false

0001634447

0001634447

2024-06-07

2024-06-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): June 7, 2024 (June 3, 2024)

ISUN,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-37707 |

|

47-2150172 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

400

Avenue D, Suite 10, Williston, Vermont 05495

(Address

of Principal Executive Offices) (Zip Code)

(802)

658-3378

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value per share |

|

ISUN |

|

N/A1 |

1On

June 3, 2024, Nasdaq filed a Form 25 to delist our Common Stock and remove such securities from registration under Section 12(b) of the

Securities Exchange Act of 1934 (the “Exchange Act”). The delisting will become effective 10 days after the filing of the

Form 25.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.03. Bankruptcy or Receivership.

Voluntary

Petitions for Bankruptcy

On

June 3, 2024 (the “Petition Date”), iSun, Inc. (the “Company”) and certain of its subsidiaries (such subsidiaries,

each a “Debtor,” and together with the Company, the “Debtors”) filed a voluntary petition for reorganization

under chapter 11 of title 11 of the U.S. Code (the “Bankruptcy Code”) in the Bankruptcy Court for the District of Delaware

(the “Bankruptcy Court”) (the “Chapter 11 Cases”). The Debtors are seeking to jointly administer the Chapter

11 Cases under the caption “In re: ISUN, INC., et al.” Case No. 24-11144. The subsidiaries that are Debtors

in the Chapter 11 Cases are Hudson Solar Service, LLC; Hudson Valley Clean Energy, Inc.; iSun Corporate, LLC; iSun Energy, LLC; iSun

Industrial, LLC; iSun Residential, Inc.; iSun Utility, LLC; Liberty Electric, Inc.; Peck Electric Co.; SolarCommunities , Inc.; and Sun

CSA 36, LLC.

The

Debtors expect to continue their operations in the ordinary course of business during the pendency of the Chapter 11 Cases. To ensure

ordinary course operations, the Debtors have filed motions seeking orders from the Bankruptcy Court approving a variety of “first

day” motions. No trustee has been appointed and each Debtor will continue to operate its business as a “debtor-in-possession”

(DIP) subject to the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and

the orders of the Bankruptcy Court.

Item

2.04. Triggering Events that Accelerate/Increase Direct Financial Obligation or Off-Balance Sheet Arrangement Obligation.

The

text set forth in Item 1.03 of this Current Report on Form 8-K regarding the bankruptcy filing is incorporated into this item by reference.

The bankruptcy filing described above constituted an event of default or otherwise triggered or may trigger repayment obligations under

a number of instruments and agreements relating to direct financial obligations of the Company and certain of its subsidiaries (the “Debt

Instruments”).

The

Debt Instruments provide that, as a result of the Chapter 11 Cases, the principal, accrued and unpaid interest and certain other amounts

due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Debt Instruments are automatically

stayed as a result of the Chapter 11 Cases, and the creditors’ rights of enforcement in respect of the Debt Instruments are subject

to the applicable provisions of the Bankruptcy Code.

Item

3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

As

previously disclosed, The Nasdaq Stock Market, LLC (“Nasdaq”) suspended trading in the Common Stock of the Company on May

23, 2024, due to noncompliance with Nasdaq Listing Rule 5550(a)(2). On June 3, 2024, Nasdaq filed a Form 25 Notification of Delisting

with the Securities and Exchange Commission to complete the delisting. The delisting becomes effective ten days after the Form 25 is

filed.

Beginning

on May 23, 2024, the Company’s Common Stock had been trading over the counter on the OTC Pink Market under its current trading

symbol “ISUN.”

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

Appointment

of Rob Vanderbeek as Chief Restructuring Officer.

Effective

June 3, 2024, the Board of Directors (the “Board”) of iSun, Inc. (“iSun” or the “Company”) appointed

Rob Vanderbeek to serve as Chief Restructuring Officer of the Company. Mr. Vanderbeek will not receive any direct compensation from the

Company other than indirectly in connection with the fees paid by the Company to Novo Advisors, LLC in connection with Mr. Vanderbeek’s

services as the Company’s Interim Chief Financial Officer, as described in the Company’s Current Report on Form 8-K filed

April 22, 2024.

Item

8.01. Other Events.

On

June 5, 2024, the Bankruptcy Court approved a variety of “first day” motions seeking customary relief intended to

enable the Debtors to continue ordinary course operations during the Chapter 11 Cases by, among other things, making payments upon, or

otherwise honoring, certain obligations that arose prior to the Petition Date.

Cautionary

Note Regarding the Company’s Securities

The

Company cautions that trading in the Company’s securities during the pendency of the Chapter 11 Cases is highly speculative and

poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the actual recovery,

if any, by holders of the Company’s securities in the Chapter 11 Cases. The Company expects that holders of shares of the Company’s

Common Stock could experience a significant or complete loss on their investment, depending on the outcome of the Chapter 11 Cases.

Forward-Looking

Statements

This

Current Report on Form 8-K contains “forward-looking statements” related to future events. Forward-looking statements contain

words such as “expect,” “anticipate,” “could,” “should,” “intend,” “plan,”

“believe,” “seek,” “see,” “may,” “will,” “would,” or “target.”

Forward-looking statements are based on management’s current expectations, beliefs, assumptions and estimates and may include,

for example, statements regarding the Chapter 11 Cases, the Debtors’ ability to consummate and complete a plan of reorganization

and their ability to continue operating in the ordinary course while the Chapter 11 Cases are pending. These statements are subject to

significant risks, uncertainties, and assumptions that are difficult to predict and could cause actual results to differ materially and

adversely from those expressed or implied in the forward-looking statements, including risks and uncertainties regarding the Debtors’

ability to successfully complete a restructuring under Chapter 11, including: consummation of a plan of reorganization; potential adverse

effects of the Chapter 11 Cases on the Company’s liquidity and results of operations; the Debtors’ ability to obtain timely

approval by the Bankruptcy Court with respect to the motions filed in the Chapter 11 Cases; objections to the any plan of reorganization

or other pleadings filed that could protract the Chapter 11 Cases; employee attrition and the Company’s ability to retain senior

management and other key personnel due to distractions and uncertainties resulting from the Chapter 11 Cases; the Company’s ability

to maintain relationships with suppliers, customers, employees and other third parties and regulatory authorities as a result of the

Chapter 11 Cases; the effects of the Chapter 11 Cases on the Company and on the interests of various constituents, including holders

of the Company’s Common Stock; the Bankruptcy Court’s rulings in the Chapter 11 Cases, including the approvals of the terms

and conditions of any plan of reorganization and the DIP Credit Agreement; the outcome of the Chapter 11 Cases generally; the length

of time that the Company will operate under Chapter 11 protection and the availability of operating capital during the pendency of the

Chapter 11 Cases; risks associated with third party motions in the Chapter 11 Cases, which may interfere with the Company’s ability

to consummate a plan of reorganization or an alternative restructuring; increased administrative and legal costs related to the Chapter

11 process; potential delays in the Chapter 11 process due to unanticipated factors; and other

litigation and inherent risks involved in a bankruptcy process.

Forward-looking

statements are also subject to the risk factors and cautionary language described from time to time in the reports the Company files

with the U.S. Securities and Exchange Commission, including those in the Company’s most recent Annual Report on Form 10-K and any

updates thereto in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These risks and uncertainties

may cause actual future results to be materially different than those expressed in such forward-looking statements. The Company has no

obligation to update or revise these forward-looking statements and does not undertake to do so, except as required by law.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Dated:

June 7, 2024

| |

iSun,

Inc. |

| |

|

|

| |

By: |

/s/

Jeffrey Peck |

| |

Name: |

Jeffrey

Peck |

| |

Title: |

Chief

Executive Officer |

v3.24.1.1.u2

Cover

|

Jun. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 07, 2024

|

| Entity File Number |

001-37707

|

| Entity Registrant Name |

ISUN,

INC.

|

| Entity Central Index Key |

0001634447

|

| Entity Tax Identification Number |

47-2150172

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

400

Avenue D

|

| Entity Address, Address Line Two |

Suite 10

|

| Entity Address, City or Town |

Williston

|

| Entity Address, State or Province |

VT

|

| Entity Address, Postal Zip Code |

05495

|

| City Area Code |

(802)

|

| Local Phone Number |

658-3378

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value per share

|

| Trading Symbol |

ISUN

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

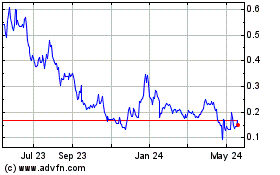

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Feb 2025 to Mar 2025

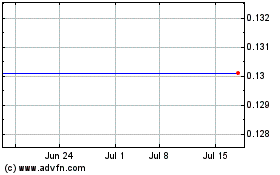

iSun (NASDAQ:ISUN)

Historical Stock Chart

From Mar 2024 to Mar 2025