Aurora Mobile Limited (“Aurora Mobile” or the “Company”) (NASDAQ:

JG), a leading provider of customer engagement and marketing

technology services in China, today announced its unaudited

financial results for the second quarter ended June 30, 2024.

Second Quarter 2024 Financial Highlights

-

Revenues were RMB79.4 million (US$10.9 million),

an increase of 8% year-over-year.

-

Cost of revenues was RMB26.7 million (US$3.7

million), an increase of 4% year-over-year.

-

Gross profit was RMB52.8 million (US$7.3 million),

an increase of 11% year-over-year.

-

Total operating expenses were RMB54.8 million

(US$7.5 million), a decrease of 15% year-over-year.

-

Net loss was RMB1.3 million (US$0.2 million),

compared with a net loss of RMB23.7 million for the same quarter

last year.

-

Net loss attributable to Aurora Mobile Limited’s

shareholders was RMB1.0 million (US$0.1 million), compared

with a net loss attributable to Aurora Mobile Limited’s

shareholders of RMB23.0 million for the same quarter last

year.

-

Adjusted net loss (non-GAAP) was RMB0.4 million

(US$54 thousand), compared with a RMB8.9 million adjusted net loss

for the same quarter last year.

-

Adjusted EBITDA (non-GAAP) was at positive RMB1.6

million (US$0.2 million), compared with a negative RMB4.6 million

for the same quarter last year.

Mr. Weidong Luo, Chairman and Chief Executive

Officer of Aurora Mobile, commented, “The appropriate description

for the performance of this quarter is “Riding on the Great Growth

Momentum”. The reasons for this description are as follows:

- Firstly,

continuing the great Q1’2024 momentum, we recorded the 4th

consecutive positive Adjusted EBITDA in this quarter. This is an

historical achievement for us since IPO in 2018.

- Secondly,

Developer Subscription revenue recorded both a 14% growth

quarter-over-quarter and a 19% growth year-over-year.

- Thirdly, our

gross profit recorded good growth for both year-over-year and

quarter-over-quarter.

- Fourthly, our

net loss has narrowed by 50% quarter-over-quarter and 95%

year-over-year.”

Mr. Shan-Nen Bong, Chief Financial Officer of

Aurora Mobile, added, “We have had a great quarter. Our total group

revenue grew both quarter-over-quarter and year-over-year with 23%

and 8%, respectively. Subscription Services revenues of RMB48.1

million were showing great growth where it grew by 14%

quarter-over-quarter and 19% year-over-year, driven by growth in

EngageLab business and improvement in ARPU. Value-added services

revenues increased by 245% quarter-over-quarter which was due to

the 6/18 online shopping festival in Q2 where online advertisers

have increased their ads spending. Overall Vertical applications

revenues had recorded a great quarter where revenue grew by 16%

quarter-over-quarter and 8% year-over-year. This was driven by

Financial Risk Management where its revenue grew by 28%

quarter-over-quarter and 34% year-over-year fueled by a strong 30%

customer number growth.

With strong and solid revenue growth while

maintaining optimal level of operating expenses, for the quarter

ended June 30, 2024, we recorded yet another positive Adjusted

EBITDA. This is an historical event where we now have 4 consecutive

quarters of positive Adjusted EBITDA.”

Second Quarter 2024 Financial

Results

Revenues were RMB79.4 million

(US$10.9 million), an increase of 8% from RMB73.3 million in the

same quarter of last year, attributable to an 8% increase in

revenue from both Developer Services and Vertical Applications.

Cost of revenues was RMB26.7

million (US$3.7 million), an increase of 4% from RMB25.6 million in

the same quarter of last year. The increase was mainly due to a

RMB2.1 million increase in short messaging cost and a RMB0.9

million increase in other direct costs, and offset by a RMB2.4

million decrease in media cost.

Gross profit was RMB52.8

million (US$7.3 million), an increase of 11% from RMB47.7 million

in the same quarter of last year.

Total operating expenses were

RMB54.8 million (US$7.5 million), a decrease of 15% from RMB64.1

million in the same quarter of last year.

- Research

and development expenses were RMB23.7 million (US$3.3

million), a decrease of 22% from RMB30.2 million in the same

quarter of last year, mainly due to a RMB4.2 million decrease in

personnel costs, a RMB3.4 million decrease in bandwidth cost, and a

RMB1.8 million decrease in depreciation expense. The impact is

partially offset by a RMB4.0 million increase in cloud cost.

- Sales

and marketing expenses were RMB20.5 million (US$2.8

million), an increase of 2% from RMB20.0 million in the same

quarter of last year, mainly due to a RMB0.3 million increase in

personnel costs.

- General

and administrative expenses were RMB10.7 million (US$1.5

million), a decrease of 23% from RMB13.9 million in the same

quarter of last year, mainly due to a RMB3.3 million decrease in

personnel costs.

Loss from operations was RMB1.0

million (US$0.1 million), compared with RMB14.8 million in the same

quarter of last year.

Net Loss was RMB1.3 million

(US$0.2 million), compared with RMB23.7 million in the same quarter

of last year.

Adjusted net loss (non-GAAP)

was RMB0.4 million (US$54 thousand), compared with RMB8.9 million

in the same quarter of last year.

Adjusted EBITDA (non-GAAP) was

at positive RMB1.6 million (US$0.2 million) compared with a

negative RMB4.6 million for the same quarter of last year.

The cash and cash equivalents and restricted

cash were RMB92.7 million (US$12.8 million) as of June 30, 2024

compared with RMB115.0 million as of December 31, 2023.

Update on Share Repurchase

As of June 30, 2024, the Company had repurchased

a total of 216,643 ADS, of which 11,626 ADSs, or around

US$36.1 thousand were repurchased during the second quarter in

2024.

Conference Call

The Company will host an earnings conference

call on Thursday, August 29, 2024 at 7:30 a.m. U.S. Eastern Time

(7:30 p.m. Beijing time on the same day).

All participants must register in advance to

join the conference using the link provided below. Please dial in

15 minutes before the call is scheduled to begin. Conference access

information will be provided upon registration.

Participant Online Registration:

https://register.vevent.com/register/BIdc3f18de42e247d3a31f621244e171b9

A live and archived webcast of the conference

call will be available on the Investor Relations section of Aurora

Mobile’s website at https://ir.jiguang.cn/.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company

considers and uses two non-GAAP measures, adjusted net loss and

adjusted EBITDA, as a supplemental measure to review and assess its

operating performance. The presentation of these non-GAAP financial

measures is not intended to be considered in isolation or as a

substitute for the financial information prepared and presented in

accordance with U.S. GAAP. The Company defines adjusted net loss as

net loss excluding share-based compensation, reduction in force

charges and impairment of long-term investments. The Company

defines adjusted EBITDA as net loss excluding interest expense,

depreciation of property and equipment, amortization of intangible

assets, amortization of land use right, income tax

expenses/(benefits), share-based compensation, reduction in force

charges and impairment of long-term investments.

The Company believes that adjusted net loss and

adjusted EBITDA help identify underlying trends in its business

that could otherwise be distorted by the effect of certain expenses

that it includes in loss from operations and net loss.

The Company believes that adjusted net loss and

adjusted EBITDA provide useful information about its operating

results, enhance the overall understanding of its past performance

and future prospects and allow for greater visibility with respect

to key metrics used by the management in their financial and

operational decision-making.

The non-GAAP financial measures are not defined

under U.S. GAAP and are not presented in accordance with U.S. GAAP.

The non-GAAP financial measures have limitations as analytical

tools. One of the key limitations of using adjusted net loss and

adjusted EBITDA is that they do not reflect all items of income and

expense that affect the Company’s operations. Further, the non-GAAP

financial measures may differ from the non-GAAP information used by

other companies, including peer companies, and therefore their

comparability may be limited.

The Company compensates for these limitations by

reconciling the non-GAAP financial measures to the nearest U.S.

GAAP performance measure, all of which should be considered when

evaluating the Company’s performance. The Company encourages you to

review its financial information in its entirety and not rely on a

single financial measure.

Reconciliations of the non-GAAP financial

measures to the most comparable U.S. GAAP measure are included at

the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. These forward-looking statements can be identified by

terminology such as “will,” “expects,” “anticipates,” “future,”

“intends,” “plans,” “believes,” “estimates,” “confident” and

similar statements. Among other things, the Business Outlook and

quotations from management in this announcement, as well as Aurora

Mobile’s strategic and operational plans, contain forward-looking

statements. Aurora Mobile may also make written or oral

forward-looking statements in its reports to the U.S. Securities

and Exchange Commission, in its annual report to shareholders, in

press releases and other written materials and in oral statements

made by its officers, directors or employees to third parties.

Statements that are not historical facts, including but not limited

to statements about Aurora Mobile’s beliefs and expectations, are

forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause

actual results to differ materially from those contained in any

forward-looking statement, including but not limited to the

following: Aurora Mobile’s strategies; Aurora Mobile’s future

business development, financial condition and results of

operations; Aurora Mobile’s ability to attract and retain

customers; its ability to develop and effectively market data

solutions, and penetrate the existing market for developer

services; its ability to transition to the new advertising-driven

SAAS business model; its ability to maintain or enhance its brand;

the competition with current or future competitors; its ability to

continue to gain access to mobile data in the future; the laws and

regulations relating to data privacy and protection; general

economic and business conditions globally and in China and

assumptions underlying or related to any of the foregoing. Further

information regarding these and other risks is included in the

Company’s filings with the Securities and Exchange Commission. All

information provided in this press release and in the attachments

is as of the date of the press release, and Aurora Mobile

undertakes no duty to update such information, except as required

under applicable law.

About Aurora Mobile Limited

Founded in 2011, Aurora Mobile is a leading

provider of customer engagement and marketing technology services

in China. Since its inception, Aurora Mobile has focused on

providing stable and efficient messaging services to enterprises

and has grown to be a leading mobile messaging service provider

with its first-mover advantage. With the increasing demand for

customer reach and marketing growth, Aurora Mobile has developed

forward-looking solutions such as Cloud Messaging and Cloud

Marketing to help enterprises achieve omnichannel customer reach

and interaction, as well as artificial intelligence and big

data-driven marketing technology solutions to help enterprises'

digital transformation.

For more information, please visit https://ir.jiguang.cn/.

For investor and media inquiries,

please contact:

Aurora Mobile

Limitedir@jiguang.cn

ChristensenIn ChinaMs. Xiaoyan

SuPhone: +86-10-5900-1548E-mail:

Xiaoyan.Su@christensencomms.com

In U.S.Ms. Linda BergkampPhone:

+1-480-614-3004Email: linda.bergkamp@christensencomms.com

Footnote:

This announcement contains translations of

certain RMB amounts into U.S. dollars at specified rates solely for

the convenience of the reader. Unless otherwise noted, all

translations from RMB to U.S. dollars are made at a rate of

RMB7.2672 to US$1.00, the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of June 28, 2024.

|

AURORA MOBILE LIMITED |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED INCOME

STATEMENTS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”), except for number of shares and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

73,331 |

|

|

|

64,524 |

|

|

|

79,441 |

|

|

|

10,931 |

|

|

|

138,764 |

|

|

|

143,965 |

|

|

|

19,810 |

|

|

Cost of revenues |

|

|

(25,620 |

) |

|

|

(18,152 |

) |

|

|

(26,670 |

) |

|

|

(3,670 |

) |

|

|

(45,061 |

) |

|

|

(44,822 |

) |

|

|

(6,168 |

) |

|

Gross profit |

|

|

47,711 |

|

|

|

46,372 |

|

|

|

52,771 |

|

|

|

7,261 |

|

|

|

93,703 |

|

|

|

99,143 |

|

|

|

13,642 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

(30,243 |

) |

|

|

(22,681 |

) |

|

|

(23,652 |

) |

|

|

(3,255 |

) |

|

|

(61,924 |

) |

|

|

(46,333 |

) |

|

|

(6,376 |

) |

|

Sales and marketing |

|

|

(20,009 |

) |

|

|

(17,391 |

) |

|

|

(20,478 |

) |

|

|

(2,818 |

) |

|

|

(38,899 |

) |

|

|

(37,869 |

) |

|

|

(5,211 |

) |

|

General and administrative |

|

|

(13,873 |

) |

|

|

(12,932 |

) |

|

|

(10,677 |

) |

|

|

(1,469 |

) |

|

|

(28,146 |

) |

|

|

(23,609 |

) |

|

|

(3,249 |

) |

|

Total operating expenses |

|

|

(64,125 |

) |

|

|

(53,004 |

) |

|

|

(54,807 |

) |

|

|

(7,542 |

) |

|

|

(128,969 |

) |

|

|

(107,811 |

) |

|

|

(14,836 |

) |

|

Other operating income(1) |

|

|

1,572 |

|

|

|

1,579 |

|

|

|

1,055 |

|

|

|

145 |

|

|

|

4,329 |

|

|

|

2,634 |

|

|

|

362 |

|

|

Loss from operations |

|

|

(14,842 |

) |

|

|

(5,053 |

) |

|

|

(981 |

) |

|

|

(136 |

) |

|

|

(30,937 |

) |

|

|

(6,034 |

) |

|

|

(832 |

) |

|

Foreign exchange (loss)/gain, net |

|

|

(118 |

) |

|

|

(23 |

) |

|

|

12 |

|

|

|

2 |

|

|

|

(93 |

) |

|

|

(11 |

) |

|

|

(2 |

) |

|

Interest income |

|

|

354 |

|

|

|

2,187 |

|

|

|

195 |

|

|

|

27 |

|

|

|

684 |

|

|

|

2,382 |

|

|

|

328 |

|

|

Interest expenses |

|

|

(218 |

) |

|

|

(6 |

) |

|

|

(42 |

) |

|

|

(6 |

) |

|

|

(441 |

) |

|

|

(48 |

) |

|

|

(7 |

) |

|

Other (loss)/income |

|

|

(9,086 |

) |

|

|

15 |

|

|

|

(20 |

) |

|

|

(3 |

) |

|

|

(8,527 |

) |

|

|

(5 |

) |

|

|

(1 |

) |

|

Change in fair value of structured deposits |

|

|

- |

|

|

|

23 |

|

|

|

15 |

|

|

|

2 |

|

|

|

13 |

|

|

|

38 |

|

|

|

5 |

|

|

Loss before income taxes |

|

|

(23,910 |

) |

|

|

(2,857 |

) |

|

|

(821 |

) |

|

|

(114 |

) |

|

|

(39,301 |

) |

|

|

(3,678 |

) |

|

|

(509 |

) |

|

Income tax benefits/(expenses) |

|

|

179 |

|

|

|

244 |

|

|

|

(483 |

) |

|

|

(66 |

) |

|

|

329 |

|

|

|

(239 |

) |

|

|

(33 |

) |

|

Net loss |

|

|

(23,731 |

) |

|

|

(2,613 |

) |

|

|

(1,304 |

) |

|

|

(180 |

) |

|

|

(38,972 |

) |

|

|

(3,917 |

) |

|

|

(542 |

) |

|

Less: net loss attributable to noncontrolling interests and

redeemable noncontrolling interests |

|

|

(715 |

) |

|

|

(214 |

) |

|

|

(304 |

) |

|

|

(42 |

) |

|

|

(890 |

) |

|

|

(518 |

) |

|

|

(71 |

) |

|

Net loss attributable to Aurora Mobile Limited’s

shareholders |

|

|

(23,016 |

) |

|

|

(2,399 |

) |

|

|

(1,000 |

) |

|

|

(138 |

) |

|

|

(38,082 |

) |

|

|

(3,399 |

) |

|

|

(471 |

) |

|

Net loss per share, for Class A and Class B common

shares: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A and B Common Shares - basic and diluted |

|

|

(0.29 |

) |

|

|

(0.03 |

) |

|

|

(0.01 |

) |

|

|

(0.00 |

) |

|

|

(0.48 |

) |

|

|

(0.04 |

) |

|

|

(0.01 |

) |

|

Shares used in net loss per share

computation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A Common Shares - basic and diluted |

|

|

62,943,573 |

|

|

|

62,687,345 |

|

|

|

62,603,736 |

|

|

|

62,603,736 |

|

|

|

62,855,277 |

|

|

|

62,645,540 |

|

|

|

62,645,540 |

|

|

Class B Common Shares - basic and diluted |

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

|

17,000,189 |

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments |

|

|

2,787 |

|

|

|

78 |

|

|

|

208 |

|

|

|

29 |

|

|

|

1,983 |

|

|

|

286 |

|

|

|

39 |

|

|

Total other comprehensive income, net of tax |

|

|

2,787 |

|

|

|

78 |

|

|

|

208 |

|

|

|

29 |

|

|

|

1,983 |

|

|

|

286 |

|

|

|

39 |

|

|

Total comprehensive loss |

|

|

(20,944 |

) |

|

|

(2,535 |

) |

|

|

(1,096 |

) |

|

|

(151 |

) |

|

|

(36,989 |

) |

|

|

(3,631 |

) |

|

|

(503 |

) |

|

Less: comprehensive loss attributable to noncontrolling interests

and redeemable noncontrolling interests |

|

|

(715 |

) |

|

|

(214 |

) |

|

|

(304 |

) |

|

|

(42 |

) |

|

|

(890 |

) |

|

|

(518 |

) |

|

|

(71 |

) |

|

Comprehensive loss attributable to Aurora Mobile Limited’s

shareholders |

|

|

(20,229 |

) |

|

|

(2,321 |

) |

|

|

(792 |

) |

|

|

(109 |

) |

|

|

(36,099 |

) |

|

|

(3,113 |

) |

|

|

(432 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Beginning on January 1, 2024 we classified the government

grants that are operating in nature as other operating income.

Comparative figures were reclassified to conform to this

presentation. |

|

|

|

AURORA MOBILE LIMITED |

|

UNAUDITED INTERIM CONDENSED CONSOLIDATED BALANCE

SHEETS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”)) |

|

|

|

|

|

|

|

|

| |

|

As of |

| |

|

December 31, 2023 |

|

June 30, 2024 |

| |

|

RMB |

|

RMB |

|

US$ |

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

114,521 |

|

|

|

92,178 |

|

|

|

12,684 |

|

|

Restricted cash |

|

|

486 |

|

|

|

505 |

|

|

|

69 |

|

|

Accounts receivable |

|

|

34,344 |

|

|

|

43,132 |

|

|

|

5,935 |

|

|

Prepayments and other current assets |

|

|

20,225 |

|

|

|

20,796 |

|

|

|

2,863 |

|

|

Total current assets |

|

|

169,576 |

|

|

|

156,611 |

|

|

|

21,551 |

|

|

Non-current assets: |

|

|

|

|

|

|

|

Long-term investments |

|

|

112,912 |

|

|

|

113,160 |

|

|

|

15,571 |

|

|

Property and equipment, net |

|

|

1,433 |

|

|

|

1,061 |

|

|

|

146 |

|

|

Operating lease right-of-use assets |

|

|

4,081 |

|

|

|

3,550 |

|

|

|

488 |

|

|

Intangible assets, net |

|

|

17,941 |

|

|

|

15,801 |

|

|

|

2,174 |

|

|

Goodwill |

|

|

37,785 |

|

|

|

37,785 |

|

|

|

5,199 |

|

|

Deferred tax assets |

|

|

1,072 |

|

|

|

580 |

|

|

|

80 |

|

|

Other non-current assets |

|

|

5,387 |

|

|

|

6,517 |

|

|

|

898 |

|

|

Total non-current assets |

|

|

180,611 |

|

|

|

178,454 |

|

|

|

24,556 |

|

|

Total assets |

|

|

350,187 |

|

|

|

335,065 |

|

|

|

46,107 |

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Short-term loan |

|

|

- |

|

|

|

3,000 |

|

|

|

413 |

|

|

Accounts payable |

|

|

21,073 |

|

|

|

26,639 |

|

|

|

3,666 |

|

|

Deferred revenue and customer deposits |

|

|

141,518 |

|

|

|

135,137 |

|

|

|

18,595 |

|

|

Operating lease liabilities |

|

|

4,007 |

|

|

|

2,767 |

|

|

|

381 |

|

|

Accrued liabilities and other current liabilities |

|

|

74,682 |

|

|

|

60,694 |

|

|

|

8,352 |

|

|

Total current liabilities |

|

|

241,280 |

|

|

|

228,237 |

|

|

|

31,407 |

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

Operating lease liabilities |

|

|

629 |

|

|

|

1,004 |

|

|

|

138 |

|

|

Deferred tax liabilities |

|

|

3,994 |

|

|

|

3,643 |

|

|

|

501 |

|

|

Other non-current liabilities |

|

|

563 |

|

|

|

567 |

|

|

|

78 |

|

|

Total non-current liabilities |

|

|

5,186 |

|

|

|

5,214 |

|

|

|

717 |

|

|

Total liabilities |

|

|

246,466 |

|

|

|

233,451 |

|

|

|

32,124 |

|

|

Shareholders’ equity: |

|

|

|

|

|

|

|

Common shares |

|

|

50 |

|

|

|

50 |

|

|

|

7 |

|

|

Treasury shares |

|

|

(2,453 |

) |

|

|

(835 |

) |

|

|

(115 |

) |

|

Additional paid-in capital |

|

|

1,045,397 |

|

|

|

1,045,303 |

|

|

|

143,838 |

|

|

Accumulated deficit |

|

|

(988,669 |

) |

|

|

(992,068 |

) |

|

|

(136,513 |

) |

|

Accumulated other comprehensive income |

|

|

19,223 |

|

|

|

19,509 |

|

|

|

2,685 |

|

|

Total Aurora Mobile Limited’s shareholders’

equity |

|

|

73,548 |

|

|

|

71,959 |

|

|

|

9,902 |

|

|

Noncontrolling interests |

|

|

30,173 |

|

|

|

29,655 |

|

|

|

4,081 |

|

|

Total shareholders’ equity |

|

|

103,721 |

|

|

|

101,614 |

|

|

|

13,983 |

|

|

Total liabilities and shareholders’ equity |

|

|

350,187 |

|

|

|

335,065 |

|

|

|

46,107 |

|

| |

|

|

|

|

|

|

|

AURORA MOBILE LIMITED |

|

RECONCILIATION OF GAAP AND NON-GAAP RESULTS |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Six months ended |

| |

|

June 30, 2023 |

|

March 31,2024 |

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

Reconciliation of Net Loss to Adjusted Net

Loss: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(23,731 |

) |

|

|

(2,613 |

) |

|

|

(1,304 |

) |

|

|

(180 |

) |

|

|

(38,972 |

) |

|

|

(3,917 |

) |

|

|

(542 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

4,168 |

|

|

|

1,268 |

|

|

|

913 |

|

|

|

126 |

|

|

|

7,206 |

|

|

|

2,181 |

|

|

|

300 |

|

|

Reduction in force charges |

|

|

1,051 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,739 |

|

|

|

- |

|

|

|

- |

|

|

Impairment of long-term investment |

|

|

9,660 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9,660 |

|

|

|

- |

|

|

|

- |

|

|

Adjusted net loss |

|

|

(8,852 |

) |

|

|

(1,345 |

) |

|

|

(391 |

) |

|

|

(54 |

) |

|

|

(20,367 |

) |

|

|

(1,736 |

) |

|

|

(242 |

) |

|

Reconciliation of Net Loss to Adjusted

EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

|

(23,731 |

) |

|

|

(2,613 |

) |

|

|

(1,304 |

) |

|

|

(180 |

) |

|

|

(38,972 |

) |

|

|

(3,917 |

) |

|

|

(542 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax (benefits)/expenses |

|

|

(179 |

) |

|

|

(244 |

) |

|

|

483 |

|

|

|

66 |

|

|

|

(329 |

) |

|

|

239 |

|

|

|

33 |

|

|

Interest expenses |

|

|

218 |

|

|

|

6 |

|

|

|

42 |

|

|

|

6 |

|

|

|

441 |

|

|

|

48 |

|

|

|

7 |

|

|

Depreciation of property and equipment |

|

|

1,799 |

|

|

|

380 |

|

|

|

371 |

|

|

|

51 |

|

|

|

3,985 |

|

|

|

751 |

|

|

|

103 |

|

|

Amortization of intangible assets |

|

|

1,589 |

|

|

|

1,369 |

|

|

|

1,115 |

|

|

|

153 |

|

|

|

3,195 |

|

|

|

2,484 |

|

|

|

342 |

|

|

Amortization of land use right |

|

|

811 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

994 |

|

|

|

- |

|

|

|

- |

|

|

EBITDA |

|

|

(19,493 |

) |

|

|

(1,102 |

) |

|

|

707 |

|

|

|

96 |

|

|

|

(30,686 |

) |

|

|

(395 |

) |

|

|

(57 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

4,168 |

|

|

|

1,268 |

|

|

|

913 |

|

|

|

126 |

|

|

|

7,206 |

|

|

|

2,181 |

|

|

|

300 |

|

|

Reduction in force charges |

|

|

1,051 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,739 |

|

|

|

- |

|

|

|

- |

|

|

Impairment of long-term investment |

|

|

9,660 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

9,660 |

|

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA |

|

|

(4,614 |

) |

|

|

166 |

|

|

|

1,620 |

|

|

|

222 |

|

|

|

(12,081 |

) |

|

|

1,786 |

|

|

|

243 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AURORA MOBILE LIMITED |

|

UNAUDITED SAAS BUSINESSES REVENUE |

|

(Amounts in thousands of Renminbi (“RMB”) and US dollars

(“US$”)) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Six months ended |

|

|

|

June 30, 2023 |

|

March 31, 2024 |

|

June 30, 2024 |

|

June 30, 2023 |

|

June 30, 2024 |

|

|

|

RMB |

|

RMB |

|

RMB |

|

US$ |

|

RMB |

|

RMB |

|

US$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer Services |

|

52,072 |

|

|

44,749 |

|

|

56,406 |

|

|

7,762 |

|

|

97,537 |

|

|

101,155 |

|

|

13,920 |

|

|

Subscription |

|

40,526 |

|

|

42,351 |

|

|

48,124 |

|

|

6,622 |

|

|

78,034 |

|

|

90,475 |

|

|

12,450 |

|

|

Value-Added Services |

|

11,546 |

|

|

2,398 |

|

|

8,282 |

|

|

1,140 |

|

|

19,503 |

|

|

10,680 |

|

|

1,470 |

|

|

Vertical Applications |

|

21,259 |

|

|

19,775 |

|

|

23,035 |

|

|

3,169 |

|

|

41,227 |

|

|

42,810 |

|

|

5,890 |

|

|

Total Revenue |

|

73,331 |

|

|

64,524 |

|

|

79,441 |

|

|

10,931 |

|

|

138,764 |

|

|

143,965 |

|

|

19,810 |

|

|

Gross Profits |

|

47,711 |

|

|

46,372 |

|

|

52,771 |

|

|

7,261 |

|

|

93,703 |

|

|

99,143 |

|

|

13,642 |

|

|

Gross Margin |

|

65.1 |

% |

|

71.9 |

% |

|

66.4 |

% |

|

66.4 |

% |

|

67.5 |

% |

|

68.9 |

% |

|

68.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

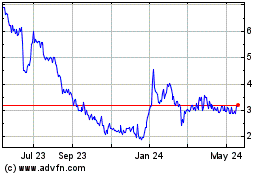

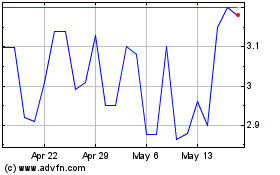

Aurora Mobile (NASDAQ:JG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aurora Mobile (NASDAQ:JG)

Historical Stock Chart

From Nov 2023 to Nov 2024