Intuitive (the “Company”) (Nasdaq: ISRG), a global technology

leader in minimally invasive care and the pioneer of

robotic-assisted surgery, today announced financial results for the

quarter ended September 30, 2024.

Q3

Highlights

- Worldwide da

Vinci procedures grew approximately 18% compared with the third

quarter of 2023.

- The Company

placed 379 da Vinci surgical systems, compared with 312 in the

third quarter of 2023. The third quarter 2024 da Vinci surgical

system placements included 110 da Vinci 5 systems.

- The Company grew

its da Vinci surgical system installed base to 9,539 systems as of

September 30, 2024, an increase of 15% compared with 8,285 as

of the end of the third quarter of 2023.

- Third quarter

2024 revenue of $2.04 billion increased 17% compared with $1.74

billion in the third quarter of 2023.

- Third quarter

2024 GAAP net income attributable to Intuitive was $565 million, or

$1.56 per diluted share, compared with $416 million, or $1.16 per

diluted share, in the third quarter of 2023.

- Third quarter

2024 non-GAAP* net income attributable to Intuitive was $669

million, or $1.84 per diluted share, compared with $524 million, or

$1.46 per diluted share, in the third quarter of 2023.

- In October 2024,

the Company obtained regulatory clearance in South Korea for the da

Vinci 5 surgical system for use in urologic, general, gynecologic,

thoracoscopic, thoracoscopically-assisted cardiotomy, and transoral

otolaryngology surgical procedures.

Q3 Financial

Summary

Gross profit, income from operations, net income

attributable to Intuitive Surgical, Inc., and net income per

diluted share attributable to Intuitive Surgical, Inc. are reported

on a GAAP and non-GAAP* basis. The non-GAAP* measures are described

below and are reconciled to the corresponding GAAP measures at the

end of this release.

Third quarter 2024 revenue was $2.04

billion, an increase of 17% compared with $1.74 billion

in the third quarter of 2023. The higher third quarter

revenue was driven by growth in da Vinci procedure volume and an

increase in the installed base of systems.

Third quarter 2024 instruments and accessories

revenue increased by 18% to $1.26 billion, compared with $1.07

billion in the third quarter of 2023. The increase in instruments

and accessories revenue was primarily driven by approximately 18%

growth in da Vinci procedure volume and approximately 73% growth in

Ion procedure volume.

Third quarter 2024 systems revenue was $445

million, compared with $379 million in the third quarter of 2023.

The Company placed 379 da Vinci surgical systems, of which 110 were

da Vinci 5 systems, in the third quarter of 2024, compared with 312

systems in the third quarter of 2023. The third quarter 2024 da

Vinci surgical system placements included 220 systems placed

under operating lease arrangements, of which 141 systems were

placed under usage-based operating lease arrangements, compared

with 163 systems placed under operating lease arrangements, of

which 93 systems were placed under usage-based operating lease

arrangements in the third quarter of 2023.

Third quarter 2024 GAAP income from operations

increased to $577 million, compared with $466 million in the third

quarter of 2023. Third quarter 2024 GAAP income from operations

included share-based compensation expense of $176 million, compared

with $157 million in the third quarter of 2023. Third quarter 2024

non-GAAP* income from operations increased to $755 million,

compared with $624 million in the third quarter of 2023.

Third quarter 2024 GAAP net income attributable

to Intuitive Surgical, Inc. was $565 million, or $1.56 per diluted

share, compared with $416 million, or $1.16 per diluted share, in

the third quarter of 2023. Third quarter 2024 GAAP net income

attributable to Intuitive Surgical, Inc. included excess tax

benefits of $42 million, or $0.12 per diluted share, compared with

$22 million, or $0.06 per diluted share, in the third quarter of

2023.

Third quarter 2024 non-GAAP* net income

attributable to Intuitive Surgical, Inc. was $669 million, or $1.84

per diluted share, compared with $524 million, or $1.46 per diluted

share, in the third quarter of 2023.

The Company ended the third quarter of 2024 with

$8.31 billion in cash, cash equivalents, and investments, an

increase of $628 million during the quarter, primarily driven by

cash generated from operations, partially offset by capital

expenditures.

Impact of COVID-19 Pandemic

The first nine months of 2024 did not reflect

any noticeable procedure volume disruptions from COVID-19. During

the first quarter of 2023, in January, the Company saw COVID-19

resurgences impact da Vinci procedure volumes in China, with a

recovery during February and March. Additionally, we believe that

the high patient treatment backlogs that developed during the

COVID-19 pandemic contributed positively to the 2023 procedure

volumes, as those patients returned for diagnosis and

treatment.

“Core measures of our business were healthy this

quarter, and we are pleased by customer adoption of da Vinci 5,”

said Gary Guthart, Intuitive CEO. “We remain focused on delivering

the goals we share with our customers, centered on improving

patient outcomes.”

Additional supplemental financial and procedure

information has been posted to the Investor Relations section of

the Intuitive website at https://isrg.gcs-web.com/.

Webcast and Conference Call

Information

Intuitive will hold a teleconference at 1:30

p.m. PDT today to discuss the third quarter 2024 financial results.

The call will be webcast by Nasdaq OMX and can be accessed on

Intuitive’s website at www.intuitive.com or by dialing (844)

867-6169 using the access code 8311320. The webcast replay of the

call will be made available on our website at www.intuitive.com

within 24 hours after the end of the live teleconference and will

be accessible for at least 30 days.

About Intuitive

Intuitive (Nasdaq: ISRG), headquartered in

Sunnyvale, California, is a global leader in minimally invasive

care and the pioneer of robotic-assisted surgery. Our technologies

include the da Vinci surgical systems and the Ion endoluminal

system. By uniting advanced systems, progressive learning, and

value-enhancing services, we help physicians and their teams

optimize care delivery to support the best outcomes possible. At

Intuitive, we envision a future of care that is less invasive and

profoundly better, where diseases are identified early and treated

quickly, so patients can get back to what matters most.

Product and brand names/logos are trademarks or

registered trademarks of Intuitive or their respective owner. See

www.intuitive.com/trademarks.

For more information, please visit the Company’s

website at www.intuitive.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements relate to

expectations concerning matters that are not historical facts.

Statements using words such as “estimates,” “projects,” “believes,”

“anticipates,” “plans,” “expects,” “intends,” “may,” “will,”

“could,” “should,” “would,” “targeted,” and similar words and

expressions are intended to identify forward-looking statements.

These forward-looking statements are necessarily estimates

reflecting the judgment of the Company’s management and involve a

number of risks and uncertainties that could cause actual results

to differ materially from those suggested by the forward-looking

statements. These forward-looking statements include, but are not

limited to, statements related to future results of operations,

future financial position, the adoption by customers of the

Company’s products, and the goals it shares with its customers,

including improving patient outcomes. These forward-looking

statements should be considered in light of various important

factors, including, but not limited to, the following: the overall

macroeconomic environment, which may impact customer spending and

the Company’s costs, including the levels of inflation and interest

rates; the conflict in Ukraine; conflicts in the Middle East,

including Israel and Iran; disruption to the Company’s supply

chain, including difficulties in obtaining a sufficient supply of

materials; curtailed or delayed capital spending by hospitals; the

impact of global and regional economic and credit market conditions

on healthcare spending; delays in obtaining new product approvals,

clearances, or certifications from the United States (“U.S.”) Food

and Drug Administration (“FDA”), comparable regulatory authorities,

or notified bodies; the risk of the Company’s inability to comply

with complex FDA and other regulations, which may result in

significant enforcement actions; regulatory approvals, clearances,

certifications, and restrictions or any dispute that may occur with

any regulatory body; healthcare reform legislation in the U.S. and

its impact on hospital spending, reimbursement, and fees levied on

certain medical device revenues; changes in hospital admissions and

actions by payers to limit or manage surgical procedures; the

timing and success of product development and customer acceptance

of developed products; the results of any collaborations,

in-licensing arrangements, joint ventures, strategic alliances, or

partnerships, including the joint venture with Shanghai Fosun

Pharmaceutical (Group) Co., Ltd.; the Company’s completion of and

ability to successfully integrate acquisitions; intellectual

property positions and litigation; risks associated with the

Company’s operations and any expansion outside of the U.S.;

unanticipated manufacturing disruptions or the inability to meet

demand for products; the Company’s reliance on sole- and

single-sourced suppliers; the results of legal proceedings to which

the Company is or may become a party; adverse publicity regarding

the Company and the safety of the Company’s products and adequacy

of training; the impact of changes to tax legislation, guidance,

and interpretations; changes in tariffs, trade barriers, and

regulatory requirements; and other risks and uncertainties. Readers

are cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date of this press release

and which are based on current expectations and are subject to

risks, uncertainties, and assumptions that are difficult to

predict, including those risk factors identified under the heading

“Risk Factors” in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023, as updated by the Company’s

other filings with the Securities and Exchange Commission. The

Company’s actual results may differ materially and adversely from

those expressed in any forward-looking statement, and the Company

undertakes no obligation to publicly update or release any

revisions to these forward-looking statements, except as required

by law.

*About Non-GAAP Financial

Measures

To supplement its consolidated financial

statements, which are prepared and presented in accordance with

U.S. generally accepted accounting principles (“GAAP”), the Company

uses the following non-GAAP financial measures: non-GAAP gross

profit, non-GAAP income from operations, non-GAAP net income

attributable to Intuitive Surgical, Inc., and non-GAAP net income

per diluted share attributable to Intuitive Surgical, Inc. (“EPS”).

The presentation of this financial information is not intended to

be considered in isolation or as a substitute for, or superior to,

the financial information prepared and presented in accordance with

GAAP.

The Company uses these non-GAAP financial

measures for financial and operational decision-making and as a

means to evaluate period-to-period comparisons. The Company

believes that these non-GAAP financial measures provide meaningful

supplemental information regarding its performance by excluding

items such as amortization of intangible assets, share-based

compensation (“SBC”) and long-term incentive plan expenses, and

other special items. Long-term incentive plan expense relates to

phantom share awards granted in China by the Company’s

Intuitive-Fosun joint venture to its employees that vest over four

years and can remain outstanding for seven to ten years. These

awards are valued based on certain key performance metrics.

Accordingly, they are subject to significant volatility based on

the performance of these metrics and are not tied to performance of

the Company’s business within the period. The Company believes that

both management and investors benefit from referring to these

non-GAAP financial measures in assessing its performance and when

planning, forecasting, and analyzing future periods. These non-GAAP

financial measures also facilitate management’s internal

comparisons to its historical performance. The Company believes

these non-GAAP financial measures are useful to investors, because

(1) they allow for greater transparency with respect to key metrics

used by management in its financial and operational

decision-making, and (2) they are used by institutional investors

and the analyst community to help them analyze the performance of

the Company’s business.

Non-GAAP gross profit. The Company defines

non-GAAP gross profit as gross profit, excluding SBC and long-term

incentive plan expenses and amortization of intangible assets.

Non-GAAP income from operations. The Company

defines non-GAAP income from operations as income from operations,

excluding SBC and long-term incentive plan expenses, amortization

of intangible assets, and litigation charges and recoveries.

Non-GAAP net income attributable to Intuitive

Surgical, Inc. and EPS. The Company defines non-GAAP net income as

net income attributable to Intuitive Surgical, Inc., excluding SBC

and long-term incentive plan expenses, amortization of intangible

assets, litigation charges and recoveries, gains and losses on

strategic investments, tax adjustments, including the excess tax

benefits or deficiencies associated with SBC arrangements, a

one-time tax benefit from re-measurement of Swiss deferred tax

assets, a one-time tax benefit from receipt of certain tax assets

by the Company’s Swiss entity, and the net tax effects related to

intra-entity transfers of non-inventory assets, and adjustments

attributable to noncontrolling interest in joint venture, net of

the related tax effects. The Company excludes the excess tax

benefits or deficiencies associated with SBC arrangements as well

as the tax effects associated with non-cash amortization of

deferred tax assets related to intra-entity non-inventory

transfers, because the Company does not believe these items

correlate with the ongoing results of its core operations. The tax

effects of the non-GAAP items are determined by applying a

calculated non-GAAP effective tax rate, which is commonly referred

to as the with-and-without method. Without excluding these tax

effects, investors would only see the gross effect that these

non-GAAP adjustments had on the Company’s operating results. The

Company’s calculated non-GAAP effective tax rate is generally

higher than its GAAP effective tax rate. The Company defines

non-GAAP EPS as non-GAAP net income attributable to Intuitive

Surgical, Inc. divided by diluted shares outstanding, which are

calculated as GAAP weighted-average outstanding shares plus

dilutive potential shares outstanding during the period.

There are a number of limitations related to the

use of non-GAAP measures versus measures calculated in accordance

with GAAP. Non-GAAP gross profit, non-GAAP income from operations,

non-GAAP net income attributable to Intuitive Surgical, Inc., and

non-GAAP EPS exclude items such as SBC and long-term incentive plan

expenses, amortization of intangible assets, excess tax benefits or

deficiencies associated with SBC arrangements, and non-cash

amortization of deferred tax assets related to intra-entity

transfer of non-inventory assets, which are primarily recurring

items. SBC expense has been, and will continue to be for the

foreseeable future, a significant recurring expense in the

Company’s business. In addition, the components of the costs that

the Company excludes in its calculation of non-GAAP net income

attributable to Intuitive Surgical, Inc. and non-GAAP EPS may

differ from the components that its peer companies exclude when

they report their results of operations. Management addresses these

limitations by providing specific information regarding the GAAP

amounts excluded from non-GAAP net income attributable to Intuitive

Surgical, Inc. and non-GAAP EPS and evaluating non-GAAP net income

attributable to Intuitive Surgical, Inc. and non-GAAP EPS together

with net income attributable to Intuitive Surgical, Inc. and net

income per share attributable to Intuitive Surgical, Inc.

calculated in accordance with GAAP.

| |

|

| |

|

|

INTUITIVE SURGICAL, INC. UNAUDITED QUARTERLY CONDENSED

CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS, EXCEPT PER SHARE

DATA) |

| |

|

| |

Three Months Ended |

| |

September 30,2024 |

|

June 30,2024 |

|

September 30,2023 |

| Revenue: |

|

|

|

|

|

|

Instruments and accessories |

$ |

1,264.2 |

|

|

$ |

1,244.4 |

|

|

$ |

1,071.4 |

|

|

Systems |

|

445.0 |

|

|

|

448.2 |

|

|

|

379.4 |

|

|

Services |

|

328.9 |

|

|

|

317.3 |

|

|

|

292.9 |

|

|

Total revenue |

|

2,038.1 |

|

|

|

2,009.9 |

|

|

|

1,743.7 |

|

| Cost of revenue: |

|

|

|

|

|

|

Product |

|

555.4 |

|

|

|

539.4 |

|

|

|

489.5 |

|

|

Service |

|

108.8 |

|

|

|

97.8 |

|

|

|

87.0 |

|

|

Total cost of revenue |

|

664.2 |

|

|

|

637.2 |

|

|

|

576.5 |

|

|

Gross profit |

|

1,373.9 |

|

|

|

1,372.7 |

|

|

|

1,167.2 |

|

| Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

510.6 |

|

|

|

525.3 |

|

|

|

452.0 |

|

|

Research and development |

|

286.0 |

|

|

|

280.1 |

|

|

|

249.4 |

|

|

Total operating expenses |

|

796.6 |

|

|

|

805.4 |

|

|

|

701.4 |

|

| Income from operations

(1) |

|

577.3 |

|

|

|

567.3 |

|

|

|

465.8 |

|

| Interest and other income

(expense), net |

|

93.7 |

|

|

|

87.2 |

|

|

|

56.2 |

|

| Income before taxes |

|

671.0 |

|

|

|

654.5 |

|

|

|

522.0 |

|

| Income tax expense (2) |

|

100.4 |

|

|

|

123.0 |

|

|

|

102.2 |

|

| Net income |

|

570.6 |

|

|

|

531.5 |

|

|

|

419.8 |

|

|

Less: net income attributable to noncontrolling interest in joint

venture |

|

5.5 |

|

|

|

4.6 |

|

|

|

4.1 |

|

| Net income attributable to

Intuitive Surgical, Inc. |

$ |

565.1 |

|

|

$ |

526.9 |

|

|

$ |

415.7 |

|

| Net income per share

attributable to Intuitive Surgical, Inc.: |

|

|

|

|

|

|

Basic |

$ |

1.59 |

|

|

$ |

1.48 |

|

|

$ |

1.18 |

|

|

Diluted (3) |

$ |

1.56 |

|

|

$ |

1.46 |

|

|

$ |

1.16 |

|

| Weighted average

shares outstanding: |

|

|

|

|

|

|

Basic |

|

355.8 |

|

|

|

355.0 |

|

|

|

351.7 |

|

|

Diluted |

|

362.7 |

|

|

|

361.0 |

|

|

|

358.2 |

|

| |

|

|

|

|

|

| (1) Income from operations

includes the effect of the following items: |

|

|

|

|

|

|

Amortization of intangible assets |

$ |

(3.5 |

) |

|

$ |

(5.0 |

) |

|

$ |

(5.1 |

) |

|

Expensed IP charged to R&D |

$ |

— |

|

|

$ |

(0.2 |

) |

|

$ |

(7.5 |

) |

| (2) Income tax expense

includes the effect of the following items: |

|

|

|

|

|

|

Excess tax benefits related to share-based compensation

arrangements |

$ |

(42.2 |

) |

|

$ |

(35.7 |

) |

|

$ |

(22.0 |

) |

| (3) Diluted net income per

share attributable to Intuitive Surgical, Inc. includes the effect

of the following items: |

|

|

|

|

|

|

Amortization of intangible assets, net of tax |

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

$ |

(0.01 |

) |

|

Expensed IP charged to R&D, net of tax |

$ |

— |

|

|

$ |

— |

|

|

$ |

(0.02 |

) |

|

Excess tax benefits related to share-based compensation

arrangements |

$ |

0.12 |

|

|

$ |

0.10 |

|

|

$ |

0.06 |

|

| |

|

|

INTUITIVE SURGICAL, INC. UNAUDITED NINE MONTHS ENDED

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (IN MILLIONS, EXCEPT

PER SHARE DATA) |

| |

|

| |

Nine Months Ended |

| |

September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

Instruments and accessories |

$ |

3,667.5 |

|

|

$ |

3,132.9 |

|

|

Systems |

|

1,311.4 |

|

|

|

1,199.5 |

|

|

Services |

|

959.7 |

|

|

|

863.4 |

|

|

Total revenue |

|

5,938.6 |

|

|

|

5,195.8 |

|

| Cost of revenue: |

|

|

|

|

Product |

|

1,649.2 |

|

|

|

1,480.5 |

|

|

Service |

|

297.4 |

|

|

|

263.2 |

|

|

Total cost of revenue |

|

1,946.6 |

|

|

|

1,743.7 |

|

|

Gross profit |

|

3,992.0 |

|

|

|

3,452.1 |

|

| Operating expenses: |

|

|

|

|

Selling, general and administrative |

|

1,527.4 |

|

|

|

1,396.8 |

|

|

Research and development |

|

850.6 |

|

|

|

738.7 |

|

|

Total operating expenses |

|

2,378.0 |

|

|

|

2,135.5 |

|

| Income from operations

(1) |

|

1,614.0 |

|

|

|

1,316.6 |

|

| Interest and other income,

net |

|

250.0 |

|

|

|

126.4 |

|

| Income before taxes |

|

1,864.0 |

|

|

|

1,443.0 |

|

| Income tax expense (2) |

|

214.5 |

|

|

|

236.4 |

|

| Net income |

|

1,649.5 |

|

|

|

1,206.6 |

|

|

Less: net income attributable to noncontrolling interest in joint

venture |

|

12.6 |

|

|

|

14.8 |

|

| Net income attributable to

Intuitive Surgical, Inc. |

$ |

1,636.9 |

|

|

$ |

1,191.8 |

|

| Net income per share

attributable to Intuitive Surgical, Inc.: |

|

|

|

|

Basic |

$ |

4.61 |

|

|

$ |

3.40 |

|

|

Diluted (3) |

$ |

4.53 |

|

|

$ |

3.34 |

|

| Weighted average

shares outstanding: |

|

|

|

|

Basic |

|

354.8 |

|

|

|

351.0 |

|

|

Diluted |

|

361.4 |

|

|

|

357.1 |

|

| |

|

|

|

| (1) Income from operations

includes the effect of the following items: |

|

|

|

|

Amortization of intangible assets |

$ |

(13.6 |

) |

|

$ |

(15.1 |

) |

|

Expensed IP charged to R&D |

$ |

(0.2 |

) |

|

$ |

(9.0 |

) |

| (2) Income tax expense

includes the effect of the following items: |

|

|

|

|

Excess tax benefits related to share-based compensation

arrangements |

$ |

(189.0 |

) |

|

$ |

(86.2 |

) |

| (3) Diluted net income per

share attributable to Intuitive Surgical, Inc. includes the effect

of the following items: |

|

|

|

|

Amortization of intangible assets, net of tax |

$ |

(0.03 |

) |

|

$ |

(0.03 |

) |

|

Expensed IP charged to R&D, net of tax |

$ |

— |

|

|

$ |

(0.02 |

) |

|

Excess tax benefits related to share-based compensation

arrangements |

$ |

0.52 |

|

|

$ |

0.24 |

|

| |

|

|

|

|

INTUITIVE SURGICAL, INC. UNAUDITED CONDENSED CONSOLIDATED

BALANCE SHEETS (IN MILLIONS) |

| |

|

|

|

| |

September 30,2024 |

|

December 31,2023 |

|

Cash, cash equivalents, and investments |

$ |

8,311.5 |

|

|

$ |

7,343.2 |

|

| Accounts receivable, net |

|

1,153.0 |

|

|

|

1,130.2 |

|

| Inventory |

|

1,481.7 |

|

|

|

1,220.6 |

|

| Property, plant, and

equipment, net |

|

4,433.0 |

|

|

|

3,537.6 |

|

| Goodwill |

|

348.3 |

|

|

|

348.7 |

|

| Deferred tax assets |

|

997.0 |

|

|

|

910.5 |

|

| Other assets |

|

1,018.9 |

|

|

|

950.7 |

|

|

Total assets |

$ |

17,743.4 |

|

|

$ |

15,441.5 |

|

| |

|

|

|

| Accounts payable and other

liabilities |

$ |

1,580.3 |

|

|

$ |

1,552.5 |

|

| Deferred revenue |

|

485.6 |

|

|

|

491.7 |

|

| Total liabilities |

|

2,065.9 |

|

|

|

2,044.2 |

|

| Stockholders’ equity |

|

15,677.5 |

|

|

|

13,397.3 |

|

|

Total liabilities and stockholders’ equity |

$ |

17,743.4 |

|

|

$ |

15,441.5 |

|

| |

|

INTUITIVE SURGICAL, INC.UNAUDITED RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES(IN MILLIONS, EXCEPT PER SHARE

DATA) |

| |

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30,2024 |

|

June 30,2024 |

|

September 30,2023 |

|

September 30,2024 |

|

September 30,2023 |

|

GAAP gross profit |

$ |

1,373.9 |

|

|

$ |

1,372.7 |

|

|

$ |

1,167.2 |

|

|

$ |

3,992.0 |

|

|

$ |

3,452.1 |

|

| Share-based compensation

expense |

|

31.3 |

|

|

|

29.7 |

|

|

|

29.5 |

|

|

|

90.1 |

|

|

|

80.3 |

|

| Long-term incentive plan

expense |

|

0.2 |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.6 |

|

|

|

0.8 |

|

| Amortization of intangible

assets |

|

2.4 |

|

|

|

3.7 |

|

|

|

3.7 |

|

|

|

9.9 |

|

|

|

10.6 |

|

| Non-GAAP gross

profit |

$ |

1,407.8 |

|

|

$ |

1,406.2 |

|

|

$ |

1,200.5 |

|

|

$ |

4,092.6 |

|

|

$ |

3,543.8 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP income from

operations |

$ |

577.3 |

|

|

$ |

567.3 |

|

|

$ |

465.8 |

|

|

$ |

1,614.0 |

|

|

$ |

1,316.6 |

|

| Share-based compensation

expense |

|

172.9 |

|

|

|

173.6 |

|

|

|

156.1 |

|

|

|

499.8 |

|

|

|

442.4 |

|

| Long-term incentive plan

expense |

|

1.2 |

|

|

|

1.0 |

|

|

|

0.7 |

|

|

|

4.4 |

|

|

|

5.9 |

|

| Amortization of intangible

assets |

|

3.5 |

|

|

|

5.0 |

|

|

|

5.1 |

|

|

|

13.6 |

|

|

|

15.1 |

|

| Litigation charges

(recoveries) |

|

— |

|

|

|

7.2 |

|

|

|

(4.0 |

) |

|

|

7.2 |

|

|

|

(4.0 |

) |

| Non-GAAP income from

operations |

$ |

754.9 |

|

|

$ |

754.1 |

|

|

$ |

623.7 |

|

|

$ |

2,139.0 |

|

|

$ |

1,776.0 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP net income

attributable to Intuitive Surgical, Inc. |

$ |

565.1 |

|

|

$ |

526.9 |

|

|

$ |

415.7 |

|

|

$ |

1,636.9 |

|

|

$ |

1,191.8 |

|

| Share-based compensation

expense |

|

172.9 |

|

|

|

173.6 |

|

|

|

156.1 |

|

|

|

499.8 |

|

|

|

442.4 |

|

| Long-term incentive plan

expense |

|

1.2 |

|

|

|

1.0 |

|

|

|

0.7 |

|

|

|

4.4 |

|

|

|

5.9 |

|

| Amortization of intangible

assets |

|

3.5 |

|

|

|

5.0 |

|

|

|

5.1 |

|

|

|

13.6 |

|

|

|

15.1 |

|

| Litigation charges

(recoveries) |

|

— |

|

|

|

7.2 |

|

|

|

(4.0 |

) |

|

|

7.2 |

|

|

|

(4.0 |

) |

| (Gains) losses on strategic

investments |

|

0.9 |

|

|

|

(7.8 |

) |

|

|

1.7 |

|

|

|

(3.5 |

) |

|

|

7.9 |

|

| Tax adjustments (1) |

|

(74.0 |

) |

|

|

(64.5 |

) |

|

|

(51.0 |

) |

|

|

(305.5 |

) |

|

|

(189.6 |

) |

| Adjustments attributable to

noncontrolling interest in joint venture |

|

(0.5 |

) |

|

|

(0.4 |

) |

|

|

(0.3 |

) |

|

|

(1.7 |

) |

|

|

(1.6 |

) |

| Non-GAAP net income

attributable to Intuitive Surgical, Inc. |

$ |

669.1 |

|

|

$ |

641.0 |

|

|

$ |

524.0 |

|

|

$ |

1,851.2 |

|

|

$ |

1,467.9 |

|

| |

|

|

|

|

|

|

|

|

|

| GAAP net income per

share attributable to Intuitive Surgical, Inc. -

diluted |

$ |

1.56 |

|

|

$ |

1.46 |

|

|

$ |

1.16 |

|

|

$ |

4.53 |

|

|

$ |

3.34 |

|

| Share-based compensation

expense |

|

0.48 |

|

|

|

0.48 |

|

|

|

0.44 |

|

|

|

1.38 |

|

|

|

1.24 |

|

| Long-term incentive plan

expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.02 |

|

| Amortization of intangible

assets |

|

0.01 |

|

|

|

0.02 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.04 |

|

| Litigation charges

(recoveries) |

|

— |

|

|

|

0.02 |

|

|

|

(0.01 |

) |

|

|

0.02 |

|

|

|

(0.01 |

) |

| (Gains) losses on strategic

investments |

|

— |

|

|

|

(0.02 |

) |

|

|

— |

|

|

|

(0.01 |

) |

|

|

0.02 |

|

| Tax adjustments (1) |

|

(0.21 |

) |

|

|

(0.18 |

) |

|

|

(0.14 |

) |

|

|

(0.85 |

) |

|

|

(0.53 |

) |

| Adjustments attributable to

noncontrolling interest in joint venture |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.01 |

) |

| Non-GAAP net income

per share attributable to Intuitive Surgical, Inc. -

diluted |

$ |

1.84 |

|

|

$ |

1.78 |

|

|

$ |

1.46 |

|

|

$ |

5.12 |

|

|

$ |

4.11 |

|

| |

|

|

|

|

|

|

|

|

|

|

(1) For the three months ended September 30, 2024, tax

adjustments included: (a) excess tax benefits associated with

share-based compensation arrangements of $(42.2) million, or

$(0.12) per diluted share; (b) the tax impact related to

intra-entity transfers of non-inventory assets of $10.1 million, or

$0.03 per diluted share; and (c) other tax adjustments effects

determined by applying a calculated non-GAAP effective tax rate of

$(41.9) million, or $(0.12) per diluted share. For the three months

ended September 30, 2023, tax adjustments included: (a) excess

tax benefits associated with share-based compensation arrangements

of $(22.0) million, or $(0.06) per diluted share; (b) the tax

impact related to intra-entity transfers of non-inventory assets of

$7.0 million, or $0.02 per diluted share; and (c) other tax

adjustments effects determined by applying a calculated non-GAAP

effective tax rate of $(36.0) million, or $(0.10) per diluted

share. |

|

|

|

For the nine months ended September 30, 2024, tax adjustments

included: (a) excess tax benefits associated with share-based

compensation arrangements of $(189.0) million, or $(0.52) per

diluted share; (b) tax impact related to intra-entity transfers of

non-inventory assets of $30.5 million, or $0.08 per diluted share;

and (c) other tax adjustments effects determined by applying a

calculated non-GAAP effective tax rate of $(147.0) million, or

$(0.41) per diluted share. For the nine months ended

September 30, 2023, tax adjustments included: (a) excess tax

benefits associated with share-based compensation arrangements of

$(86.2) million, or $(0.24) per diluted share; (b) tax impact

related to intra-entity transfers of non-inventory assets of $21.0

million, or $0.06 per diluted share; and (c) other tax adjustments

effects determined by applying a calculated non-GAAP effective tax

rate of $(124.4) million, or $(0.35) per diluted share. |

Contact: Investor Relations(408) 523-2161

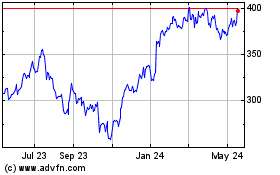

Intuitive Surgical (NASDAQ:ISRG)

Historical Stock Chart

From Jan 2025 to Feb 2025

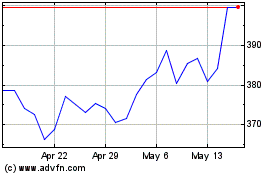

Intuitive Surgical (NASDAQ:ISRG)

Historical Stock Chart

From Feb 2024 to Feb 2025