false

0000728535

0000728535

2024-07-16

2024-07-16

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 16, 2024

J.B. HUNT TRANSPORT SERVICES, INC.

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

Arkansas

|

0-11757

|

71-0335111

|

|

(State or other Jurisdiction of

Incorporation or Organization

|

Commission File Number

|

(IRS Employer

Identification No.)

|

| |

|

|

| |

|

|

|

615 J.B. Hunt Corporate Drive

Lowell, Arkansas

|

72745

|

(479) 820-0000

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(Registrant’s telephone number)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

JBHT

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The information in this Current Report is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

|

ITEM 2.02.

|

RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

|

On July 16, 2024, we issued a news release announcing our revenues and earnings for the second quarter ended June 30, 2024. A copy of the news release is attached as Exhibit 99.1 and is incorporated herein by reference.

|

ITEM 9.01.

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

(d)

|

Exhibits.

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL Document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized on the 16th day of July 2024.

|

|

J.B. HUNT TRANSPORT SERVICES, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BY:

|

/s/ Shelley Simpson

|

|

| |

|

Shelley Simpson |

|

|

|

|

President and Chief Executive Officer

|

|

| |

|

(Principal Executive Officer) |

|

|

|

BY:

|

/s/ John Kuhlow

|

|

| |

|

John Kuhlow |

|

| |

|

Chief Financial Officer, |

|

| |

|

Executive Vice President |

|

|

|

|

(Principal Financial Officer)

|

|

Exhibit 99.1

|

J.B. Hunt Transport Services, Inc.

|

|

615 J.B. Hunt Corporate Drive

|

| Contact: Brad Delco |

|

Senior Vice President – Finance |

|

Lowell, Arkansas 72745

|

|

(479) 820-2723

|

| (NASDAQ: JBHT) |

|

|

FOR IMMEDIATE RELEASE

J.B. HUNT TRANSPORT SERVICES, INC. REPORTS U.S. GAAP REVENUES, NET EARNINGS AND

EARNINGS PER SHARE FOR THE SECOND QUARTER 2024

|

■ Second Quarter 2024 Revenue:

|

|

$2.93 billion; down 7%

|

|

■ Second Quarter 2024 Operating Income:

|

|

$205.7 million; down 24%

|

|

■ Second Quarter 2024 EPS:

|

|

$1.32 vs. $1.81; down 27%

|

LOWELL, Ark., July 16, 2024 - J.B. Hunt Transport Services, Inc. (NASDAQ: JBHT) announced second quarter 2024 U.S. GAAP (United States Generally Accepted Accounting Principles) net earnings of $135.9 million, or diluted earnings per share of $1.32 versus second quarter 2023 net earnings of $189.6 million, or $1.81 per diluted share.

Total operating revenue for the current quarter was $2.93 billion, compared with $3.13 billion for the second quarter 2023, a decrease of 7%. The decline in revenue was primarily driven by a 5% decrease in gross revenue per load in Intermodal (JBI) and a decline in load volume of 25% in Integrated Capacity Solutions (ICS), 9% in Truckload (JBT), and 9% in Dedicated Contract Services® (DCS®). These items were partially offset by Final Mile Services® (FMS) revenue growth of 5%, primarily driven by new contracts implemented over the past year, and a 5% increase in revenue per load in ICS. Current quarter total operating revenue, excluding fuel surcharge revenue, decreased 6% versus the comparable quarter 2023.

Operating income for the current quarter decreased 24% to $205.7 million versus $270.7 million for the second quarter 2023. The decrease in operating income was primarily due to lower revenue, and higher insurance and claims, equipment-related, and certain personnel-related expenses. Operating income as a percentage of gross revenue decreased year-over-year as a result of the same aforementioned expense items, partially offset by lower rail and truck purchased transportation costs as a percentage of gross revenue.

Net interest expense for the current quarter increased approximately 38% from the second quarter 2023 due to higher effective interest rates and consolidated debt balance, partially offset by higher interest income.

The effective income tax rate was 26.8% in the current quarter compared to 26.0% in the second quarter 2023. We continue to expect our 2024 annual tax rate to be between 24.0% and 25.0%.

Segment Information:

Intermodal (JBI)

| ■ Second Quarter 2024 Segment Revenue: |

|

$1.41 billion; down 5% |

| ■ Second Quarter 2024 Operating Income: |

|

$99.2 million; down 31% |

Intermodal volume decreased 1% over the same period in 2023. Transcontinental network loads increased 4%, while eastern network loads decreased 7% compared to the second quarter 2023. While experiencing some seasonal build in demand through the quarter, overall performance continued to be pressured by the soft freight market and its impact on over-the-road truck competition in the eastern network. Segment gross revenue decreased 5% from the prior-year period, reflecting the 1% decrease in volume and a 5% decrease in gross revenue per load, resulting from changes in customer rates, fuel surcharge revenue, and the mix of freight. Revenue per load excluding fuel surcharge revenue decreased 4% year-over-year.

Operating income decreased 31% compared to the second quarter 2023 primarily from a combination of lower yields and the underutilization of assets in the network. JBI segment operating income as a percentage of segment gross revenue declined versus the prior-year period as a result of increases in professional driver and non-driver wages and benefits, ownership costs of underutilized equipment, higher equipment and maintenance expenses, and higher insurance and claims expense, as a percentage of gross revenue. During the period, we onboarded 1,862 new pieces of trailing equipment. We ended the quarter with approximately 121,200 containers and 6,200 power units in the dray fleet.

Dedicated Contract Services (DCS)

| ■ Second Quarter 2024 Segment Revenue: |

|

$851 million; down 4% |

| ■ Second Quarter 2024 Operating Income: |

|

$96.4 million; down 15% |

DCS revenue decreased 4% during the current quarter over the same period 2023 driven by a 1% decline in average trucks combined with a 3% decline in productivity (revenue per truck per week). Productivity excluding fuel surcharge revenue decreased 3% from a year ago driven primarily from lower utilization and increases in idled equipment, partially offset by contracted indexed-based price escalators. On a net basis, there were 339 fewer revenue-producing trucks in the fleet by the end of the quarter compared to the prior-year period and 365 fewer versus the end of the first quarter 2024. Customer retention rates are approximately 88%, largely reflecting downsizing of fleets and to a lesser extent account losses, as compared to the prior-year period.

Operating income decreased 15% from the prior-year quarter primarily from lower revenue, higher insurance and claims, equipment-related and bad debt expenses and higher new account start-up costs as compared to the prior-year period. These items were partially offset by lower maintenance costs and the maturing of new business onboarded over the past trailing twelve months.

Integrated Capacity Solutions (ICS)

| ■ Second Quarter 2024 Segment Revenue: |

|

$270 million; down 21% |

| ■ Second Quarter 2024 Operating Loss: |

|

$(13.3) million; vs. $(4.4) million in Q2’23 |

ICS revenue declined 21% during the current quarter versus the second quarter 2023. Overall segment volume decreased 25% versus the prior-year period. Revenue per load increased 5% compared to the second quarter 2023 due to increases in both contractual and transactional rates as well as changes in customer mix. Contractual volume represented approximately 61% of the total load volume and 59% of the gross segment revenue in the current quarter compared to 66% and 64%, respectively, in second quarter 2023.

Operating loss was $13.3 million compared to an operating loss of $4.4 million in the second quarter 2023. The increase in operating loss was largely driven by a $4.9 million decrease in gross profit, higher insurance and claims costs, and integration and transition costs related to the purchase of the brokerage assets of BNSF Logistics. These items were partially offset by lower personnel-related expenses and reduced technology costs. Gross profit declined 11% versus the prior-year period as a result of lower revenue, despite gross profit margins improving to 14.8% compared to 13.0% in the prior-year period. This reflects intentional yield management and discipline during bid season and better execution on capacity procurement. The ICS carrier base decreased 24% year-over-year, largely driven by changes to carrier qualification requirements to mitigate cargo theft.

Final Mile Services (FMS)

| ■ Second Quarter 2024 Segment Revenue: |

|

$235 million; up 5% |

| ■ Second Quarter 2024 Operating Income: |

|

$19.8 million; up 33% |

FMS revenue increased 5% compared to the same period 2023. The increase was primarily driven by multiple new contracts implemented over the past year. This was partially offset by ongoing efforts to improve revenue quality and profitability across various accounts which resulted in some loss of business in addition to general weakness in demand across some of the end markets served.

Operating income increased 33% compared to the prior-year period. Second quarter 2024 included a $1.1 million net benefit from two offsetting claim settlements. Excluding this impact, operating income increased primarily from higher revenue and lower personnel, equipment-related, and bad debt expenses compared to the prior-year period. These items were partially offset by higher building maintenance expense and loss on sale of equipment as compared to the prior-year period.

Truckload (JBT)

| ■ Second Quarter 2024 Segment Revenue: |

|

$168 million; down 12% |

| ■ Second Quarter 2024 Operating Income: |

|

$3.5 million; down 7% |

JBT revenue decreased 12% compared to the same period in the previous year. Revenue excluding fuel surcharge revenue decreased 13% due to a 9% decline in load volume and a 4% decline in revenue per load excluding fuel surcharge revenue. Total average effective trailer count decreased by approximately 500 units, or 4% versus the prior-year period. Trailer turns in the quarter were down 5% from the prior period primarily due to weaker overall market demand compared to the second quarter 2023.

JBT operating income decreased 7% to $3.5 million compared to the second quarter 2023. The decrease in operating income was primarily driven by the decline in revenue. JBT segment operating income as a percentage of segment gross revenue improved slightly year-over-year as a result of overall cost management initiatives, partially offset by higher third-party capacity cost and insurance and claims expense as a percentage of gross revenue.

Cash Flow and Capitalization:

At June 30, 2024, we had approximately $1.48 billion outstanding on various debt instruments compared to $1.45 billion at June 30, 2023 and $1.58 billion at December 31, 2023.

Our net capital expenditures for the six months ended June 30, 2024 approximated $409 million compared to $854 million for the same period 2023. At June 30, 2024, we had cash and cash equivalents of approximately $54 million.

In the second quarter 2024, we purchased approximately 1,225,000 shares of common stock for approximately $203 million. At June 30, 2024, we had approximately $163 million remaining under our share repurchase authorization. Actual shares outstanding at June 30, 2024 approximated 102.0 million.

Conference Call Information:

The company will hold a conference call today from 4:00–5:00 p.m. CDT to discuss the quarterly earnings. Investors will have the opportunity to listen to the conference call live over the internet by going to investor.jbhunt.com. Please log on 15 minutes early to register, download and install any necessary audio software. For those who cannot listen to the live broadcast, an online replay of the earnings call webcast will be available a few hours after the completion of the call.

Forward-Looking Statements:

This press release may contain forward-looking statements, which are based on information currently available. Actual results may differ materially from those currently anticipated due to a number of factors, including, but not limited to, those discussed in Item 1A of our Annual Report filed on Form 10-K for the year ended December 31, 2023. We assume no obligation to update any forward-looking statement to the extent we become aware that it will not be achieved for any reason. This press release and additional information will be available to interested parties on our website, www.jbhunt.com.

About J.B. Hunt

J.B. Hunt’s vision is to create the most efficient transportation network in North America. The company’s industry-leading solutions and mode-neutral approach generate value for customers by eliminating waste, reducing costs and enhancing supply chain visibility. Powered by one of the largest company-owned fleets in the country and third-party capacity through its J.B. Hunt 360°® digital freight marketplace, J.B. Hunt can meet the unique shipping needs of any business, from first mile to final delivery, and every shipment in-between. Through disciplined investments in its people, technology and capacity, J.B. Hunt is delivering exceptional value and service that enable long-term growth for the company and its stakeholders.

J.B. Hunt Transport Services Inc. is a Fortune 500 company, an S&P 500 company and a component of the Dow Jones Transportation Average. Its stock trades on NASDAQ under the ticker symbol JBHT. J.B. Hunt Transport Inc. is a wholly owned subsidiary of JBHT. The company’s services include intermodal, dedicated, refrigerated, truckload, less-than-truckload, flatbed, single source, last mile, transload and more. For more information, visit www.jbhunt.com.

|

|

J.B. HUNT TRANSPORT SERVICES, INC.

Condensed Consolidated Statements of Earnings

(in thousands, except per share data)

(unaudited)

|

|

| |

|

Three Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

% Of

|

|

|

|

|

|

|

% Of

|

|

| |

|

Amount

|

|

|

Revenue

|

|

|

Amount

|

|

|

Revenue

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues, excluding fuel surcharge revenues

|

|

$ |

2,545,023 |

|

|

|

|

|

|

$ |

2,707,560 |

|

|

|

|

|

|

Fuel surcharge revenues

|

|

|

383,662 |

|

|

|

|

|

|

|

425,063 |

|

|

|

|

|

|

Total operating revenues

|

|

|

2,928,685 |

|

|

|

100.0 |

% |

|

|

3,132,623 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rents and purchased transportation

|

|

|

1,274,011 |

|

|

|

43.5 |

% |

|

|

1,404,586 |

|

|

|

44.8 |

% |

|

Salaries, wages and employee benefits

|

|

|

803,047 |

|

|

|

27.4 |

% |

|

|

821,876 |

|

|

|

26.2 |

% |

|

Depreciation and amortization

|

|

|

184,658 |

|

|

|

6.3 |

% |

|

|

179,972 |

|

|

|

5.7 |

% |

|

Fuel and fuel taxes

|

|

|

164,291 |

|

|

|

5.6 |

% |

|

|

171,846 |

|

|

|

5.5 |

% |

|

Operating supplies and expenses

|

|

|

120,425 |

|

|

|

4.1 |

% |

|

|

128,949 |

|

|

|

4.1 |

% |

|

General and administrative expenses, net of asset dispositions

|

|

|

74,707 |

|

|

|

2.6 |

% |

|

|

61,472 |

|

|

|

2.1 |

% |

|

Insurance and claims

|

|

|

73,222 |

|

|

|

2.5 |

% |

|

|

63,893 |

|

|

|

2.1 |

% |

|

Operating taxes and licenses

|

|

|

17,575 |

|

|

|

0.6 |

% |

|

|

18,951 |

|

|

|

0.6 |

% |

|

Communication and utilities

|

|

|

11,040 |

|

|

|

0.4 |

% |

|

|

10,366 |

|

|

|

0.3 |

% |

|

Total operating expenses

|

|

|

2,722,976 |

|

|

|

93.0 |

% |

|

|

2,861,911 |

|

|

|

91.4 |

% |

|

Operating income

|

|

|

205,709 |

|

|

|

7.0 |

% |

|

|

270,712 |

|

|

|

8.6 |

% |

|

Net interest expense

|

|

|

20,198 |

|

|

|

0.7 |

% |

|

|

14,604 |

|

|

|

0.4 |

% |

|

Earnings before income taxes

|

|

|

185,511 |

|

|

|

6.3 |

% |

|

|

256,108 |

|

|

|

8.2 |

% |

|

Income taxes

|

|

|

49,638 |

|

|

|

1.7 |

% |

|

|

66,556 |

|

|

|

2.1 |

% |

|

Net earnings

|

|

$ |

135,873 |

|

|

|

4.6 |

% |

|

$ |

189,552 |

|

|

|

6.1 |

% |

|

Average diluted shares outstanding

|

|

|

103,146 |

|

|

|

|

|

|

|

104,566 |

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

1.32 |

|

|

|

|

|

|

$ |

1.81 |

|

|

|

|

|

| |

|

Six Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

% Of

|

|

|

|

|

|

|

% Of

|

|

| |

|

Amount

|

|

|

Revenue

|

|

|

Amount

|

|

|

Revenue

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating revenues, excluding fuel surcharge revenues

|

|

$ |

5,097,508 |

|

|

|

|

|

|

$ |

5,450,070 |

|

|

|

|

|

|

Fuel surcharge revenues

|

|

|

775,177 |

|

|

|

|

|

|

|

912,142 |

|

|

|

|

|

|

Total operating revenues

|

|

|

5,872,685 |

|

|

|

100.0 |

% |

|

|

6,362,212 |

|

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rents and purchased transportation

|

|

|

2,554,998 |

|

|

|

43.5 |

% |

|

|

2,872,384 |

|

|

|

45.1 |

% |

|

Salaries, wages and employee benefits

|

|

|

1,610,931 |

|

|

|

27.4 |

% |

|

|

1,646,875 |

|

|

|

25.9 |

% |

|

Depreciation and amortization

|

|

|

367,655 |

|

|

|

6.3 |

% |

|

|

355,784 |

|

|

|

5.6 |

% |

|

Fuel and fuel taxes

|

|

|

337,817 |

|

|

|

5.8 |

% |

|

|

367,680 |

|

|

|

5.8 |

% |

|

Operating supplies and expenses

|

|

|

243,416 |

|

|

|

4.1 |

% |

|

|

257,308 |

|

|

|

4.0 |

% |

|

General and administrative expenses, net of asset dispositions

|

|

|

151,490 |

|

|

|

2.6 |

% |

|

|

121,879 |

|

|

|

2.0 |

% |

|

Insurance and claims

|

|

|

148,908 |

|

|

|

2.5 |

% |

|

|

134,221 |

|

|

|

2.1 |

% |

|

Operating taxes and licenses

|

|

|

35,110 |

|

|

|

0.6 |

% |

|

|

37,058 |

|

|

|

0.6 |

% |

|

Communication and utilities

|

|

|

22,282 |

|

|

|

0.4 |

% |

|

|

20,822 |

|

|

|

0.3 |

% |

|

Total operating expenses

|

|

|

5,472,607 |

|

|

|

93.2 |

% |

|

|

5,814,011 |

|

|

|

91.4 |

% |

|

Operating income

|

|

|

400,078 |

|

|

|

6.8 |

% |

|

|

548,201 |

|

|

|

8.6 |

% |

|

Net interest expense

|

|

|

35,847 |

|

|

|

0.6 |

% |

|

|

29,393 |

|

|

|

0.4 |

% |

|

Earnings before income taxes

|

|

|

364,231 |

|

|

|

6.2 |

% |

|

|

518,808 |

|

|

|

8.2 |

% |

|

Income taxes

|

|

|

100,865 |

|

|

|

1.7 |

% |

|

|

131,488 |

|

|

|

2.1 |

% |

|

Net earnings

|

|

$ |

263,366 |

|

|

|

4.5 |

% |

|

$ |

387,320 |

|

|

|

6.1 |

% |

|

Average diluted shares outstanding

|

|

|

103,626 |

|

|

|

|

|

|

|

104,647 |

|

|

|

|

|

|

Diluted earnings per share

|

|

$ |

2.54 |

|

|

|

|

|

|

$ |

3.70 |

|

|

|

|

|

|

Financial Information By Segment

|

|

(in thousands)

|

|

(unaudited)

|

| |

|

Three Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

% Of

|

|

|

|

|

|

|

% Of

|

|

| |

|

Amount

|

|

|

Total

|

|

|

Amount

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

$ |

1,407,496 |

|

|

|

48 |

% |

|

$ |

1,489,148 |

|

|

|

48 |

% |

|

Dedicated

|

|

|

851,010 |

|

|

|

29 |

% |

|

|

887,593 |

|

|

|

28 |

% |

|

Integrated Capacity Solutions

|

|

|

270,378 |

|

|

|

9 |

% |

|

|

343,691 |

|

|

|

11 |

% |

|

Final Mile Services

|

|

|

235,290 |

|

|

|

8 |

% |

|

|

223,939 |

|

|

|

7 |

% |

|

Truckload

|

|

|

168,095 |

|

|

|

6 |

% |

|

|

191,803 |

|

|

|

6 |

% |

|

Subtotal

|

|

|

2,932,269 |

|

|

|

100 |

% |

|

|

3,136,174 |

|

|

|

100 |

% |

|

Intersegment eliminations

|

|

|

(3,584 |

) |

|

|

(0 |

%) |

|

|

(3,551 |

) |

|

|

(0 |

%) |

|

Consolidated revenue

|

|

$ |

2,928,685 |

|

|

|

100 |

% |

|

$ |

3,132,623 |

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

$ |

99,244 |

|

|

|

48 |

% |

|

$ |

142,860 |

|

|

|

53 |

% |

|

Dedicated

|

|

|

96,410 |

|

|

|

47 |

% |

|

|

113,615 |

|

|

|

42 |

% |

|

Integrated Capacity Solutions

|

|

|

(13,287 |

) |

|

|

(7 |

%) |

|

|

(4,419 |

) |

|

|

(2 |

%) |

|

Final Mile Services

|

|

|

19,778 |

|

|

|

10 |

% |

|

|

14,824 |

|

|

|

5 |

% |

|

Truckload

|

|

|

3,549 |

|

|

|

2 |

% |

|

|

3,798 |

|

|

|

2 |

% |

|

Other (1)

|

|

|

15 |

|

|

|

0 |

% |

|

|

34 |

|

|

|

0 |

% |

|

Operating income

|

|

$ |

205,709 |

|

|

|

100 |

% |

|

$ |

270,712 |

|

|

|

100 |

% |

| |

|

Six Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

% Of

|

|

|

|

|

|

|

% Of

|

|

| |

|

Amount

|

|

|

Total

|

|

|

Amount

|

|

|

Total

|

|

|

Revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

$ |

2,802,846 |

|

|

|

48 |

% |

|

$ |

3,028,707 |

|

|

|

48 |

% |

|

Dedicated

|

|

|

1,711,026 |

|

|

|

29 |

% |

|

|

1,766,735 |

|

|

|

28 |

% |

|

Integrated Capacity Solutions

|

|

|

555,665 |

|

|

|

9 |

% |

|

|

728,465 |

|

|

|

11 |

% |

|

Final Mile Services

|

|

|

464,570 |

|

|

|

8 |

% |

|

|

449,016 |

|

|

|

7 |

% |

|

Truckload

|

|

|

346,407 |

|

|

|

6 |

% |

|

|

397,665 |

|

|

|

6 |

% |

|

Subtotal

|

|

|

5,880,514 |

|

|

|

100 |

% |

|

|

6,370,588 |

|

|

|

100 |

% |

|

Intersegment eliminations

|

|

|

(7,829 |

) |

|

|

(0 |

%) |

|

|

(8,376 |

) |

|

|

(0 |

%) |

|

Consolidated revenue

|

|

$ |

5,872,685 |

|

|

|

100 |

% |

|

$ |

6,362,212 |

|

|

|

100 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intermodal

|

|

$ |

201,133 |

|

|

|

50 |

% |

|

$ |

311,518 |

|

|

|

57 |

% |

|

Dedicated

|

|

|

190,060 |

|

|

|

48 |

% |

|

|

216,175 |

|

|

|

39 |

% |

|

Integrated Capacity Solutions

|

|

|

(30,828 |

) |

|

|

(8 |

%) |

|

|

(9,791 |

) |

|

|

(2 |

%) |

|

Final Mile Services

|

|

|

34,864 |

|

|

|

9 |

% |

|

|

21,444 |

|

|

|

4 |

% |

|

Truckload

|

|

|

4,778 |

|

|

|

1 |

% |

|

|

8,788 |

|

|

|

2 |

% |

|

Other (1)

|

|

|

71 |

|

|

|

0 |

% |

|

|

67 |

|

|

|

0 |

% |

|

Operating income

|

|

$ |

400,078 |

|

|

|

100 |

% |

|

$ |

548,201 |

|

|

|

100 |

% |

(1) Includes corporate support activity

|

Operating Statistics by Segment

|

|

(unaudited)

|

| |

|

Three Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

497,446 |

|

|

|

501,681 |

|

|

Average length of haul

|

|

|

1,689 |

|

|

|

1,655 |

|

|

Revenue per load

|

|

$ |

2,829 |

|

|

$ |

2,968 |

|

|

Average tractors during the period *

|

|

|

6,209 |

|

|

|

6,517 |

|

|

Tractors (end of period) *

|

|

|

6,162 |

|

|

|

6,491 |

|

|

Trailing equipment (end of period)

|

|

|

121,169 |

|

|

|

116,481 |

|

|

Average effective trailing equipment usage

|

|

|

98,350 |

|

|

|

95,815 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

1,007,798 |

|

|

|

1,104,896 |

|

|

Average length of haul

|

|

|

182 |

|

|

|

172 |

|

|

Revenue per truck per week**

|

|

$ |

5,004 |

|

|

$ |

5,182 |

|

|

Average trucks during the period***

|

|

|

13,142 |

|

|

|

13,236 |

|

|

Trucks (end of period) ***

|

|

|

12,889 |

|

|

|

13,228 |

|

|

Trailing equipment (end of period)

|

|

|

31,802 |

|

|

|

31,280 |

|

|

Average effective trailing equipment usage

|

|

|

32,461 |

|

|

|

31,979 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Integrated Capacity Solutions

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

145,362 |

|

|

|

194,635 |

|

|

Revenue per load

|

|

$ |

1,860 |

|

|

$ |

1,766 |

|

|

Gross profit margin

|

|

|

14.8 |

% |

|

|

13.0 |

% |

|

Employee count (end of period)

|

|

|

708 |

|

|

|

769 |

|

|

Approximate number of third-party carriers (end of period)

|

|

|

109,200 |

|

|

|

144,600 |

|

|

Marketplace for J.B. Hunt 360 revenue (millions)

|

|

$ |

104.1 |

|

|

$ |

225.0 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Final Mile Services

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stops

|

|

|

1,098,521 |

|

|

|

1,141,415 |

|

|

Average trucks during the period***

|

|

|

1,374 |

|

|

|

1,551 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

92,628 |

|

|

|

101,402 |

|

|

Revenue per load

|

|

$ |

1,815 |

|

|

$ |

1,892 |

|

|

Average length of haul

|

|

|

646 |

|

|

|

659 |

|

| |

|

|

|

|

|

|

|

|

|

Tractors (end of period)

|

|

|

|

|

|

|

|

|

|

Company-owned

|

|

|

23 |

|

|

|

33 |

|

|

Independent contractor

|

|

|

1,874 |

|

|

|

2,035 |

|

|

Total tractors

|

|

|

1,897 |

|

|

|

2,068 |

|

| |

|

|

|

|

|

|

|

|

|

Trailers (end of period)

|

|

|

13,299 |

|

|

|

13,851 |

|

|

Average effective trailing equipment usage

|

|

|

12,600 |

|

|

|

13,108 |

|

* Includes company-owned and independent contractor tractors

** Using weighted workdays

*** Includes company-owned, independent contractor, and customer-owned trucks

|

Operating Statistics by Segment

|

|

(unaudited)

|

| |

|

Six Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Intermodal

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

982,612 |

|

|

|

987,772 |

|

|

Average length of haul

|

|

|

1,689 |

|

|

|

1,653 |

|

|

Revenue per load

|

|

$ |

2,852 |

|

|

$ |

3,066 |

|

|

Average tractors during the period *

|

|

|

6,277 |

|

|

|

6,558 |

|

|

Tractors (end of period) *

|

|

|

6,162 |

|

|

|

6,491 |

|

|

Trailing equipment (end of period)

|

|

|

121,169 |

|

|

|

116,481 |

|

|

Average effective trailing equipment usage

|

|

|

97,231 |

|

|

|

96,061 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Dedicated

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

2,012,135 |

|

|

|

2,182,268 |

|

|

Average length of haul

|

|

|

181 |

|

|

|

172 |

|

|

Revenue per truck per week**

|

|

$ |

5,012 |

|

|

$ |

5,120 |

|

|

Average trucks during the period***

|

|

|

13,220 |

|

|

|

13,353 |

|

|

Trucks (end of period) ***

|

|

|

12,889 |

|

|

|

13,228 |

|

|

Trailing equipment (end of period)

|

|

|

31,802 |

|

|

|

31,280 |

|

|

Average effective trailing equipment usage

|

|

|

32,728 |

|

|

|

31,679 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Integrated Capacity Solutions

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

303,609 |

|

|

|

397,166 |

|

|

Revenue per load

|

|

$ |

1,830 |

|

|

$ |

1,834 |

|

|

Gross profit margin

|

|

|

14.5 |

% |

|

|

13.3 |

% |

|

Employee count (end of period)

|

|

|

708 |

|

|

|

769 |

|

|

Approximate number of third-party carriers (end of period)

|

|

|

109,200 |

|

|

|

144,600 |

|

|

Marketplace for J.B. Hunt 360 revenue (millions)

|

|

$ |

209.6 |

|

|

$ |

475.6 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Final Mile Services

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stops

|

|

|

2,175,210 |

|

|

|

2,303,553 |

|

|

Average trucks during the period***

|

|

|

1,391 |

|

|

|

1,601 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Truckload

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Loads

|

|

|

186,313 |

|

|

|

200,186 |

|

|

Revenue per load

|

|

$ |

1,859 |

|

|

$ |

1,986 |

|

|

Average length of haul

|

|

|

662 |

|

|

|

650 |

|

| |

|

|

|

|

|

|

|

|

|

Tractors (end of period)

|

|

|

|

|

|

|

|

|

|

Company-owned

|

|

|

23 |

|

|

|

33 |

|

|

Independent contractor

|

|

|

1,874 |

|

|

|

2,035 |

|

|

Total tractors

|

|

|

1,897 |

|

|

|

2,068 |

|

| |

|

|

|

|

|

|

|

|

|

Trailers (end of period)

|

|

|

13,299 |

|

|

|

13,851 |

|

|

Average effective trailing equipment usage

|

|

|

12,746 |

|

|

|

13,118 |

|

* Includes company-owned and independent contractor tractors

** Using weighted workdays

*** Includes company-owned, independent contractor, and customer-owned trucks

J.B. HUNT TRANSPORT SERVICES, INC.

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

| |

|

June 30, 2024

|

|

|

December 31, 2023

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

53,505 |

|

|

$ |

53,344 |

|

|

Accounts Receivable, net

|

|

|

1,251,665 |

|

|

|

1,334,912 |

|

|

Prepaid expenses and other

|

|

|

608,540 |

|

|

|

696,656 |

|

|

Total current assets

|

|

|

1,913,710 |

|

|

|

2,084,912 |

|

|

Property and equipment

|

|

|

9,007,510 |

|

|

|

8,767,872 |

|

|

Less accumulated depreciation

|

|

|

3,174,017 |

|

|

|

2,993,959 |

|

|

Net property and equipment

|

|

|

5,833,493 |

|

|

|

5,773,913 |

|

|

Other assets, net

|

|

|

668,677 |

|

|

|

679,435 |

|

| |

|

$ |

8,415,880 |

|

|

$ |

8,538,260 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES & SHAREHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current debt

|

|

$ |

- |

|

|

$ |

249,961 |

|

|

Trade accounts payable

|

|

|

724,862 |

|

|

|

737,364 |

|

|

Claims accruals

|

|

|

594,482 |

|

|

|

547,277 |

|

|

Accrued payroll

|

|

|

111,234 |

|

|

|

94,563 |

|

|

Other accrued expenses

|

|

|

150,882 |

|

|

|

150,256 |

|

|

Total current liabilities

|

|

|

1,581,460 |

|

|

|

1,779,421 |

|

| |

|

|

|

|

|

|

|

|

|

Long-term debt

|

|

|

1,483,804 |

|

|

|

1,326,107 |

|

|

Other long-term liabilities

|

|

|

394,494 |

|

|

|

392,766 |

|

|

Deferred income taxes

|

|

|

880,126 |

|

|

|

936,208 |

|

|

Shareholders' equity

|

|

|

4,075,996 |

|

|

|

4,103,758 |

|

| |

|

$ |

8,415,880 |

|

|

$ |

8,538,260 |

|

Supplemental Data

(unaudited)

| |

|

June 30, 2024

|

|

|

December 31, 2023

|

|

| |

|

|

|

|

|

|

|

|

|

Actual shares outstanding at end of period (000)

|

|

|

101,987 |

|

|

|

103,220 |

|

| |

|

|

|

|

|

|

|

|

|

Book value per actual share outstanding at end of period

|

|

$ |

39.97 |

|

|

$ |

39.76 |

|

| |

|

Six Months Ended June 30

|

|

| |

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities (000)

|

|

$ |

827,021 |

|

|

$ |

1,097,290 |

|

| |

|

|

|

|

|

|

|

|

|

Net capital expenditures (000)

|

|

$ |

408,853 |

|

|

$ |

853,778 |

|

v3.24.2

Document And Entity Information

|

Jul. 16, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

J.B. HUNT TRANSPORT SERVICES, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 16, 2024

|

| Entity, Incorporation, State or Country Code |

AR

|

| Entity, File Number |

0-11757

|

| Entity, Tax Identification Number |

71-0335111

|

| Entity, Address, Address Line One |

615 J.B. Hunt Corporate Drive

|

| Entity, Address, City or Town |

Lowell

|

| Entity, Address, State or Province |

AR

|

| Entity, Address, Postal Zip Code |

72745

|

| City Area Code |

479

|

| Local Phone Number |

820-0000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

JBHT

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000728535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

J B Hunt Transport Servi... (NASDAQ:JBHT)

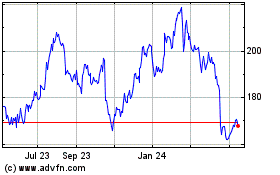

Historical Stock Chart

From Jun 2024 to Jul 2024

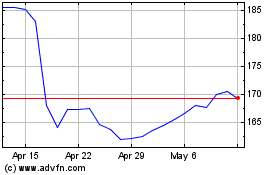

J B Hunt Transport Servi... (NASDAQ:JBHT)

Historical Stock Chart

From Jul 2023 to Jul 2024