procter LLP (included in Exhibit 5.1) |

| Consent of PricewaterhouseCoopers LLP |

| Power of Attorney (included as part of the signature page of this Registration Statement) |

| Third Amendment to the iRobot Corporation 2018 Stock Option and Incentive Plan (filed as Exhibit 10.1 to the Registrant’s Current Report on Form 8-K filed on May 23, 2024 and incorporated by reference herein) |

| Form of Performance-Based Restricted Stock Unit Award Agreement, by and between the Company and Gary S. Cohen. |

| Form of Restricted Stock Unit Award Agreement, by and between the Company and Gary S. Cohen. |

| Filing Fee Table |

| |

| * Filed herewith. |

Item 9. Undertakings.

(a) The Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act.

(ii) To reflect in the prospectus any facts or events arising after the effective date of the Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” table in the effective registration statement.

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the Registration Statement or any material change to such information in the Registration Statement.

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) herein do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act (15 U.S.C. 78m or 78o(d)) that are incorporated by reference in the Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore,

unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Bedford, Commonwealth of Massachusetts, on May 28, 2024.

| | | | | |

| iROBOT CORPORATION |

| |

| By: | /s/ Gary S. Cohen |

| Gary S. Cohen |

| Chief Executive Officer |

POWER OF ATTORNEY AND SIGNATURES

We, the undersigned officers and directors of iRobot Corporation (the “Company”), hereby severally constitute and appoint Gary S. Cohen and Tonya Drake, and each of them singly, our true and lawful attorneys, with full power to them, and to each of them singly, to sign for us and in our names in the capacities indicated below, any and all amendments (including post-effective amendments) to this Registration Statement, and all other documents in connection therewith to be filed with the Securities and Exchange Commission, and generally to do all things in our names and on our behalf in such capacities to enable the Company to comply with the provisions of the Securities Act of 1933, as amended, and all requirements of the Securities and Exchange Commission.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities indicated on May 28, 2024.

| | | | | | | | | | | | | | |

| Signature | | Title(s) | | Date |

| /s/ Gary S. Cohen | | | | |

| Gary S. Cohen | | Chief Executive Officer and Director (Principal Executive Officer) | | May 28, 2024 |

| | | | |

| /s/ Julie Zeiler | | | | |

| Julie Zeiler | | Executive Vice President and Chief Financial Officer (Principal Financial Officer) | | May 28, 2024 |

| | | | |

| /s/ Karian Wong | | | | |

| Karian Wong | | SVP, Finance (Principal Accounting Officer) | | May 28, 2024 |

| | | | |

| /s/ Andrew Miller | | | | |

| Andrew Miller | | Chairman | | May 28, 2024 |

| | | | |

| /s/ Mohamad Ali | | | | |

| Mohamad Ali | | Director | | May 28, 2024 |

| | | | |

| /s/ Karen Golz | | | | |

| Karen Golz | | Director | | May 28, 2024 |

| | | | |

| /s/ Ruey-Bin Kao | | | | |

| Ruey-Bin Kao | | Director | | May 28, 2024 |

| | | | |

| /s/ Eva Manolis | | | | |

| Eva Manolis | | Director | | May 28, 2024 |

| | | | |

| /s/ Michelle Stacy | | | | |

| Michelle Stacy | | Director | | May 28, 2024 |

Exhibit 5.1

May 28, 2024

iRobot Corporation

8 Crosby Drive

Bedford, Massachusetts 01730

| | | | | |

Re: | Securities Being Registered under Registration Statement on Form S-8 |

We have acted as counsel to you in connection with your filing of a Registration Statement on Form S-8 (the “Registration Statement”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), on or about the date hereof relating to (i) 900,000 shares (the “Plan Shares”) of Common Stock, $0.01 par value per share (“Common Stock”), of iRobot Corporation, a Delaware corporation (the “Company”), that may be issued pursuant to the Company’s 2018 Stock Option and Incentive Plan, as amended (the “Plan”), and (ii) an aggregate of 725,000 shares of Common Stock (the “Award Shares” and, together with the Plan Shares, the “Shares”), that may be issued pursuant to a Performance-Based Restricted Stock Unit Award Agreement (the “PSU Agreement”) and Restricted Stock Unit Award Agreement (the “RSU Agreement,” and together with the PSU Agreement, the “Award Agreements”).

We have reviewed such documents and made such examination of law as we have deemed appropriate to give the opinions set forth below. We have relied, without independent verification, on certificates of public officials and, as to matters of fact material to the opinion set forth below, on certificates of officers of the Company.

The opinion set forth below is limited to the Delaware General Corporation Law.

For purposes of the opinion set forth below, we have assumed that no event occurs that causes the number of authorized shares of Common Stock available for issuance by the Company to be less than the number of then unissued Shares.

Based on the foregoing, we are of the opinion that the Shares have been duly authorized and, upon issuance and delivery against payment therefor in accordance with the terms of the Plan and the Award Agreements, as applicable, will be validly issued, fully paid and nonassessable.

This opinion letter and the opinion it contains shall be interpreted in accordance with the Core Opinion Principles as published in 74 Business Lawyer 815 (Summer 2019).

We hereby consent to the inclusion of this opinion as Exhibit 5.1 to the Registration Statement. In giving our consent, we do not admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations thereunder.

| | | | | | | | | |

| Very truly yours, | |

| | | |

| /s/ Goodwin Procter LLP | |

| | | |

| GOODWIN PROCTER LLP | |

| | | |

| | | |

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of iRobot Corporation of our report dated February 27, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in iRobot Corporation’s Annual Report on Form 10-K for the year ended December 30, 2023.

/s/ PricewaterhouseCoopers LLP

Boston, Massachusetts

May 28, 2024

THIRD AMENDMENT

TO THE

IROBOT CORPORATION

2018 STOCK OPTION AND INCENTIVE PLAN

WHEREAS, iRobot Corporation (the “Company”) maintains the iRobot Corporation 2018 Stock Option and Incentive Plan (the “Plan”), which was previously adopted by the Board of Directors on March 26, 2018 and approved by the stockholders of the Company on May 23, 2018;

WHEREAS, the Plan was amended effective May 20, 2020 and May 27, 2022 to increase the number of shares reserved under the Plan;

WHEREAS, the Board of Directors of the Company believes that the number of shares of common stock of the Company (“Common Stock”) remaining available for issuance under the Plan, as amended, has become insufficient for the Company’s anticipated future needs under the Plan;

WHEREAS, Section 16 of the Plan provides that the Board of Directors of the Company may amend the Plan at any time, subject to certain conditions set forth therein; and

WHEREAS, the Board of Directors of the Company has determined that it is in the best interests of the Company to amend the Plan, subject to stockholder approval, to increase both the aggregate number of shares of Common Stock available for issuance under the Plan, and the number of shares that may be issued in the form of Incentive Stock Options (as defined in the Plan) from 3,395,000 shares to 4,295,000 shares.

NOW, THEREFORE:

1. Increase in Shares. Section 3(a) of the Plan is hereby amended by deleting it in its entirety and replacing it with the following:

“The maximum number of shares of Stock reserved and available for issuance under the Plan shall be 4,295,000 shares, subject to adjustment as provided in this Section 3. For purposes of this limitation, the shares of Stock underlying any awards under the Plan or the Company’s 2015 Stock Option and Incentive Plan that are forfeited, canceled or otherwise terminated (other than by exercise) shall be added back to the shares of Stock available for issuance under the Plan. Notwithstanding the foregoing, the following shares shall not be added to the shares authorized for grant under the Plan: (i) shares tendered or held back upon exercise of an Option or settlement of an Award to cover the exercise price or tax withholding, and (ii) shares subject to a Stock Appreciation Right that are not issued in connection with the stock settlement of the Stock Appreciation Right upon exercise thereof. In the event the Company repurchases shares of Stock on the open market, such shares shall not be added to the shares of Stock available for issuance under the Plan. Subject to such overall limitations, shares of Stock may be issued up to such maximum number pursuant to any type or types of Award; provided, however, that no more than 4,295,000 shares of the Stock may be issued in the form of Incentive Stock Options. The shares available for issuance under the Plan may be authorized but unissued shares of Stock or shares of Stock reacquired by the Company.”

2. Effective Date of Amendment. This Amendment to the Plan shall become effective upon the date that it is approved by the Company’s stockholders in accordance with applicable laws and regulations.

3. Other Provisions. Except as set forth above, all other provisions of the Plan shall remain unchanged.

Exhibit 99.2

iROBOT CORPORATION PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT (INDUCEMENT AWARD)

Name of Grantee: Gary Cohen

Target No. of Restricted Stock Units Granted: 435,000 (the “Target Award”)

Grant Date:

iRobot Corporation (the “Company”) has selected the Grantee named above to be awarded the Target Award specified above, subject to the terms and conditions of this Award Agreement. This Award is not issued under the Company’s 2018 Stock Option and Incentive Plan, as amended through the date hereof (the “Plan”), and does not reduce the share reserve under the Plan. However, for purposes of interpreting the applicable provisions of this Award, the terms and conditions of the Plan (other than those applicable to the share reserve) shall govern and apply to this Award as if this Award had actually been issued under the Plan. This Award has been granted as an inducement pursuant to Rule 5635(c)(4) of the Marketplace Rules of The NASDAQ Stock Market LLC (“NASDAQ”), and consequently is intended to be exempt from the NASDAQ rules regarding stockholder approval of equity compensation plans. Capitalized terms used but not defined in this Award Agreement shall have the meaning given such terms in the Plan.

1.Definitions

For purposes of this Award Agreement (including, without limitation, Exhibit A hereto):

(a) “Award” means this award of performance-based Restricted Stock Units.

(b)“Award Agreement” means this Performance-Based Restricted Stock Unit Award Agreement.

(c) “Change in Control Date” means with respect to each Change in Control Performance Period, the last day of the full calendar month immediately preceding the effective date of a Sale Event.

(d)“Change in Control Performance Period” means the Performance Period that is shortened by the Administrator such that each such period shall be deemed to have concluded as of the Change in Control Date.

(e)“Performance Goals” mean the performance criteria applicable to the Award, as determined by the Administrator and set forth in this Award Agreement.

(f)“Performance Period” means a four year period commencing on May 6, 2024 and concluding on May 6, 2028.

(g)“Sale Event” shall have the meaning given such term in the Plan.

2.Restrictions on Transfer of Award and Award Agreement. The Award shall not be sold, transferred, pledged, assigned or otherwise encumbered or disposed of by the Grantee until (i) the Restricted Stock Units have vested as provided in Section 3 of this Award Agreement, and (ii) shares have been issued pursuant to Section 7 of this Award Agreement. This Award Agreement is personal to the Grantee, is non-assignable and is not transferable in any manner, by operation of law or otherwise, other than by will or the laws of descent and distribution.

3.Vesting of Restricted Stock Units. Subject to Sections 4 and 6 below, the Restricted Stock Units shall vest in accordance with the vesting schedule set forth on Exhibit A hereto.

4.Termination of Employment. Subject to Section 6 below, if at any time prior to the fourth Anniversary of the Grant Date (the “Vesting Date”), the Grantee’s employment with the Company terminates for any reason, the Grantee shall automatically forfeit the right to receive any portion of the Award; provided, however, that if the Grantee’s employment terminates by reason of the Grantee’s death after the Restricted Stock Units have been earned pursuant to Section 5 below, but before the Vesting Date, the Grantee shall not forfeit any such earned Restricted Stock Units.

5.Determination and Payment of Awards.

(a)The Target Award for the Performance Period shall be earned based on the Company’s performance for such Performance Period as measured by the Performance Goal(s), subject to the Grantee’s continued employment with the Company through the Vesting Date, except as set forth in Section 4 above and Section 6 below.

(b)At a meeting during the first fiscal quarter after the conclusion of the Performance Period, the Administrator shall determine the total number of Restricted Stock Units that shall be deemed earned as of the final day of the Performance Period, in accordance with the terms of this Award Agreement.

6.Change in Control. Subject to any Executive Agreement, Employment Agreement or similar agreement between the Company and the Grantee, in the event a Sale Event occurs prior to the end of a Performance Period, the Administrator shall determine the number of Restricted Stock Units to be earned by the Grantee in accordance with the principles set forth in Section 5 based upon the Company’s performance during the Change in Control Performance Period.

7.Issuance of Shares of Stock; Rights as Stockholder.

(a)As soon as practicable following the conclusion of the Performance Period, (but in no event later than 74 days following the last day of the calendar year in which the Vesting Date or a Sale Event, as applicable, occurs), the earned and vested Restricted Stock Units, if any, will be settled in an equal number of shares of Stock. The Company shall direct its transfer agent to issue to the Grantee in book entry form the number of shares of Stock equal to the number of Restricted Stock Units that have been earned pursuant to Sections 3 and 5 and Exhibit A of this Award Agreement on such date in satisfaction of such Restricted Stock Units. Such issuance may be effected by the Company directing its transfer agent to deposit such shares of Stock into the Grantee’s brokerage account. The Grantee’s cost basis in any shares of Stock issued hereunder shall be $0.00.

(b)In each instance above, the issuance of shares of Stock shall be subject to the payment by the Grantee by cash or other means acceptable to the Company of any Federal, state,

local and other applicable taxes required to be withheld in connection with such issuance in accordance with Section 9 of this Award Agreement.

(c)The Grantee understands that (i) the Grantee shall have no rights with respect to the shares of Stock underlying the Restricted Stock Units, such as voting rights, dividend rights and dividend equivalent rights, unless and until the Award has been settled and such shares of Stock have been issued to the Grantee as specified in Section 7(a) hereof and (ii) once shares have been delivered by book entry to the Grantee in respect of the Restricted Stock Units, the Grantee will be free to sell such shares of Stock, subject to applicable requirements of Federal and state securities laws and Company policy.

8.Incorporation of Plan. As set forth above, this Award is not granted pursuant to the Plan. However, for purposes of interpreting the provisions of this Award, the terms and conditions of the Plan (other than those applicable to the share reserve, but, including the powers of the Administrator set forth in Section 2 of the Plan) shall govern and apply to this Award as if this Award had actually been issued under the Plan.

9.Tax Withholding. In the event the Company is required to withhold taxes from the Grantee for taxable compensation relating to the issuance of shares of Stock in connection with this Award, the Grantee shall, not later than the date as of which the receipt of this Award becomes a taxable event for Federal income tax purposes, pay to the Company or make arrangements satisfactory to the Administrator for payment of any Federal, state, and local taxes required by law to be withheld on account of such taxable event. Subject to approval by the Administrator, the Company’s required tax withholding obligation may be satisfied, in whole or in part, by the Company withholding from shares of Stock to be issued by the transfer agent, a number of shares of Stock with an aggregate Fair Market Value (as defined in the Plan) that would satisfy the withholding amount due; provided, however, that the amount withheld does not exceed the maximum statutory tax rate or such lesser amount as is necessary to avoid adverse accounting treatment or as determined by the Administrator. The Administrator may also require this Award to be subject to mandatory share withholding up to the required withholding amount. In the event that the Grantee does not satisfy his or her tax withholding obligation within five business days of being notified by the Company of such obligation, the Company shall, to the extent permitted by law, have the right to deduct such taxes from any payment of any kind otherwise due to the Grantee.

10.Section 409A.

(a)All payments and benefits described in this Award Agreement are intended to constitute a short term deferral for purposes of Section 409A of the Code and this Award Agreement shall be interpreted in accordance with such intent. To the extent that any payment or benefit described in this Award Agreement constitutes “non-qualified deferred compensation” under Section 409A of the Code, and to the extent that such payment or benefit is payable upon the Grantee’s termination of employment, then such payments or benefits shall be payable only upon the Grantee’s “separation from service.” The determination of whether and when a separation from service has occurred shall be made in accordance with the presumptions set forth in Treasury Regulation Section 1.409A‑1(h).

(b)The parties intend that this Award will be administered in accordance with Section 409A of the Code. To the extent that any provision of this Award Agreement is

ambiguous as to its compliance with Section 409A of the Code, the provision shall be read in such a manner so that all payments hereunder are exempt from or comply with Section 409A of the Code. The parties agree that this Award Agreement may be amended, as reasonably requested by either party, and as may be necessary to fully comply with Section 409A of the Code and all related rules and regulations in order to preserve the payments and benefits provided hereunder without additional cost to either party.

(c)The Company makes no representation or warranty and shall have no liability to the Grantee or any other person if any provisions of this Awards are determined to constitute deferred compensation subject to Section 409A of the Code but do not satisfy an exemption from, or the conditions of, such Section.

11.No Obligation to Continue Service Relationship. Neither the Company nor any Subsidiary (as defined in the Plan) is obligated by or as a result of the Plan or this Award Agreement to continue the Grantee in a service relationship with the Company or any Subsidiary and neither the Plan nor this Award Agreement shall interfere in any way with the right of the Company or any Subsidiary to terminate its service relationship with the Grantee at any time.

12.Arbitration. Any dispute, controversy or claim arising out of, in connection with, or relating to the performance of this Award Agreement or its termination shall be settled by arbitration in the Commonwealth of Massachusetts, pursuant to the rules then obtaining of the American Arbitration Association. Any award shall be final, binding and conclusive upon the parties and a judgment rendered thereon may be entered in any court having jurisdiction thereof.

13.Miscellaneous.

(a)Notices. Notices hereunder shall be mailed or delivered to the Company at its principal place of business and shall be mailed or delivered to the Grantee at the address on file with the Company or, in either case, at such other address as one party may subsequently furnish to the other party in writing.

(b)Modification. This Award Agreement may be modified, amended or rescinded only by a written agreement executed by both parties.

(c)Severability. The invalidity, illegality or unenforceability of any provision of this Award Agreement shall in no way affect the validity, legality or enforceability of any other provision.

(d)Successors and Assigns. This Award Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

(e)Governing Law. This Award Agreement shall be governed by and interpreted in accordance with the laws of the State of Delaware, without giving effect to the principles of the conflicts of laws thereof.

(f)Fractional Shares. All fractional shares resulting from the adjustment provisions or from the withholding of shares to satisfy tax withholding obligations, contained in this Award Agreement or in the Plan, shall be rounded down.

(g)Integration. This Award Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and supersedes any prior agreements regarding such subject matter.

| | | | | | | | | | | |

| iROBOT CORPORATION |

| By: | |

| | Title: |

The foregoing Award Agreement is hereby accepted and the terms and conditions thereof hereby agreed to by the undersigned.

| | | | | | | | | | | | | | |

| Dated: | | | |

| | | Grantee’s Signature |

| | | | |

| | | Grantee’s name and address: |

| | | |

| | | |

| | | |

EXHIBIT A

EARNING & VESTING SCHEDULE

The Target Award will be earned if, during the Performance Period, the Volume Weighted Average Price of the iRobot Corporation stock exceeds the associated Stock Price Milestone (as outlined below).

At the end of each fiscal month, the Administrator shall make the determination of whether the Stock Price Milestone Goal has been met and what portion of the Target Award, if any, is earned during Performance Period and/or upon attainment of a Stock Price Milestone Goal.

The Stock Price Milestones shall be as follows:

•Stock Price Milestone 1: Twenty-five percent (25%) of the Target Award will vest on the later of the date on which the VWAP equals or exceeds $10.00 per share and (b) one year from the Grant Date. No portion of this twenty-five percent (25%) of the Target Award will vest if the VWAP fails to equal or exceed $10.00 per share during the Performance Period.

•Stock Price Milestone 2: Twenty-five percent (25%) of the Target Award will vest on the later of the date on which the VWAP equals or exceeds $12.50 per share and (b) two years from the Grant Date. No portion of this twenty-five percent (25%) of the Target Award will vest if the VWAP fails to equal or exceed $12.50 per share during the Performance Period.

•Stock Price Milestone 3: Twenty-five percent (25%) of the Target Award will vest on the later of the date on which the VWAP equals or exceeds $15.00 per share and (b) three years from the Grant Date. No portion of this twenty-five percent (25%) of the Target Award will vest if the VWAP fails to equal or exceed $15.00 per share during the Performance Period.

•Stock Price Milestone 4: Twenty-five percent (25%) of the Target Award will vest on the later of the date on which the VWAP equals or exceeds $20.00 per share and (b) three years from the Grant Date. No portion of this twenty-five percent (25%) of the Target Award will vest if the VWAP fails to equal or exceed $20.00 per share during the Performance Period.

“Daily Volume-Weighted Average Price (“Daily VWAP”)” means the ratio of the value traded to total volume traded of iRobot’s common stock on a particular date.

“Volume-Weighted Average Price (“VWAP”)” means the volume-weighted average of iRobot’s Daily VWAP for a period of sixty consecutive calendar days during the Performance Period.

“Performance Period” means four (4) years from May 6, 2024.

The Administrator shall appropriately and proportionately adjust the VWAP goal or any of the foregoing in the event of acquisitions and/or divestitures that occur during the Performance Period; provided, however, that no such adjustment shall be made if the Administrator

determines, in its discretion, that it would be unnecessary or inappropriate to do so, including, but not limited to, the case of acquisitions and divestitures not involving a significant amount of assets. Any such adjustment (or decision to not make an adjustment) shall be binding on the Grantee.

In the event of a Change in Control, the Stock Price Milestone shall be measured using the share price paid in the Change in Control (as opposed to the VWAP). Shares associated with any achieved Stock Price Milestone(s) shall vest. Any achievement between two stock price milestones will be interpolated. No shares will vest for stock price milestones not achieved.

Exhibit 99.3

IROBOT CORPORATION RESTRICTED STOCK UNIT AWARD AGREEMENT (INDUCEMENT AWARD)

Name of Grantee: Gary Cohen

No. of Restricted Stock Units: 290,000

Grant Date:

iRobot Corporation (the “Company”) hereby grants an award of the number of Restricted Stock Units listed above (an “Award”) to the Grantee named above. Each Restricted Stock Unit shall relate to one share of Common Stock, par value $0.01 per share (the “Stock”) of the Company. This Award is not issued under the Company’s 2018 Stock Option and Incentive Plan, as amended through the date hereof (the “Plan”), and does not reduce the share reserve under the Plan. However, for purposes of interpreting the applicable provisions of this Award, the terms and conditions of the Plan (other than those applicable to the share reserve) shall govern and apply to this Award as if this Award had actually been issued under the Plan. This Award has been granted as an inducement pursuant to Rule 5635(c)(4) of the Marketplace Rules of The NASDAQ Stock Market LLC (“NASDAQ”), and consequently is intended to be exempt from the NASDAQ rules regarding stockholder approval of equity compensation plans.

1.Restrictions on Transfer of Award. This Award may not be sold, transferred, pledged, assigned or otherwise encumbered or disposed of by the Grantee, and any shares of Stock issuable with respect to the Award may not be sold, transferred, pledged, assigned or otherwise encumbered or disposed of until (i) the Restricted Stock Units have vested as provided in Paragraph 2 of this Agreement and (ii) shares of Stock have been issued to the Grantee in accordance with the terms this Agreement.

2.Vesting of Restricted Stock Units. The restrictions and conditions of Paragraph 1 of this Agreement shall lapse on the Vesting Date or Dates specified in the following schedule so long as the Grantee remains an employee of the Company or a Subsidiary on such Dates. If a series of Vesting Dates is specified, then the restrictions and conditions in Paragraph 1 shall lapse only with respect to the number of Restricted Stock Units specified as vested on such date.

| | | | | |

| Incremental (Aggregate) Number of Restricted Stock Units Vested | Vesting Date |

| 96,667 (33.33%) | |

| 24,167 (8.33%) | |

| 24,167 (8.33%) | |

| 24,167 (8.33%) | |

| 24,167 (8.33%) | |

| 24,167 (8.33%) | |

| 24,166 (8.33%) | |

| | | | | |

| 24,166 (8.33%) | |

| 24,166 (8.33%) | |

The Administrator may at any time accelerate the vesting schedule specified in this Paragraph 2.

3.Termination of Employment. If the Grantee’s employment with the Company and its Subsidiaries terminates for any reason (including death or disability) prior to the satisfaction of the vesting conditions set forth in Paragraph 2 above, any Restricted Stock Units that have not vested as of such date shall automatically and without notice terminate and be forfeited, and neither the Grantee nor any of his or her successors, heirs, assigns, or personal representatives will thereafter have any further rights or interests in such unvested Restricted Stock Units.

4.Issuance of Shares of Stock. As soon as practicable following each Vesting Date (but in no event later than two and one-half months after the end of the year in which the Vesting Date occurs), the Company shall issue to the Grantee the number of shares of Stock equal to the aggregate number of Restricted Stock Units that have vested pursuant to Paragraph 2 of this Agreement on such date and the Grantee shall thereafter have all the rights of a stockholder of the Company with respect to such shares.

5.Incorporation of Plan. As set forth above, this Award is not granted pursuant to the Plan. However, for purposes of interpreting the provisions of this Award, the terms and conditions of the Plan (other than those applicable to the share reserve, but, including the powers of the Administrator set forth in Section 2 of the Plan) shall govern and apply to this Award as if this Award had actually been issued under the Plan. Capitalized terms in this Agreement shall have the meaning specified in the Plan, unless a different meaning is specified herein.

6.Clawback Policy. This Award shall be subject to the Company’s clawback policy, as in effect from time to time.

7.Tax Withholding. In the event that the Company is required to withhold taxes from the Grantee for taxable compensation relating to the issuance of shares of Stock in connection with this Award, the Company shall cause its transfer agent or any manager of Plan benefits to sell from the number of shares of Stock to be issued to the Grantee, the minimum number of shares of Stock necessary to satisfy the Federal, state and local taxes required by law to be withheld from the Grantee on account of such event along with any applicable third-party commission; provided, however, that in the event that this method is unavailable for any reason, the Grantee will be required to satisfy his or her tax withholding obligations with respect to this Award in another manner permitted by the Plan. The Company shall use the proceeds from such sale to satisfy the Grantee’s tax withholding obligation. Notwithstanding the foregoing, during any period of time during which the Grantee is a director or executive officer of the Company and/or subject to the reporting requirements of Section 16 of the Exchange Act, the preceding sentences shall have no force or effect and the Grantee will be required to satisfy his or her tax withholding obligations with respect to this Award in another manner permitted by the Plan.

8.Section 409A of the Code. This Agreement shall be interpreted in such a manner that all provisions relating to the settlement of the Award are exempt from the requirements of Section 409A of the Code as “short-term deferrals” as described in Section 409A of the Code.

9.No Obligation to Continue Employment. Neither the Company nor any Subsidiary is obligated by or as a result of the Plan or this Agreement to continue the Grantee in employment and neither the Plan nor this Agreement shall interfere in any way with the right of the Company or any Subsidiary to terminate the employment of the Grantee at any time.

10.Integration. This Agreement constitutes the entire agreement between the parties with respect to this Award and supersedes all prior agreements and discussions between the parties concerning such subject matter.

11.Data Privacy Consent. In order to administer the Plan and this Agreement and to implement or structure future equity grants, the Company, its subsidiaries and affiliates and certain agents thereof (together, the “Relevant Companies”) may process any and all personal or professional data, including but not limited to Social Security or other identification number, home address and telephone number, date of birth and other information that is necessary or desirable for the administration of the Plan and/or this Agreement (the “Relevant Information”). By entering into this Agreement, the Grantee (i) authorizes the Company to collect, process, register and transfer to the Relevant Companies all Relevant Information; (ii) waives any privacy rights the Grantee may have with respect to the Relevant Information; (iii) authorizes the Relevant Companies to store and transmit such information in electronic form; and (iv) authorizes the transfer of the Relevant Information to any jurisdiction in which the Relevant Companies consider appropriate. The Grantee shall have access to, and the right to change, the Relevant Information. Relevant Information will only be used in accordance with applicable law.

12.Notices. Notices hereunder shall be mailed or delivered to the Company at its principal place of business and shall be mailed or delivered to the Grantee at the address on file with the Company or, in either case, at such other address as one party may subsequently furnish to the other party in writing.

| | | | | | | | | | | |

| iRobot Corporation |

| By: | |

| | Title: EVP & General Counsel |

The foregoing Agreement is hereby accepted and the terms and conditions thereof hereby agreed to by the undersigned. Electronic acceptance of this Agreement pursuant to the Company’s instructions to the Grantee (including through an online acceptance process) is acceptable.

| | | | | | | | | | | | | | |

| Dated: | | | |

| | | Grantee’s Signature |

| | | | |

| | | Grantee’s name and address: |

| | | |

| | | |

| | | |

Exhibit 107

CALCULATION OF REGISTRATION FEE

Form S-8

(Form Type)

iRobot Corporation

(Exact Name of Registrant as Specified in its Charter)

Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(1) | Proposed Maximum Offering Price Per Share(2) | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

| Equity | Common Stock, par value $0.01 per share | Other (2) | 900,000 shares | $9.91 | $8,919,000 | $0.00014760 | $1,316.45 |

| Equity | Common Stock, par value $0.01 per share | Other (2) | 435,000 shares (3) | $9.91 | $4,310,850 | $0.00014760 | $636.29 |

| Equity | Common Stock, par value $0.01 per share | Other (2) | 290,000 shares (4) | $9.91 | $2,873,900 | $0.00014760 | $424.19 |

| Total Offering Amounts | | $16,103,750 | | $2,376.93 |

| Total Fee Offsets | | | | $0 |

| Net Fee Due | | | | $2,376.93 |

| | | | | |

| (1) | Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock, $0.01 par value per share (“Common Stock”), which become issuable under the Registrant’s 2018 Stock Option and Incentive Plan, as amended (the “2018 Plan”), by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected without the receipt of consideration which results in an increase in the number of the Registrant’s outstanding shares of Common Stock. |

| (2) | The price of $9.91 per share, which is the average of the high and low sale prices of the Common Stock on the NASDAQ Global Select Market on May 23, 2024, is set forth solely for purposes of calculating the registration fee pursuant to Rules 457(c) and (h) of the Securities Act. |

| (3) | Represents shares of Common Stock underlying performance-based restricted stock units expected to be granted to the Registrant’s Chief Executive Officer pursuant to the performance-based restricted stock unit award agreement as an inducement material to his acceptance of employment with the Registrant in accordance with the “inducement” grant exception under Nasdaq Rule 5635(c)(4). |

| (4) | Represents shares of Common Stock underlying restricted stock units expected to be granted to the Registrant’s Chief Executive Officer pursuant to the restricted stock unit award agreement as an inducement material to his acceptance of employment with the Registrant in accordance with the “inducement” grant exception under Nasdaq Rule 5635(c)(4). |

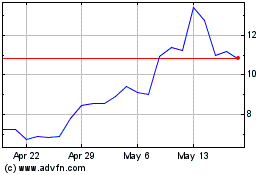

iRobot (NASDAQ:IRBT)

Historical Stock Chart

From Oct 2024 to Nov 2024

iRobot (NASDAQ:IRBT)

Historical Stock Chart

From Nov 2023 to Nov 2024