false

0000836690

0000836690

2024-11-20

2024-11-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 20, 2024

INNOVATIVE SOLUTIONS AND SUPPORT, INC.

(Exact name of registrant as specified in its charter)

| Pennsylvania |

001-41503 |

23-2507402 |

| (State or other jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

720 Pennsylvania Drive

Exton, Pennsylvania 19341

(Address of principal executive offices) (Zip Code)

(610) 646-9800

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

ISSC |

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 20, 2024 (the “Grant Date”), Innovative Solutions

and Support, Inc. (the “Company”) granted Shahram Askarpour, the Company’s Chief Executive Officer, an award of 2,100,000

performance stock units (the “CEO Performance Award”) under the Innovative Solutions and Support, Inc. Amended and Restated

2019 Stock-Based Incentive Compensation Plan (the “Plan”). Pursuant to the CEO Performance Award, Mr. Askarpour would earn

one share of the Company’s common stock, $0.001 par value per share (“Common Stock”) for each performance stock unit

that vests if the Company’s Common Stock trades for 20 consecutive trading days at or above the applicable trading price thresholds

(each such threshold, a “Vesting Price”), described below, during the four-year period following the Grant Date (the “Performance

Period”).

The performance stock units will vest in three tranches (each a “Tranche”).

Each Tranche consists of one-third of the performance stock units. The Vesting Prices for the three Tranches are $10.00, $12.00 and $14.00,

respectively, but if the first Tranche has not vested by the third anniversary of the Grant Date, the Vesting Price first Tranche will

be increased to $12.00 for the remainder of the Performance Period. Any performance stock units that have not vested as of the end of

the Performance Period will be forfeited.

In the event Mr. Askarpour’s employment with the Company is terminated

for any reason, any unvested performance stock units will be immediately forfeited with no compensation or payment due to Mr. Askarpour.

If a Change in Control (as defined in the Plan) or similar event occurs during the Performance Period, each unvested Tranche will vest

as of the effective time of such Change in Control to the extent that the per share consideration received by the Company’s shareholders

in connection with the Change in Control is equal to or greater than the applicable Vesting Price for such Tranche.

The foregoing summary of the terms of the CEO Performance Award does

not purport to be complete and is qualified in its entirety by reference to the award agreement evidencing the CEO Performance Award,

a copy of which is attached as Exhibit 10.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

INNOVATIVE SOLUTIONS AND SUPPORT, INC. |

| |

|

| Date: November 22, 2024 |

By: |

/s/ Jeffrey DiGiovanni |

| |

|

Jeffrey DiGiovanni |

| |

|

Chief Financial Officer |

Exhibit 10.1

PERFORMANCE STOCK UNIT AWARD AGREEMENT

UNDER THE

INNOVATIVE SOLUTIONS AND SUPPORT, INC. 2019

STOCK-BASED INCENTIVE

COMPENSATION PLAN

THIS PERFORMANCE STOCK UNIT

AWARD AGREEMENT (this “Agreement”) evidences an award of Performance Stock Units by Innovative Solutions and

Support, Inc., a Pennsylvania corporation (the “Company”), to Shahram Askarpour (the “Grantee”)

under the terms and conditions of the Innovative Solutions and Support, Inc. Amended and Restated 2019 Stock-Based Incentive Compensation

Plan (as it may be amended and/or restated from time to time, the “Plan”), with such grant having been made

on November 20, 2024 (the “Grant Date”). This Agreement constitutes an Award Agreement for purposes of the Plan.

RECITALS

WHEREAS, the Company maintains

the Plan;

WHEREAS, the Plan permits

the Company to award Performance Stock Units with respect to shares of the Company’s Common Stock, $0.001 par value per share (“Shares”),

subject to the terms of the Plan; and

WHEREAS, the Company desires

to grant Performance Stock Units to the Grantee in accordance with the terms of this Agreement.

1. Award

of Performance Stock Units. The Company hereby grants to the Grantee pursuant to the terms and conditions of the Plan, as of the Grant

Date, 201,000 Performance Stock Units (the “PSUs”). With respect to each PSU that becomes vested in accordance

with the terms of this Agreement, the Grantee will be entitled to receive one Share upon the settlement of such PSU. The PSUs are subject

to the terms of the Plan, which terms and provisions are incorporated herein by reference, and the more specific terms set forth herein.

Capitalized terms used in this Agreement and not otherwise defined in this Agreement have the meanings ascribed to them in the Plan.

2. Vesting;

Settlement.

(a) The

PSUs shall vest as follows: (i) an initial one-third (1/3rd) of the PSUs shall vest on the first trading date after the Shares

have traded at a price equal to or greater than Ten Dollars ($10.00) per share for twenty (20) consecutive trading days or as provided

in the provisions of the second succeeding paragraph below; (ii) an additional one-third (1/3rd) of the PSUs shall vest on

the first trading date after the Shares have traded at a price equal to or greater than Twelve Dollars ($12.00) per share for twenty (20)

consecutive trading days; and (iii) the remaining PSUs shall vest on the first trading date after the Shares have traded at a price equal

to or greater than Fourteen Dollars ($14.00) per share for twenty (20) consecutive trading days.

Each of the dates on which PSUs

vest is referred to herein as a “Vesting Date.” To the extent that the vesting schedule shall yield a fractional

Share, the number of vested PSUs shall be rounded up to the next nearest integer. Notwithstanding anything in this Agreement to the contrary,

in no event shall more than 100% of the PSUs become vested.

If the tranche of PSUs subject

to vesting pursuant to subsection (a)(i) above does not vest on or before the third anniversary of the Grant Date, then, with respect

to such PSUs, the target trading price for the Shares shall be increased to Twelve Dollars ($12.00) per share, such that the PSUs subject

to subsection (a)(i) shall vest on the first trading date after the Shares have traded at a price equal to or greater than Twelve Dollars

($12.00) per share for twenty (20) consecutive trading days.

Any PSUs that have not vested

in accordance with this subsection (a) on or before the fourth anniversary of the Grant Date shall be immediately forfeited with no compensation

or payment due to the Grantee or any other Person.

(b) Vesting

of any PSUs is in all cases subject to the Grantee’s continued employment with the Company or one of its Subsidiaries from the Grant

Date through and including the applicable Vesting Date.

(c) Notwithstanding

anything to the contrary contained in any offer letter, severance agreement, employment agreement, consulting agreement or similar agreement

between the Grantee and the Company or any of its Subsidiaries or affiliates, the PSUs shall not vest or be settled upon a Change in Control,

a change in control, a change of control or any similar event (each, a “CinC Event”) except as provided in Section

7.1 of the Plan; provided, however, that a number of PSUs shall vest immediately prior to the closing of the CinC Event as if the Shares

had traded for twenty (20) consecutive trading days at a price equal to the per share consideration to be received by the Company’s

shareholders in connection with such CinC Event.

(d) Except

as otherwise provided in Section 3, each PSU that becomes vested shall be settled as soon as reasonably practicable following the date

on which such PSU becomes vested, and in any event within 30 days after the Vesting Date, but not later than immediately prior to the

closing of the applicable CinC Event. Each PSU that has settled shall be cancelled immediately and shall terminate upon such settlement.

(e) Grantee

shall have no rights as a stockholder with respect to any PSUs (including voting or dividend rights), nor shall the Grantee have any rights

as a stockholder with respect to any Shares underlying the PSUs (including voting or dividend rights) until such Shares are delivered

to the Grantee in settlement of the PSUs (and then stockholder rights shall apply only after the Grantee’s receipt of such Shares).

(f) Notwithstanding

anything to the contrary in the Plan, the Performance Goals set forth in Section 2(a) above shall be adjusted appropriately in the event

of unusual or nonrecurring events affecting the Company or any Subsidiary. This may include, but shall not be limited, to proportional

adjustments to the target share price thresholds in the case of extraordinary dividends, distributions, spin-off or split-off transactions

or issuances of Shares or other securities convertible into, or exercisable to purchase, Shares other than awards under the Plan.

3. Termination

of Employment. Upon Grantee’s termination of employment for any reason, regardless of whether such termination is initiated

by the Grantee, by the Company or by any of the Company’s Subsidiaries, all unvested PSUs shall be immediately forfeited upon such

termination of employment with no compensation or payment due to the Grantee or any other Person.

4. Transferability.

The PSUs may not be sold, pledged, assigned, hypothecated, gifted, transferred or disposed of in any manner either voluntarily or involuntarily

by operation of law, other than by will or by the laws of descent and distribution.

5. Conditions

on All Transfers of Shares. Notwithstanding anything to the contrary contained in this Agreement or the Plan, no transfer of a Share

acquired in connection with the PSUs shall be made, or, if attempted or purported to be made, shall be effective, unless and until the

Company is satisfied that the transfer will not violate any federal or state securities law or any other law or agreement (including this

Agreement or the Plan) or the rules of any applicable stock exchange. If the transfer would violate any such law, agreement or rule and

the Grantee nevertheless attempts or purports to engage in a transfer of such Shares, then the Company shall not recognize such transfer

on the books and records of the Company and such transfer will be null and void ab initio. In addition, the Grantee will be liable to

the Company for damages, if any, which may result from such attempted or purported transfer.

6. No

Promise of Employment; Employment. None of the Plan, this Agreement, the granting or holding of the PSUs nor the holding of

any Shares issued in connection with the PSUs will confer upon the Grantee any right to continue in the employ or service of the Company

or any Subsidiary thereof, or limit, in any respect, the right of the Company or any Subsidiary thereof to discharge the Grantee at any

time, for any reason and with or without notice. Subject to any rules and regulations adopted by the Committee from time to time, the

Grantee shall not be considered to have incurred a termination of employment if the Grantee’s employment is transferred from the

Company or any of its Subsidiaries to any of the Company’s Subsidiaries or to the Company.

7. Withholding.

The Grantee shall be responsible for making appropriate provision for all taxes required to be withheld in connection with the grant of

PSUs and/or the vesting or settlement thereof. Such responsibility shall extend to all applicable federal, state, local and foreign withholding

taxes. Except as provided below, the Company or its Subsidiaries shall retain the number of whole Shares whose Fair Market Value equals

the amount to be withheld in satisfaction of the applicable withholding taxes, unless the Grantee provides written notice no later than

the trading date following the applicable Vesting Date (or, if earlier, at least one day prior to any CinC Event that gives rise to a

Vesting Event) that such a reduction in the number of deliverable Shares is not acceptable to the Grantee. Notwithstanding the foregoing,

the Company shall retain the right to require that satisfaction of the withholding taxes due in connection with the grant, vesting or

settlement of the PSUs be made by the Grantee in cash or from any payroll or other amounts otherwise due to the Grantee. Withholding in

Shares shall not occur at a rate that equals or exceeds the rate that would result in liability accounting treatment or other adverse

accounting treatment. The Company’s obligation to make any delivery or transfer of Shares shall be conditioned on the Grantee’s

compliance, to the Company’s satisfaction, with any withholding requirement.

8. The

Plan. The Grantee has received a copy of the Plan, has read the Plan and is familiar with its terms, and hereby accepts the PSUs subject

to all of the terms and provisions of the Plan and this Agreement. Pursuant to the Plan, the Committee is authorized to interpret the

Plan and this Agreement, and to adopt rules and regulations not inconsistent with the Plan as it deems appropriate. The Grantee hereby

agrees to accept as binding, conclusive and final all decisions and interpretations of the Committee with respect to the Plan, this Agreement,

the PSUs, the Shares acquired in connection with the PSUs and any agreement relating to the PSUs or such Shares. In the event of a conflict

between the terms of the Plan and the terms of this Agreement, the terms of the Plan shall control.

9. Governing

Law. This Agreement will be construed in accordance with the laws of the Commonwealth of Pennsylvania, without regard to the application

of the principles of conflicts of laws of Pennsylvania or any other jurisdiction.

10. Disputes.

All disputes regarding or relating to the Plan, this Agreement or the PSUs shall be resolved in accordance with the Plan.

11. Severability.

All provisions of this Agreement are distinct and severable and if any clause shall be held to be invalid, illegal or against public policy,

the validity or the legality of the remainder of this Agreement shall not be affected thereby, and the remainder of this Agreement shall

be interpreted to give maximum effect to the original intention of the parties hereto.

12. Amendment;

Termination; Waiver. Subject to the provisions of the Plan, this Agreement may be amended or terminated, and its terms or

covenants waived, only by a written instrument executed on behalf of the Company (as authorized by the Committee) and the Grantee that,

in the case of an amendment or waiver, identifies the specific provision of this Agreement being amended or waived (as applicable).

13. Entire

Document. This Agreement, together with the Plan, represents the complete understanding between Grantee and the Company relating to

the subject matter hereof, and merges and supersedes all prior and contemporaneous discussions, agreements and understandings of every

nature relating to the subject matter hereof between the Grantee and the Company.

14. Binding

Effect. This Agreement shall be binding upon and inure to the benefit of the Company and its successors and assigns, and upon the

Grantee and his or her heirs, executors, administrators and legal representatives. This Agreement may be assigned by the Company without

the consent of the Grantee or any other Person, but may not be assigned by the Grantee.

15. Construction.

Captions and titles contained in this Agreement are for convenience only and shall not affect the meaning or interpretation of any provision

of this Agreement.

[End of Agreement]

IN WITNESS WHEREOF, the Company has caused this

Agreement to be executed by an appropriate officer and Grantee has executed this Agreement, both as of the day and year first above written.

| |

INNOVATIVE SOLUTIONS AND SUPPORT, INC. |

| |

| |

By: |

/s/ Jeffrey DiGiovanni |

| Date: November 20, 2024 |

| |

| Agreed to and Accepted |

| |

| /s/ Shahram Askarpour |

|

| |

|

| Shahram Askarpour |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

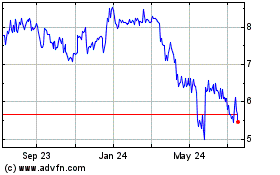

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Dec 2024 to Jan 2025

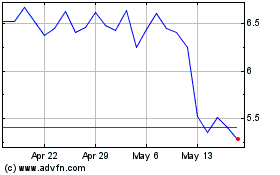

Innovative Solutions and... (NASDAQ:ISSC)

Historical Stock Chart

From Jan 2024 to Jan 2025